West Virginia Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

How to fill out Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

Are you in a place where you need documents for possibly company or individual reasons virtually every time? There are a lot of legal file themes accessible on the Internet, but discovering kinds you can rely on is not simple. US Legal Forms provides thousands of kind themes, such as the West Virginia Agreement and plan of merger by Gelco Corp. and Grossman Corp., that are created to fulfill state and federal needs.

If you are previously acquainted with US Legal Forms internet site and possess your account, simply log in. Following that, you may obtain the West Virginia Agreement and plan of merger by Gelco Corp. and Grossman Corp. design.

If you do not offer an bank account and wish to begin using US Legal Forms, follow these steps:

- Obtain the kind you need and make sure it is to the right area/region.

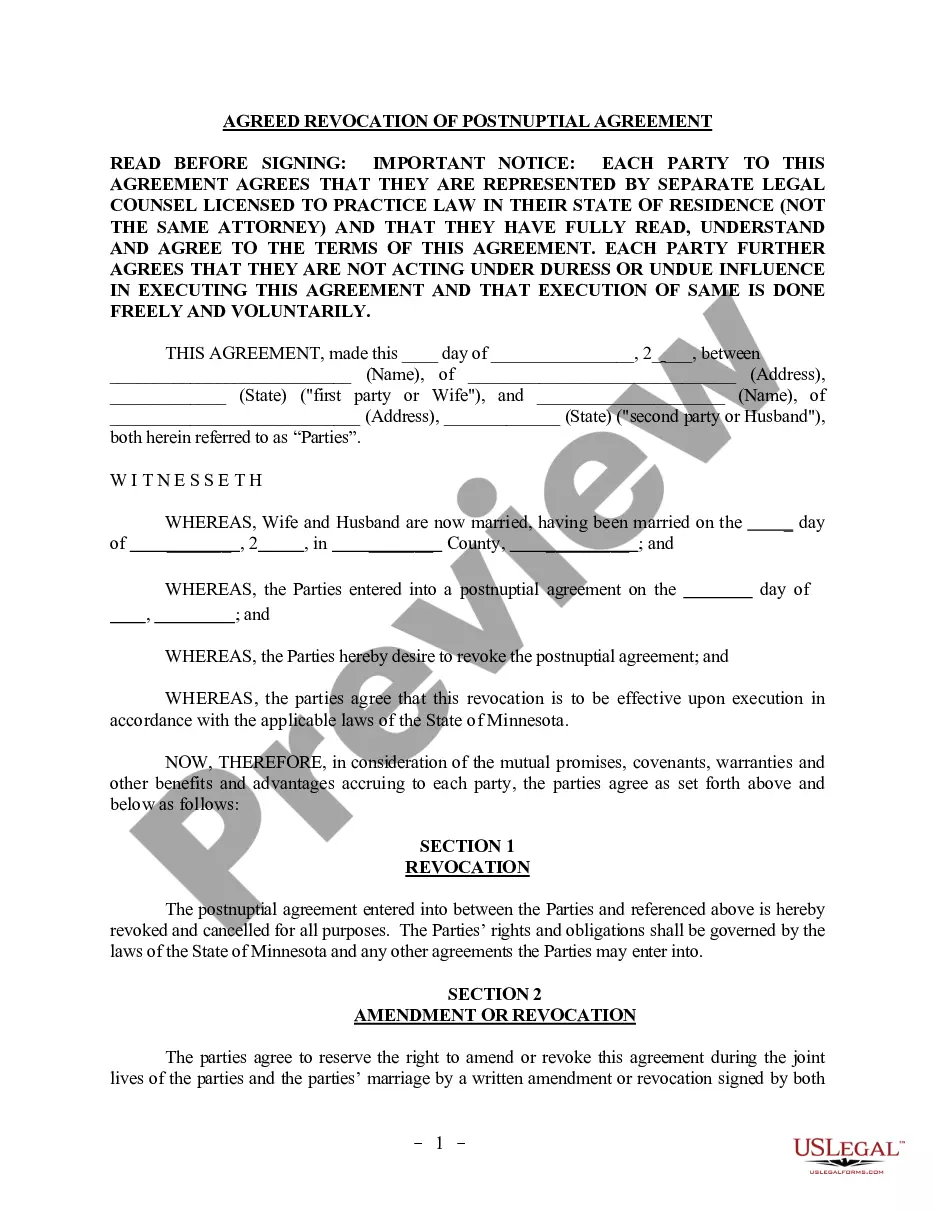

- Use the Preview key to examine the shape.

- Browse the explanation to ensure that you have selected the right kind.

- If the kind is not what you are trying to find, take advantage of the Lookup field to obtain the kind that meets your requirements and needs.

- If you get the right kind, click Get now.

- Select the costs prepare you want, fill out the necessary info to make your bank account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Decide on a practical file formatting and obtain your duplicate.

Get every one of the file themes you might have purchased in the My Forms menus. You can get a extra duplicate of West Virginia Agreement and plan of merger by Gelco Corp. and Grossman Corp. any time, if necessary. Just go through the necessary kind to obtain or print out the file design.

Use US Legal Forms, probably the most substantial variety of legal forms, to conserve efforts and stay away from mistakes. The services provides skillfully manufactured legal file themes which can be used for a variety of reasons. Make your account on US Legal Forms and initiate making your way of life easier.