West Virginia Convertible Secured Promissory Note

Description

How to fill out Convertible Secured Promissory Note?

Are you within a situation that you need files for either company or individual functions nearly every day time? There are tons of lawful record themes available online, but locating versions you can rely is not straightforward. US Legal Forms gives a large number of type themes, just like the West Virginia Convertible Secured Promissory Note, that are composed to fulfill state and federal specifications.

When you are presently acquainted with US Legal Forms site and get an account, simply log in. Afterward, you may obtain the West Virginia Convertible Secured Promissory Note web template.

If you do not have an accounts and need to begin to use US Legal Forms, follow these steps:

- Get the type you want and ensure it is for your proper metropolis/area.

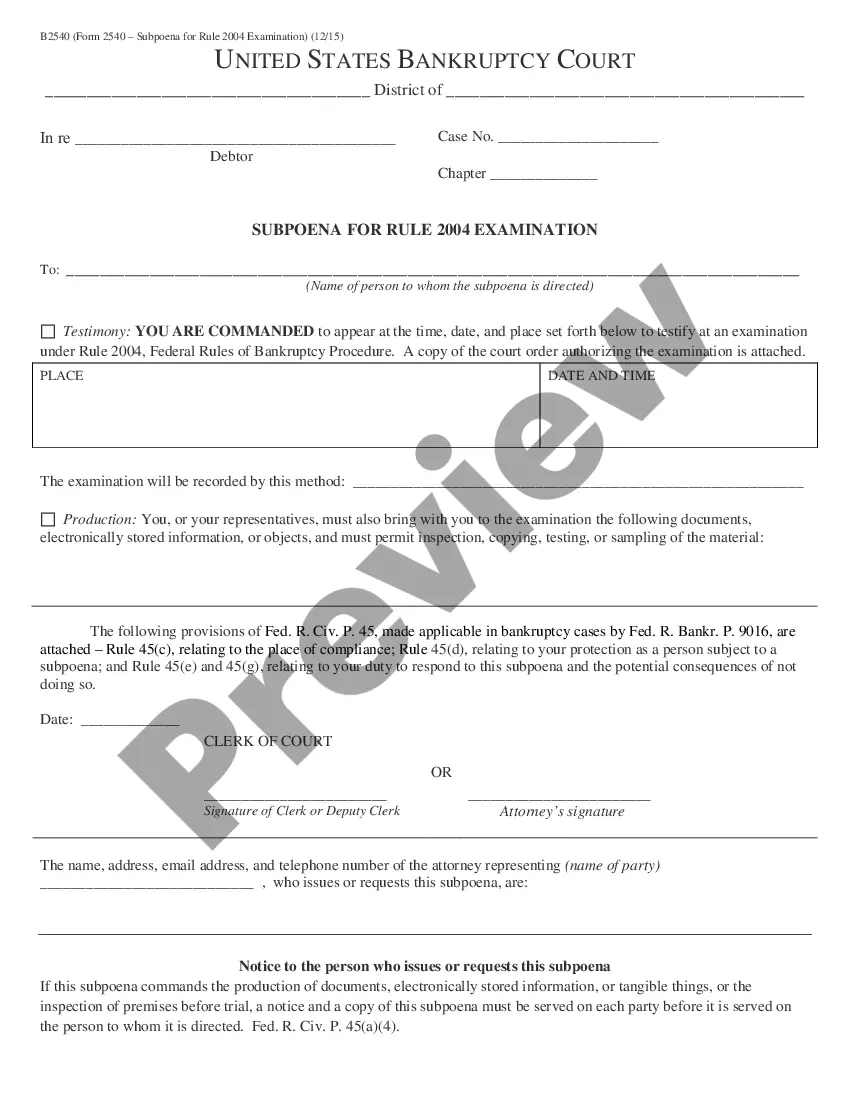

- Take advantage of the Review option to examine the shape.

- Read the outline to ensure that you have chosen the proper type.

- In the event the type is not what you`re searching for, make use of the Search discipline to get the type that fits your needs and specifications.

- Once you find the proper type, simply click Buy now.

- Opt for the rates prepare you want, fill out the necessary information to produce your bank account, and pay money for an order with your PayPal or charge card.

- Choose a convenient document format and obtain your duplicate.

Get all the record themes you might have purchased in the My Forms menu. You can obtain a additional duplicate of West Virginia Convertible Secured Promissory Note anytime, if required. Just click on the necessary type to obtain or produce the record web template.

Use US Legal Forms, the most comprehensive assortment of lawful varieties, in order to save some time and prevent errors. The assistance gives professionally manufactured lawful record themes that can be used for a variety of functions. Generate an account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

A convertible loan note (also known as a convertible note, or CLN) is a type of short-term debt that is converted into equity shares at a later date. Making an investment into a startup via a convertible loan note typically allows the investor to receive a discounted share price based on the company's future valuation.

In recent years, SAFEs have become the most common convertible instrument due to their relative simplicity. Like convertible notes, SAFEs convert into stock in a future priced round. Unlike convertible notes, they are not debt and do not require the company to pay back the investment with interest.

A convertible promissory note is a debt instrument that converts into equity of the issuing company upon certain events. Typically, a note would convert into equity in a subsequent equity financing round and perhaps upon the note's maturity or a sale of the company.

Checks, bills of exchange, and promissory notes are all considered negotiable instruments because the person who holds these notes can claim payment provided that they are taken: For consideration.

From a negotiation standpoint, the instruments vary in the different elements commonly subject to negotiation. A Convertible Note involves, at a minimum, discussions around: cap, discount, interest and maturity date . Conversely, a SAFE usually involves one point of negotiation: cap.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved. Canceling a promissory note is a completely different process from amending it.

A secured convertible promissory note, or SCP for short, is a type of security instrument that gives the holder the right to convert their debt into equity in the issuer company. Typically, an SCP will convert at a discount to the market value of the company's shares at the time of conversion.

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Disadvantages of convertible notes More frequently used to fund early-stage companies, which comes with more risk for investors. Lenders may not recoup their initial investment if the company dissolves and doesn't have enough money left over to repay the debt.