West Virginia Advisory Agreement between Real Estate Investment Trust (REIT) and corporation, like any other advisory agreement, is a legally binding contract that outlines the terms and conditions governing the advisory services provided by the REIT to the corporation. This agreement serves as a guide to ensure both parties understand their roles and responsibilities in the business relationship. Keywords: West Virginia, advisory agreement, Real Estate Investment Trust, corporation, terms and conditions, legally binding, advisory services, roles and responsibilities, business relationship. In West Virginia, there are various types of advisory agreements between Rests and corporations, including: 1. General Advisory Agreement: This agreement outlines the overall scope and responsibilities of the advisory services provided by the REIT to the corporation. It covers areas such as investment advice, property management, market analysis, and financial planning. 2. Real Estate Acquisition Advisory Agreement: This type of agreement focuses specifically on the advisory services provided by the REIT in real estate acquisition matters. It includes assistance in identifying potential investment properties, conducting due diligence, negotiating deals, and managing the acquisition process. 3. Asset Management Advisory Agreement: This agreement centers on the REIT's role in managing the corporation's existing real estate assets, maximizing their value, and ensuring proper maintenance and strategic planning. It may include tasks such as tenant management, lease negotiations, property valuation, and financial reporting. 4. Portfolio Management Advisory Agreement: In this agreement, the focus is on the overall management of the corporation's real estate portfolio. The REIT provides advisory services related to portfolio diversification, risk assessment, investment strategies, and performance monitoring. 5. Development Advisory Agreement: This type of agreement is specific to situations where the corporation seeks assistance from the REIT in undertaking real estate development projects. The advisory services may involve market research, feasibility studies, project management, and regulatory compliance. Regardless of the specific type, a West Virginia Advisory Agreement between a REIT and a corporation typically includes key provisions such as: — Scope of advisory services: Clearly defining the areas and responsibilities of the REIT's advisory services and the goals to be achieved. — Compensation: Outlining the fees, payment schedule, and any additional costs associated with the services provided by the REIT. — Duration: Specifying the duration of the agreement, including any renewal or termination clauses. — Confidentiality: Addressing the protection of confidential information shared between the parties during the advisory relationship. — Non-disclosure and non-compete: Detailing any restrictions on disclosing proprietary information or engaging in competitive activities during or after the agreement's termination. — Indemnification: Outlining the responsibility of each party to indemnify the other against losses or damages resulting from a breach of the agreement. — Dispute resolution: Identifying the procedures for resolving any disputes that may arise between the parties, such as through negotiation, mediation, or arbitration. It is essential to consult legal professionals experienced in West Virginia laws and regulations to draft and review the advisory agreement thoroughly. This will ensure compliance with state-specific requirements and protect the interests of both the REIT and the corporation involved in the advisory relationship.

West Virginia Advisory Agreement between Real Estate Investment Trust and corporation

