West Virginia Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York

Description

How to fill out Investment Advisory Agreement Between BNY Hamilton Large Growth CRT Fund And The Bank Of New York?

Choosing the right lawful record format can be quite a battle. Of course, there are a variety of web templates available on the net, but how can you get the lawful develop you require? Make use of the US Legal Forms web site. The support offers 1000s of web templates, for example the West Virginia Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York, which you can use for company and personal demands. All of the varieties are examined by experts and fulfill federal and state requirements.

When you are previously signed up, log in for your accounts and click the Acquire option to obtain the West Virginia Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York. Utilize your accounts to check throughout the lawful varieties you have acquired previously. Check out the My Forms tab of the accounts and get one more backup of your record you require.

When you are a fresh consumer of US Legal Forms, listed below are simple guidelines that you can follow:

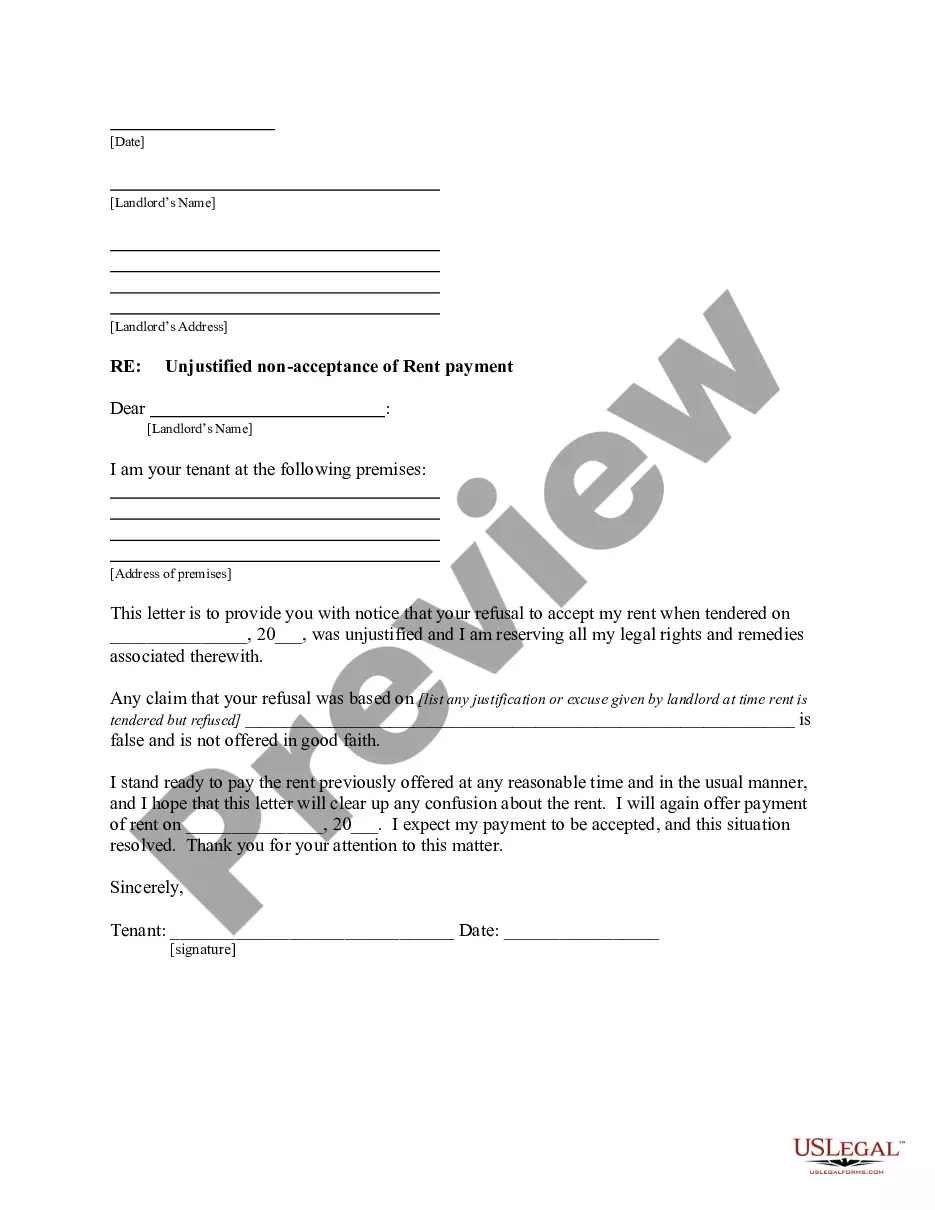

- Initially, ensure you have chosen the proper develop for your personal city/county. You can check out the form using the Preview option and read the form explanation to ensure this is the best for you.

- If the develop will not fulfill your needs, take advantage of the Seach field to obtain the proper develop.

- When you are positive that the form is acceptable, click on the Purchase now option to obtain the develop.

- Opt for the rates plan you want and type in the required information and facts. Make your accounts and buy the transaction with your PayPal accounts or Visa or Mastercard.

- Opt for the data file formatting and obtain the lawful record format for your system.

- Total, edit and printing and signal the obtained West Virginia Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York.

US Legal Forms will be the greatest local library of lawful varieties in which you can find a variety of record web templates. Make use of the company to obtain expertly-made paperwork that follow state requirements.