West Virginia Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan

Description

How to fill out Adoption Of Nonemployee Directors Deferred Compensation Plan With Copy Of Plan?

If you need to complete, download, or print legitimate file themes, use US Legal Forms, the largest assortment of legitimate kinds, that can be found on the Internet. Take advantage of the site`s basic and practical research to get the documents you will need. Different themes for organization and person purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to get the West Virginia Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan in a handful of click throughs.

In case you are already a US Legal Forms consumer, log in for your accounts and click on the Download switch to obtain the West Virginia Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan. Also you can accessibility kinds you earlier downloaded in the My Forms tab of your respective accounts.

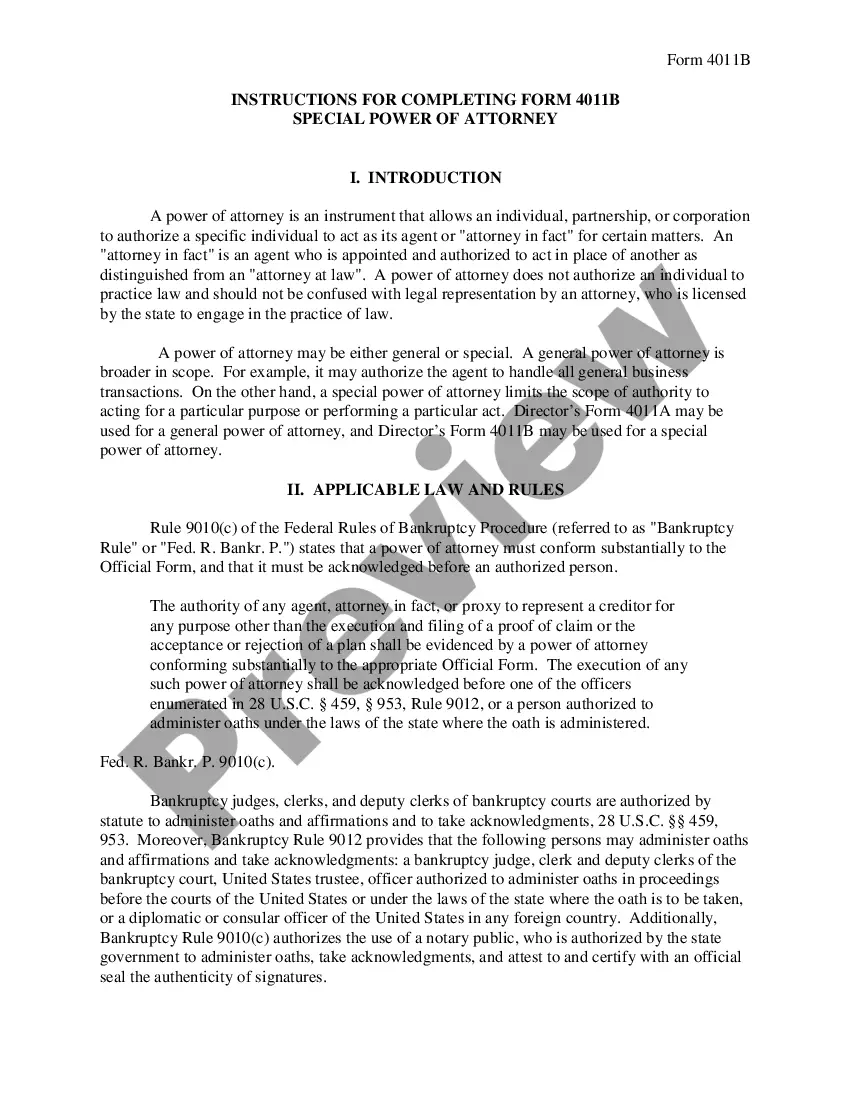

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for the appropriate area/land.

- Step 2. Use the Preview choice to check out the form`s articles. Don`t overlook to read the explanation.

- Step 3. In case you are not satisfied with the develop, take advantage of the Research industry on top of the monitor to locate other versions of the legitimate develop format.

- Step 4. After you have discovered the form you will need, click the Buy now switch. Choose the rates plan you like and include your qualifications to register for the accounts.

- Step 5. Procedure the purchase. You should use your Мisa or Ьastercard or PayPal accounts to perform the purchase.

- Step 6. Select the formatting of the legitimate develop and download it on your own system.

- Step 7. Total, edit and print or indicator the West Virginia Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan.

