The West Virginia Nonqualified Stock Option Plan of Mediocre, Inc. is a comprehensive program designed specifically for officers, directors, consultants, and key employees of the company. This plan serves as a valuable incentive and compensation device, allowing eligible individuals to acquire shares of Mediocre, Inc. stock at a predetermined price within a specified period. The primary aim of the Nonqualified Stock Option Plan is to attract and retain highly skilled individuals who contribute significantly to the growth and success of Mediocre, Inc. By offering stock options, the plan aligns the interests of these key personnel with the long-term success of the company. This, in turn, promotes dedication, increases motivation, and fosters a sense of ownership among the participants. Under the West Virginia Nonqualified Stock Option Plan, officers, directors, consultants, and key employees have the opportunity to be granted stock options at the discretion of the company's board of directors or its Compensation Committee. These options are nonqualified, meaning they do not have the same tax advantages as incentive stock options. However, they offer flexibility and are available to a broader range of individuals. The plan incorporates several key components to ensure its effectiveness. First, it establishes the terms and conditions of the options, including the exercise price, the vesting schedule, and the expiration period. These specifications provide transparency and fairness to all participants. Secondly, the plan outlines potential triggers for the acceleration of vesting. This may include a change of control, the acquisition of Mediocre, Inc., or the death or disability of a participant. Such provisions ensure that participants are fairly compensated in the event of unforeseen circumstances. Furthermore, the plan allows for the transferability of options within certain limitations, enabling participants to leverage their stock options for personal financial planning and investment diversification. Finally, the West Virginia Nonqualified Stock Option Plan emphasizes compliance with applicable laws and regulations, including those related to securities and tax. This ensures the utmost adherence to legal requirements and protects the interests of Mediocre, Inc. and its participants. While there may not be specific variations of the plan for different groups of individuals such as officers, directors, consultants, or key employees, the plan's flexibility allows for customization and tailoring to meet the unique needs and circumstances of each eligible participant. In conclusion, the West Virginia Nonqualified Stock Option Plan of Mediocre, Inc. is a comprehensive compensation and incentive program that aims to attract, retain, and reward valuable officers, directors, consultants, and key employees. By granting stock options, the plan aligns the interests of these individuals with the company's long-term success, fostering dedication and a sense of ownership. Through transparent terms and equitable provisions, the plan ensures fairness and compliance while offering flexibility for customization.

West Virginia Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees

Description

How to fill out West Virginia Nonqualified Stock Option Plan Of Medicore, Inc., For Officers, Directors, Consultants, Key Employees?

If you need to complete, obtain, or print legal papers templates, use US Legal Forms, the most important collection of legal types, which can be found on the web. Utilize the site`s basic and convenient search to discover the documents you need. Different templates for enterprise and person functions are categorized by categories and suggests, or keywords. Use US Legal Forms to discover the West Virginia Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees within a handful of click throughs.

Should you be presently a US Legal Forms consumer, log in to the accounts and click on the Acquire button to find the West Virginia Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees. You can even access types you previously acquired inside the My Forms tab of your accounts.

