West Virginia Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out West Virginia Outside Project Manager Agreement - Self-Employed Independent Contractor?

If you have to total, download, or print out legal document web templates, use US Legal Forms, the greatest assortment of legal types, that can be found on the Internet. Utilize the site`s simple and hassle-free search to get the papers you require. Various web templates for company and person purposes are categorized by types and states, or keywords and phrases. Use US Legal Forms to get the West Virginia Outside Project Manager Agreement - Self-Employed Independent Contractor in just a handful of mouse clicks.

When you are presently a US Legal Forms customer, log in in your account and then click the Acquire key to have the West Virginia Outside Project Manager Agreement - Self-Employed Independent Contractor. You may also access types you previously acquired inside the My Forms tab of your respective account.

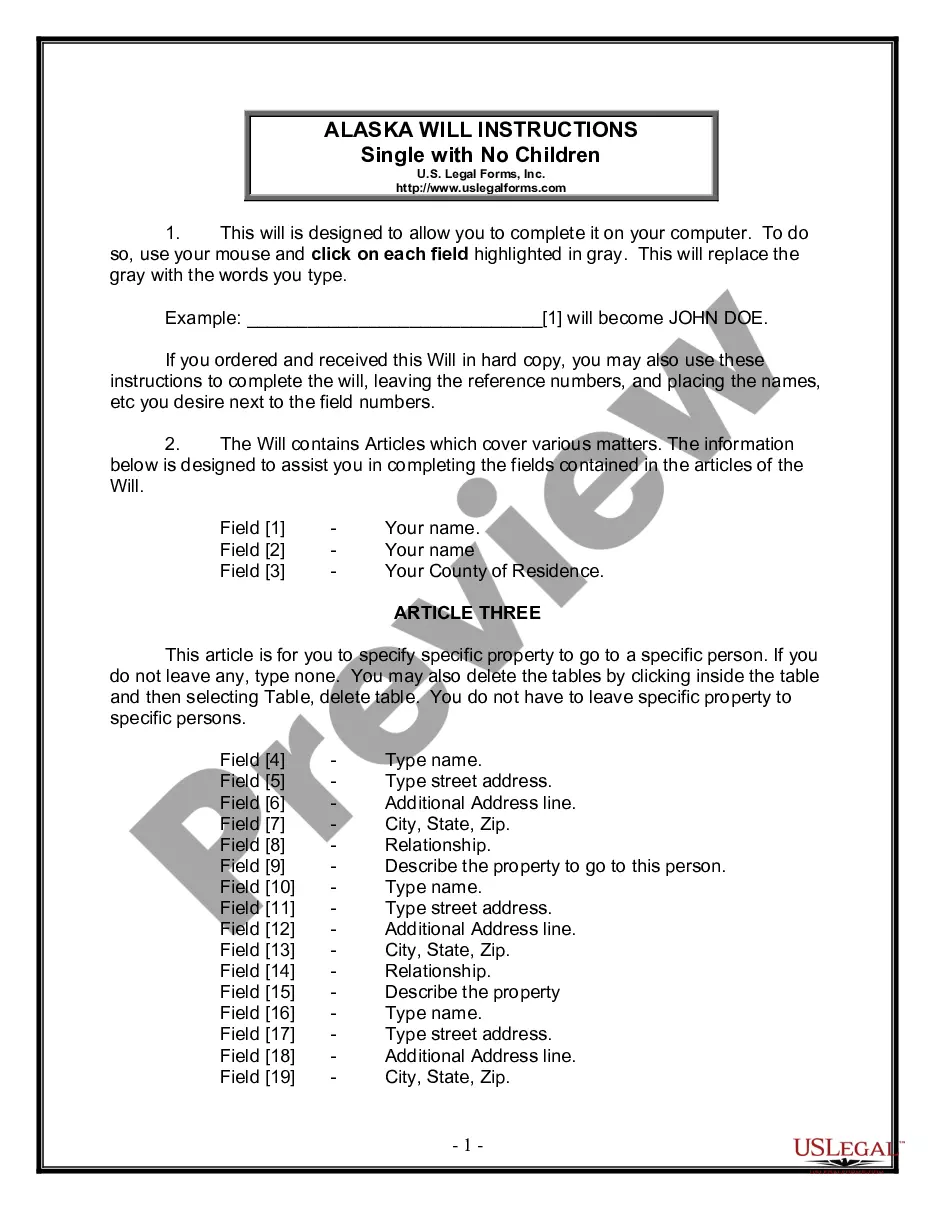

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape to the right area/country.

- Step 2. Use the Preview choice to check out the form`s content. Don`t neglect to read the description.

- Step 3. When you are unhappy using the develop, utilize the Search field on top of the monitor to discover other variations of the legal develop web template.

- Step 4. Upon having discovered the shape you require, click the Get now key. Pick the pricing plan you like and add your accreditations to sign up to have an account.

- Step 5. Approach the deal. You can utilize your charge card or PayPal account to finish the deal.

- Step 6. Choose the format of the legal develop and download it on your device.

