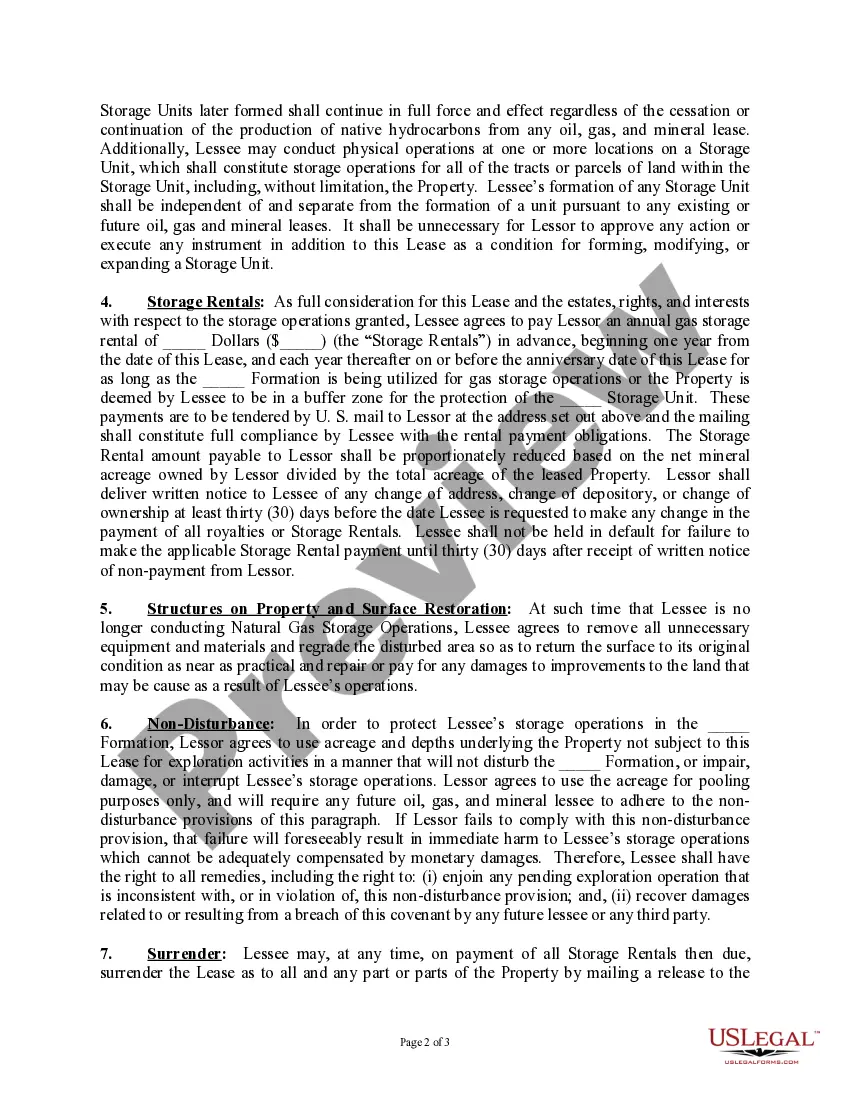

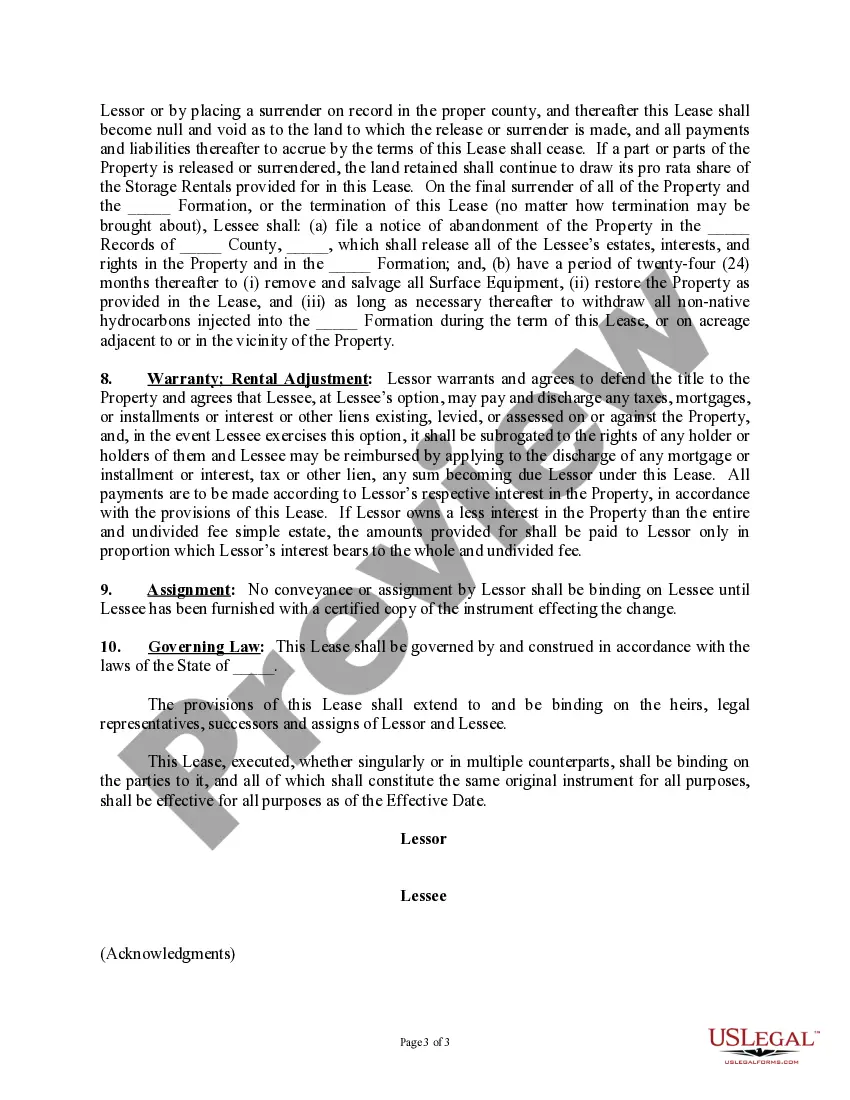

West Virginia Natural Gas Storage Lease: A Comprehensive Overview Introduction: A West Virginia Natural Gas Storage Lease refers to a legally binding agreement between the landowner and a lessee (usually an energy or gas company) allowing the lessee to store natural gas in underground reservoirs located in the state of West Virginia. Such storage facilities are crucial for ensuring a steady and reliable supply of natural gas to meet the demands of consumers, especially during peak usage periods and unforeseen disruptions. This detailed description aims to shed light on the various aspects of West Virginia Natural Gas Storage Lease and its key components. Types of West Virginia Natural Gas Storage Lease: 1. Depleted Gas Reservoir Leases: This type of lease involves utilizing depleted gas fields or underground reservoirs that were once productive but have been depleted of their natural gas content. These reservoirs provide an excellent storage solution due to their geologic characteristics, ensuring secure storage conditions. 2. Aquifer Storage and Recovery (ASR) Leases: ASR leases involve injecting natural gas into porous rock formations or aquifers located underground. These formations act as natural storage sites due to their ability to store significant volumes of gas. The injection and recovery process in ASR leases are carefully managed to avoid any environmental impacts or contamination risks. 3. Salt Cavern Leases: Salt caverns are formed by solution mining in underground salt deposits. These caverns offer ideal conditions for natural gas storage due to their impermeability, stability, and the ability to quickly inject or withdraw gas. Salt cavern leases are highly valued for their flexibility and fast response capabilities in meeting demand fluctuations. Key Components of a West Virginia Natural Gas Storage Lease: 1. Lease Term: This specifies the duration for which the lessee has the right to store natural gas in the designated underground storage reservoir. 2. Authorized Purpose: The lease outlines the permitted use of the storage facility, typically restricted to the storage of natural gas. 3. Storage Capacity: The lease will include the agreed-upon volume or capacity of natural gas that can be stored within the reservoir. This capacity is measured in cubic feet (cf) or a million cubic feet (MCF). 4. Rental Payments and Royalties: The lease will define the rental payments or royalties to be paid by the lessee to the landowner for utilizing the storage facility. These payments are typically based on the volume of gas stored or the number of operating wells within the reservoir. 5. Operation and Maintenance: The lease addresses the lessee's responsibilities for operating and maintaining the storage facilities in compliance with applicable regulations and safety standards. It may also specify guidelines for well drilling, monitoring, and environmental protection measures. 6. Groundwater Protection: Given the potential risks of gas storage, the lease includes provisions to safeguard groundwater resources from contamination, ensuring strict adherence to environmental regulations and preventative measures. Conclusion: A West Virginia Natural Gas Storage Lease is a significant agreement that allows energy companies to utilize strategically located underground reservoirs in the state to store natural gas. By understanding the different types of leases and the key components involved, both landowners and lessees can enter into mutually beneficial agreements that support energy security while ensuring environmental protection and compliance.

