West Virginia Sample Letter for Short Sale Request to Lender

Description

How to fill out West Virginia Sample Letter For Short Sale Request To Lender?

You can commit hrs online looking for the legal papers format that fits the state and federal needs you need. US Legal Forms offers thousands of legal varieties which are evaluated by professionals. You can easily download or printing the West Virginia Sample Letter for Short Sale Request to Lender from our support.

If you already have a US Legal Forms bank account, you may log in and click on the Obtain button. Following that, you may comprehensive, edit, printing, or signal the West Virginia Sample Letter for Short Sale Request to Lender. Each legal papers format you acquire is your own property eternally. To acquire another duplicate associated with a bought form, proceed to the My Forms tab and click on the related button.

If you use the US Legal Forms internet site initially, follow the straightforward directions below:

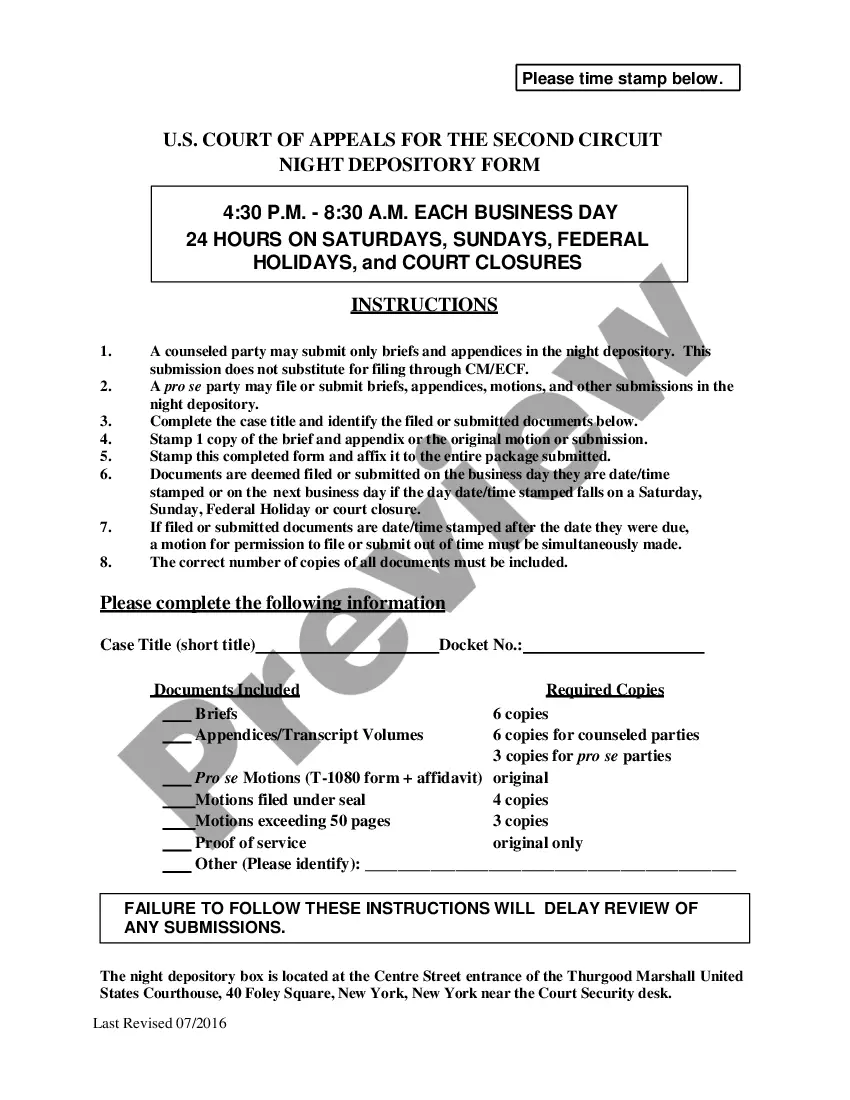

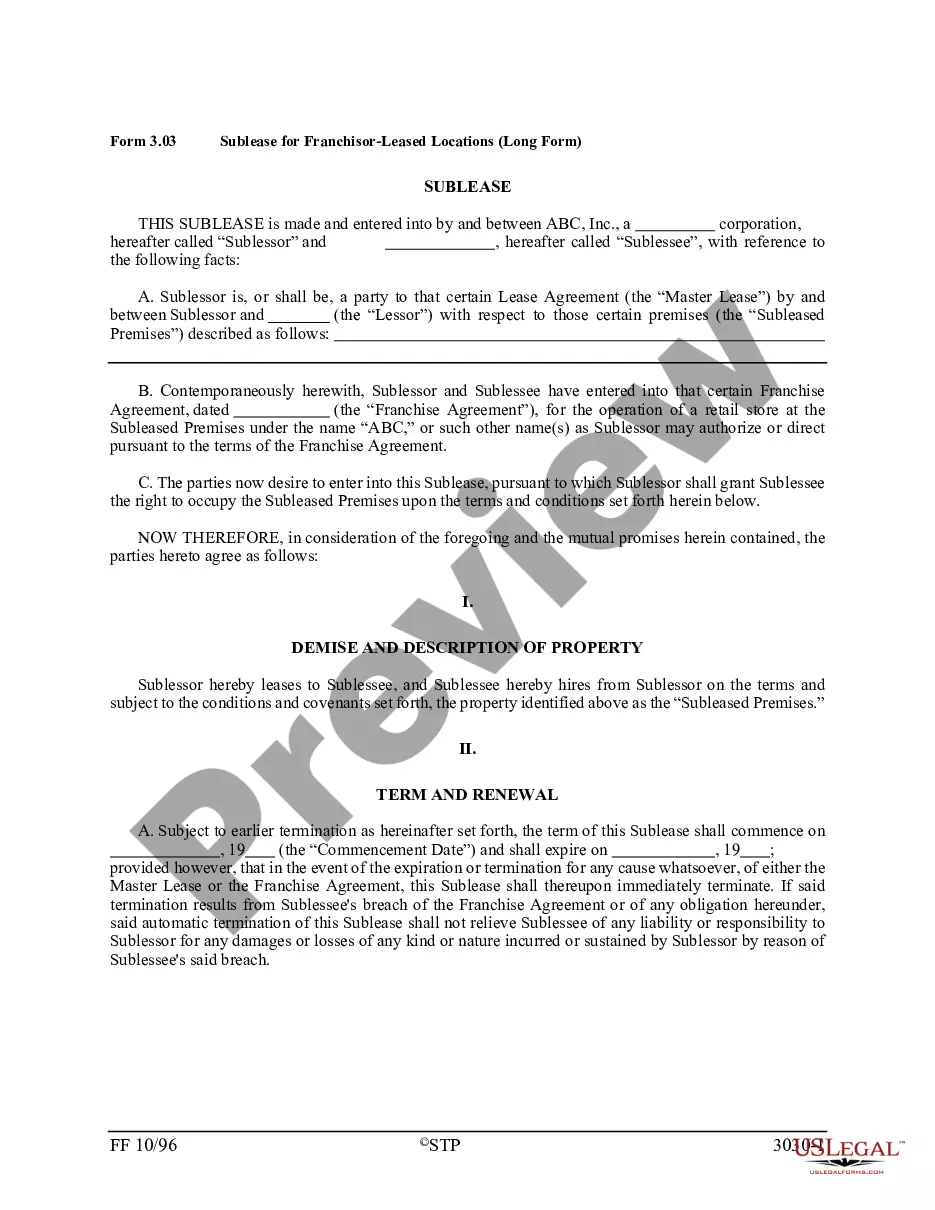

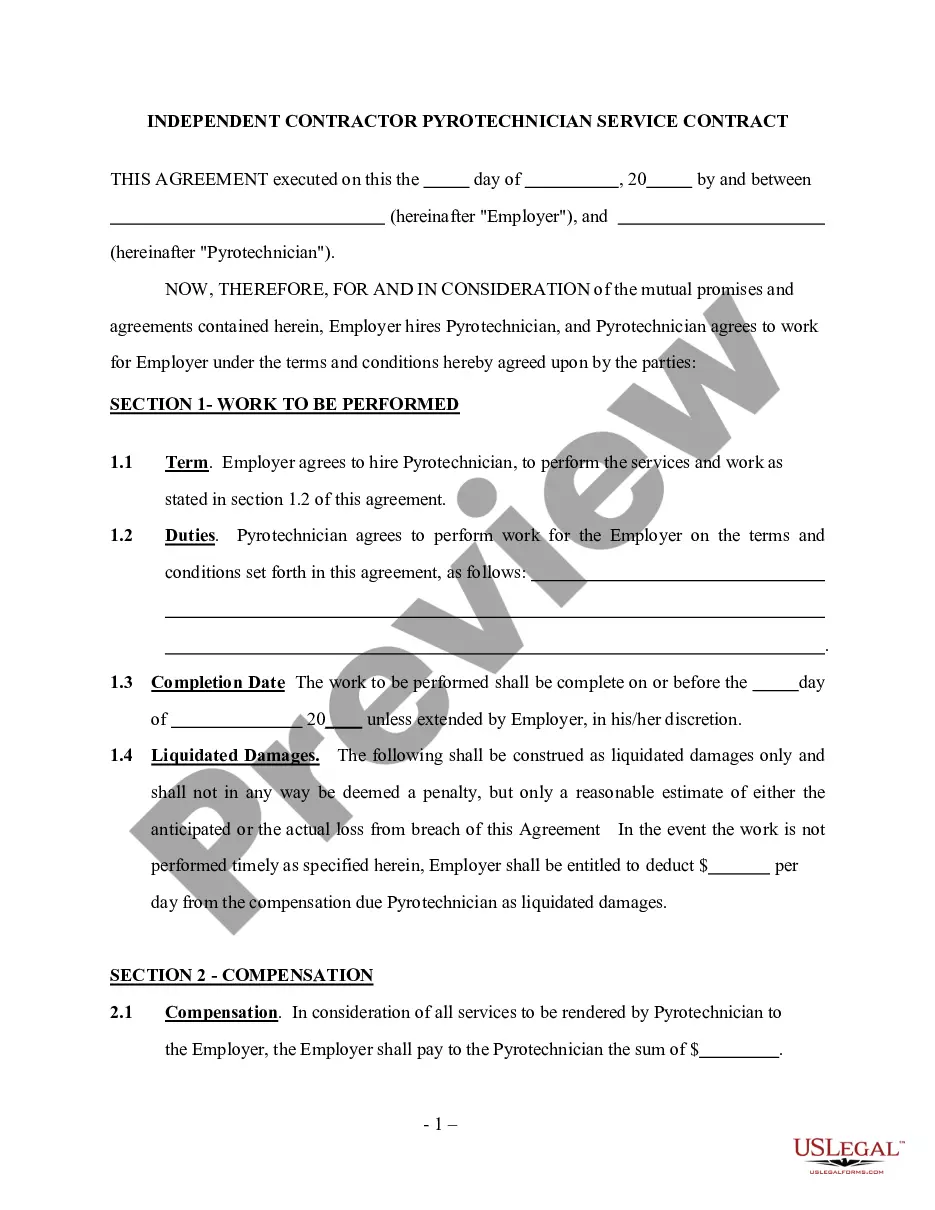

