A West Virginia Waiver Special Meeting of Shareholders refers to a specific type of gathering held by corporations incorporated in West Virginia when they seek to address crucial matters that require the consent of their shareholders. In this meeting, shareholders have the opportunity to provide their approval or disapproval for certain corporate actions. It is important to note that there are several variations of the West Virginia Waiver Special Meeting of Shareholders, distinguished based on their purpose or focus. Some commonly encountered types include: 1. West Virginia Waiver Special Meeting for Merger or Acquisition: This type of meeting is called to discuss and receive shareholder consent on corporate mergers or acquisitions involving the company. Shareholders are provided with detailed information regarding the proposed transaction and are given an opportunity to express their support or opposition based on their assessment of the deal's potential impact on the company's value and strategic direction. 2. West Virginia Waiver Special Meeting for Proxy Contest: This meeting is held when a corporation experiences a proxy contest, meaning individuals or groups seek to influence the outcome of an election of directors or any other important issue requiring shareholder approval. Shareholders discuss and vote on matters such as the election of directors, removal of directors, or any other proposals put forth by dissident shareholders or activist investors. 3. West Virginia Waiver Special Meeting for Bylaws Amendments: In this type of meeting, shareholders are presented with proposed amendments or changes to the company's bylaws, which govern the internal operations and rules of the corporation. Shareholders analyze the proposed amendments and vote accordingly, taking into account the potential impact on the company's governance or the rights of existing shareholders. 4. West Virginia Waiver Special Meeting for Dissolution or Liquidation: This meeting is held when a company is considering dissolution or liquidation. Shareholders deliberate on the reasons behind the proposed dissolution or liquidation, potential alternatives, and the distribution of assets to shareholders. Their decision will determine the fate of the company and the allocation of remaining value among shareholders. In summary, the West Virginia Waiver Special Meeting of Shareholders is a versatile and significant event in corporate governance. It provides shareholders with a platform to participate in voting and decision-making processes related to matters critical to the corporation. By identifying the specific variations of these meetings, such as those for mergers/acquisitions, proxy contests, bylaw amendments, and dissolution/liquidation, stakeholders can gain a clearer understanding of the focus and purpose behind the gathering.

West Virginia Waiver Special Meeting of Shareholders

Description

How to fill out West Virginia Waiver Special Meeting Of Shareholders?

US Legal Forms - among the biggest libraries of legal forms in the States - provides a wide range of legal document themes it is possible to acquire or produce. Utilizing the site, you can find thousands of forms for company and person purposes, categorized by categories, suggests, or keywords.You can get the most up-to-date types of forms such as the West Virginia Waiver Special Meeting of Shareholders within minutes.

If you currently have a subscription, log in and acquire West Virginia Waiver Special Meeting of Shareholders from the US Legal Forms local library. The Acquire option can look on every single kind you look at. You have access to all formerly saved forms in the My Forms tab of the profile.

If you want to use US Legal Forms initially, listed below are easy directions to help you get started out:

