The West Virginia Approval of Company Employee Stock Purchase Plan provides a platform for employees of West Virginia-based companies to purchase stocks within their respective organizations. This plan allows employees to invest in their company's stock at discounted prices, offering them an opportunity to become stakeholders in the success and growth of their company. Under the West Virginia Approval of Company Employee Stock Purchase Plan, employees can contribute a portion of their salary, typically through payroll deductions, towards the purchase of company stocks. This contribution is made on an after-tax basis. The plan often offers a discount on the stock purchase price, allowing employees to acquire shares at a lower cost compared to the market value. The West Virginia Approval of Company Employee Stock Purchase Plan is designed to encourage employee loyalty, engagement, and long-term commitment to the organization. By aligning employee interests with those of the company, this plan fosters a sense of ownership amongst the workforce. Additionally, it can serve as a valuable retention tool, as employees with a vested interest in the company's success are more likely to stay with the organization. Companies implementing the West Virginia Approval of Company Employee Stock Purchase Plan may have various types or structures of the plan, including: 1. Non-Qualified Stock Purchase Plan: This type of plan is typically available to all employees and does not meet certain requirements set by the Internal Revenue Code. The contributions made through this plan are subject to income tax and social security tax. 2. Qualified Stock Purchase Plan: This plan meets specific criteria outlined by the Internal Revenue Code, making it eligible for certain tax advantages. Contributions made through a qualified plan are typically exempt from income tax and social security tax until the shares are sold. 3. Direct Stock Purchase Plan: Some companies offer a direct stock purchase plan, allowing employees to purchase company stock directly from the organization without involving a brokerage firm. This type of plan often offers convenient features, such as small investment amounts, automatic payroll deductions, and potential discounts on stock prices. 4. Indirect Stock Purchase Plan: In an indirect stock purchase plan, employees invest in company stocks through a brokerage firm or financial institution. The plan still provides the benefits of stock ownership, but the purchase and sale of shares are facilitated through a third-party platform. Overall, the West Virginia Approval of Company Employee Stock Purchase Plan is an attractive employee benefit that enables workers to invest in their employer's success. It encourages employee loyalty, engagement, and aligns interests between the workforce and the organization. Different plan types, such as non-qualified, qualified, direct, and indirect stock purchase plans, offer flexibility and options for employee participation based on their preferences and the structure of the company's stock purchase program.

West Virginia Approval of Company Employee Stock Purchase Plan

Description

How to fill out West Virginia Approval Of Company Employee Stock Purchase Plan?

If you want to complete, acquire, or produce lawful record web templates, use US Legal Forms, the biggest collection of lawful forms, that can be found online. Make use of the site`s simple and convenient search to discover the paperwork you need. Various web templates for business and person functions are sorted by categories and says, or search phrases. Use US Legal Forms to discover the West Virginia Approval of Company Employee Stock Purchase Plan within a number of clicks.

In case you are previously a US Legal Forms consumer, log in for your profile and click the Acquire option to obtain the West Virginia Approval of Company Employee Stock Purchase Plan. You may also accessibility forms you earlier saved from the My Forms tab of your own profile.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for the right town/region.