Description

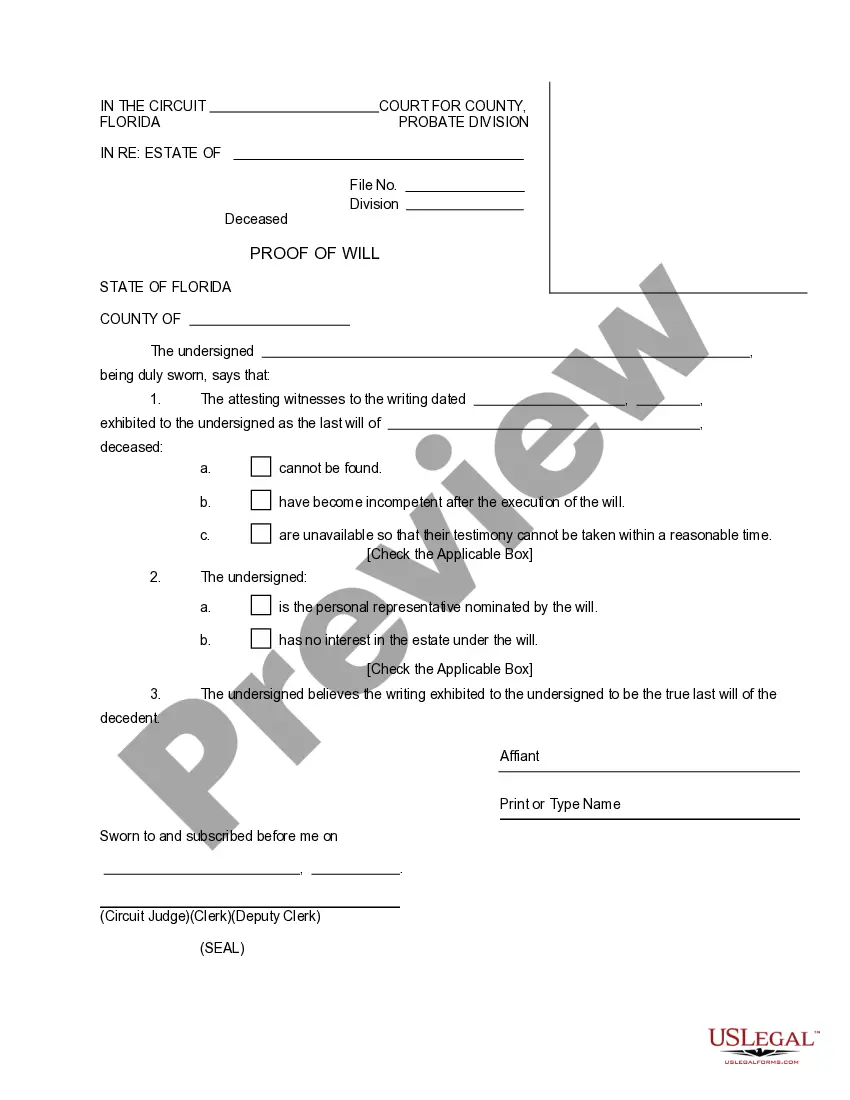

How to fill out Advisory Agreement Between Real Estate Investment Trust And Corporation?

US Legal Forms - among the biggest libraries of legal varieties in the United States - gives an array of legal papers web templates you may down load or print out. Using the internet site, you can find thousands of varieties for organization and individual reasons, categorized by categories, states, or key phrases.You can find the most up-to-date versions of varieties much like the West Virginia Advisory Agreement between Real Estate Investment Trust and corporation within minutes.

If you already possess a monthly subscription, log in and down load West Virginia Advisory Agreement between Real Estate Investment Trust and corporation through the US Legal Forms catalogue. The Down load button can look on every form you view. You gain access to all previously acquired varieties within the My Forms tab of your account.

If you wish to use US Legal Forms the first time, here are straightforward guidelines to get you started out:

- Be sure to have picked out the proper form for the metropolis/state. Click on the Preview button to examine the form`s articles. Look at the form explanation to actually have chosen the correct form.

- When the form does not suit your needs, use the Search discipline at the top of the display to obtain the one which does.

- In case you are pleased with the form, validate your choice by clicking the Get now button. Then, choose the prices program you like and provide your credentials to sign up for the account.

- Process the deal. Make use of your Visa or Mastercard or PayPal account to accomplish the deal.

- Pick the format and down load the form on the system.

- Make modifications. Fill out, revise and print out and sign the acquired West Virginia Advisory Agreement between Real Estate Investment Trust and corporation.

Each and every format you put into your money does not have an expiration particular date and is also your own property for a long time. So, if you wish to down load or print out an additional duplicate, just proceed to the My Forms area and then click around the form you want.

Get access to the West Virginia Advisory Agreement between Real Estate Investment Trust and corporation with US Legal Forms, probably the most considerable catalogue of legal papers web templates. Use thousands of professional and express-particular web templates that meet up with your small business or individual demands and needs.

Form popularity

FAQ

An Agency RMBS + MSR Real Estate Investment Trust (NYSE: TWO), we leverage our core competencies of understanding and managing interest rate and prepayment risk to invest our Agency RMBS and MSR portfolio, with the objective of delivering attractive risk-adjusted returns to our stockholders over the long-term.

There are two main types of real estate investment trusts (REITs) that investors can buy: equity REITs and mortgage REITs. Equity REITs own and operate properties, while mortgage REITs invest in mortgages and related assets.

A real estate investment trust (REIT) is a form of collective investment scheme that would enable an investor to invest in a portfolio of income-generating real estate assets, by purchasing units of it.

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.

Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs. Others may be registered with the SEC but are not publicly traded.

REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. These real estate companies have to meet a number of requirements to qualify as REITs. Most REITs trade on major stock exchanges, and they offer a number of benefits to investors.

The two main types of REITs are equity REITs and mortgage REITs, commonly known as mREITs. Equity REITs generate income through the collection of rent on, and from sales of, the properties they own for the long-term. mREITs invest in mortgages or mortgage securities tied to commercial and/or residential properties.

There are several types of real estate investments, but most fall into two categories: Physical real estate investments like land, residential and commercial properties, and other modes of investing that don't require owning physical property, such as REITs and crowdfunding platforms.