- Step 7. Full, change and print out or sign the West Virginia Outside Project Manager Agreement - Self-Employed Independent Contractor.

Each and every legal document web template you get is yours permanently. You have acces to every develop you acquired inside your acccount. Go through the My Forms segment and choose a develop to print out or download once again.

Be competitive and download, and print out the West Virginia Outside Project Manager Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of skilled and express-specific types you can utilize for your company or person demands.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

As an independent contractor, you are your own boss. That's the main reason why people decide to set up shop in their home office as a freelancer. If you're a contractor who works out of a client's location, you might work shoulder-to-shoulder with the employees, managers, and bosses of the company you work with.

Paying yourself as an independent contractor As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC. The LLC will be responsible for IRS Form 1099-MISC during tax season.

But employers that buy into some common myths about independent contractors are overlooking the costly legal risks involved. Myth No. 1: Hiring CEOs, CFOs and officers as independent contractors rather than as employees is an acceptable, routine, legal business practice.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Under the law, the general rule is that the copyright in and to the work product of an individual employee or independent contractor is owned by that individual unless an exception applies. The Work for Hire doctrine is an exception to such rule.

Independent contractors are not employees, nor are they eligible for employee benefits. They do not have taxes withheld from their paychecks but instead must pay estimated income taxes in advance through quarterly payments.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

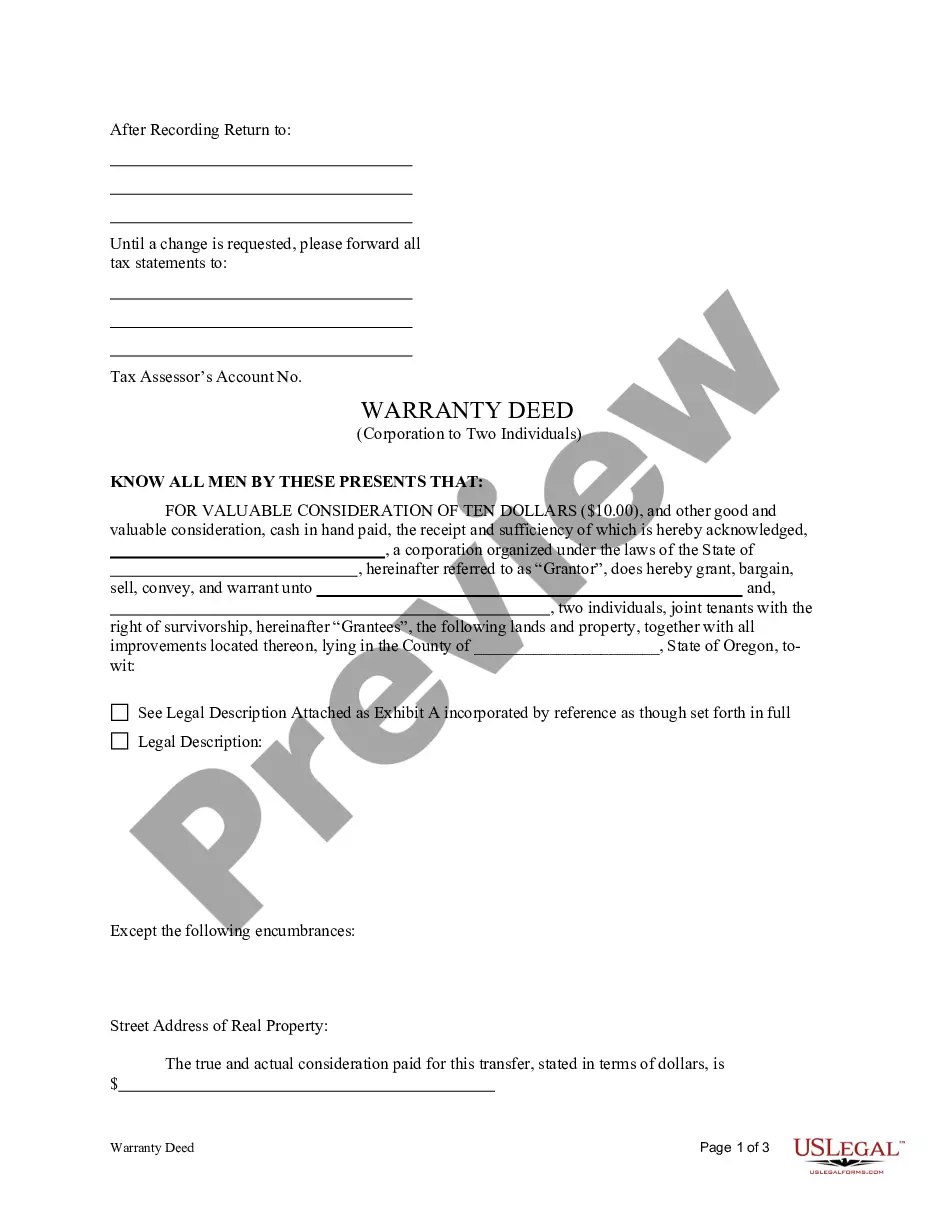

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.