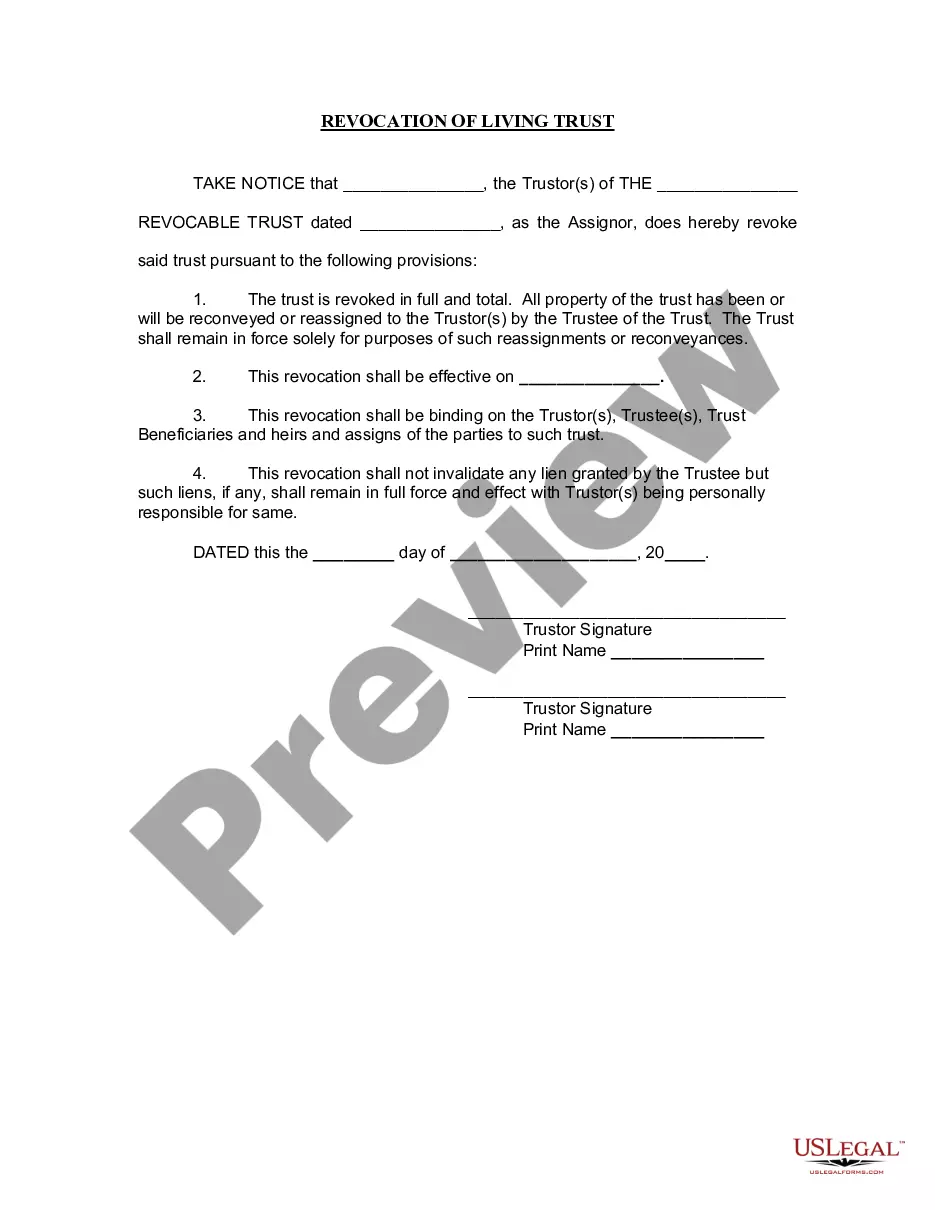

- Step 2. Take advantage of the Review method to look over the form`s articles. Do not forget to see the information.

- Step 3. In case you are not happy with all the kind, make use of the Lookup field at the top of the display screen to get other versions in the lawful kind web template.

- Step 4. Once you have identified the form you need, click the Purchase now option. Pick the prices plan you favor and include your credentials to sign up for the profile.

- Step 5. Approach the transaction. You can utilize your bank card or PayPal profile to perform the transaction.

- Step 6. Select the file format in the lawful kind and acquire it on your own product.

- Step 7. Total, revise and produce or indicator the West Virginia Approval of Company Employee Stock Purchase Plan.

Each lawful record web template you buy is your own property for a long time. You may have acces to every single kind you saved in your acccount. Select the My Forms section and choose a kind to produce or acquire once again.

Compete and acquire, and produce the West Virginia Approval of Company Employee Stock Purchase Plan with US Legal Forms. There are thousands of specialist and state-particular forms you can utilize for your personal business or person requires.