West Virginia Amended Equity Fund Partnership Agreement

Description

How to fill out Amended Equity Fund Partnership Agreement?

Discovering the right legitimate record design can be a have difficulties. Needless to say, there are plenty of themes available on the net, but how do you get the legitimate form you need? Utilize the US Legal Forms site. The service offers a huge number of themes, such as the West Virginia Amended Equity Fund Partnership Agreement, that can be used for company and personal needs. All of the forms are examined by specialists and meet up with federal and state needs.

If you are already signed up, log in to your accounts and click on the Acquire key to have the West Virginia Amended Equity Fund Partnership Agreement. Utilize your accounts to check from the legitimate forms you possess acquired earlier. Go to the My Forms tab of your own accounts and get an additional backup of the record you need.

If you are a new consumer of US Legal Forms, listed below are easy guidelines for you to comply with:

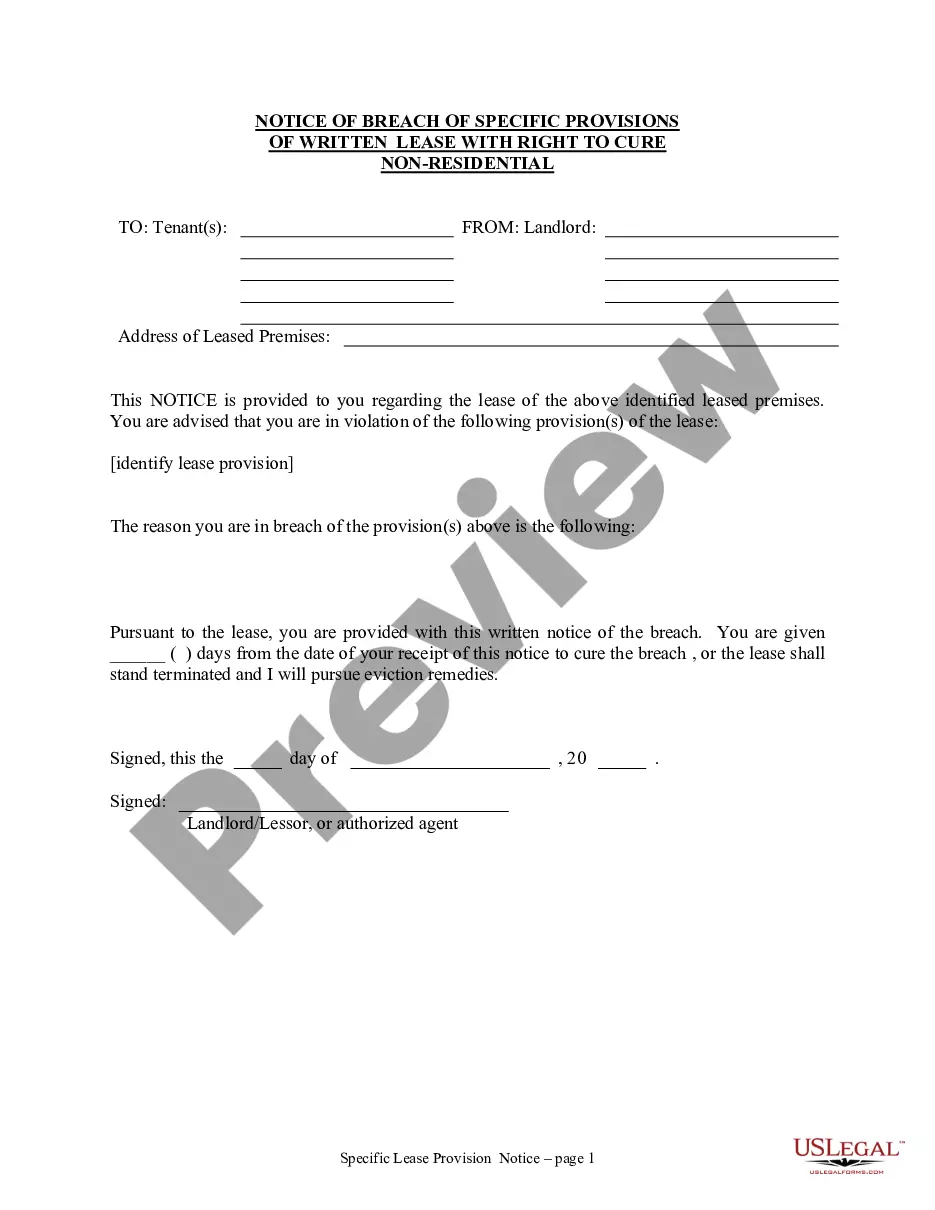

- First, make sure you have chosen the appropriate form to your metropolis/area. You are able to look through the form using the Review key and read the form information to make sure it is the right one for you.

- In the event the form is not going to meet up with your expectations, utilize the Seach discipline to find the right form.

- Once you are positive that the form is suitable, click on the Acquire now key to have the form.

- Select the prices prepare you would like and type in the required info. Build your accounts and buy an order making use of your PayPal accounts or charge card.

- Opt for the document file format and download the legitimate record design to your system.

- Comprehensive, change and print and indicator the acquired West Virginia Amended Equity Fund Partnership Agreement.

US Legal Forms is definitely the biggest library of legitimate forms for which you can find different record themes. Utilize the service to download appropriately-created documents that comply with condition needs.

Form popularity

FAQ

What is a PTE? The pass-through entity tax (PTE) allows partnerships, S Corporations and LLCs to elect to be taxed at the entity level for state income tax purposes.

States that have reciprocity with Virginia are: Kentucky. Maryland. Pennsylvania. West Virginia.

The PTE tax is calculated on a resident's share of unapportioned income. Owners of an electing PTE are allowed to claim a credit against their West Virginia individual income tax equal to their share of PTE tax paid. Excess credits may be carried forward for up to five taxable years.

Any S Corpora on or Partnership granted an extension of me to file their federal return is granted the same extension of me to file their West Virginia return. Be sure to a ach a copy of your federal extension to each tax return to avoid any penalty for late filing.

Owners of an electing PTE are allowed to claim a credit against their West Virginia individual income tax equal to their share of PTE tax paid. Excess credits may be carried forward for up to five taxable years. Resident owners are allowed a credit for taxes paid to other states.

Governor Newsom signed California Assembly Bill 150 into law on July 16, 2021. This new law allows certain pass-through entities to annually elect to pay an elective tax in the amount of 9.3% of the pro rata share or distributive share of the entity's partners, shareholders, or members.

On March 7, 2023, Governor Jim Justice signed HB 2526 immediately reducing the income tax in tax year 2023 by an average of 21.25%. The bill also provides for a number of refundable tax credits for payment of property taxes.

Justice signed HB 2526 immediately reducing the income tax in tax year 2023 by an average of 21.25%. The bill contains provisions for additional annual personal income tax rate cuts in future years beginning as early as 2025 to the extent that actual State revenue growth exceeds consumer inflation.