Each legitimate file format you get is the one you have eternally. You possess acces to every develop you downloaded in your acccount. Click on the My Forms section and decide on a develop to print or download again.

Be competitive and download, and print the West Virginia Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan with US Legal Forms. There are millions of professional and state-distinct kinds you can use for your personal organization or person requires.

Form popularity

FAQ

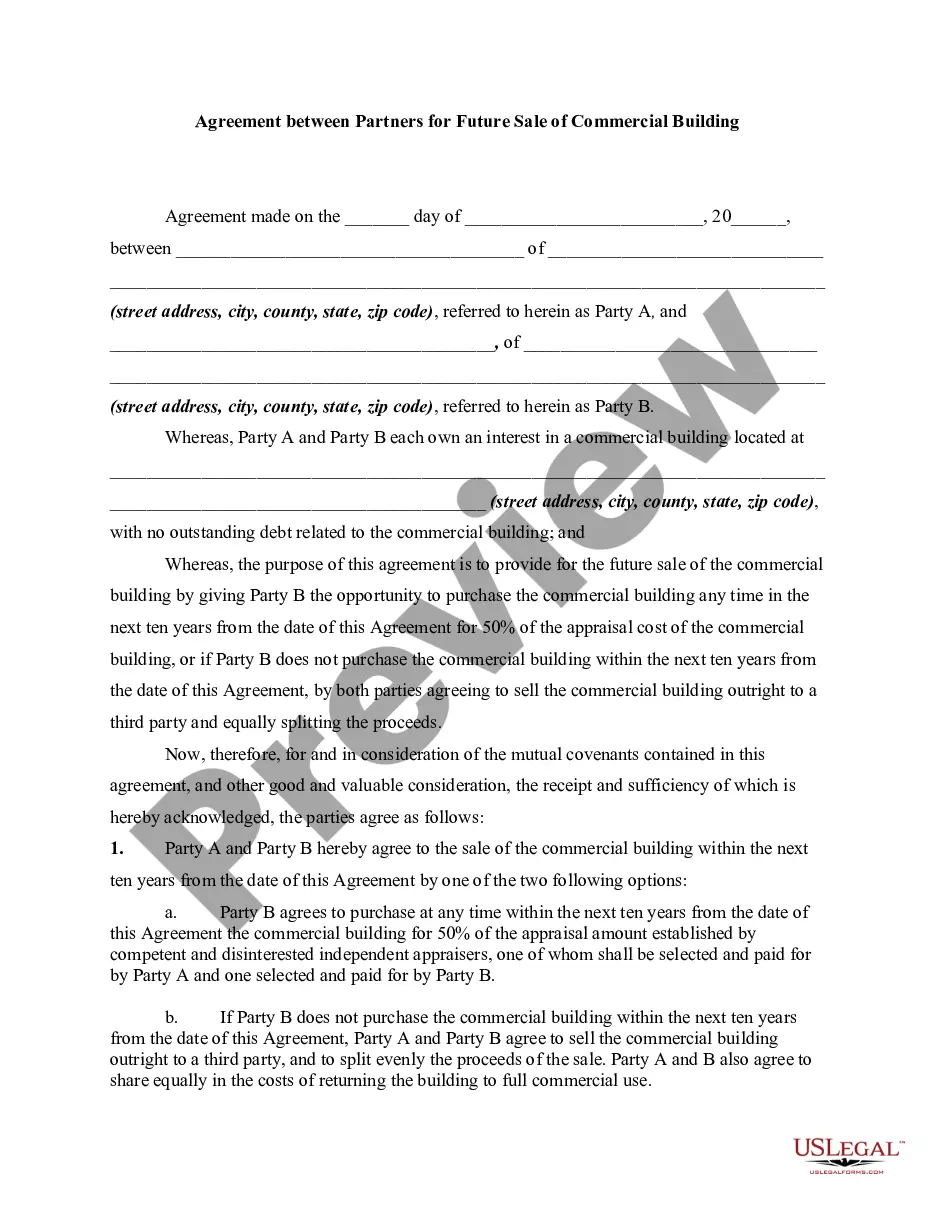

The 457 Plan is a type of tax-advantaged retirement plan with deferred compensation. The plan is non-qualified ? it doesn't meet the guidelines of the Employee Retirement Income Security Act (ERISA). 457 plans are offered by state and local government employers, as well as certain non-profit employers.

