Title: Understanding West Virginia Approval of Executive Director Loan Plan: A Comprehensive Overview Introduction: West Virginia's Approval of Executive Director Loan Plan aims to provide financial assistance to executive directors who require funding for personal or professional purposes. This robust program is designed to support the growth and development of executive leadership within various sectors, allowing eligible individuals to fulfill their goals and drive economic progress. In this article, we will explore the different types of West Virginia Approval of Executive Director Loan Plans and provide a detailed description of the program's features. Keywords: West Virginia Approval of Executive Director Loan Plan, financial assistance, executive directors, personal funding, professional funding, growth and development, economic progress. Types of West Virginia Approval of Executive Director Loan Plans: 1. Personal Funding Loan Plan: The Personal Funding Loan Plan under West Virginia's Approval of Executive Director Loan Plan offers financial assistance to executives for personal use. This variant is intended to support executives in meeting personal financial obligations, such as home improvements, debt consolidation, education expenses, medical bills, or emergency situations. Keywords: Personal Funding Loan Plan, financial assistance, executives, personal use, financial obligations, home improvements, debt consolidation, education expenses, medical bills, emergency situations. 2. Professional Funding Loan Plan: The Professional Funding Loan Plan is a specialized component of the West Virginia Approval of Executive Director Loan Plan designed to extend financial support to executives pursuing professional growth and development. It facilitates funding for initiatives like professional certifications, advanced education, conference attendance, research activities, or starting a professional venture. Keywords: Professional Funding Loan Plan, specialized component, financial support, professional growth and development, professional certifications, advanced education, conference attendance, research activities, starting a professional venture. Description of West Virginia Approval of Executive Director Loan Plan: The West Virginia Approval of Executive Director Loan Plan caters to executive directors who meet specific eligibility criteria and require financial assistance. This program emphasizes the importance of fostering executive leadership skills, promoting economic growth, and ultimately benefiting the state's industries and communities. Eligibility Criteria: To qualify for the West Virginia Approval of Executive Director Loan Plan, applicants must be serving as executive directors of eligible organizations, demonstrate a legitimate need for funding, present a well-structured loan repayment plan, and meet the program's specific financial criteria. Features and Benefits: 1. Favorable Loan Repayment Terms: Executives who receive funding under this program benefit from flexible loan repayment options, such as extended tenures, reasonable interest rates, and tailored repayment schedules based on individual financial capabilities. 2. Boosting Economic Growth: By empowering executive directors through financial assistance, West Virginia stimulates economic growth within the region, encouraging innovative projects, job creation, and enhanced productivity. 3. Personalized Loan Amounts: The loan amount granted under the West Virginia Approval of Executive Director Loan Plan is determined based on the recipient's explicit needs and financial capabilities, ensuring that the assistance provided is appropriate for their specific requirements. 4. Streamlined Application Process: The loan plan maintains an efficient application process, minimizing bureaucratic hurdles and enabling timely access to the funding. Conclusion: The West Virginia Approval of Executive Director Loan Plan offers financial aid to eligible executive directors to support their personal and professional endeavors. By tailoring the loan plans to address specific needs and providing favorable repayment terms, this program contributes to economic growth while assisting executives in fulfilling their goals.

