West Virginia Grant Agreement from 501(c)(3) to 501(c)(4)

Description

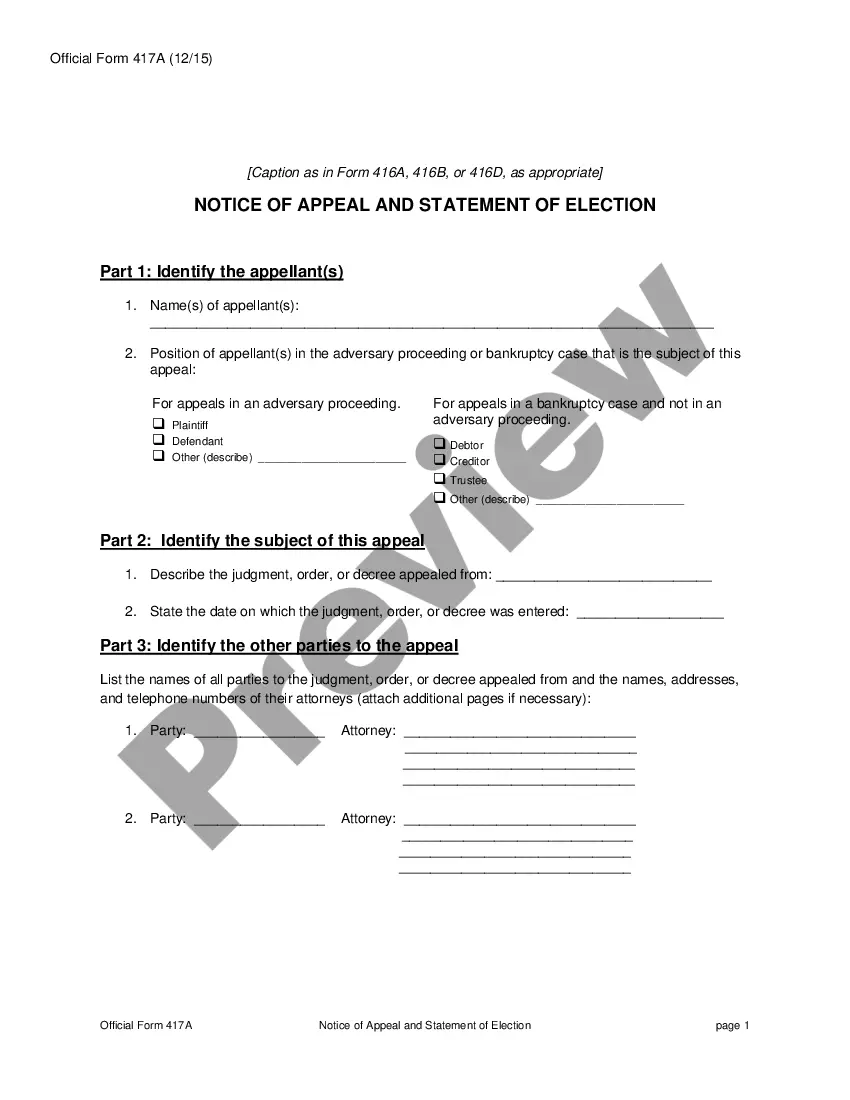

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

US Legal Forms - among the largest libraries of legal forms in the United States - delivers a wide range of legal record themes it is possible to download or print. Making use of the web site, you will get 1000s of forms for company and personal functions, categorized by categories, suggests, or search phrases.You can find the most up-to-date types of forms just like the West Virginia Grant Agreement from 501(c)(3) to 501(c)(4) within minutes.

If you have a registration, log in and download West Virginia Grant Agreement from 501(c)(3) to 501(c)(4) from your US Legal Forms local library. The Acquire option will show up on every type you look at. You have accessibility to all formerly acquired forms within the My Forms tab of your own account.

If you wish to use US Legal Forms the very first time, listed below are simple guidelines to get you started:

- Make sure you have picked out the best type for your personal town/state. Click the Preview option to review the form`s content. Look at the type outline to actually have selected the proper type.

- If the type does not fit your demands, utilize the Lookup area at the top of the monitor to find the one who does.

- If you are pleased with the shape, confirm your option by clicking on the Buy now option. Then, select the prices program you favor and supply your references to sign up to have an account.

- Method the deal. Make use of your bank card or PayPal account to accomplish the deal.

- Pick the formatting and download the shape on your product.

- Make changes. Complete, change and print and sign the acquired West Virginia Grant Agreement from 501(c)(3) to 501(c)(4).

Every format you included with your bank account does not have an expiration date and is also yours permanently. So, in order to download or print one more backup, just visit the My Forms area and click on the type you need.

Get access to the West Virginia Grant Agreement from 501(c)(3) to 501(c)(4) with US Legal Forms, by far the most substantial local library of legal record themes. Use 1000s of professional and condition-particular themes that fulfill your company or personal requires and demands.

Form popularity

FAQ

What is included in the Form 1023 package? The Form 1023 package includes (1) Form 1023, (2) Checklist for Form 1023, (3) Instructions for Form 1023 and (4) Form 5768, Election/Revocation of Election by an Eligible Section 501(c)(3) Organization To Make Expenditures To Influence Legislation.

A 501(c) organization and a 501(c)3 organization are similar in designation, however they differ slightly in their tax benefits. Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not.

Here's how you can fill out the Form W-9 for Nonprofits: Step 1 ? Write your corporation name. ... Step 2 ? Enter your business name. ... Step 3 ? Know your entity type. ... Step 4 ? Your exempt payee code. ... Step 5 ? Give your street address. ... Step 6 ? Give your city, state, and zip code. ... Step 7 ? List account numbers.

There are three types of nonprofit corporations in California: public benefit, mutual benefit, and religious.

Section 501(a) provides that organizations described under sections 501(c), 501(d), and 401(a) are exempt from federal income tax. Section 501(c) now has 29 separate sections (See Ready Reference Page: ?What Do We Mean When We Say 'Nonprofit'??), including 501(c)(3) which describes charities.

Organizations that meet the requirements of Internal Revenue Code section 501(a) are exempt from federal income taxation. In addition, charitable contributions made to some section 501(a) organizations by individuals and corporations are deductible under Code section 170.

Section 501(a) and Tax Exemption: An Overview These can include private foundations, public charities, social welfare organizations, and more. Each qualifying organization serves diverse purposes, from advancing education and relieving poverty to promoting social welfare and supporting charitable causes.

Costs of starting a new nonprofit in West Virginia Filing Articles of Incorporation: $25. 501(c) or Federal tax exemption application: $275 or $600 IRS fee.