West Virginia Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

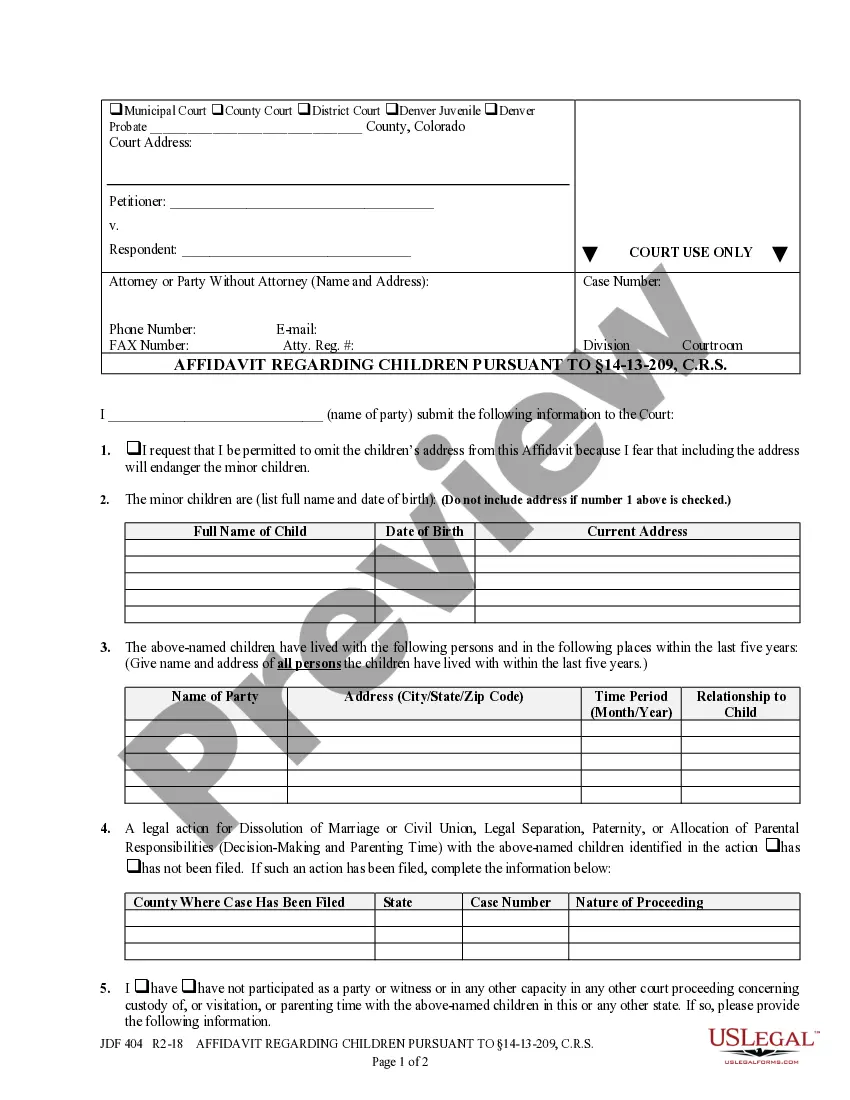

How to fill out Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

Are you presently within a place the place you will need paperwork for either company or person functions virtually every working day? There are a variety of lawful file layouts accessible on the Internet, but discovering versions you can depend on isn`t effortless. US Legal Forms offers thousands of form layouts, such as the West Virginia Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, which are composed to meet state and federal needs.

Should you be currently knowledgeable about US Legal Forms web site and have an account, simply log in. Next, you may down load the West Virginia Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan template.

Unless you provide an accounts and wish to begin using US Legal Forms, follow these steps:

- Find the form you need and ensure it is for that appropriate area/region.

- Make use of the Review key to review the form.

- See the outline to ensure that you have chosen the appropriate form.

- In the event the form isn`t what you are seeking, use the Lookup field to obtain the form that meets your requirements and needs.

- If you discover the appropriate form, just click Get now.

- Opt for the rates program you desire, fill out the required information to make your money, and buy your order with your PayPal or Visa or Mastercard.

- Choose a practical data file format and down load your version.

Discover all of the file layouts you possess purchased in the My Forms food list. You can get a further version of West Virginia Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan at any time, if needed. Just click the essential form to down load or print out the file template.

Use US Legal Forms, by far the most extensive assortment of lawful kinds, to conserve time as well as steer clear of errors. The services offers appropriately manufactured lawful file layouts which can be used for a variety of functions. Generate an account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

Like numerous other states, West Virginia has established at-will employment laws. This means if they do not have a contract in place and there are no laws specifying otherwise, employers are able to fire employees at any time. Further, they do not have to have a valid reason to do so.

Even though West Virginia doesn't have a law requiring payment of accrued, unused vacation at termination, employers can still be responsible for paying this if there is a company policy that requires it.

May an employer reduce an employee's hourly rate of pay or salary? Yes, as long as minimum wage requirements are met, employers may reduce an employee's hourly rate of pay or salary amount after providing the employee with an advance pay period's written notice of when the change will occur.

The West Virginia Equal Pay Act prohibits private and public employers from paying wages to any employee at a rate less than the rate paid to employees of the opposite sex for work of comparable character, the performance of which requires comparable skills.

Employees regular hours of work in a workweek is 40 hours. West Virginia minimum wage laws require employers to count time spent by employees waiting as hours worked for purposes of its minimum wage and overtime requirements if the employee is, based on the fact, engaged to wait.

For example, if an employee is entitled to two weeks (10 work days) of vacation per year, after six months of work he or she will have earned five days of vacation. Vacation pay accrues (adds up) as it is earned, and cannot be forfeited, even upon termination of employment, regardless of the reason for the termination.

Upon receiving a written demand, the employer has seven calendar days from receipt to correct the alleged underpayment or nonpayment of the wages and fringe benefits due.