"Summary of High Technology Developments Affecting Real Estate Financing" is a American Lawyer Media form. This form is a summary booklet of High Technology affecting real estate financing.

West Virginia Summary of High Technology Developments Affecting Real Estate Financing

Description

How to fill out Summary Of High Technology Developments Affecting Real Estate Financing?

It is possible to devote hours on the web searching for the legal file format that meets the state and federal specifications you require. US Legal Forms supplies thousands of legal kinds that happen to be reviewed by professionals. You can actually acquire or print the West Virginia Summary of High Technology Developments Affecting Real Estate Financing from the assistance.

If you already possess a US Legal Forms account, you can log in and then click the Acquire button. After that, you can comprehensive, change, print, or indication the West Virginia Summary of High Technology Developments Affecting Real Estate Financing. Every single legal file format you get is your own for a long time. To acquire an additional copy associated with a purchased kind, check out the My Forms tab and then click the related button.

If you are using the US Legal Forms website for the first time, follow the straightforward recommendations beneath:

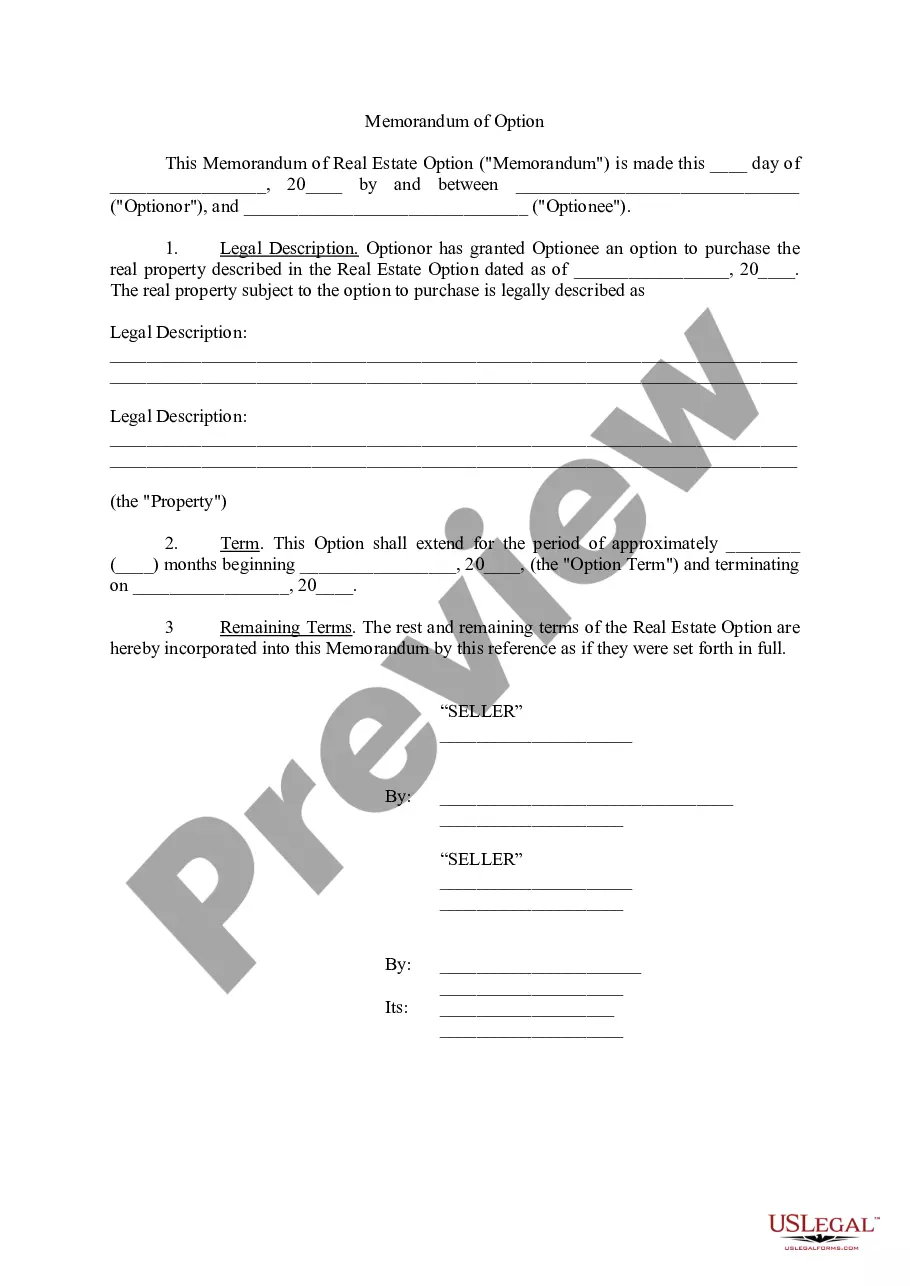

- Very first, make certain you have chosen the correct file format for the area/area of your choice. See the kind outline to make sure you have selected the proper kind. If available, make use of the Preview button to check through the file format as well.

- If you would like discover an additional variation of the kind, make use of the Search discipline to find the format that fits your needs and specifications.

- When you have found the format you want, click on Purchase now to move forward.

- Select the pricing plan you want, type in your references, and register for your account on US Legal Forms.

- Complete the purchase. You can utilize your charge card or PayPal account to cover the legal kind.

- Select the formatting of the file and acquire it in your product.

- Make changes in your file if required. It is possible to comprehensive, change and indication and print West Virginia Summary of High Technology Developments Affecting Real Estate Financing.

Acquire and print thousands of file web templates while using US Legal Forms website, which provides the largest variety of legal kinds. Use skilled and express-particular web templates to tackle your company or personal demands.