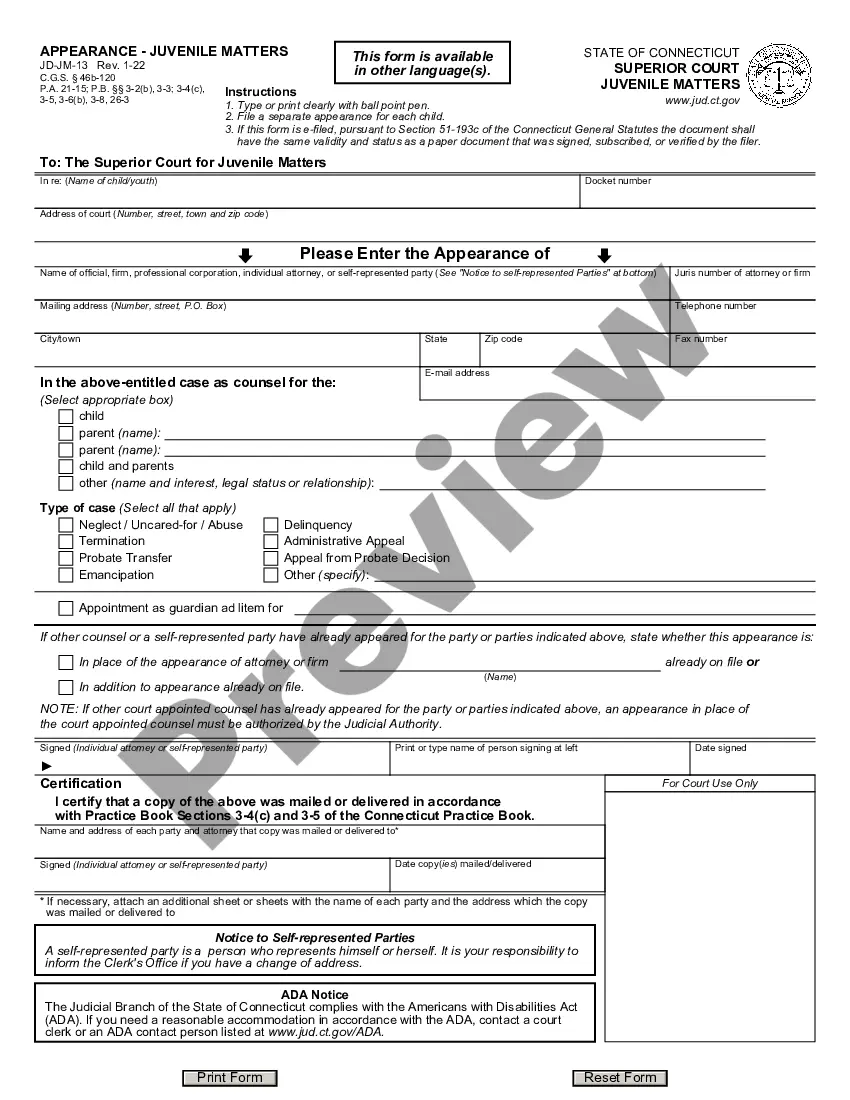

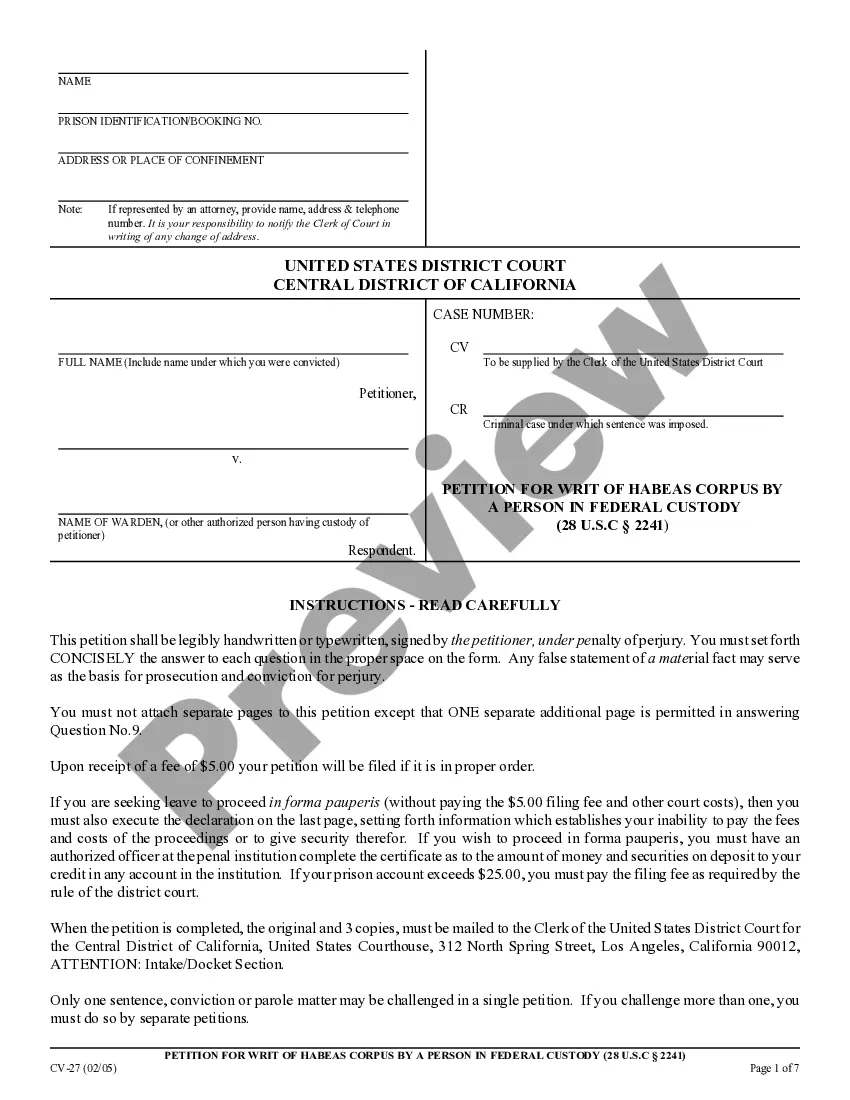

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the correct area/region.

- Step 2. Take advantage of the Review solution to check out the form`s content. Never forget to read through the explanation.

- Step 3. Should you be unhappy with all the type, utilize the Look for area towards the top of the display to get other models in the legal type design.

- Step 4. When you have identified the shape you need, click the Get now button. Select the pricing prepare you favor and add your credentials to register for the accounts.

- Step 5. Process the deal. You can use your credit card or PayPal accounts to complete the deal.

- Step 6. Select the formatting in the legal type and obtain it on your own product.

- Step 7. Comprehensive, edit and print or indication the West Virginia Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees.

Every single legal papers design you purchase is the one you have permanently. You might have acces to every type you acquired within your acccount. Click the My Forms section and select a type to print or obtain again.

Compete and obtain, and print the West Virginia Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees with US Legal Forms. There are thousands of professional and express-certain types you can utilize to your enterprise or person requires.