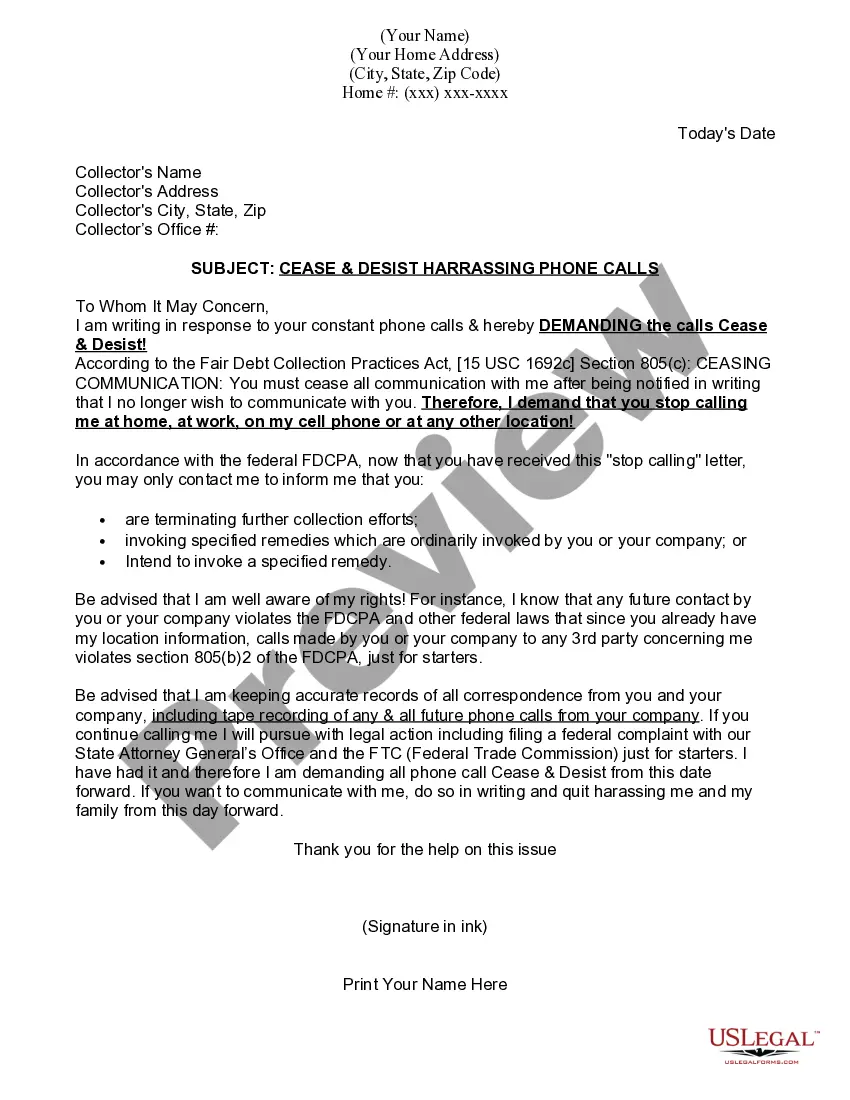

- Initially, make certain you have selected the correct papers format to the county/metropolis of your liking. Browse the form explanation to make sure you have chosen the right form. If readily available, take advantage of the Review button to check with the papers format as well.

- If you wish to find another version of the form, take advantage of the Lookup discipline to find the format that suits you and needs.

- Once you have located the format you want, click Buy now to move forward.

- Pick the prices plan you want, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You can utilize your credit card or PayPal bank account to purchase the legal form.

- Pick the format of the papers and download it for your system.

- Make alterations for your papers if required. You can comprehensive, edit and signal and printing West Virginia Sample Letter for Short Sale Request to Lender.

Obtain and printing thousands of papers layouts making use of the US Legal Forms website, which provides the largest variety of legal varieties. Use skilled and state-particular layouts to handle your small business or personal demands.

