The West Virginia Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock is a legal document that outlines the intentions and terms of investment in a company based in West Virginia. This document is crucial for both investors and the company, as it helps establish a clear understanding of the investment process and the roles and responsibilities of all parties involved. The Investment Intent Letter outlines the investor's intent to purchase a specific number of issued shares of the company's common stock. It includes important details such as the number of shares, the agreed-upon purchase price, and any conditions or restrictions associated with the investment. This letter expresses the investor's serious interest in acquiring shares and serves as a written commitment. The Appointment of Representative Agreement is a separate document that designates a representative on behalf of the investor. This representative acts as a liaison between the investor and the company, ensuring effective communication and representation of the investor's interests. The agreement specifies the representative's duties, rights, and obligations, including the authority to make decisions and sign documents on behalf of the investor. There may be different types or variations of the West Virginia Investment Intent Letter and Appointment of the Representative Agreement, depending on the specific circumstances of the investment. Some variations may include: 1. Equity Investment Intent Letter: This letter is used when an investor intends to purchase a specific number of issued shares of common stock, giving them ownership equity in the company. 2. Debt Investment Intent Letter: This letter is used when an investor provides financial assistance to the company in the form of a loan, rather than purchasing shares. The investor expects repayment of the principal amount with interest over a specified period. 3. Preferred Stock Investment Intent Letter: In certain cases, investors may indicate their intent to acquire preferred stock rather than common stock. Preferred stockholders usually receive priority treatment in terms of dividends and liquidation preferences. 4. Limited Partnership Investment Intent Letter: When an investment involves a limited partnership structure, a separate intent letter may be used to outline the terms and conditions of the partnership agreement, including the investment intent and the appointment of a representative. It is important to consult legal professionals or experts in West Virginia business law to ensure the accuracy and validity of these documents.

West Virginia Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock

Description

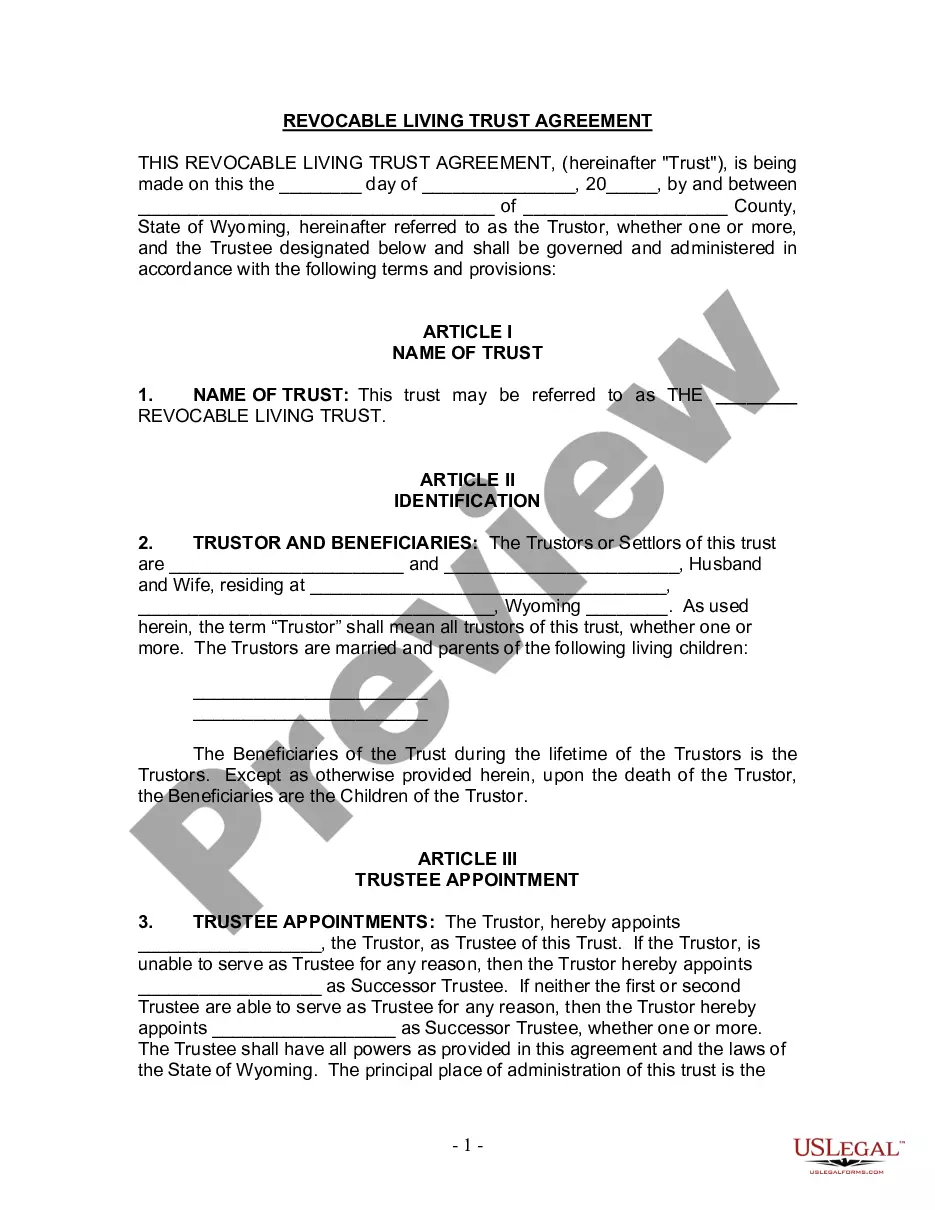

How to fill out Investment Intent Letter And Appointment Of The Representative Agreement Regarding Issued Shares Of Common Stock?

Finding the right lawful file format can be quite a battle. Obviously, there are tons of layouts accessible on the Internet, but how can you discover the lawful form you require? Use the US Legal Forms site. The assistance delivers thousands of layouts, like the West Virginia Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock, which can be used for enterprise and personal demands. Each of the varieties are checked by pros and satisfy federal and state needs.

When you are previously listed, log in for your profile and click on the Obtain button to have the West Virginia Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock. Make use of your profile to look throughout the lawful varieties you might have bought earlier. Go to the My Forms tab of your profile and acquire another duplicate from the file you require.

When you are a brand new consumer of US Legal Forms, allow me to share straightforward guidelines so that you can follow:

- First, ensure you have selected the right form for the area/area. It is possible to look through the form making use of the Preview button and browse the form information to make sure this is the best for you.

- In the event the form fails to satisfy your expectations, take advantage of the Seach area to obtain the proper form.

- Once you are certain the form is suitable, select the Buy now button to have the form.

- Select the prices plan you want and enter the necessary info. Design your profile and purchase your order using your PayPal profile or Visa or Mastercard.

- Opt for the submit formatting and down load the lawful file format for your device.

- Total, modify and produce and sign the received West Virginia Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock.

US Legal Forms may be the most significant local library of lawful varieties for which you can find various file layouts. Use the service to down load skillfully-produced papers that follow express needs.

Form popularity

FAQ

What is a letter of intent? A letter of intent (LOI) is a document written in business letter format that declares your intent to do a specific thing. It's usually, but not always, nonbinding, and it states a preliminary commitment by one party to do business with another party.

Issuing a letter of intent demonstrates that a buyer is serious, which some sellers find reassuring. As well as intent, it also explains what solid plans the potential buyer has made. For example, it might show how the buyer will fund the purchase, or give an overview of their business plan.

A letter of intent sets out the basic terms of a proposed transaction, including price, asset description, limitations, and closing conditions. Some simple transactions may not need a letter of intent. The parties can simply proceed with the creation of their final agreement.

Follow these steps when writing an LOI: Write the introduction. ... Describe the transaction and timeframes. ... List contingencies. ... Go through due diligence. ... Include covenants and other binding agreements. ... State that the agreement is nonbinding. ... Include a closing date.

A letter of intent is a document declaring the preliminary commitment of one party to do business with another. The letter outlines the chief terms of a prospective deal and is commonly used in business transactions.

A letter of intent is a document between two businesses that declares a preliminary commitment to doing business. The letter of intent should outline the terms of any future agreement and can be used to record negotiations and discussions.

A letter of intent (LOI) is a written, nonbinding document that outlines an agreement in principle between two or more parties before a legal agreement is finalized. It is often used in business transactions, such as mergers and acquisitions, joint ventures and real estate leases.