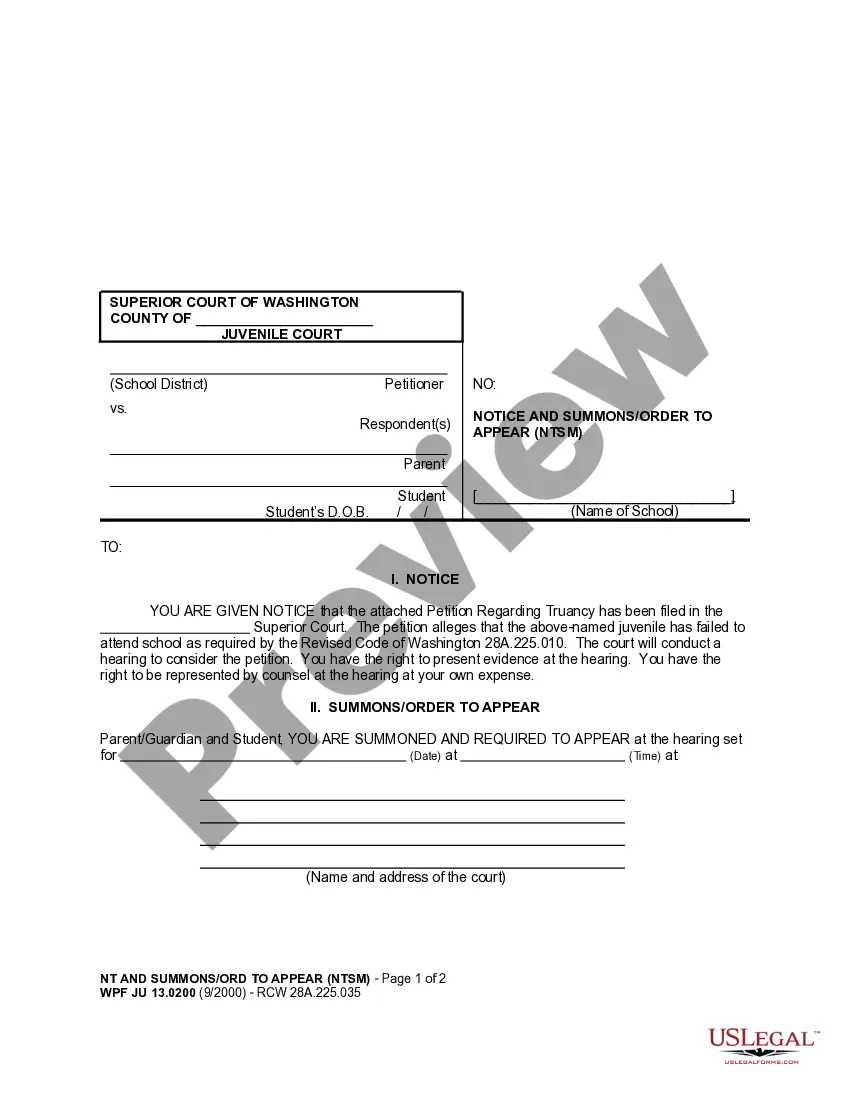

West Virginia Amendment to the articles of incorporation to eliminate par value

Description

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

Are you presently in the situation the place you will need files for both company or specific uses nearly every working day? There are a variety of lawful document templates available on the net, but finding kinds you can depend on is not effortless. US Legal Forms gives a large number of kind templates, such as the West Virginia Amendment to the articles of incorporation to eliminate par value, which can be published to fulfill state and federal requirements.

If you are presently informed about US Legal Forms web site and have your account, simply log in. After that, you may obtain the West Virginia Amendment to the articles of incorporation to eliminate par value format.

Should you not offer an accounts and need to begin using US Legal Forms, adopt these measures:

- Get the kind you want and ensure it is for your proper town/state.

- Utilize the Preview option to check the shape.

- Browse the description to actually have chosen the appropriate kind.

- When the kind is not what you are seeking, utilize the Search discipline to discover the kind that meets your requirements and requirements.

- Once you find the proper kind, click Buy now.

- Choose the rates strategy you desire, fill in the specified details to generate your money, and buy your order using your PayPal or Visa or Mastercard.

- Pick a convenient data file structure and obtain your copy.

Locate every one of the document templates you may have bought in the My Forms food selection. You can obtain a more copy of West Virginia Amendment to the articles of incorporation to eliminate par value anytime, if required. Just click on the necessary kind to obtain or print out the document format.

Use US Legal Forms, the most comprehensive assortment of lawful forms, to conserve time and steer clear of errors. The assistance gives expertly manufactured lawful document templates which can be used for an array of uses. Generate your account on US Legal Forms and start creating your way of life easier.

Form popularity

FAQ

West Virginia justifies in every way its nickname, the Mountain State. With an average elevation of about 1,500 feet (460 metres) above sea level, it is the highest of any U.S. state east of the Mississippi River.

West Virginia was separated from Virginia and admitted to the Union as a state on June 20, 1863, as the 35th state.

At 4,863 feet above sea level, Spruce Knob is West Virginia's highest peak.

Kanawha was a proposed name for the 39 counties which later became the main body of the U.S. state of West Virginia, formed on October 24, 1861.

The lowest elevation in the state (247 feet) occurs at Harpers Ferry at the eastern tip of the Eastern Panhandle, where the Potomac River leaves West Virginia.

West Virginia Code §11-22-1, provides for exemptions to paying the Transfer Tax Fee. Deeds must specifically state the reason for exemption, otherwise, the Transfer Tax Fee will be charged. Every Deed recorded requires a completed Sales Listing Form to be attached. The Sales Listing Form can be found here.

Dropping down to 247 feet above sea level, Harpers Ferry, Jefferson County, marks lowest point in the state.

Dropping down to 247 feet above sea level, Harpers Ferry, Jefferson County, marks lowest point in the state.