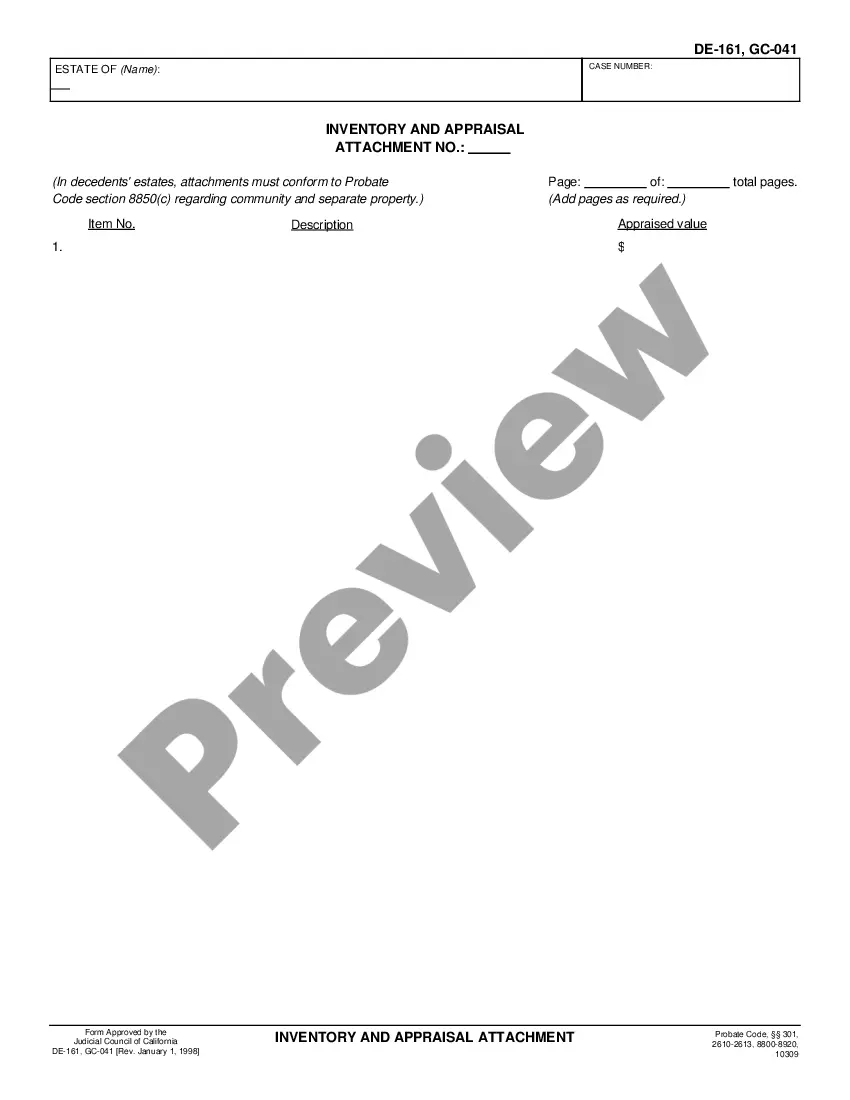

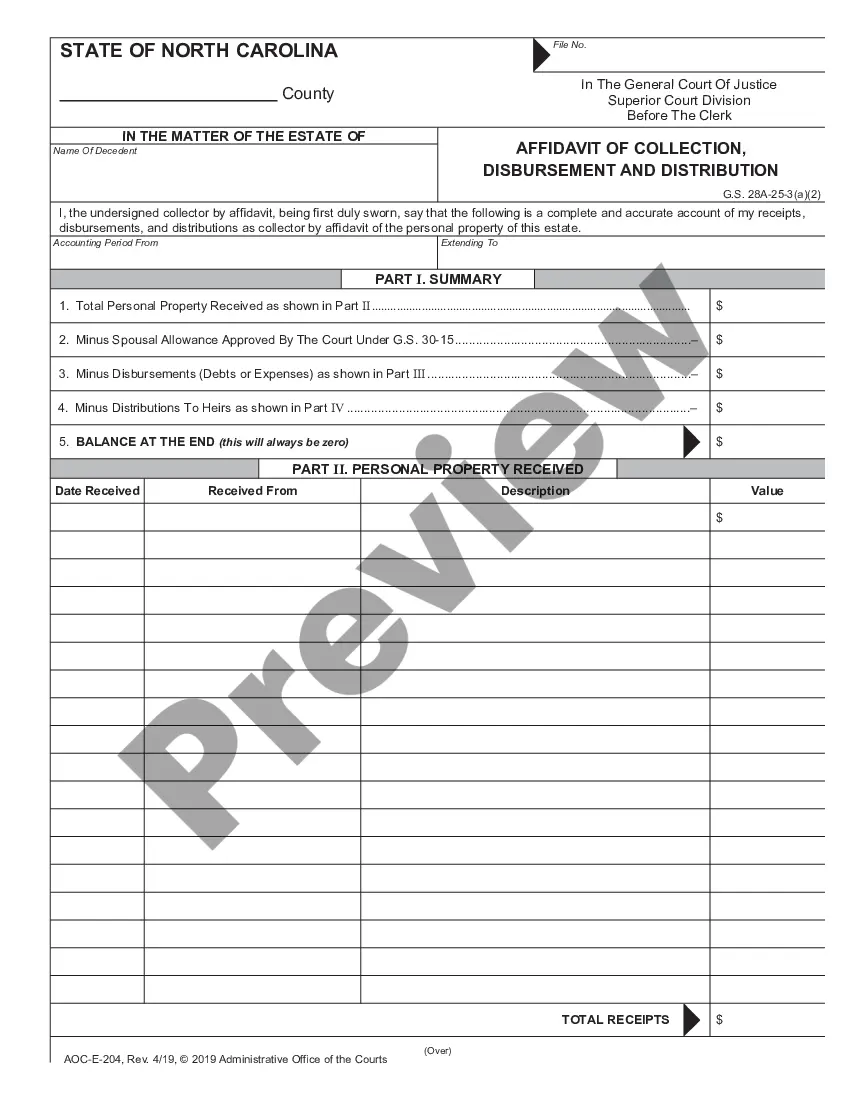

- Be sure you have picked out the correct kind for your metropolis/region. Click on the Review option to analyze the form`s content material. See the kind outline to ensure that you have chosen the correct kind.

- In the event the kind doesn`t satisfy your requirements, make use of the Search discipline towards the top of the screen to obtain the one who does.

- Should you be happy with the form, verify your option by clicking on the Purchase now option. Then, pick the rates strategy you like and offer your credentials to register to have an profile.

- Method the deal. Make use of Visa or Mastercard or PayPal profile to accomplish the deal.

- Pick the file format and acquire the form on the product.

- Make modifications. Fill out, change and produce and indicator the saved West Virginia Waiver Special Meeting of Shareholders.

Each and every template you put into your money lacks an expiration time and is also your own property eternally. So, if you want to acquire or produce another backup, just visit the My Forms segment and click about the kind you need.

Get access to the West Virginia Waiver Special Meeting of Shareholders with US Legal Forms, by far the most comprehensive local library of legal document themes. Use thousands of skilled and condition-distinct themes that meet your small business or person needs and requirements.

Form popularity

FAQ

Hear this out loud PauseCorporations that don't consistently hold annual meetings may need to hold one without notice. The waiver of notice form is needed in order to document that all stockholders agree to the actions taken during the meeting, even though they may not have been present during it.

A waiver of notice is a written acknowledgment from people eligible to attend a company meeting stating that they are giving up their right to receive formal notice of the meeting.

The notice of meeting should include a clear reference to shareholders' rights to appoint a proxy, or where the constitution so provides, to cast a direct vote. Voting forms should be drafted to ensure shareholders clearly understand how the chairperson of the meeting intends to vote undirected proxies.

Even though the corporation is legally required to notify shareholders of the annual meeting, stockholders may opt out of receiving notification of the meeting by signing a waiver of notice form. Essentially, shareholders are telling the corporation that they no longer wish to be notified of future annual meetings.

A notice of meeting letter is a document that informs a group of people when and where their company is holding an assembly. These letters effectively communicate the meeting's information so that the recipients know when the meeting occurs.

Hear this out loud PauseSpecial meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation ...