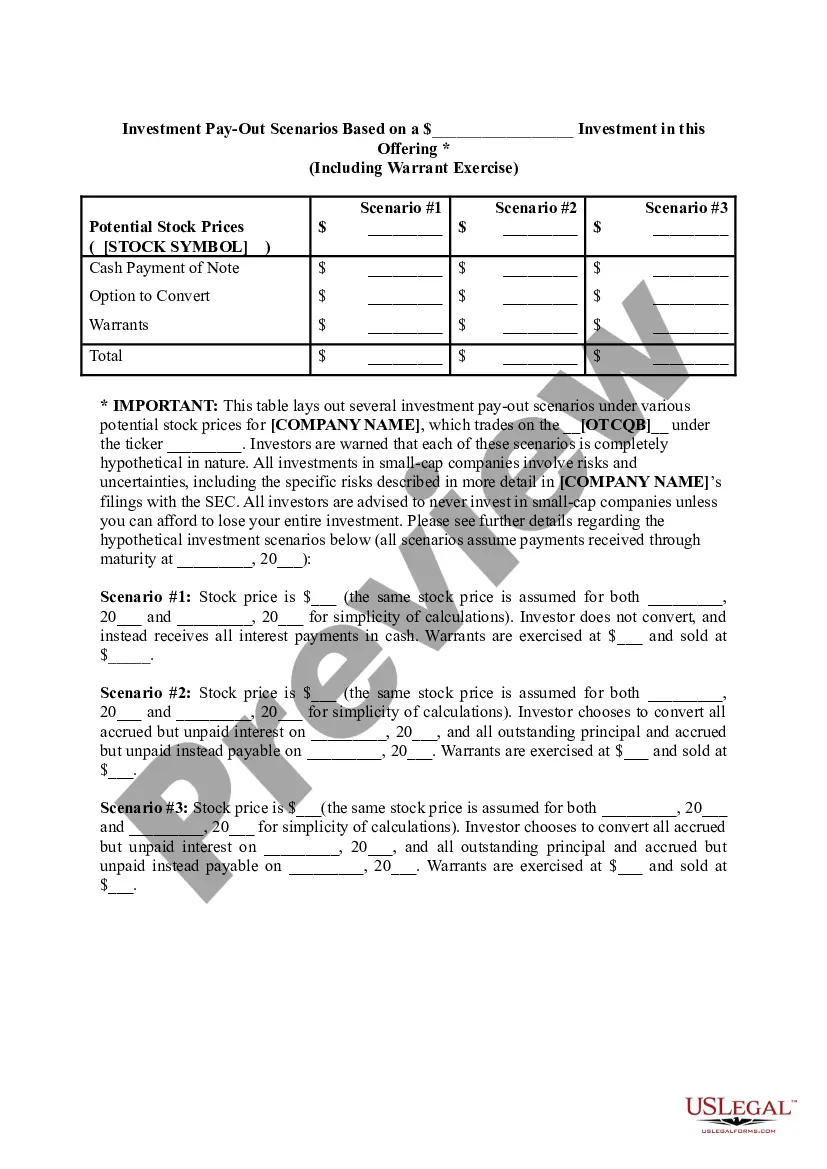

West Virginia Term Sheet — Convertible Debt Financing is a legal document outlining the terms and conditions of a financial agreement between a borrower and a lender in West Virginia, specifically related to convertible debt financing. This type of financing allows the lender to convert the debt into equity ownership at a later stage, typically upon the occurrence of certain predetermined events or milestones. Keywords: West Virginia, term sheet, convertible debt financing, legal document, borrower, lender, terms and conditions, financial agreement, convertible debt, equity ownership, predetermined events, milestones. There may be different types of West Virginia Term Sheet — Convertible Debt Financing, which can include: 1. Traditional Convertible Debt: This type of convertible debt financing allows the lender to convert the debt into equity ownership in the company at a later stage. The conversion typically happens upon the occurrence of specific events, such as a future funding round or an initial public offering (IPO). 2. Simple Agreement for Future Equity (SAFE): A SAFE is a form of convertible debt financing commonly used in startup financing. It allows the lender to receive equity in the company in the future, similar to traditional convertible debt, but without setting an explicit interest rate or maturity date. 3. Convertible Notes with Valuation Caps: This type of financing includes a valuation cap, which puts a limit on the valuation at which the debt can be converted into equity. This gives the lender additional protection, ensuring they receive a certain percentage of ownership, even if the company's valuation skyrockets. 4. Convertible Notes with Discount Rates: Convertible notes with discount rates offer the lender a discount when converting the debt into equity. This discount can be beneficial for the lender by allowing them to acquire ownership at a lower price than other investors in subsequent funding rounds. 5. Convertible Notes with Warrants: Warrants are a type of option that provides the lender with the right to purchase additional shares at a predetermined price in the future. Adding warrants to the convertible notes can offer the lender an extra incentive to invest. West Virginia Term Sheet — Convertible Debt Financing is an essential legal document used in raising capital for businesses in West Virginia. It details the terms and conditions agreed upon by the borrower and lender, providing a clear framework for their financial relationship and the potential conversion of debt into equity.

West Virginia Term Sheet - Convertible Debt Financing

Description

How to fill out West Virginia Term Sheet - Convertible Debt Financing?

US Legal Forms - one of the biggest libraries of lawful forms in the United States - provides a wide range of lawful file web templates it is possible to download or print out. Utilizing the site, you can find 1000s of forms for company and specific uses, sorted by groups, says, or key phrases.You can find the most recent types of forms like the West Virginia Term Sheet - Convertible Debt Financing within minutes.

If you already have a registration, log in and download West Virginia Term Sheet - Convertible Debt Financing through the US Legal Forms local library. The Down load option will appear on every single develop you see. You gain access to all formerly downloaded forms in the My Forms tab of your own account.

If you would like use US Legal Forms the first time, listed below are straightforward guidelines to obtain began:

- Be sure you have selected the best develop for the city/state. Click the Review option to examine the form`s information. Browse the develop information to ensure that you have selected the correct develop.

- If the develop doesn`t fit your demands, take advantage of the Research field near the top of the screen to discover the one which does.

- Should you be satisfied with the form, verify your choice by simply clicking the Buy now option. Then, choose the prices strategy you favor and offer your credentials to register for an account.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal account to complete the financial transaction.

- Choose the file format and download the form on the gadget.

- Make alterations. Load, modify and print out and sign the downloaded West Virginia Term Sheet - Convertible Debt Financing.

Every single design you added to your account lacks an expiry date and is also the one you have eternally. So, if you want to download or print out one more version, just proceed to the My Forms portion and then click in the develop you want.

Gain access to the West Virginia Term Sheet - Convertible Debt Financing with US Legal Forms, the most extensive local library of lawful file web templates. Use 1000s of expert and express-certain web templates that fulfill your small business or specific requirements and demands.