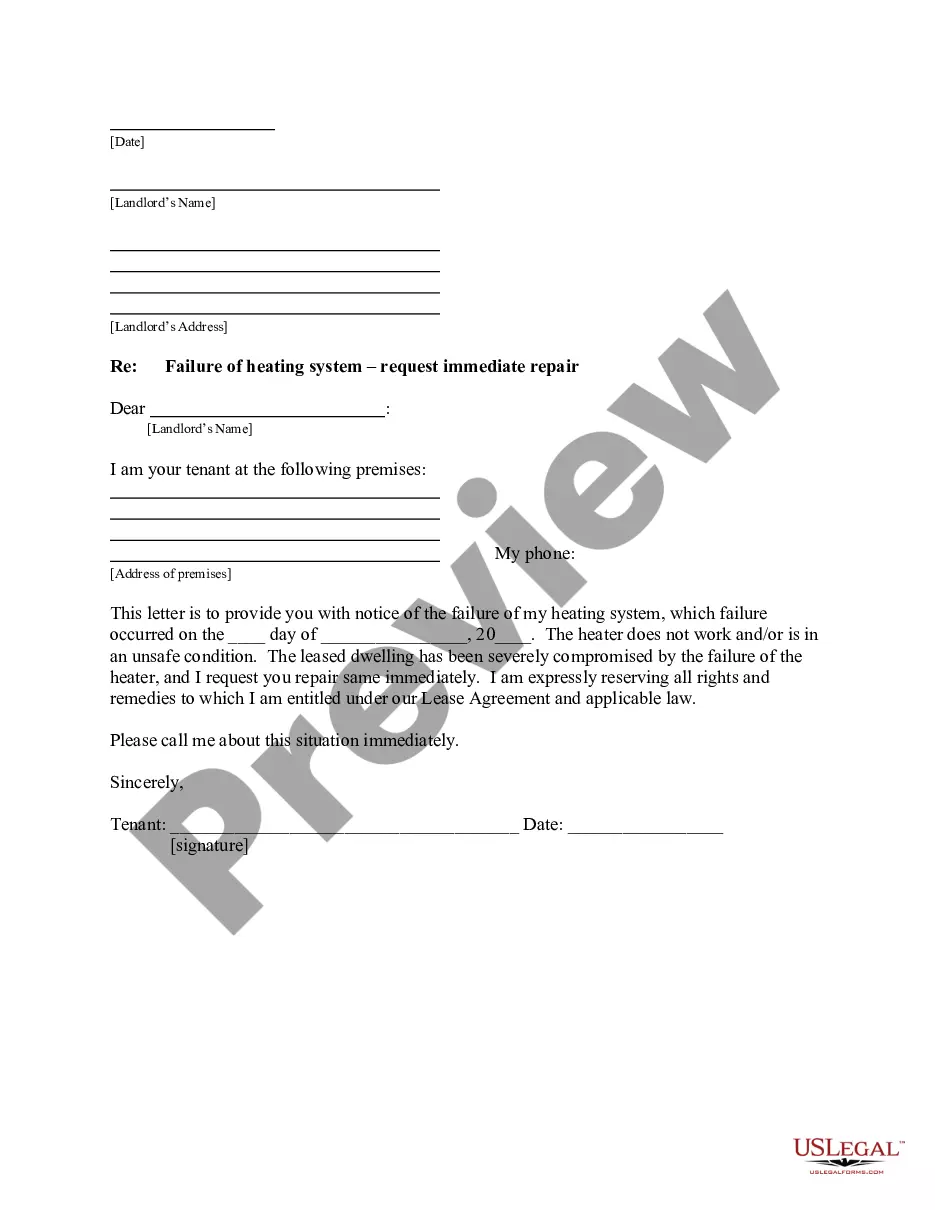

West Virginia Approval of executive director loan plan

Description

How to fill out Approval Of Executive Director Loan Plan?

You may invest time on the web attempting to find the legitimate papers web template that meets the federal and state requirements you want. US Legal Forms offers a large number of legitimate forms that happen to be evaluated by professionals. It is simple to acquire or print out the West Virginia Approval of executive director loan plan from our assistance.

If you currently have a US Legal Forms account, you may log in and click on the Down load switch. Afterward, you may comprehensive, change, print out, or signal the West Virginia Approval of executive director loan plan. Each legitimate papers web template you buy is your own property eternally. To acquire yet another copy for any obtained form, visit the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms internet site for the first time, follow the easy recommendations beneath:

- First, make sure that you have chosen the proper papers web template for the state/city of your choosing. Browse the form description to ensure you have chosen the right form. If available, use the Preview switch to look with the papers web template at the same time.

- If you want to discover yet another version of your form, use the Research discipline to obtain the web template that fits your needs and requirements.

- After you have found the web template you would like, click Buy now to carry on.

- Choose the pricing program you would like, type in your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your charge card or PayPal account to purchase the legitimate form.

- Choose the structure of your papers and acquire it in your gadget.

- Make adjustments in your papers if possible. You may comprehensive, change and signal and print out West Virginia Approval of executive director loan plan.

Down load and print out a large number of papers web templates making use of the US Legal Forms site, which offers the greatest variety of legitimate forms. Use professional and status-certain web templates to take on your small business or specific needs.

Form popularity

FAQ

The General Assembly is a bicameral body consisting of a lower house, the Virginia House of Delegates, and an upper house, the Senate of Virginia.

A bicameral legislative body, the Legislature is split between the upper West Virginia State Senate and the lower West Virginia House of Delegates.

Current members 1st district: Carol Miller (R) (since 2019) 2nd district: Alex Mooney (R) (since 2015)

Established by Article I of the Constitution, the Legislative Branch consists of the House of Representatives and the Senate, which together form the United States Congress.

West Virginia's Legislature is a bicameral legislature, meaning there are two houses of the legislature. Our Legislature is divided into a Senate, with 34 members, and House of Delegates, with 100 members.