West Virginia Angel Fund Promissory Note Term Sheet

Description

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made."

How to fill out Angel Fund Promissory Note Term Sheet?

You may spend several hours on the web attempting to find the legitimate file design that meets the federal and state specifications you will need. US Legal Forms supplies a huge number of legitimate varieties which are reviewed by professionals. It is simple to down load or print the West Virginia Angel Fund Promissory Note Term Sheet from the services.

If you have a US Legal Forms bank account, it is possible to log in and then click the Down load option. Next, it is possible to full, change, print, or indicator the West Virginia Angel Fund Promissory Note Term Sheet. Every single legitimate file design you get is yours permanently. To get one more copy of the acquired type, check out the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms site the first time, stick to the easy directions beneath:

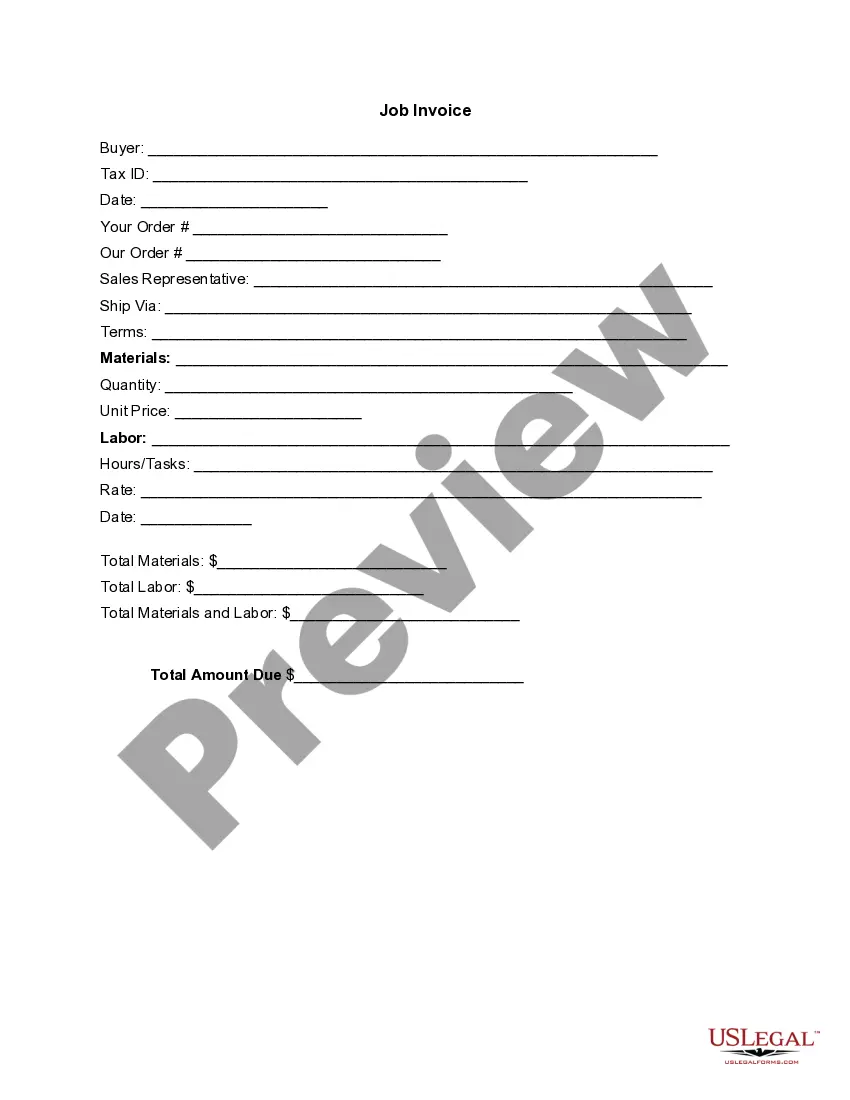

- Very first, ensure that you have selected the correct file design for that state/city of your choosing. Browse the type description to make sure you have selected the appropriate type. If readily available, use the Review option to search with the file design at the same time.

- If you want to get one more version from the type, use the Lookup area to discover the design that fits your needs and specifications.

- Upon having located the design you would like, simply click Acquire now to proceed.

- Select the pricing prepare you would like, key in your qualifications, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You should use your charge card or PayPal bank account to cover the legitimate type.

- Select the structure from the file and down load it in your system.

- Make adjustments in your file if necessary. You may full, change and indicator and print West Virginia Angel Fund Promissory Note Term Sheet.

Down load and print a huge number of file layouts using the US Legal Forms website, which offers the largest selection of legitimate varieties. Use expert and express-particular layouts to take on your small business or personal requirements.