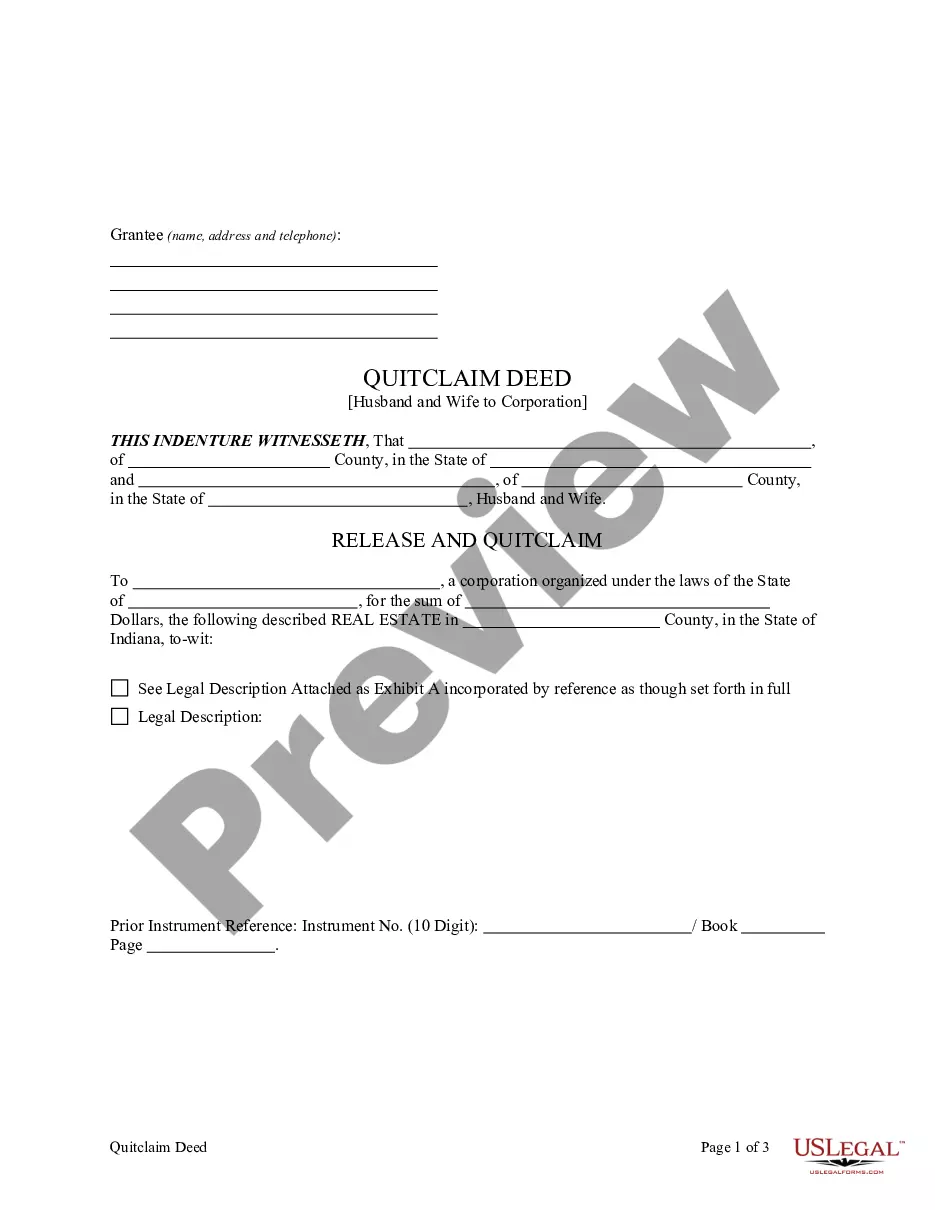

West Virginia Natural Gas Storage Lease

Description

How to fill out West Virginia Natural Gas Storage Lease?

Choosing the right authorized document web template could be a have a problem. Obviously, there are a variety of web templates available online, but how will you obtain the authorized type you require? Use the US Legal Forms web site. The support gives a huge number of web templates, such as the West Virginia Natural Gas Storage Lease, which you can use for company and personal demands. Each of the kinds are checked out by experts and meet up with federal and state demands.

In case you are currently registered, log in for your accounts and click on the Obtain button to get the West Virginia Natural Gas Storage Lease. Use your accounts to look throughout the authorized kinds you might have bought previously. Check out the My Forms tab of your accounts and get yet another copy from the document you require.

In case you are a new customer of US Legal Forms, allow me to share basic instructions so that you can comply with:

- Very first, make certain you have selected the correct type to your metropolis/area. It is possible to look through the form utilizing the Review button and study the form explanation to ensure it is the best for you.

- In the event the type fails to meet up with your expectations, take advantage of the Seach area to discover the correct type.

- When you are certain the form would work, click the Buy now button to get the type.

- Select the prices prepare you need and enter in the required information and facts. Make your accounts and pay for the order using your PayPal accounts or charge card.

- Choose the document format and down load the authorized document web template for your gadget.

- Total, edit and produce and indicator the attained West Virginia Natural Gas Storage Lease.

US Legal Forms is definitely the largest catalogue of authorized kinds that you can discover different document web templates. Use the service to down load skillfully-produced documents that comply with state demands.

