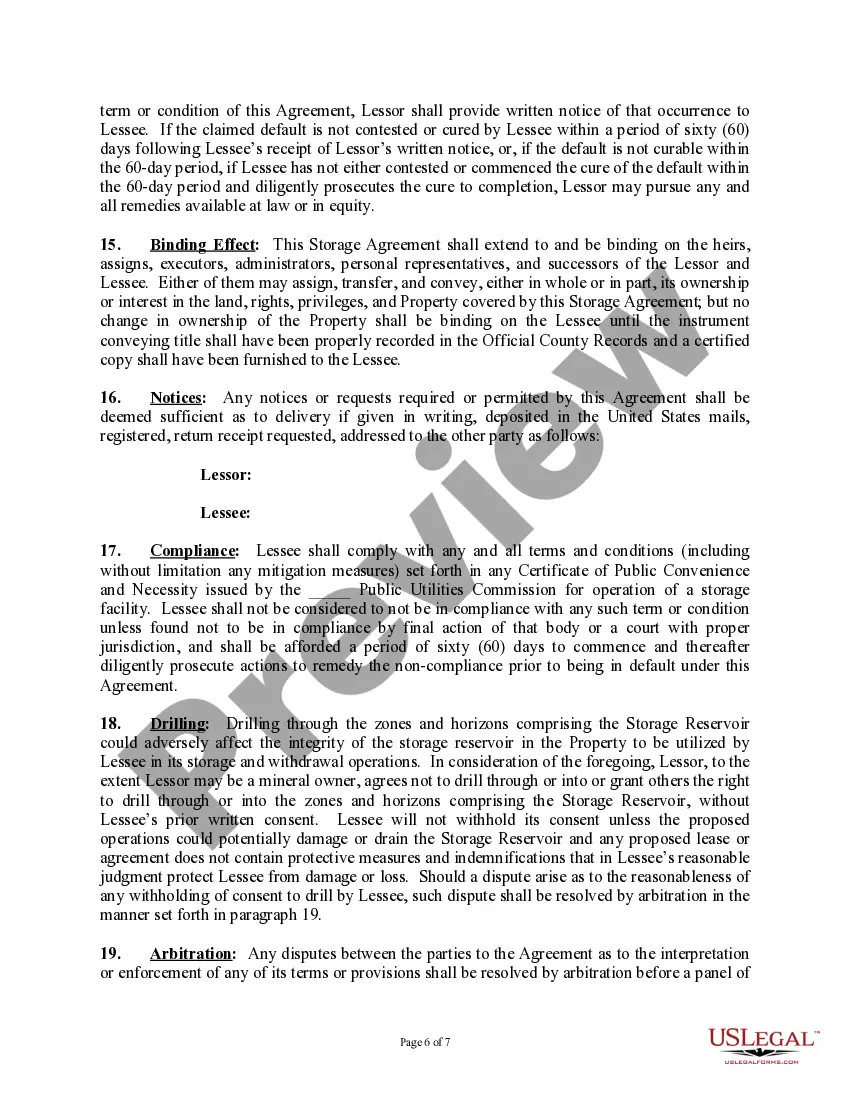

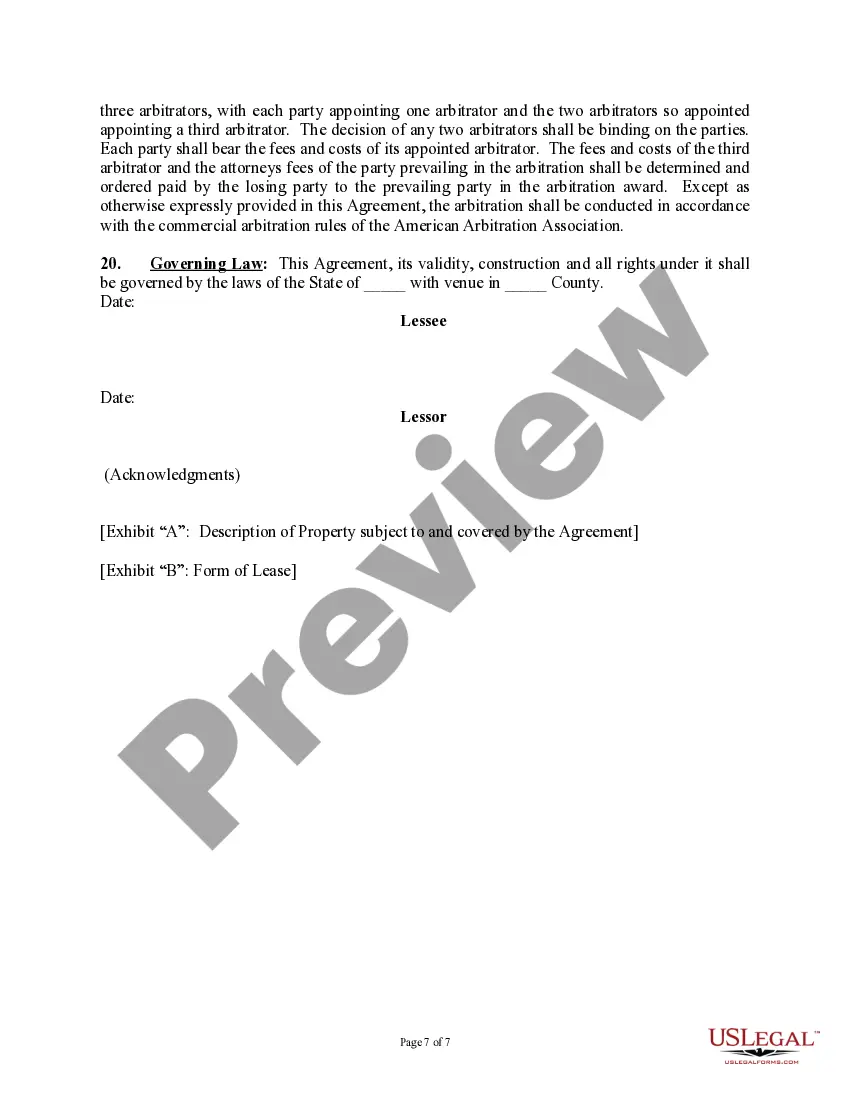

The West Virginia Underground Storage Lease and Agreement (From Surface Owner with Mineral Interest) is a legal document that outlines the terms and conditions between the surface owner and the lessee for the use and storage of underground areas for various purposes such as natural gas, oil, or other mineral storage activities in West Virginia. This agreement serves as a binding contract that delineates the rights, obligations, and responsibilities of both parties involved in the underground storage activity. Keywords: West Virginia, underground storage lease, agreement, surface owner, mineral interest, legal document, terms and conditions, lessee, underground areas, natural gas, oil, mineral storage activities, binding contract, rights, obligations, responsibilities. The different types of West Virginia Underground Storage Lease and Agreement (From Surface Owner with Mineral Interest) could include: 1. Natural Gas Underground Storage Lease and Agreement: This specific type of agreement focuses on the storage and utilization of natural gas resources in underground formations owned by the surface owner with mineral rights in West Virginia. It addresses specific terms and conditions related to the extraction, storage, and delivery of natural gas. 2. Oil Underground Storage Lease and Agreement: This type of agreement is designed for the underground storage and utilization of oil reserves owned by the surface owner in West Virginia. It covers various aspects like access rights, compensation, maintenance responsibilities, and the lessee's obligations related to the oil storage activities. 3. Mineral Storage Lease and Agreement: This broader category encompasses agreements for underground storage of various minerals, including natural gas and oil. It caters to surface owners with mineral interests who seek to lease their underground spaces for the storage of different mineral resources. 4. Underground Storage Lease and Agreement for Other Minerals: This type of agreement may refer to storage arrangements pertaining to specific minerals like coal, uranium, or other valuable resources found beneath the surface of West Virginia. It outlines the terms and conditions related to the storage, extraction, and compensation for utilizing these minerals. These variations in the types of West Virginia Underground Storage Lease and Agreement ensure that the specific needs and requirements of surface owners with mineral interests are addressed appropriately, depending on the type of resource being stored underground.

West Virginia Underground Storage Lease and Agreement (From Surface Owner with Mineral Interest)

Description

How to fill out West Virginia Underground Storage Lease And Agreement (From Surface Owner With Mineral Interest)?

