West Virginia Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

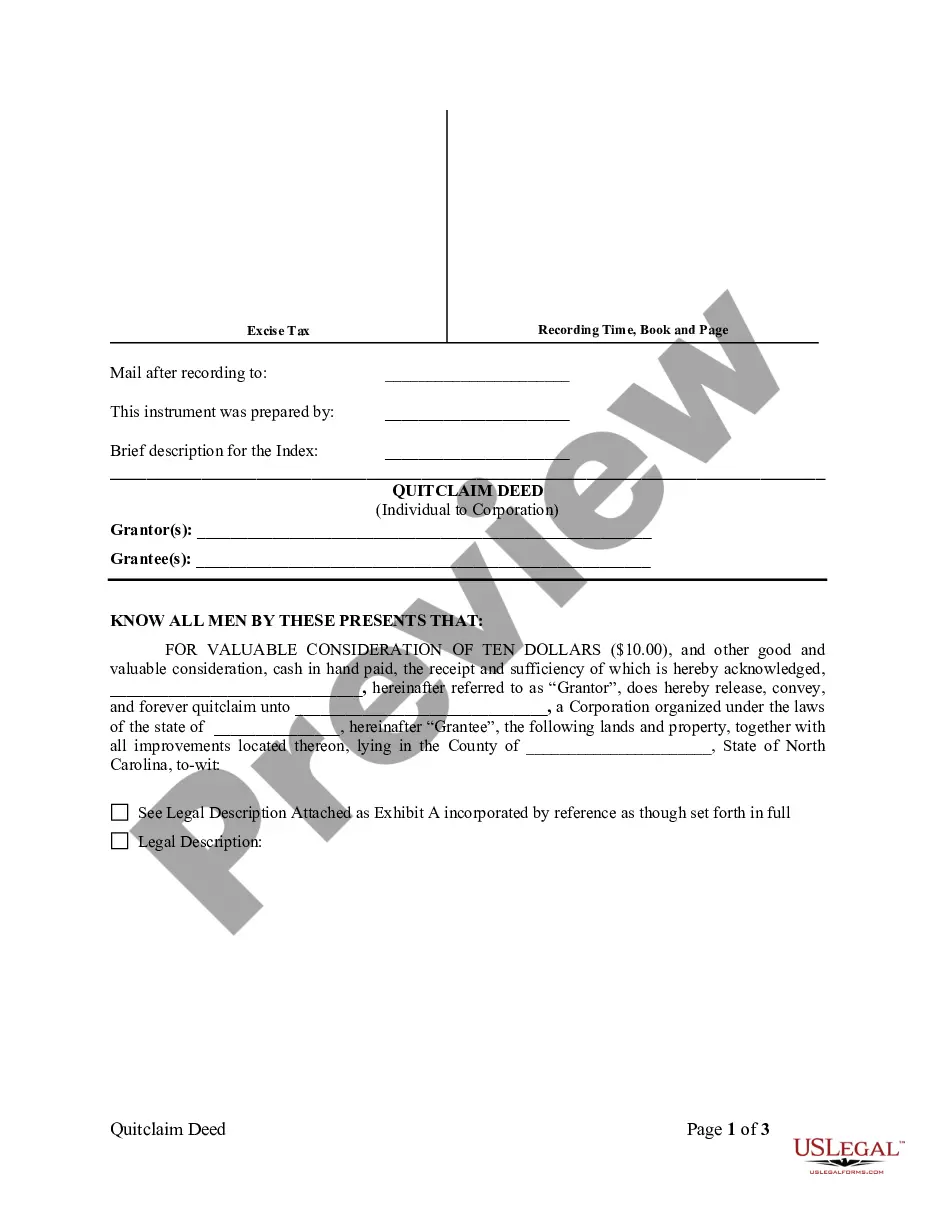

Choosing the best legal document template can be quite a struggle. Obviously, there are plenty of layouts available on the net, but how can you get the legal develop you want? Make use of the US Legal Forms web site. The support provides 1000s of layouts, including the West Virginia Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P., which you can use for organization and personal requires. Each of the types are checked by professionals and meet up with state and federal requirements.

In case you are previously registered, log in in your bank account and then click the Obtain key to have the West Virginia Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.. Make use of bank account to look throughout the legal types you might have bought earlier. Proceed to the My Forms tab of your own bank account and have an additional backup of the document you want.

In case you are a fresh user of US Legal Forms, listed here are straightforward directions so that you can stick to:

- First, ensure you have chosen the appropriate develop for your personal city/state. It is possible to look over the form making use of the Review key and study the form information to make sure it will be the right one for you.

- In the event the develop fails to meet up with your preferences, make use of the Seach discipline to find the appropriate develop.

- Once you are positive that the form is suitable, go through the Buy now key to have the develop.

- Pick the prices prepare you need and enter in the essential information. Build your bank account and buy the order making use of your PayPal bank account or bank card.

- Opt for the document file format and down load the legal document template in your system.

- Full, revise and print out and sign the received West Virginia Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

US Legal Forms will be the largest catalogue of legal types for which you will find numerous document layouts. Make use of the company to down load professionally-made documents that stick to express requirements.