The West Virginia Investment Management Agreement is a legally binding contract that outlines the terms and conditions regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to provide management and investment advisory services in West Virginia. This agreement ensures that both parties involved understand their rights, obligations, and expectations throughout the duration of the agreement. Morgan Stanley Dean Witter Advisors, Inc. is a reputable financial services firm specializing in investment management and advisory services. By entering into this agreement with West Virginia, they are entrusted with managing and advising on various investment portfolios and assets. The agreement covers a wide range of crucial aspects, including investment goals and objectives, fee structures, reporting requirements, and decision-making authority. It establishes a clear understanding of how the investment strategy will be developed, implemented, and reviewed over time. Specific keywords relevant to this agreement may include: 1. Investment management services: This refers to the comprehensive suite of services provided by Morgan Stanley Dean Witter Advisors, Inc., ranging from investment research and portfolio construction to performance monitoring and reporting. 2. Investment advisory services: This encompasses the advice and recommendations on investment strategies, asset allocation, risk management, and other related financial matters provided by Morgan Stanley Dean Witter Advisors, Inc. 3. Portfolio management: Refers to the professional management of investment portfolios, taking into consideration the client's specific objectives, risk tolerance, and time horizon. 4. Fee structure: The agreement clearly defines the compensation structure for the investment management services, which can include a percentage of assets under management, performance-based fees, or a combination of both. 5. Reporting and monitoring: This outlines the frequency and format of performance reports, as well as the level of transparency and accountability expected from Morgan Stanley Dean Witter Advisors, Inc. in providing investment updates and highlighting any potential changes in the portfolio. It's important to note that there may be different variations or types of West Virginia Investment Management Agreements, depending on factors such as the specific investment objectives, size of the portfolio, and the duration of the agreement. However, the fundamental elements of the agreement discussed above typically remain standard across all variations. Common types of West Virginia Investment Management Agreements may include: 1. Public Pension Fund Management Agreement: This type of agreement is specifically designed for managing public pension funds, taking into account the unique investment objectives and constraints associated with these funds. 2. Endowment Fund Management Agreement: Endowment funds often have different investment goals and guidelines compared to other types of portfolios. Hence, this type of agreement caters to the specific needs of managing endowment funds for organizations such as universities, charitable foundations, or hospitals. 3. Private Wealth Management Agreement: This agreement focuses on managing the investment portfolios of high-net-worth individuals or families, providing personalized investment strategies that align with their specific financial goals and risk tolerance. 4. Non-Profit Organization Fund Management Agreement: Non-profit organizations may have specific requirements and legal obligations when it comes to managing their funds. This type of agreement caters to the unique needs and objectives of non-profit organizations and their respective investment portfolios. In conclusion, the West Virginia Investment Management Agreement with Morgan Stanley Dean Witter Advisors, Inc. is a comprehensive contract that governs the provision of investment management and advisory services. It ensures a clear understanding of the responsibilities and expectations between both parties, aiming to achieve the best possible outcomes for the investment portfolios entrusted to Morgan Stanley Dean Witter Advisors, Inc.

West Virginia Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services

Description

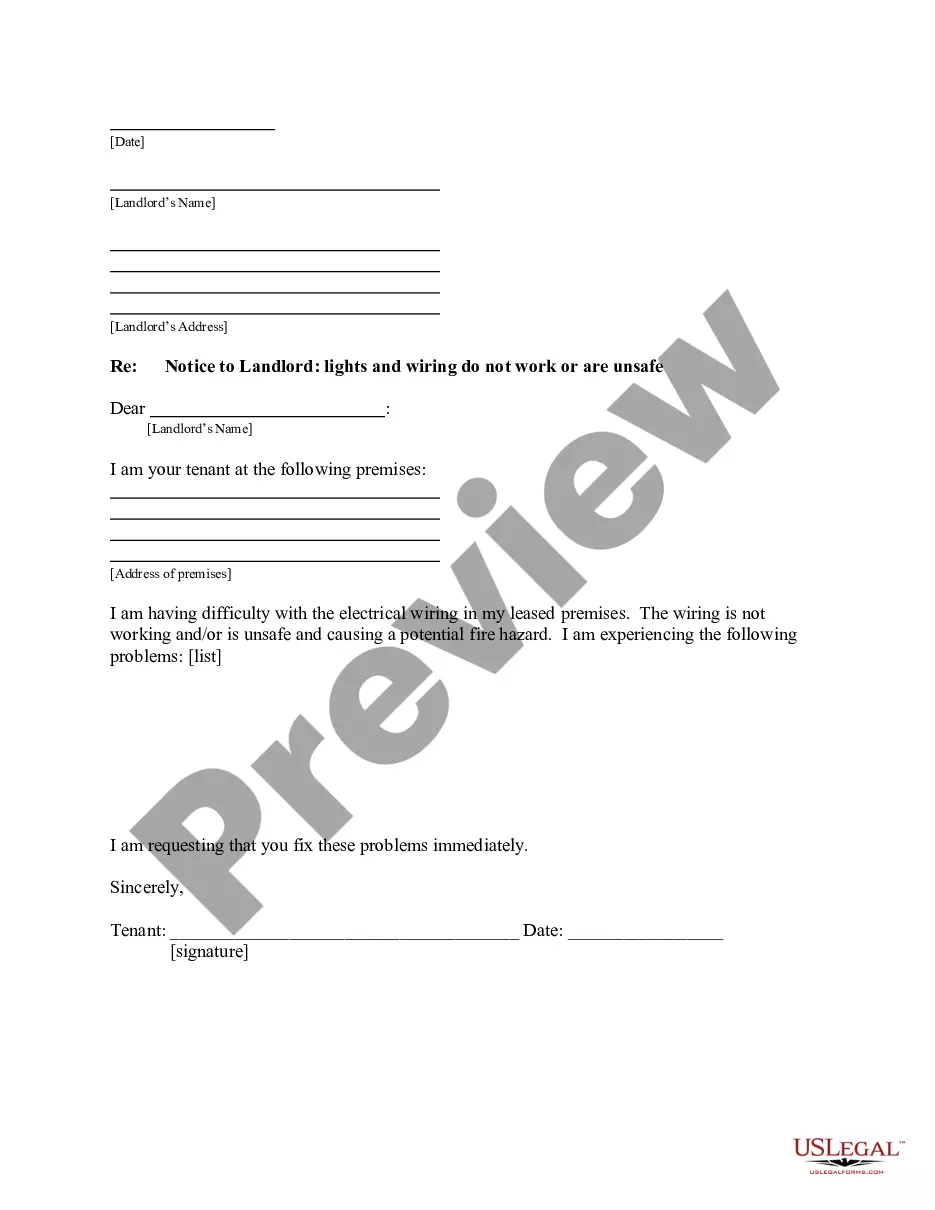

How to fill out West Virginia Investment Management Agreement Regarding The Employment Of Morgan Stanley Dean Witter Advisors, Inc. To Render Management And Investment Advisory Services?

You are able to commit time on the Internet attempting to find the authorized document format that suits the state and federal needs you need. US Legal Forms supplies a large number of authorized kinds that happen to be analyzed by specialists. You can actually acquire or produce the West Virginia Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services from your assistance.

If you already have a US Legal Forms accounts, you can log in and click on the Download key. Next, you can comprehensive, revise, produce, or indication the West Virginia Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services. Each and every authorized document format you acquire is your own property eternally. To obtain one more duplicate associated with a purchased type, go to the My Forms tab and click on the related key.

Should you use the US Legal Forms website the first time, follow the simple instructions beneath:

- Initial, ensure that you have chosen the best document format for the region/metropolis of your choice. Browse the type explanation to ensure you have picked the right type. If accessible, use the Preview key to look with the document format too.

- If you wish to locate one more version in the type, use the Search discipline to obtain the format that suits you and needs.

- Once you have discovered the format you would like, click on Purchase now to proceed.

- Choose the pricing strategy you would like, key in your references, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You should use your credit card or PayPal accounts to purchase the authorized type.

- Choose the structure in the document and acquire it for your device.

- Make changes for your document if necessary. You are able to comprehensive, revise and indication and produce West Virginia Investment Management Agreement regarding the employment of Morgan Stanley Dean Witter Advisors, Inc. to render management and investment advisory services.

Download and produce a large number of document templates utilizing the US Legal Forms web site, which offers the most important collection of authorized kinds. Use professional and state-certain templates to handle your small business or specific needs.