Title: Understanding the West Virginia Registration Rights Agreement: Object Soft Corp. and Investors' Sale and Purchase of 6% Series G Convertible Preferred Stocks Introduction: The West Virginia Registration Rights Agreement plays a crucial role in defining the rights and obligations of Object Soft Corp. and investors concerning the sale and purchase of 6% Series G convertible preferred stocks. This agreement ensures that both parties adhere to the legal requirements and procedures involved in registering securities with the regulatory authorities. Let's dive into the details of this agreement and explore its types, if applicable. Key Points (Keywords): 1. West Virginia Registration Rights Agreement 2. Object Soft Corp. 3. Investors 4. 6% Series G Convertible Preferred Stocks 5. Sale and Purchase 6. Securities 7. Legal Requirements 8. Regulatory Authorities 9. Investor Rights 10. Obligations 11. Types (if applicable) Description: 1. Purpose and Background: The West Virginia Registration Rights Agreement is a legally-binding contract that governs the registration of securities issued by Object Soft Corp., particularly the 6% Series G convertible preferred stocks, with the appropriate regulatory authorities. This agreement ensures transparency and compliance with state laws, protecting both Object Soft Corp. and investors. 2. Rights and Obligations: The agreement outlines the rights and obligations of both parties involved. Object Soft Corp. is obligated to register the 6% Series G convertible preferred stocks with the West Virginia state regulators and any relevant federal agencies like the Securities and Exchange Commission (SEC). Investors, in turn, are granted specific rights regarding the registration process. 3. Investor Rights: Through the Registration Rights Agreement, investors gain the right to have their purchased securities registered and made available to public trading. This ensures liquidity and enhances the marketability of the preferred stocks. Additionally, investors might have the right to request shelf registration, enabling them to make subsequent offerings more conveniently. 4. Filing and Disclosure Requirements: The agreement governs the filing and disclosure requirements Object Soft Corp. must fulfill when registering the 6% Series G convertible preferred stocks. This includes providing accurate financial statements, risk factors, and other relevant information about the company, ensuring transparency to potential investors. 5. Types of West Virginia Registration Rights Agreement (If Applicable): It's worth noting that there might be different types of West Virginia Registration Rights Agreements tailored specifically to different scenarios or investors. These variations could arise from factors such as the number of shares issued, the timing and manner of registration, and certain exemptions that apply to accredited or institutional investors. Conclusion: The West Virginia Registration Rights Agreement between Object Soft Corp. and investors for the sale and purchase of 6% Series G convertible preferred stocks is an essential legal document that safeguards the rights and interests of both parties. By establishing clear guidelines for registration and disclosure, this agreement promotes transparency, compliance, and investor confidence in the securities market.

West Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks

Description

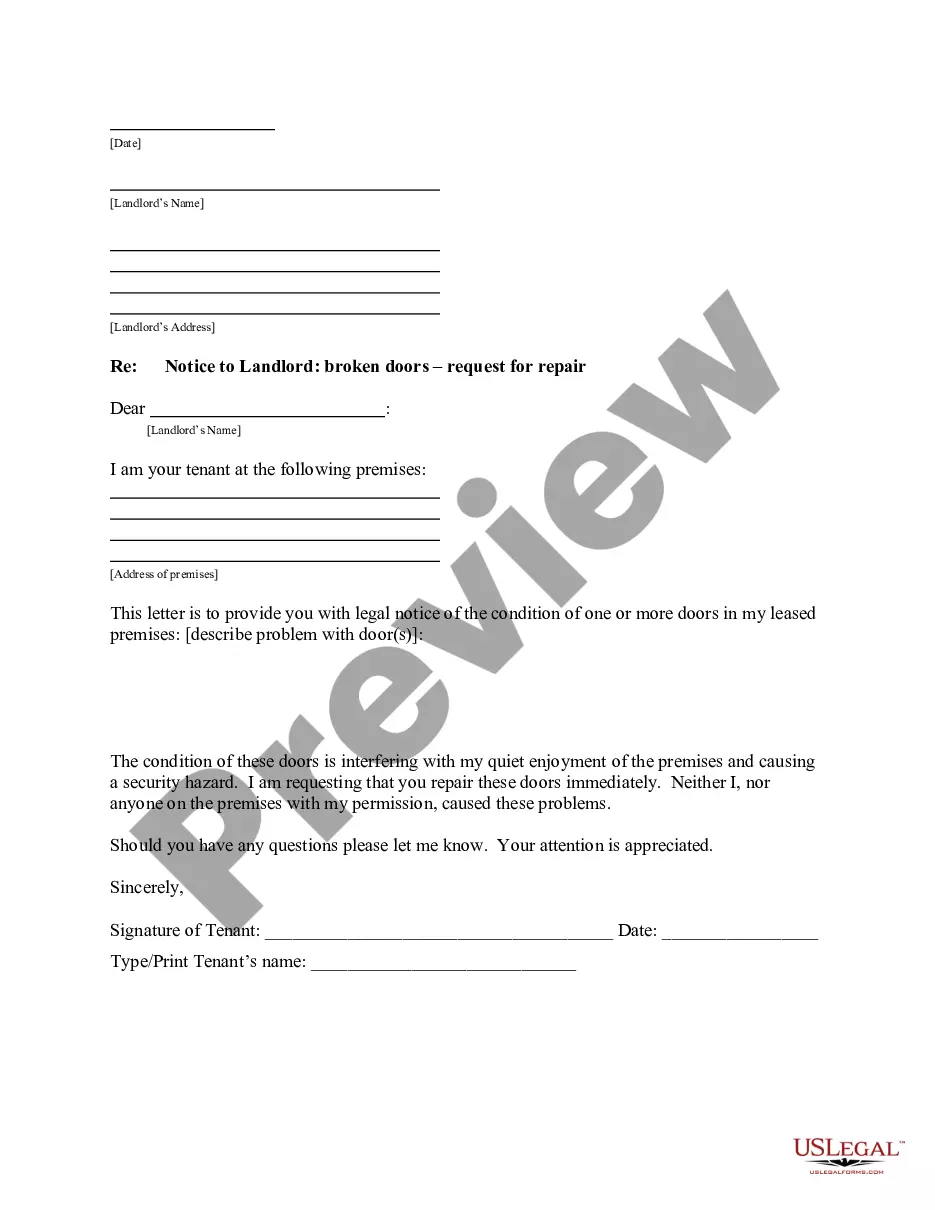

How to fill out West Virginia Registration Rights Agreement Between ObjectSoft Corp. And Investors Regarding Sale And Purchase Of 6% Series G Convertible Preferred Stocks?

If you want to complete, download, or printing legitimate document layouts, use US Legal Forms, the greatest variety of legitimate forms, which can be found on the web. Utilize the site`s simple and practical look for to get the paperwork you need. Various layouts for enterprise and person reasons are categorized by categories and states, or search phrases. Use US Legal Forms to get the West Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks within a handful of click throughs.

If you are already a US Legal Forms buyer, log in for your bank account and click on the Download option to have the West Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks. You can even accessibility forms you in the past downloaded in the My Forms tab of the bank account.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have selected the shape for your appropriate town/nation.

- Step 2. Use the Preview solution to look through the form`s content. Do not overlook to learn the outline.

- Step 3. If you are unsatisfied with the form, use the Lookup industry on top of the display to discover other types of the legitimate form design.

- Step 4. Upon having identified the shape you need, click the Purchase now option. Pick the rates prepare you prefer and include your qualifications to register for an bank account.

- Step 5. Process the purchase. You should use your charge card or PayPal bank account to perform the purchase.

- Step 6. Select the structure of the legitimate form and download it in your system.

- Step 7. Complete, edit and printing or indicator the West Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks.

Every legitimate document design you purchase is the one you have for a long time. You may have acces to each form you downloaded within your acccount. Click on the My Forms portion and select a form to printing or download once again.

Contend and download, and printing the West Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks with US Legal Forms. There are thousands of expert and state-certain forms you can use to your enterprise or person requires.