West Virginia Exhibit D to Operating Agreement Insurance - Form 2

Description

How to fill out Exhibit D To Operating Agreement Insurance - Form 2?

Finding the right legal document format can be a struggle. Obviously, there are a lot of themes available online, but how would you find the legal type you need? Use the US Legal Forms web site. The service provides a huge number of themes, like the West Virginia Exhibit D to Operating Agreement Insurance - Form 2, which you can use for organization and private requirements. All of the varieties are inspected by professionals and meet federal and state demands.

If you are presently registered, log in to the account and then click the Down load switch to find the West Virginia Exhibit D to Operating Agreement Insurance - Form 2. Make use of your account to check with the legal varieties you have acquired earlier. Check out the My Forms tab of your own account and get another copy of your document you need.

If you are a brand new customer of US Legal Forms, listed here are straightforward directions for you to adhere to:

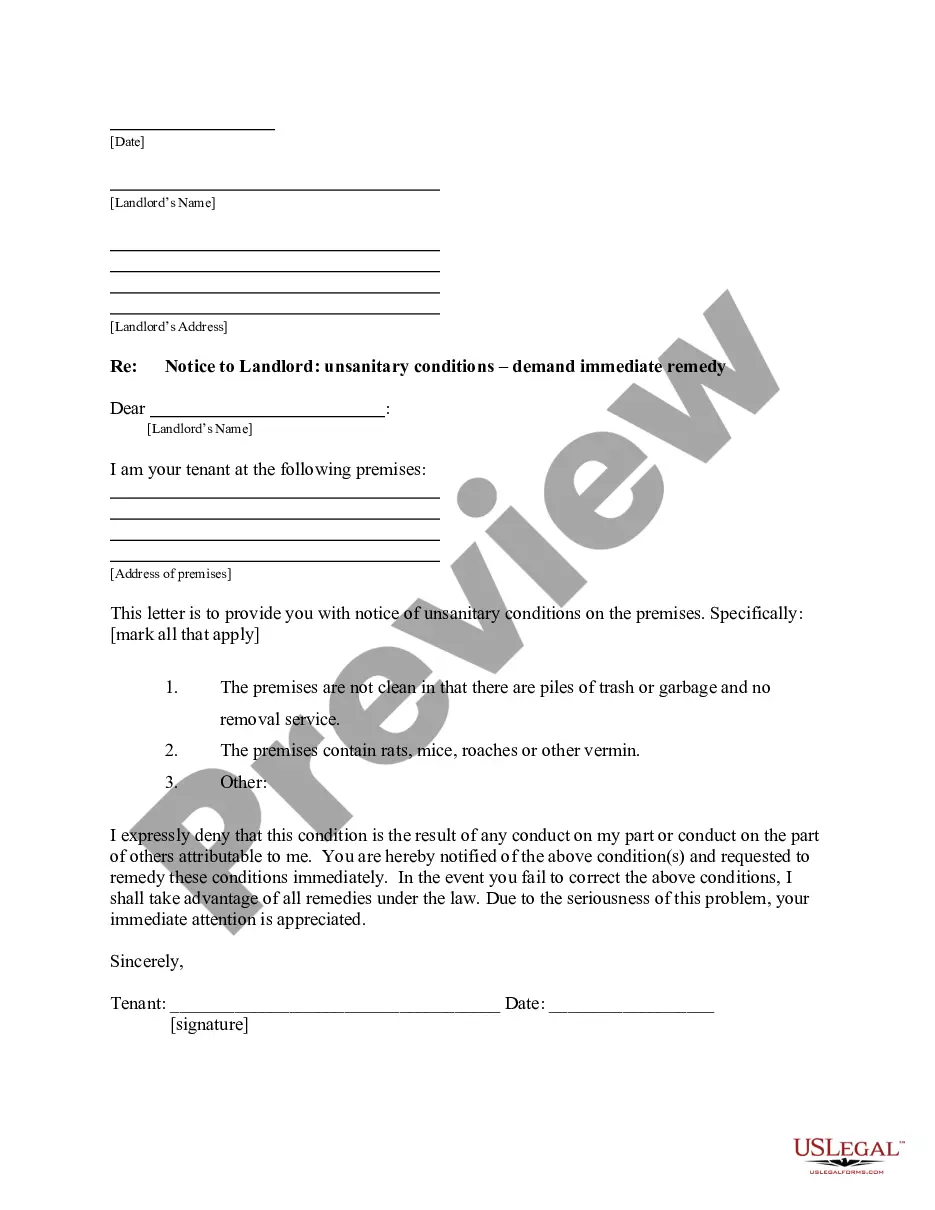

- First, ensure you have selected the right type for your personal town/region. You are able to check out the shape using the Preview switch and browse the shape outline to ensure it is the right one for you.

- If the type does not meet your expectations, utilize the Seach field to get the proper type.

- When you are certain the shape would work, go through the Get now switch to find the type.

- Pick the prices strategy you want and type in the needed information and facts. Make your account and pay money for the transaction utilizing your PayPal account or charge card.

- Choose the data file formatting and down load the legal document format to the gadget.

- Comprehensive, revise and print out and signal the received West Virginia Exhibit D to Operating Agreement Insurance - Form 2.

US Legal Forms may be the greatest collection of legal varieties in which you will find a variety of document themes. Use the service to down load expertly-created documents that adhere to status demands.

Form popularity

FAQ

West Virginia LLC Processing Times Normal LLC processing time:Expedited LLC:West Virginia LLC by mail:5-10 business days (plus mail time)24 hours ($25 extra) plus 2 more optionsWest Virginia LLC online:5-10 business days24 hours ($25 extra) plus 2 more options

Name your West Virginia LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Obtain a West Virginia business registration certificate. ... Get an Employer Identification Number.

Starting an LLC in West Virginia costs $100. This is the state filing fee for a document called the West Virginia Articles of Organization. The Articles of Organization are filed with the West Virginia Secretary of State. And once approved, this is what creates your LLC.