West Virginia Bylaws of Mitchell Hutchins Securities Trust are comprehensive legal documents that outline the rules, regulations, and governance structure of the trust. These bylaws provide a detailed framework for how the trust operates, ensuring compliance with West Virginia state laws and regulations. They serve as an essential reference for trustees, beneficiaries, and other stakeholders involved in the trust. Keywords: West Virginia, Bylaws, Mitchell Hutchins Securities Trust, rules, regulations, governance structure, compliance, trustees, beneficiaries, stakeholders. There are several types of West Virginia Bylaws of Mitchell Hutchins Securities Trust, depending on the specific purpose and nature of the trust. Some of these variations may include: 1. Investment Trust Bylaws: These bylaws focus on the investment strategy, objectives, and policies of the trust. They outline the criteria for selecting, managing, and disposing of assets and provide guidelines for risk management and asset allocation. Investment Trust Bylaws are crucial in ensuring that the trust's assets are managed prudently and in the best interests of the beneficiaries. 2. Administration Trust Bylaws: These bylaws primarily cover the administrative aspects of the trust. They outline the procedures for appointing trustees, their roles and responsibilities, and the process for trustee meetings and decision-making. Administration Trust Bylaws also address matters such as record keeping, reporting, and distribution of income or assets among beneficiaries. 3. Charitable Trust Bylaws: If the West Virginia Bylaws of Mitchell Hutchins Securities Trust are intended for philanthropic purposes, they may be structured as Charitable Trust Bylaws. These bylaws focus on fulfilling the trust's charitable objectives, define the eligible beneficiaries of the charitable distributions, and include provisions for grant-making and compliance with tax regulations. 4. Special Needs Trust Bylaws: In cases where the trust is established to provide for individuals with special needs, Special Needs Trust Bylaws come into play. These bylaws address the unique considerations of managing assets for beneficiaries with disabilities or long-term care needs. They include provisions for government benefit preservation, discretionary distributions, and coordination with other support services. It is essential to note that the specific types of West Virginia Bylaws of Mitchell Hutchins Securities Trust may vary based on the legal and financial requirements of each trust. The trustee(s), in consultation with legal professionals, would customize the bylaws according to the objectives, preferences, and regulations applicable to each specific trust.

West Virginia Bylaws of Mitchell Hutchins Securities Trust

Description

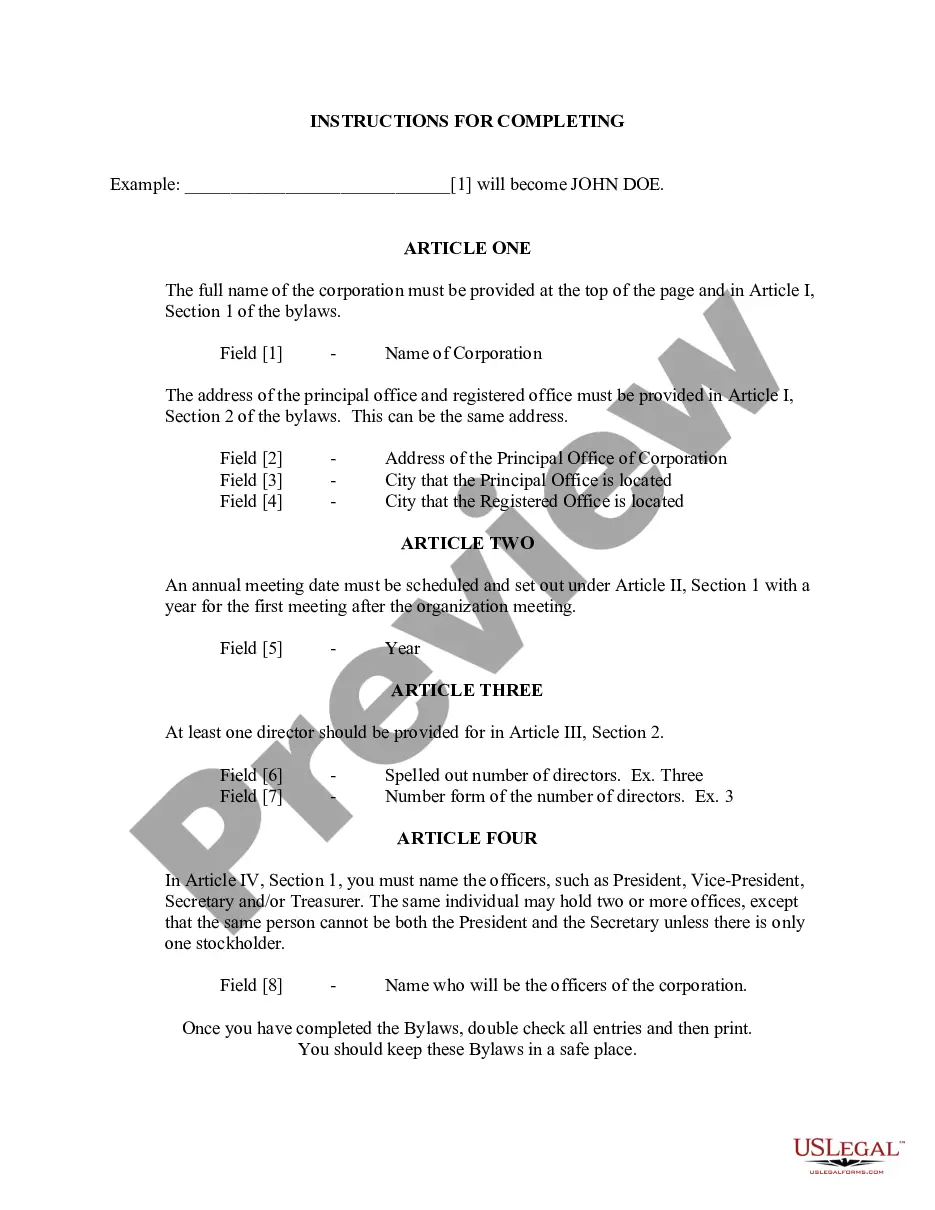

How to fill out Bylaws Of Mitchell Hutchins Securities Trust?

Are you currently within a place in which you need files for sometimes business or individual uses virtually every day time? There are plenty of legitimate document web templates available online, but locating ones you can depend on isn`t simple. US Legal Forms gives a large number of develop web templates, such as the West Virginia Bylaws of Mitchell Hutchins Securities Trust, that happen to be written in order to meet state and federal demands.

Should you be already familiar with US Legal Forms web site and get your account, just log in. Following that, you are able to acquire the West Virginia Bylaws of Mitchell Hutchins Securities Trust format.

If you do not come with an bank account and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is for the proper area/region.

- Use the Preview option to check the shape.

- Browse the explanation to ensure that you have selected the right develop.

- In the event the develop isn`t what you`re looking for, use the Research industry to obtain the develop that fits your needs and demands.

- Whenever you get the proper develop, click on Acquire now.

- Pick the rates plan you need, submit the desired information to make your account, and buy your order with your PayPal or charge card.

- Decide on a handy file format and acquire your backup.

Locate all the document web templates you might have bought in the My Forms food selection. You can obtain a further backup of West Virginia Bylaws of Mitchell Hutchins Securities Trust whenever, if possible. Just go through the necessary develop to acquire or printing the document format.

Use US Legal Forms, one of the most substantial variety of legitimate types, to save efforts and steer clear of mistakes. The assistance gives appropriately produced legitimate document web templates that you can use for an array of uses. Generate your account on US Legal Forms and initiate creating your way of life easier.