West Virginia Clauses Relating to Preferred Returns

Description

How to fill out Clauses Relating To Preferred Returns?

Are you inside a situation the place you need documents for sometimes business or personal functions nearly every working day? There are a variety of authorized file templates available online, but locating kinds you can rely isn`t straightforward. US Legal Forms offers a huge number of type templates, just like the West Virginia Clauses Relating to Preferred Returns, which can be published to meet state and federal needs.

In case you are already acquainted with US Legal Forms internet site and also have an account, basically log in. Afterward, you can obtain the West Virginia Clauses Relating to Preferred Returns format.

Should you not have an accounts and need to begin to use US Legal Forms, abide by these steps:

- Discover the type you require and make sure it is to the proper area/region.

- Utilize the Preview key to review the shape.

- Browse the description to ensure that you have selected the appropriate type.

- In case the type isn`t what you`re searching for, take advantage of the Research area to discover the type that suits you and needs.

- When you discover the proper type, simply click Purchase now.

- Pick the costs strategy you desire, fill out the specified info to make your account, and purchase your order with your PayPal or bank card.

- Choose a practical document file format and obtain your copy.

Get all of the file templates you have purchased in the My Forms menus. You can obtain a further copy of West Virginia Clauses Relating to Preferred Returns whenever, if necessary. Just select the required type to obtain or print out the file format.

Use US Legal Forms, by far the most substantial collection of authorized forms, to save some time and stay away from faults. The support offers expertly manufactured authorized file templates that you can use for a range of functions. Make an account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

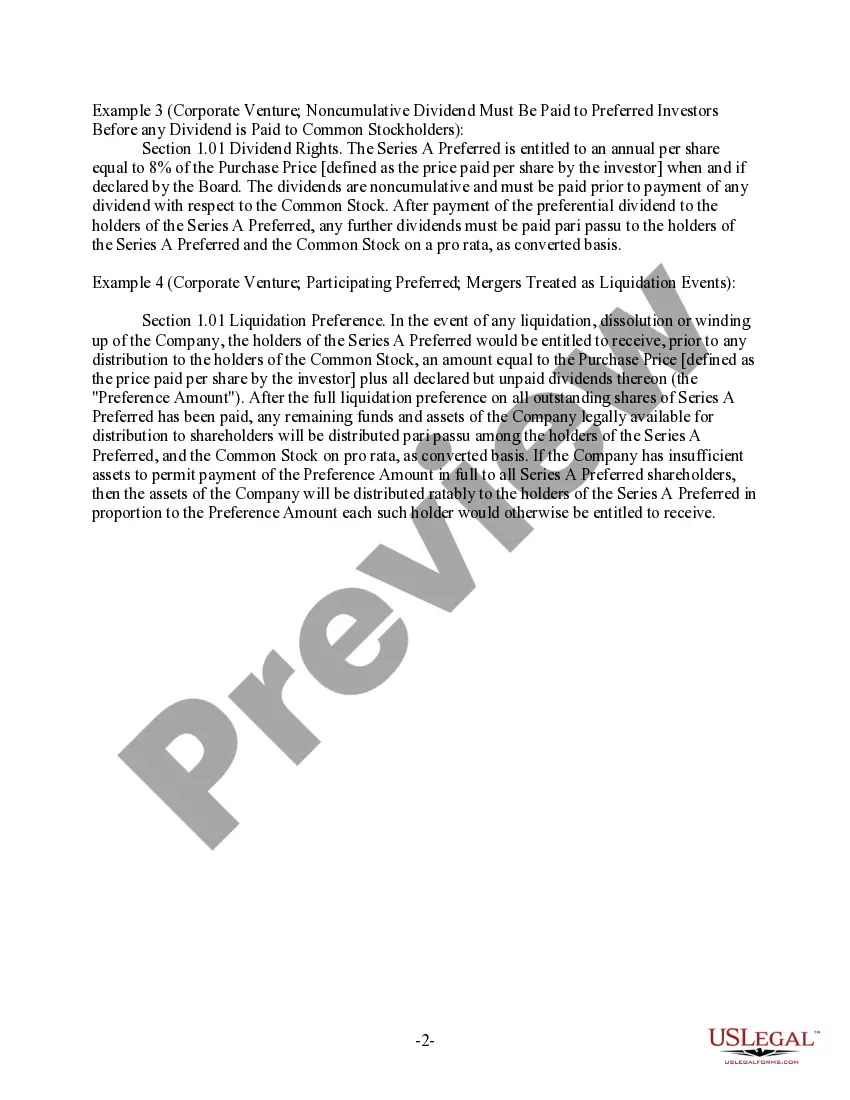

Preferred returns for an entire syndication can be calculated by multiplying the equity from the investor class by the preferred rate. For example, if $1 million is raised from investors to purchase a property, and the preferred rate is 6%, the annual preferred return would be $60,000.

A preferred return?simply called pref?describes the claim on profits given to preferred investors in a project. The preferred investors will be the first to receive returns up to a certain percentage, generally 8 to 10 percent.

Preferred returns for an entire syndication can be calculated by multiplying the equity from the investor class by the preferred rate. For example, if $1 million is raised from investors to purchase a property, and the preferred rate is 6%, the annual preferred return would be $60,000.

While a preferred return is an obligation to pay out a certain percentage of a real estate investment's initial return without fees, a guaranteed payment is what a partner collects for managing the property and investors' funds.

A preferred return?simply called pref?describes the claim on profits given to preferred investors in a project. The preferred investors will be the first to receive returns up to a certain percentage, generally 8 to 10 percent.

The minimum return to investors to be achieved before a carry is permitted. A hurdle rate of 10% means that the private equity fund needs to achieve a return of at least 10% per annum before the profits are shared ing to the carried interest arrangement.

What is a preferred return? A preferred return is a profit distribution preference whereby profits, either from operations, sale, or refinance, are distributed to one class of equity before another until a certain rate of return on the initial investment is reached.

A preferred return in real estate is a percentage of return of profits that an investor must receive before the investment management team can receive a profit. A typically preferred return in a real estate investment is generally between 6% and 9%, depending on the investment's risk.