Form popularity

FAQ

How to Write an Effective Hardship LetterPart 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.More items...?

Some common signs that you are headed for financial distress include:High balances (or balances beyond your credit limit) on credit cards.Using credit to pay for everyday expenses when you aren't able to pay off balances monthly.High debt to income ratio.Utilizing high-interest loans or cash advances to make ends meet.More items...?

The first paragraph should focus on introducing yourself and your particular situation. This will be the section that explains exactly what your hardship is and establish your desire to work with the lender to continue paying off your debts.

A hardship letter explains to a lender the circumstances that have made you unable to keep up with your debt payments. It provides specific details such as the date the hardship began, the cause and how long you expect it to continue.

You'll need to include a letter that notifies the bank of who your agent is and authorizes them to make decisions on your behalf. Your package should also document your financial reasons for seeking a short sale.

In the body of the letter, state the hardship that led you to fall behind on your mortgage payments. Explain to the lender what happened and why it was beyond your control. Keep your explanation brief. The goal of the hardship letter is to explain to the lender the nature of your hardship.

A short sale approval letter is a letter that a lender issues to the seller if a short sale offer is approved for less than the amount the borrower owes on a mortgage. It is sent by the lender at the end of a short sale to demand the "short" loan payoff in return for releasing the lien on the property.

Depending on the state, a deficiency arising from a short sale is liable for collection by the lender. In some states you'll need a waiver in writing from your lender for any mortgage deficiency after a short sale to avoid debt collection.

How to Write an Effective Hardship LetterPart 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.More items...?

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.