West Virginia Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement

Description

How to fill out Approval Of Transfer Of Outstanding Stock With Copy Of Liquidating Trust Agreement?

US Legal Forms - one of many greatest libraries of authorized varieties in America - provides an array of authorized document layouts you can down load or produce. Using the web site, you may get a large number of varieties for business and individual reasons, sorted by categories, suggests, or search phrases.You will find the latest versions of varieties like the West Virginia Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement in seconds.

If you already possess a subscription, log in and down load West Virginia Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement in the US Legal Forms collection. The Obtain button can look on each kind you view. You gain access to all previously saved varieties from the My Forms tab of your own accounts.

If you wish to use US Legal Forms the first time, listed here are straightforward directions to help you started off:

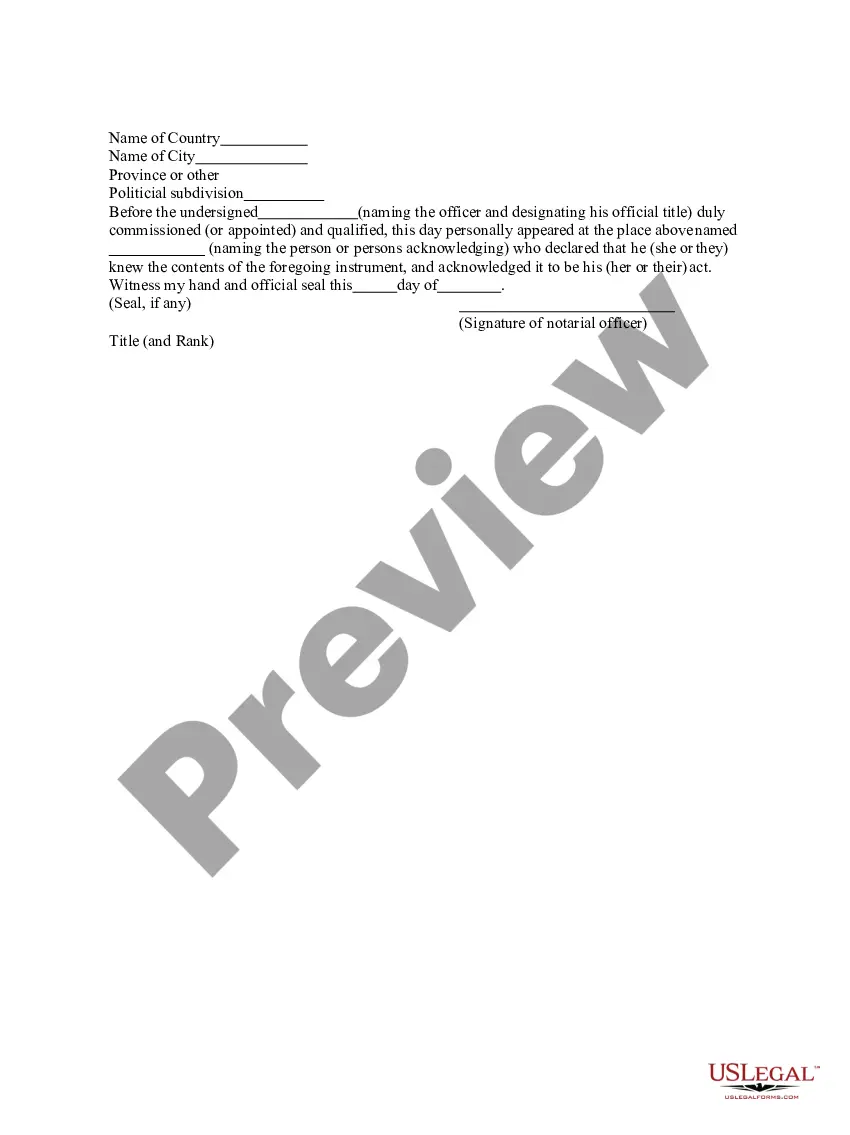

- Be sure you have picked the right kind for the area/county. Select the Review button to analyze the form`s content material. Browse the kind outline to actually have chosen the correct kind.

- In case the kind does not suit your demands, use the Search industry on top of the monitor to discover the one that does.

- When you are pleased with the form, validate your selection by clicking the Get now button. Then, pick the rates prepare you want and offer your qualifications to sign up to have an accounts.

- Method the financial transaction. Utilize your bank card or PayPal accounts to complete the financial transaction.

- Pick the file format and down load the form on the device.

- Make modifications. Load, revise and produce and sign the saved West Virginia Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement.

Every single format you included in your bank account lacks an expiration time and it is yours permanently. So, if you would like down load or produce yet another copy, just proceed to the My Forms segment and click around the kind you want.

Gain access to the West Virginia Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement with US Legal Forms, probably the most comprehensive collection of authorized document layouts. Use a large number of expert and express-particular layouts that satisfy your small business or individual requires and demands.

Form popularity

FAQ

Proceeds from a cash liquidation distribution can be either a non-taxable return of principal or a taxable distribution, depending upon whether or not the amount is more than the investors' cost basis in the stock. The proceeds can be paid in a lump sum or through a series of installments.

Liquidating trusts are commonly used to help shorten and conclude Chapter 11 cases by saving litigation for after plan confirmation. This can help save time and resources so the debtor can focus on conducting a sale or reorganization rather than being mired in creditor disputes while trying to do so.

Liquidating trusts are funded with assets held for the benefit of creditors who may have a claim against the debtor. These trusts can exist from several months to several years, depending on how long it takes to liquidate the assets and work through various claims and settlements.

Stocks and bonds can be transferred from the trust into the beneficiary's brokerage accounts. Beneficiaries typically have to pay taxes on trust income, except for distributions from the trust's principle.