West Virginia Employee Shareholder Escrow Agreement is a legally binding document entered into by businesses based in West Virginia to safeguard the interests of both employers and employees during critical events, such as mergers, acquisitions, or private placement offerings. This agreement establishes an escrow account to hold shares or securities owned by the employees of a company involved in the aforementioned events, ensuring compliance with state laws and providing financial security. Keyword: West Virginia Employee Shareholder Escrow Agreement Keyword variations: WV Employee Shareholder Escrow Agreement, West Virginia Employee Escrow Agreement, Employee Shareholder Agreement WV, Escrow Agreement for Employees in West Virginia Different types of West Virginia Employee Shareholder Escrow Agreements: 1. Acquisition Escrow Agreement: This type of agreement is commonly used when a company is being acquired by another entity. It ensures that the shares owned by employees of the target company are securely held in an escrow account until the completion of the acquisition, to protect the interests of both parties. 2. Merger Escrow Agreement: In instances where two companies decide to merge, a merger escrow agreement is employed. This agreement stipulates that shares held by employees of the merging companies are placed in an escrow account until the merger is finalized, ensuring a smooth transition and safeguarding the value of the shares. 3. Private Placement Escrow Agreement: When a company decides to raise funds through a private placement offering, a private placement escrow agreement may be utilized. This agreement ensures that shares purchased by investors are held in an escrow account until certain predefined conditions are met, providing security to both the company and investors. 4. Corporate Restructuring Escrow Agreement: In cases of significant corporate restructuring, such as spin-offs or divestitures, a corporate restructuring escrow agreement is utilized. This agreement holds shares of employees in an escrow account until the restructuring is complete, ensuring an efficient and organized process. 5. Initial Public Offering (IPO) Escrow Agreement: When a company decides to go public and conducts an IPO, an IPO escrow agreement is implemented. This agreement ensures that shares allocated to employees, under employee stock option plans or other arrangements, are held in an escrow account until a specified period (lock-up period) following the IPO, preventing premature sales and stabilizing share prices. These various types of West Virginia Employee Shareholder Escrow Agreements provide clarity, protection, and security to both employers and employees, facilitating smooth transactions and mitigating potential risks during critical corporate events.

West Virginia Employee Shareholder Escrow Agreement

Description

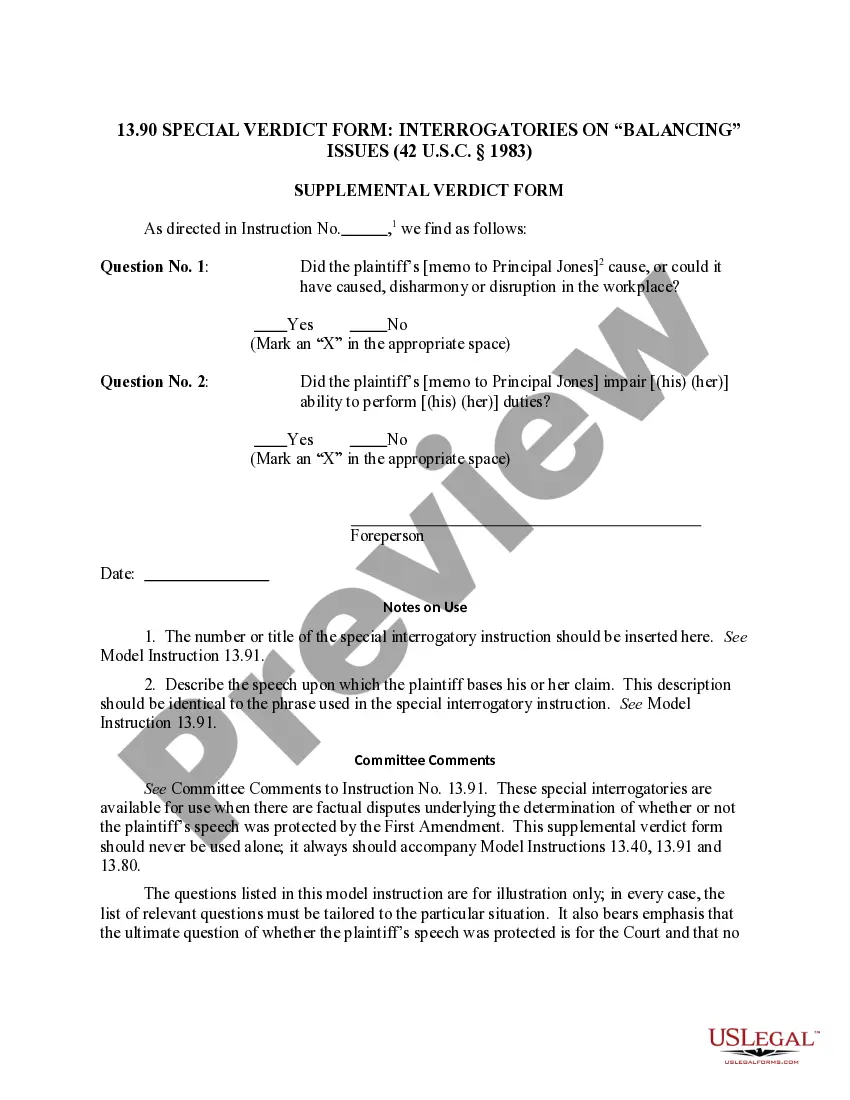

How to fill out West Virginia Employee Shareholder Escrow Agreement?

If you need to full, acquire, or print out authorized file layouts, use US Legal Forms, the largest assortment of authorized forms, that can be found on-line. Take advantage of the site`s simple and hassle-free search to discover the files you need. Numerous layouts for organization and specific uses are categorized by categories and states, or keywords and phrases. Use US Legal Forms to discover the West Virginia Employee Shareholder Escrow Agreement in a number of clicks.

When you are already a US Legal Forms consumer, log in to your bank account and then click the Download key to have the West Virginia Employee Shareholder Escrow Agreement. Also you can gain access to forms you in the past saved inside the My Forms tab of your respective bank account.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for that proper area/nation.

- Step 2. Take advantage of the Review option to look through the form`s information. Do not overlook to learn the information.

- Step 3. When you are not satisfied with all the form, utilize the Research area on top of the screen to find other models in the authorized form format.

- Step 4. Upon having discovered the shape you need, go through the Purchase now key. Select the prices prepare you favor and add your credentials to sign up for the bank account.

- Step 5. Procedure the transaction. You can use your charge card or PayPal bank account to complete the transaction.

- Step 6. Pick the formatting in the authorized form and acquire it in your gadget.

- Step 7. Total, revise and print out or indication the West Virginia Employee Shareholder Escrow Agreement.

Every single authorized file format you purchase is your own property for a long time. You possess acces to every single form you saved inside your acccount. Go through the My Forms section and pick a form to print out or acquire once again.

Contend and acquire, and print out the West Virginia Employee Shareholder Escrow Agreement with US Legal Forms. There are thousands of skilled and status-distinct forms you can utilize for the organization or specific demands.