West Virginia Stock Option Plan of Star States Corporation

Description

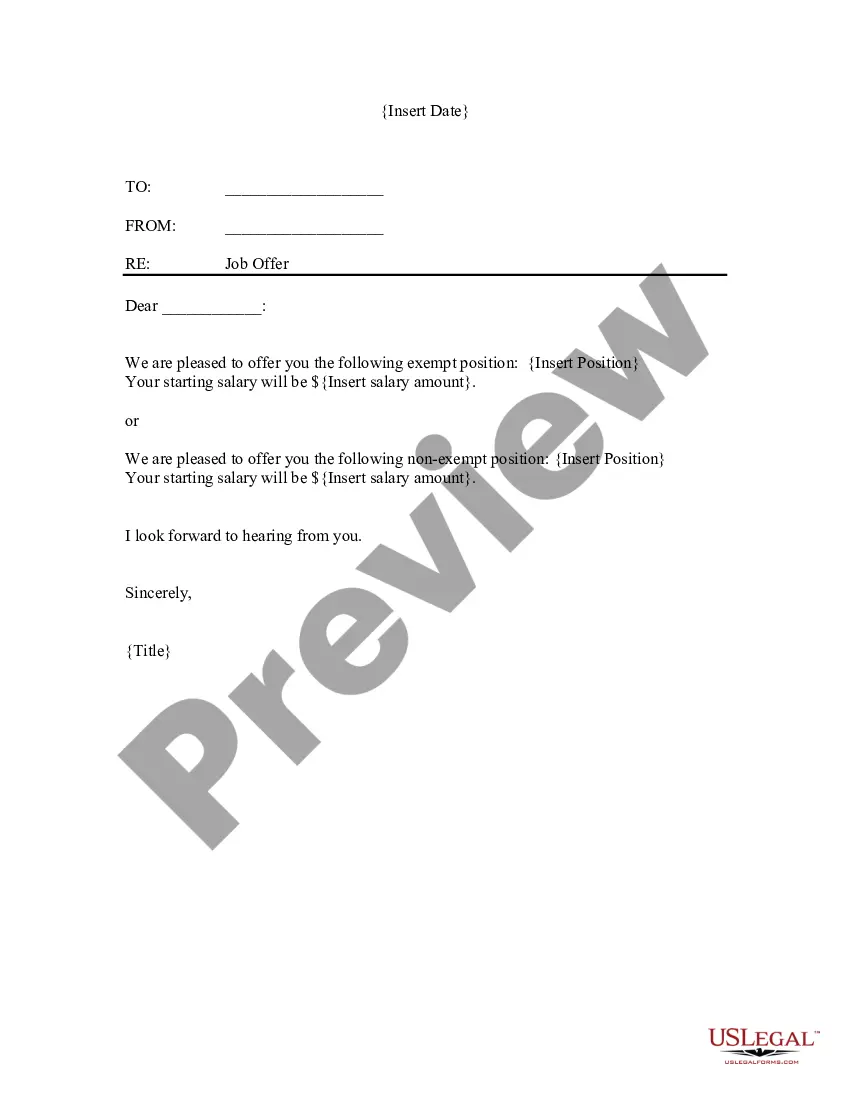

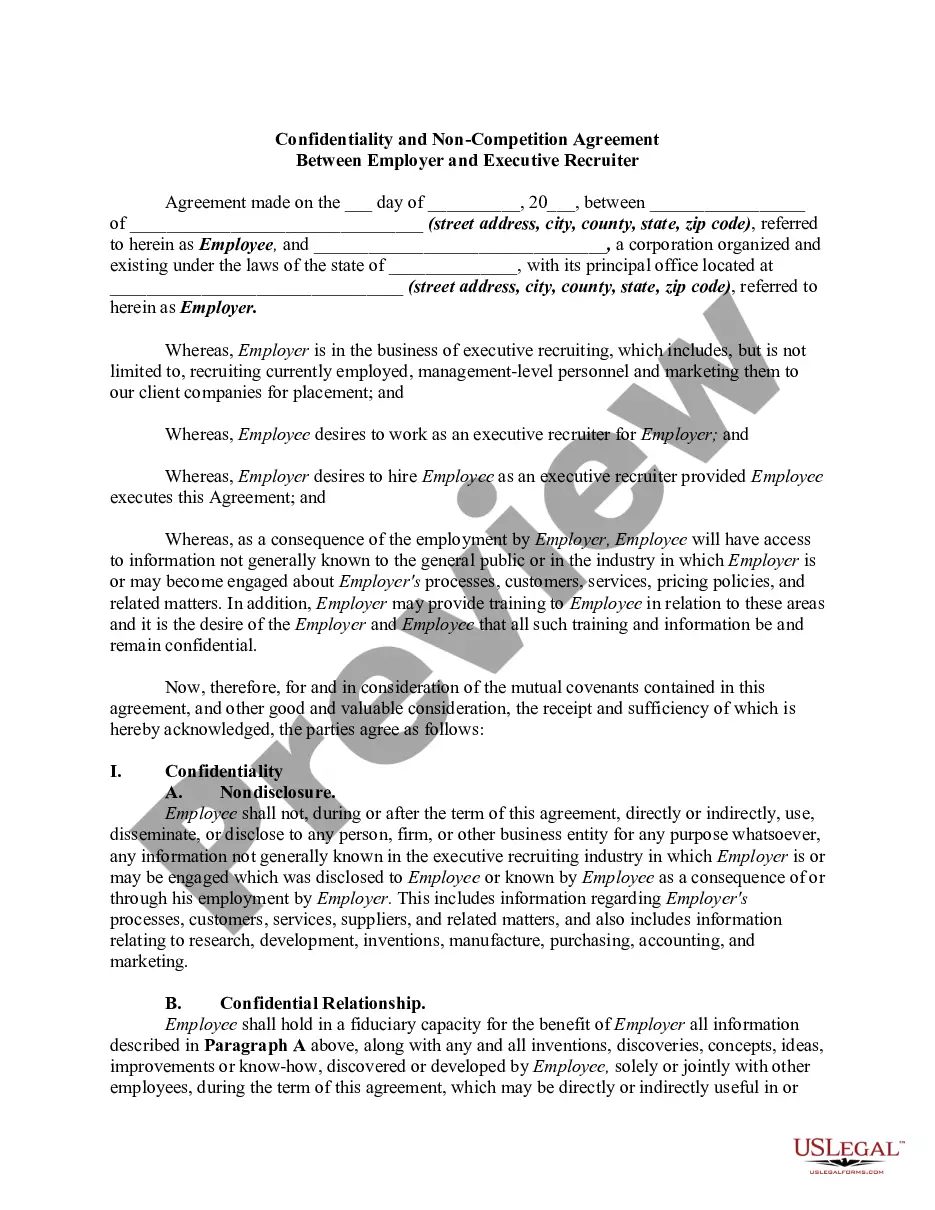

How to fill out Stock Option Plan Of Star States Corporation?

If you want to total, down load, or print legal file templates, use US Legal Forms, the biggest variety of legal varieties, that can be found on the web. Take advantage of the site`s simple and handy look for to find the paperwork you need. Different templates for business and specific uses are sorted by types and says, or keywords and phrases. Use US Legal Forms to find the West Virginia Stock Option Plan of Star States Corporation with a few mouse clicks.

Should you be previously a US Legal Forms customer, log in to your accounts and click the Download key to have the West Virginia Stock Option Plan of Star States Corporation. Also you can accessibility varieties you previously saved from the My Forms tab of your accounts.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have selected the shape to the correct metropolis/country.

- Step 2. Utilize the Review method to look through the form`s articles. Never neglect to see the outline.

- Step 3. Should you be not satisfied using the develop, take advantage of the Search field towards the top of the display screen to find other variations in the legal develop format.

- Step 4. Upon having discovered the shape you need, select the Purchase now key. Choose the prices program you choose and put your credentials to register on an accounts.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the transaction.

- Step 6. Select the format in the legal develop and down load it on your own system.

- Step 7. Complete, change and print or indicator the West Virginia Stock Option Plan of Star States Corporation.

Every single legal file format you get is your own property forever. You have acces to each develop you saved in your acccount. Select the My Forms section and select a develop to print or down load once again.

