West Virginia Proposals for Approving Employees' Stock Deferral Plan and Directors' Stock Deferral Plan: A Comprehensive Overview Introduction: The state of West Virginia offers various proposals aiming to approve and implement both Employees' Stock Deferral Plan and Directors' Stock Deferral Plan. These plans aim to provide employees and directors with the opportunity to defer a portion of their compensation into stock options or stock rewards. This article will delve into the details of these proposals, explaining their benefits and outlining the different types available. Keywords: West Virginia, Proposals, Employees' Stock Deferral Plan, Directors' Stock Deferral Plan, Copy of Plans 1. Employees' Stock Deferral Plan: The Employees' Stock Deferral Plan proposed in West Virginia is designed to offer participating employees the option to defer a portion of their salary, wages, or bonuses and receive stock options or stock rewards instead. This allows employees to align their financial interests with the success of the company and potentially benefit from its long-term growth. Types of Employees' Stock Deferral Plan: a) Basic Stock Deferral Plan: This plan enables employees to defer a predetermined percentage or fixed amount of their compensation and receive an equivalent value in stock options or stock rewards. It provides a straightforward mechanism for employees to participate in the company's stock ownership. b) Matching Stock Deferral Plan: This plan incorporates a matching component, where the employer matches a percentage or specific amount of the employee's deferral contribution with additional stock options or stock rewards. The matching feature serves as an incentive to encourage employee participation and aligns the employer's interests with those of the employees. 2. Directors' Stock Deferral Plan: The Directors' Stock Deferral Plan proposed in West Virginia aims to offer directors the flexibility to defer their compensation, such as fees or retainers, into stock options or stock rewards. This plan allows directors to share in the long-term success of the company and reinforces their commitment to its growth and prosperity. Types of Directors' Stock Deferral Plan: a) Board Fee Deferral Plan: This plan enables directors to defer a portion or all of their board fees into stock options or stock rewards. By deferring their fees, directors become invested in the company's performance and can benefit from its future success. b) Retainer Deferral Plan: This plan allows directors to defer a percentage or fixed amount of their retainer compensation into stock options or stock rewards. It provides an opportunity for directors to accumulate a stake in the company's equity over time. Importance of Approval: To implement these stock deferral plans in West Virginia, it is essential for employers and directors to gain approval from the appropriate parties. This typically involves presenting detailed proposals outlining the structure, terms, and benefits of the plans. Employers and directors may need to provide a copy of the plans to demonstrate transparency and clarity regarding the deferral options available. Conclusion: West Virginia Proposals for Employees' Stock Deferral Plan and Directors' Stock Deferral Plan allow both employees and directors to defer a portion of their compensation into stock options or stock rewards. By approving these plans, companies can foster long-term loyalty, alignment of interests, and potentially unlock the full potential of their employees and directors. Employers considering these proposals should ensure they have a well-defined plan structure and seek the necessary approvals to implement these beneficial stock deferral plans.

West Virginia Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans

Description

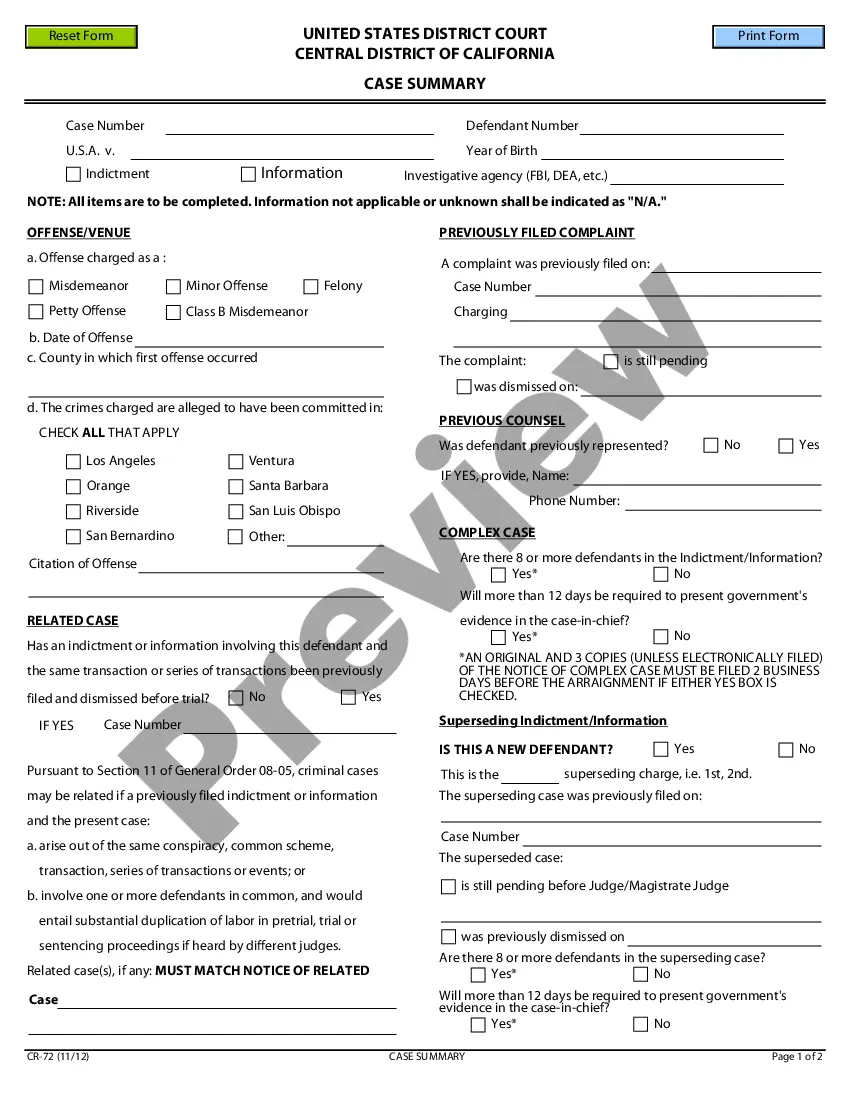

How to fill out West Virginia Proposals To Approve Employees' Stock Deferral Plan And Directors' Stock Deferral Plan With Copy Of Plans?

Are you currently in a place where you require documents for both enterprise or individual reasons almost every day? There are plenty of lawful papers templates available on the net, but getting ones you can trust is not straightforward. US Legal Forms gives thousands of form templates, such as the West Virginia Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans, that happen to be written to meet state and federal specifications.

If you are previously informed about US Legal Forms internet site and get your account, merely log in. Next, you may down load the West Virginia Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans format.

Should you not have an account and want to start using US Legal Forms, follow these steps:

- Discover the form you require and ensure it is for the appropriate metropolis/county.

- Take advantage of the Review switch to check the form.

- Look at the information to ensure that you have selected the right form.

- When the form is not what you are searching for, make use of the Research industry to discover the form that meets your requirements and specifications.

- When you find the appropriate form, simply click Acquire now.

- Opt for the costs plan you want, submit the desired details to make your bank account, and buy the order utilizing your PayPal or credit card.

- Choose a convenient file formatting and down load your copy.

Get all of the papers templates you possess purchased in the My Forms food list. You can aquire a extra copy of West Virginia Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans anytime, if necessary. Just select the required form to down load or printing the papers format.

Use US Legal Forms, probably the most comprehensive assortment of lawful kinds, to save time and stay away from errors. The support gives professionally created lawful papers templates which can be used for an array of reasons. Make your account on US Legal Forms and commence generating your daily life a little easier.