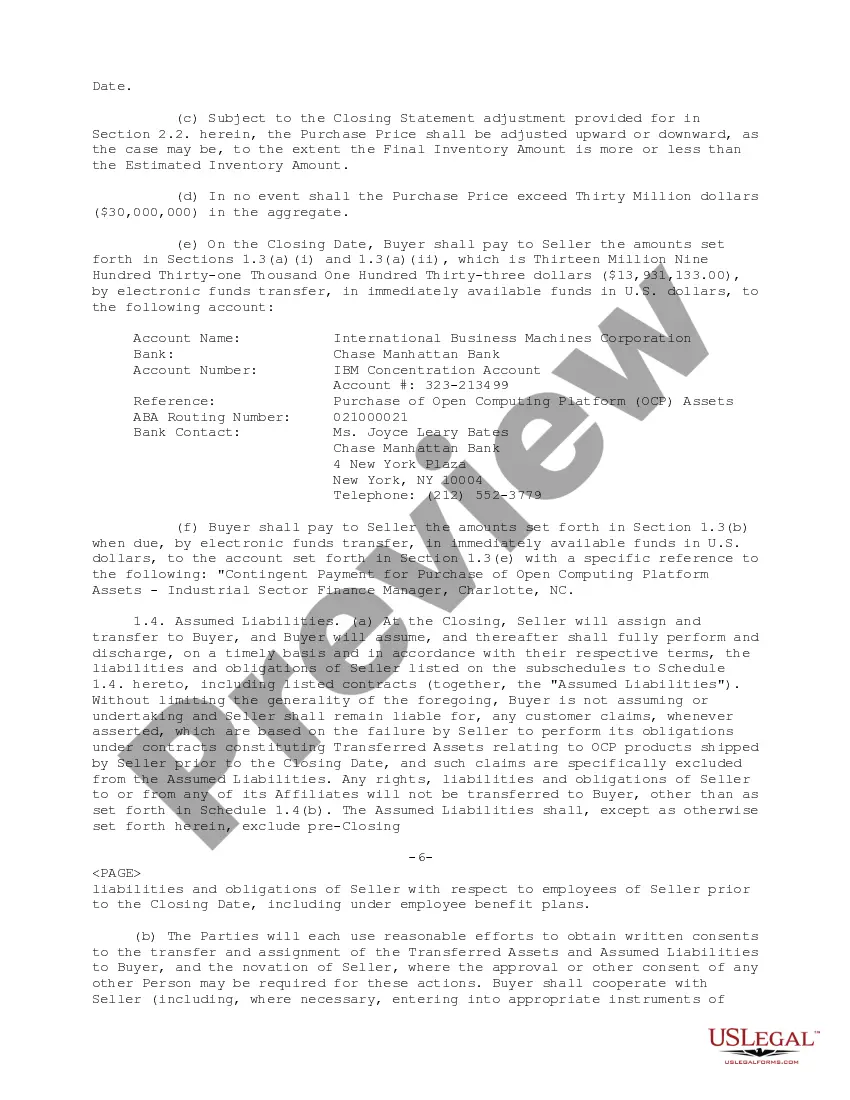

Title: West Virginia Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation — Sample Keywords: West Virginia, asset purchase agreement, Radius Corporation, International Business Machines Corporation, detailed description: This detailed description provides an overview of the West Virginia Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation. The agreement outlines the terms and conditions related to the purchase of assets by IBM from Radius in West Virginia. The West Virginia Sample Asset Purchase Agreement consists of the following key elements: 1. Parties Involved: Radiusys Corporation: A technology company specializing in embedded products and solutions. — International Business Machines Corporation (IBM): A multinational technology corporation renowned for its hardware, software, and IT services. 2. Asset Acquisition: — The agreement entails the transfer of specified assets from Radius to IBM. — Assets may include tangible properties, intellectual property rights, customer lists, contracts, software, patents, and other related items. — The precise list of assets to be purchased is detailed within the agreement. 3. Purchase Consideration: — The agreement specifies the payment terms and considerations agreed upon by both parties. — The purchase price may be based on factors such as fair market value, book value, or negotiated value. — The agreement may also include details on any additional payments, earn-outs, or contingencies. 4. Representations and Warranties: — Both parties provide assurances regarding their legal authority, ownership of assets, and absence of encumbrances. — Representations and warranties cover the accuracy of financial statements, compliance with laws and regulations, and absence of pending litigation. 5. Conditions Precedent and Closing: — The agreement outlines the conditions that must be fulfilled before the purchase can be completed. — These conditions may include necessary approvals, consents, regulatory clearances, and due diligence completion. — The closing process defines the date and manner in which the transaction will be finalized. Different types of the West Virginia Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation could include variations specific to the nature of the assets being purchased, unique terms negotiated by the parties, or additional clauses necessary to address specific circumstances. Note: The given content is a fictitious description and does not represent an actual agreement. It is purely generated for illustrative purposes.

West Virginia Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out West Virginia Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

Are you in the position in which you need to have documents for both business or specific uses just about every day? There are plenty of legal file web templates accessible on the Internet, but getting ones you can depend on is not simple. US Legal Forms offers 1000s of type web templates, such as the West Virginia Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample, which can be created to satisfy federal and state requirements.

Should you be previously familiar with US Legal Forms web site and possess an account, simply log in. Next, you may download the West Virginia Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample template.

Unless you come with an accounts and need to start using US Legal Forms, abide by these steps:

- Find the type you require and make sure it is for that right area/area.

- Take advantage of the Preview switch to examine the form.

- Browse the explanation to actually have chosen the appropriate type.

- In case the type is not what you`re trying to find, take advantage of the Research area to get the type that meets your requirements and requirements.

- Whenever you get the right type, click on Buy now.

- Select the rates strategy you desire, fill in the specified information to create your bank account, and pay money for an order utilizing your PayPal or charge card.

- Select a handy paper format and download your duplicate.

Get all of the file web templates you might have purchased in the My Forms menus. You may get a more duplicate of West Virginia Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample at any time, if needed. Just click on the necessary type to download or printing the file template.

Use US Legal Forms, the most substantial collection of legal forms, to conserve time as well as prevent errors. The support offers expertly manufactured legal file web templates that can be used for a variety of uses. Generate an account on US Legal Forms and commence making your daily life easier.