This form is when the Lessor ratifies the Lease and grants, leases, and lets all of Lessor's undivided mineral interest in the Lands to Lessee on the same terms and conditions as provided for in the Lease, and adopts and confirms the Lease as if Lessor was an original party to and named as a Lessor in the Lease.

West Virginia Ratification of Oil, Gas, and Mineral Lease by Mineral Owner

Description

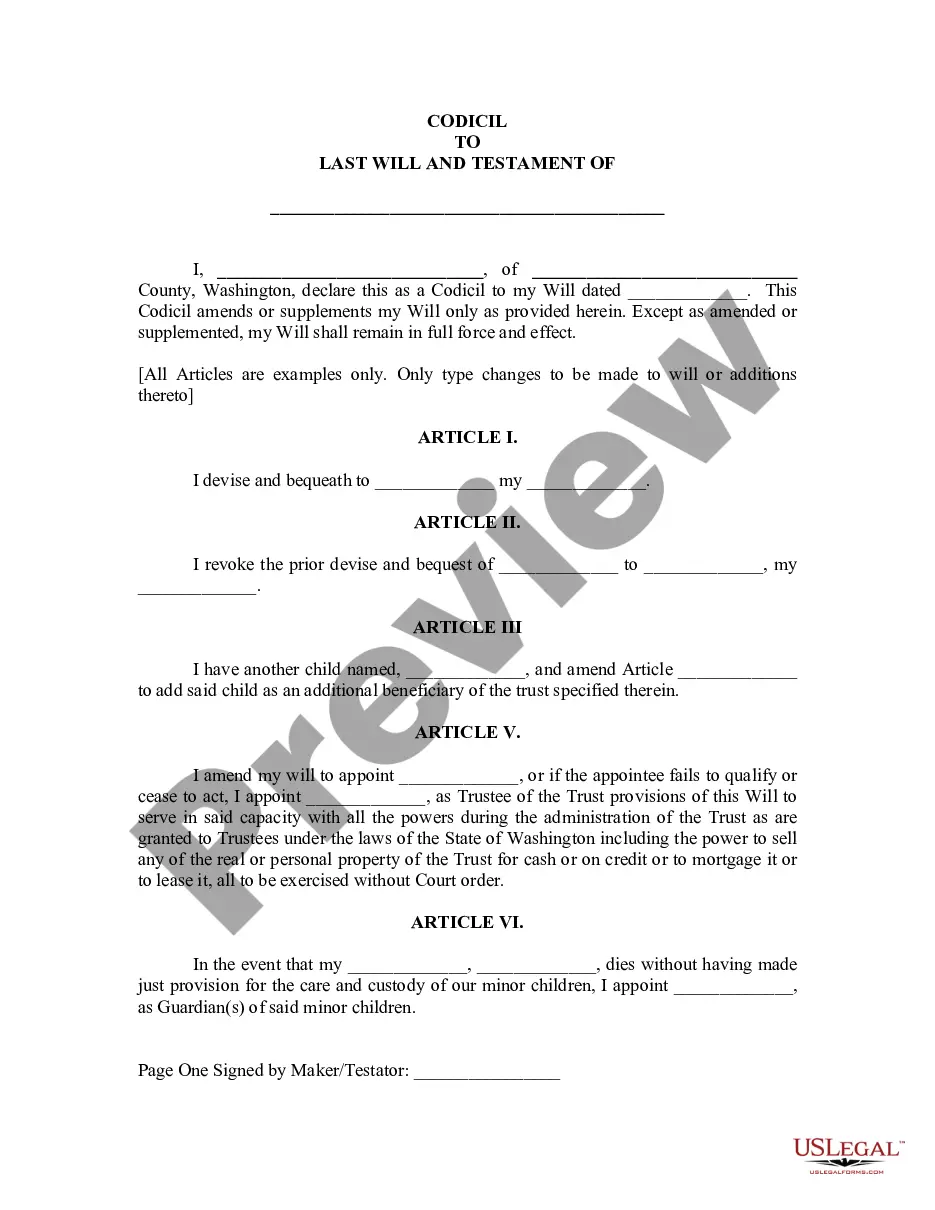

How to fill out Ratification Of Oil, Gas, And Mineral Lease By Mineral Owner?

If you have to complete, down load, or produce lawful papers themes, use US Legal Forms, the largest assortment of lawful types, which can be found on-line. Utilize the site`s simple and easy hassle-free search to get the papers you will need. Various themes for company and person purposes are sorted by categories and claims, or keywords. Use US Legal Forms to get the West Virginia Ratification of Oil, Gas, and Mineral Lease by Mineral Owner with a number of clicks.

In case you are presently a US Legal Forms consumer, log in for your profile and then click the Obtain key to find the West Virginia Ratification of Oil, Gas, and Mineral Lease by Mineral Owner. You can also access types you previously downloaded within the My Forms tab of your respective profile.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have selected the form for that correct metropolis/nation.

- Step 2. Use the Review method to examine the form`s content. Never overlook to learn the description.

- Step 3. In case you are not satisfied together with the type, use the Look for area towards the top of the monitor to locate other models from the lawful type template.

- Step 4. Once you have found the form you will need, select the Purchase now key. Opt for the pricing program you choose and include your references to sign up on an profile.

- Step 5. Method the deal. You may use your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Choose the format from the lawful type and down load it on the system.

- Step 7. Full, modify and produce or indication the West Virginia Ratification of Oil, Gas, and Mineral Lease by Mineral Owner.

Each and every lawful papers template you purchase is yours forever. You have acces to each type you downloaded in your acccount. Click on the My Forms section and choose a type to produce or down load once again.

Compete and down load, and produce the West Virginia Ratification of Oil, Gas, and Mineral Lease by Mineral Owner with US Legal Forms. There are thousands of skilled and status-specific types you may use to your company or person requirements.

Form popularity

FAQ

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

Many owners wonder what's a ?good? oil and gas lease royalty is. It depends on several factors, but in general you should be able to lease your oil and gas mineral rights for between 17% and 25%.

The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value. Royalties are an important source of income for landowners who have mineral rights.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

With a royalty rate at 12.5 percent, BLM gets as little as half as much as state or private landowners for every dollar's worth of oil and gas produced from its lands.