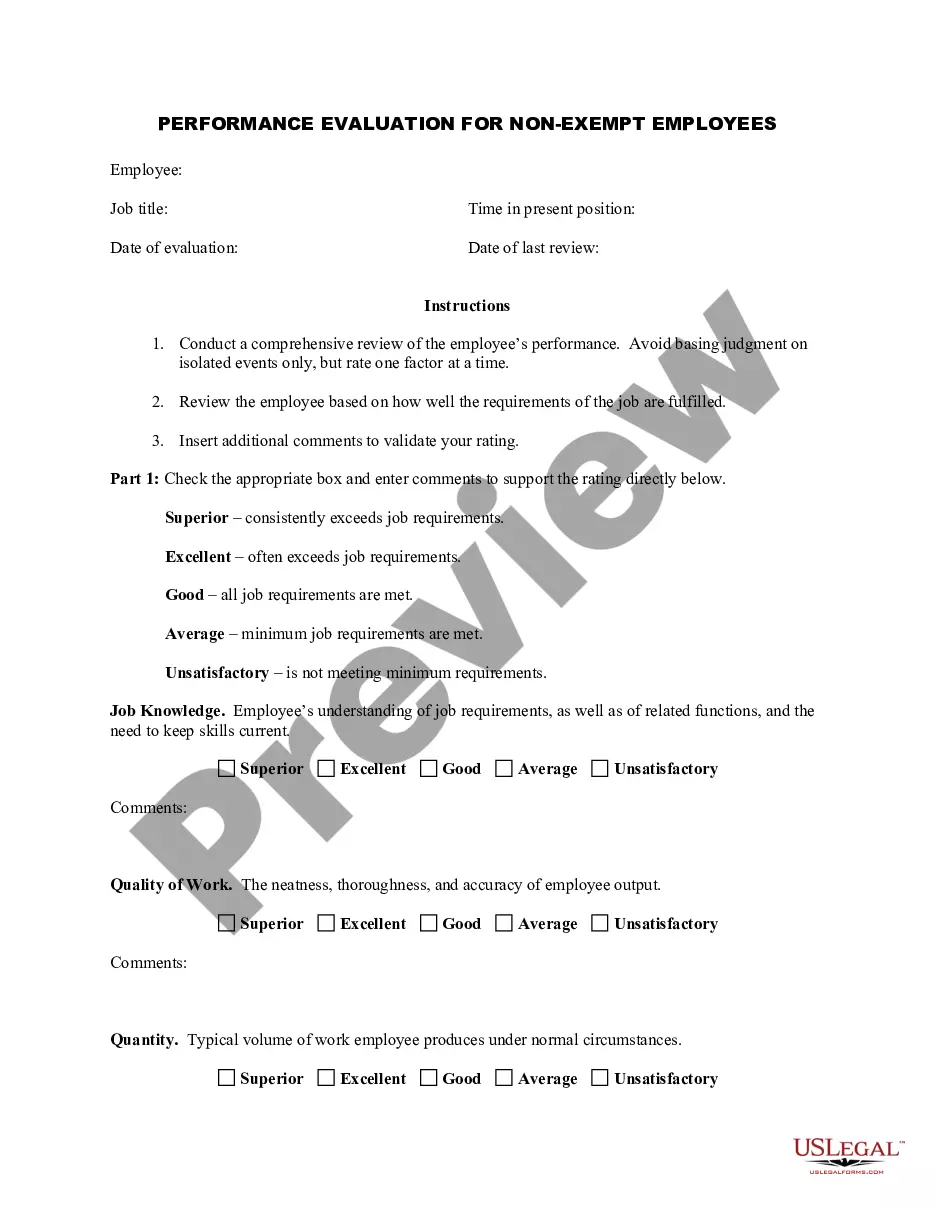

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

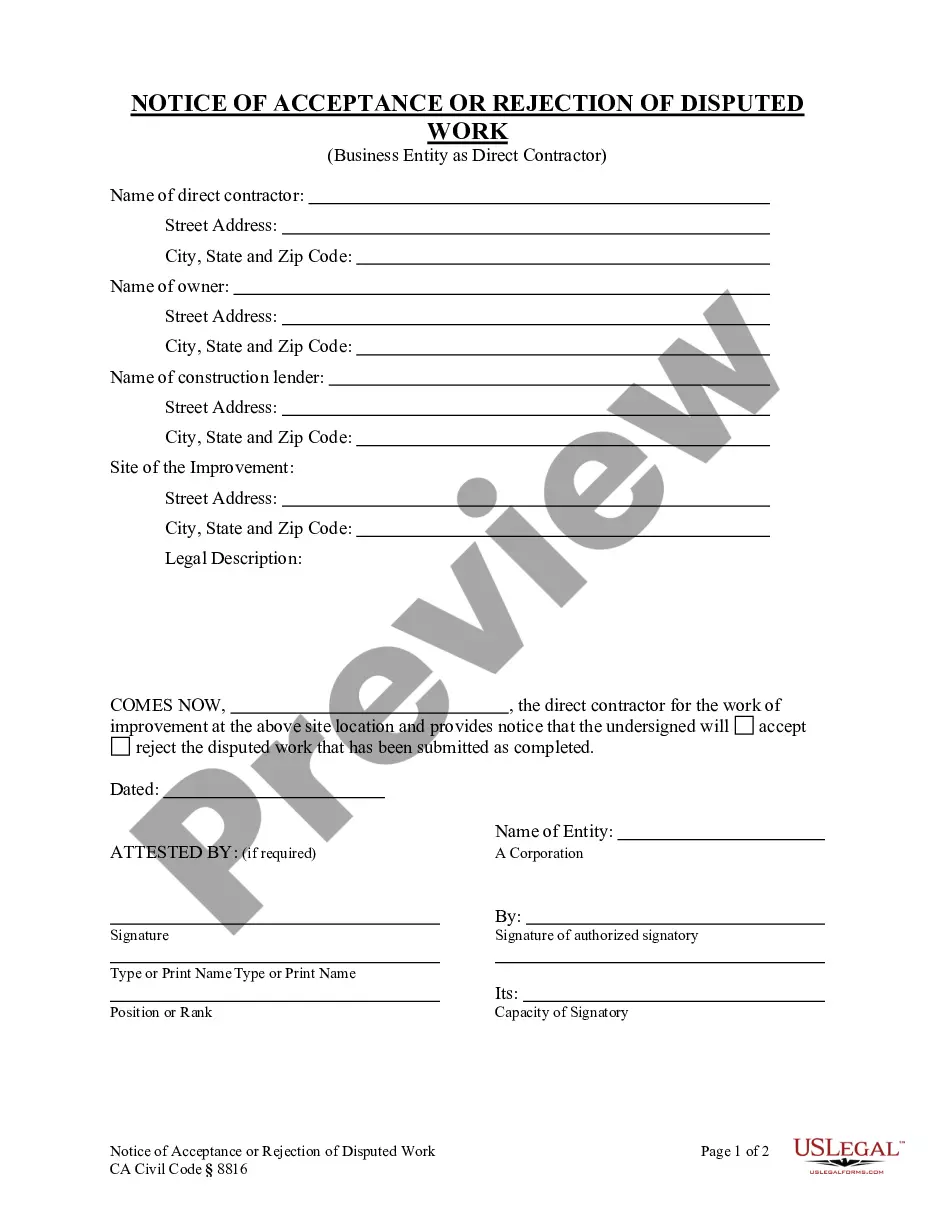

The Plan allows Eligible Directors to defer the receipt of Director Fees and to receive settlement of the right to receive payment of such amounts in the form of an issuance of Shares and/or cash.

Common types of employer-sponsored retirement accounts that fall under ERISA include 401(k) plans, pensions, deferred-compensation plans, and profit-sharing plans. In addition, ERISA laws don't apply to Simplified employee pensions (SEPs) or, as mentioned above, IRAs.

A deferred compensation plan can be qualifying or non-qualifying. Qualifying plans are protected under the ERISA and must be drafted based on ERISA rules. While such rules do not apply to NQDC plans, tax laws require NQDC plans to meet the following conditions: The plan must be in writing.

In terms of accounting, deferred compensation is typically recognized as an expense by the company in the period in which the employee performs the service, and it is accrued as a liability on the balance sheet until it is paid out.

Qualified plans include 401(k) plans, 403(b) plans, profit-sharing plans, and Keogh (HR-10) plans. Nonqualified plans include deferred-compensation plans, executive bonus plans, and split-dollar life insurance plans.

To enroll, your employer must participate in the Plan (employers can visit our Employer Resource Center or call us at (800) 696-3907 to learn more). For more information, visit CalPERS 457 Plan website, call the Plan Information Line at (800) 260-0659, or view the additional resources below.