Remain competitive and down load, and print the West Virginia Stock Option Plan of Star States Corporation with US Legal Forms. There are many specialist and status-specific varieties you can utilize for the business or specific demands.

Form popularity

FAQ

If your business is organized as an S corporation or partnership and is a calendar year taxpayer, the income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year, usually March 15th.

General Instructions If you obtain a Federal extension, you will automatically receive a corresponding West Virginia tax extension, which moves the corporation filing deadline to September 15 (for calendar year filers).

On March 28, West Virginia Gov. Jim Justice signed Senate Bill 151, which allows a qualifying PTE to annually elect to be subject to the personal income tax at the entity level for tax years beginning on or after Jan. 1, 2022.

States that have reciprocity with Virginia are: Kentucky. Maryland. Pennsylvania. West Virginia.

West Virginia Tax Extension Form: To request a West Virginia extension, file Schedule L (Form IT-140) by the original due date of your return. However, Schedule L should not be filed if you have a Federal extension and you owe zero West Virginia income tax.

Extensions - Virginia provides an automatic 6-month extension for income tax returns. No application for extension is required. This extension is for the filing of the return and not for the payment of any taxes owed to Virginia.

You are allowed an automatic 7-month extension for filing your corporation income tax returns, (6-months for nonprofits and entities other than C-corporations,) but there is no extension for payment of taxes due.

West Virginia businesses deriving income from the state while operating as an S corporation or partnership and acting as a pass-through entity should use a form SPF-100 to file their state tax due. Before you can complete this document, you will need to complete the separate Schedule SP form.