Form popularity

FAQ

Mineral interests in WV are taxed the same as your home. You will pay 60% of the appraised value on the minerals at the levy rate for your county.

Mineral rights include everything under the ground with some exceptions like groundwater, sand, and limestone in most cases. These minerals in West Virginia typically include coal, oil and natural gas. Precious metals mining in West Virginia is not prevalent.

? The Interior Department on Friday said it's moving forward with the first onshore sales of public oil and natural gas drilling leases under President Joe Biden, but will sharply increase royalty rates for companies as federal officials weigh efforts to fight climate change against pressure to bring down high gasoline ...

Gas used in lease operations includes usage such as for drilling operations, heaters, dehydraters, field compressors, and net used for gas lift.

Mineral rights give ownership, for a specified time, of the underground minerals that do not include sand, limestone, gravel, or subsurface water. If the mineral rights to your property have been sold before you acquired the land, that means you own only the surface rights and cannot use the minerals.

Royalty is a portion of the proceeds from the sale of production which is paid monthly to the mineral rights owner. The royalty is usually described in the lease as a fraction such as 1/8th, or 1/6th.

Natural gas. West Virginia is the fourth-largest producer of marketed natural gas in the nation. West Virginia is the nation's fourth-largest producer of marketed natural gas. The state is within the Marcellus Shale productive region, one of the largest natural gas-producing areas in the United States.

How many royalties do you get from an oil well? The customary royalty percentage is 12.5 percent or 1/8 of the value of the oil or gas at the wellhead. Some states have laws that require the owner be paid a minimum royalty (often 12.5 percent).