You can devote several hours on-line searching for the legitimate papers design which fits the state and federal specifications you need. US Legal Forms provides 1000s of legitimate types which are evaluated by professionals. It is simple to download or print out the West Virginia Underground Storage Lease and Agreement (From Surface Owner with Mineral Interest) from my support.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Obtain switch. After that, it is possible to comprehensive, revise, print out, or signal the West Virginia Underground Storage Lease and Agreement (From Surface Owner with Mineral Interest). Every single legitimate papers design you purchase is your own property for a long time. To have yet another backup for any bought type, proceed to the My Forms tab and click the related switch.

If you work with the US Legal Forms web site the first time, follow the simple guidelines below:

- Initially, be sure that you have chosen the right papers design to the state/metropolis of your choosing. Browse the type explanation to make sure you have selected the right type. If offered, take advantage of the Preview switch to check throughout the papers design at the same time.

- In order to find yet another edition in the type, take advantage of the Research industry to obtain the design that suits you and specifications.

- Upon having located the design you desire, just click Acquire now to proceed.

- Pick the pricing strategy you desire, type your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can use your charge card or PayPal accounts to cover the legitimate type.

- Pick the format in the papers and download it for your device.

- Make changes for your papers if needed. You can comprehensive, revise and signal and print out West Virginia Underground Storage Lease and Agreement (From Surface Owner with Mineral Interest).

Obtain and print out 1000s of papers themes utilizing the US Legal Forms website, which provides the largest variety of legitimate types. Use professional and state-certain themes to take on your company or personal requirements.

Form popularity

FAQ

The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is permanently and totally disabled is exempt.

Mineral interests in WV are taxed the same as your home. You will pay 60% of the appraised value on the minerals at the levy rate for your county. The value of these minerals in based on WV Code procedures and is the same for all counties in WV. Minerals are taxed at a minimum value until production begins.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

Capital gains taxes apply to the sale of mineral rights. If you retain your rights and lease them, therefore earning a royalty on the production, the royalty amount is taxed as regular income. Income tax rates tend to be higher than capital gain tax rates.

After confirming your legal ownership with an attorney at law, you need to draw up a deed of transfer form in your name and register it with the county records office as the mineral owner. The land transaction, leasing transaction, and royalty compliance go through the county office.

Mineral rights give ownership, for a specified time, of the underground minerals that do not include sand, limestone, gravel, or subsurface water. If the mineral rights to your property have been sold before you acquired the land, that means you own only the surface rights and cannot use the minerals.