West Virginia Purchase by company of its stock

Description

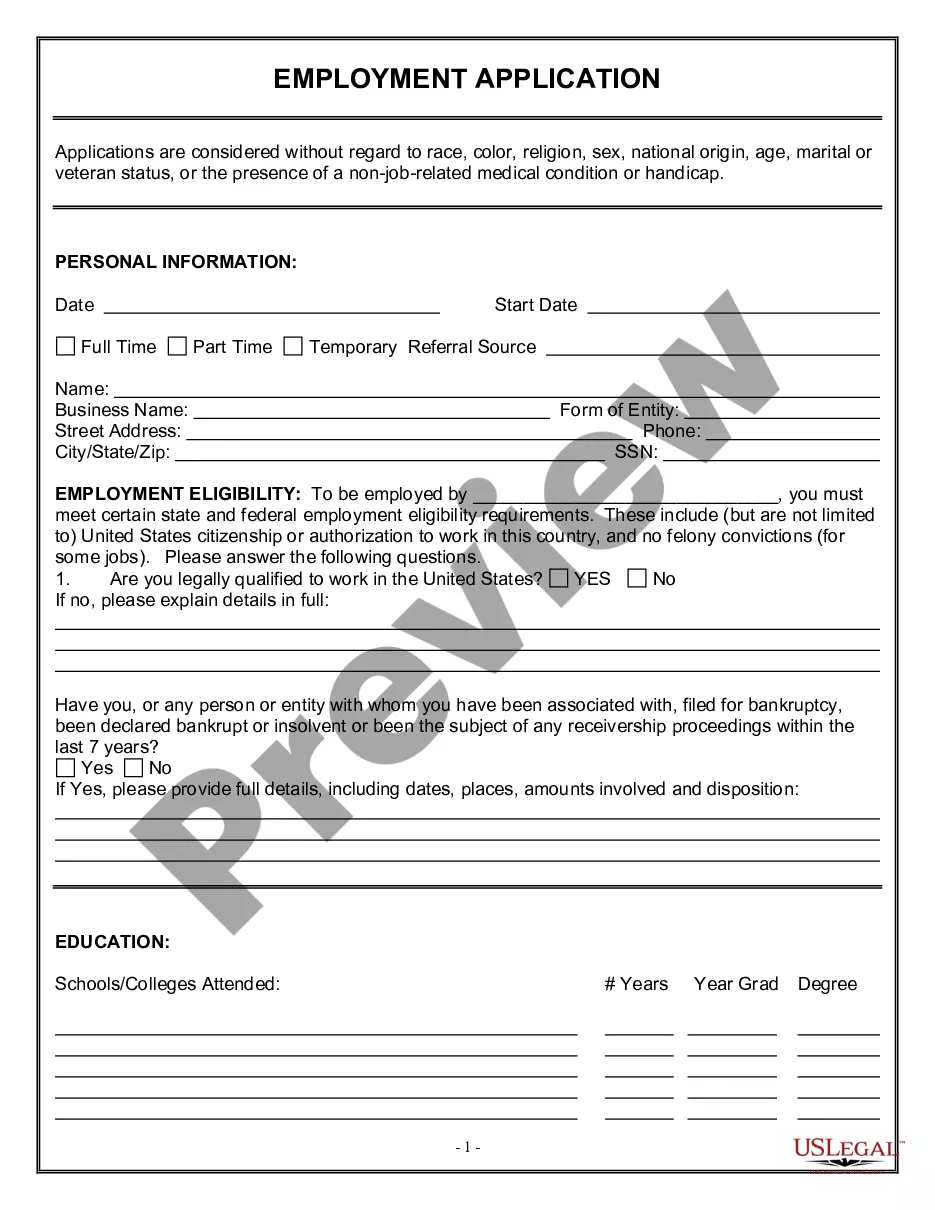

How to fill out Purchase By Company Of Its Stock?

Have you been in the position in which you need documents for either enterprise or person functions just about every time? There are plenty of legitimate file layouts accessible on the Internet, but locating ones you can rely isn`t easy. US Legal Forms provides a huge number of form layouts, like the West Virginia Purchase by company of its stock, that are created in order to meet federal and state demands.

When you are already informed about US Legal Forms website and possess your account, basically log in. Afterward, it is possible to acquire the West Virginia Purchase by company of its stock format.

If you do not provide an account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the form you want and make sure it is for that correct city/county.

- Take advantage of the Review option to review the shape.

- Read the explanation to ensure that you have chosen the right form.

- If the form isn`t what you`re searching for, use the Search discipline to discover the form that suits you and demands.

- If you discover the correct form, click on Buy now.

- Select the prices program you desire, fill in the specified information and facts to make your bank account, and purchase the order using your PayPal or bank card.

- Decide on a practical data file formatting and acquire your duplicate.

Discover all of the file layouts you possess purchased in the My Forms food list. You can aquire a extra duplicate of West Virginia Purchase by company of its stock any time, if necessary. Just click on the necessary form to acquire or printing the file format.

Use US Legal Forms, one of the most comprehensive variety of legitimate varieties, to save lots of some time and avoid blunders. The services provides appropriately made legitimate file layouts which can be used for a selection of functions. Create your account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

What are some key shareholder rights? Shareholders have the right to inspect the company's books and records, the power to sue the corporation for the misdeeds of its directors and/or officers, and the right to vote on critical corporate matters, such as naming board directors.

While individuals can't buy stock in a private company, they can own and sell those shares. If you want to sell, you will usually have to sell back to the company that issued those shares. Otherwise, seek out a broker experienced in dealing with sophisticated transactions.

A shareholder is an individual or entity that holds shares representing an equity ownership interest in a corporation, often termed either common or preferred stock. A shareholder can also be referred to interchangeably as a stockholder.

Can a Majority Owner Fire a Minority Owner? Yes, a majority owner can terminate a minority owner if they are employed by the company.

If you own shares in a public company that goes private, you must sell your shares at the acquisition price that's been agreed to by the parties.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.