West Virginia Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.

Description

How to fill out Plan Of Merger Between Ichargeit.Com, Inc. And Ichargeit.Com, Inc.?

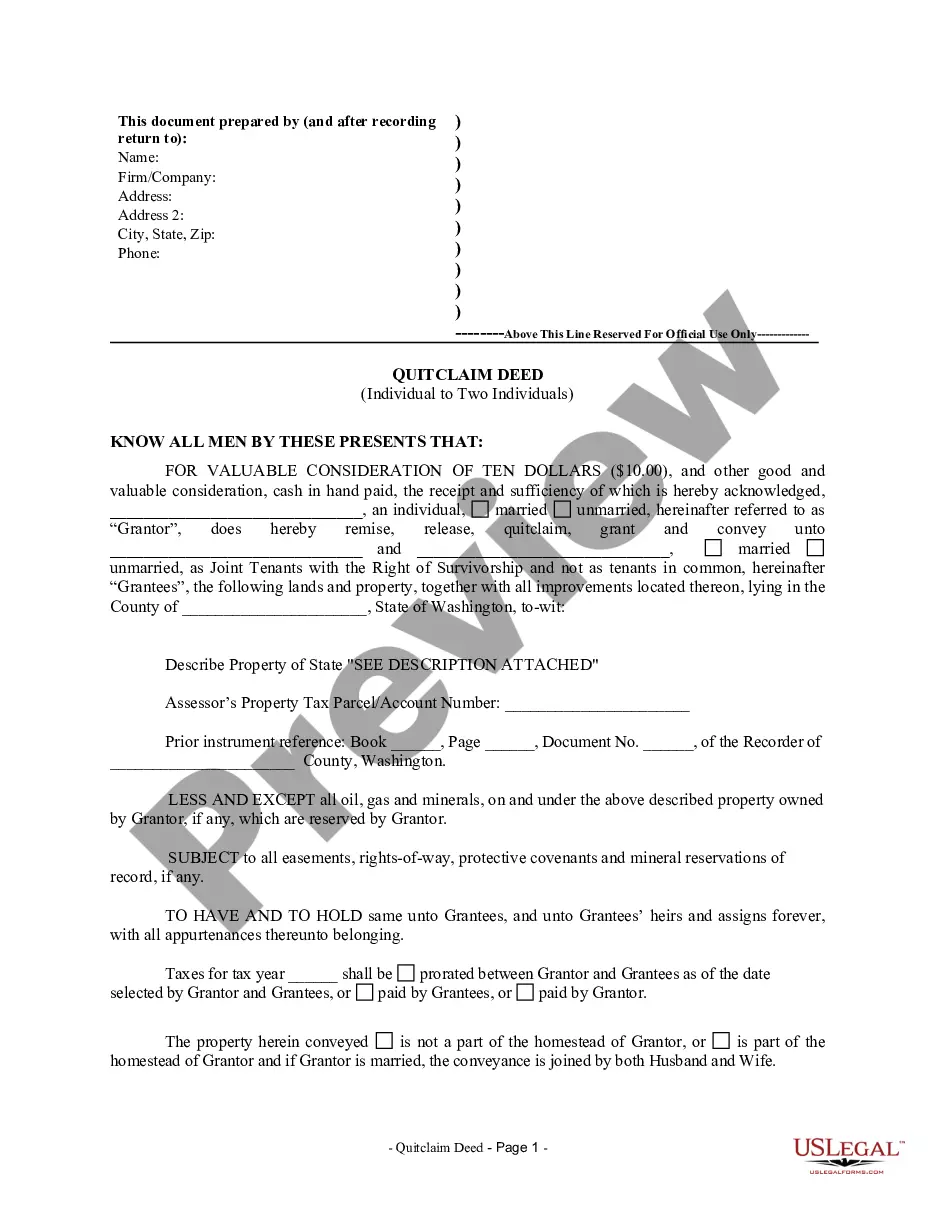

Discovering the right lawful document web template can be a struggle. Needless to say, there are a lot of themes available on the net, but how do you obtain the lawful kind you will need? Make use of the US Legal Forms internet site. The services offers thousands of themes, including the West Virginia Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc., that can be used for business and personal needs. All the types are inspected by professionals and meet federal and state demands.

Should you be presently authorized, log in in your bank account and then click the Down load option to find the West Virginia Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.. Use your bank account to check with the lawful types you have purchased previously. Check out the My Forms tab of your respective bank account and get another version in the document you will need.

Should you be a brand new user of US Legal Forms, listed here are straightforward guidelines so that you can comply with:

- Initial, make certain you have chosen the appropriate kind for your personal town/area. You may look over the shape utilizing the Preview option and look at the shape outline to make certain this is basically the best for you.

- In case the kind is not going to meet your preferences, use the Seach area to find the correct kind.

- When you are sure that the shape is proper, click the Buy now option to find the kind.

- Pick the rates plan you want and enter the needed information. Design your bank account and purchase the transaction utilizing your PayPal bank account or Visa or Mastercard.

- Choose the file structure and acquire the lawful document web template in your system.

- Complete, revise and print and indication the attained West Virginia Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc..

US Legal Forms will be the greatest collection of lawful types in which you can see a variety of document themes. Make use of the service to acquire professionally-produced paperwork that comply with express demands.