US Legal Forms - one of several most significant libraries of lawful forms in the United States - delivers a variety of lawful record web templates you can obtain or produce. Using the internet site, you can get 1000s of forms for enterprise and individual functions, sorted by groups, says, or keywords and phrases.You will discover the most recent models of forms like the West Virginia Personal Property Inventory Questionnaire within minutes.

If you already have a registration, log in and obtain West Virginia Personal Property Inventory Questionnaire through the US Legal Forms collection. The Download option can look on each type you see. You gain access to all formerly downloaded forms in the My Forms tab of your respective profile.

In order to use US Legal Forms the very first time, allow me to share simple recommendations to get you started:

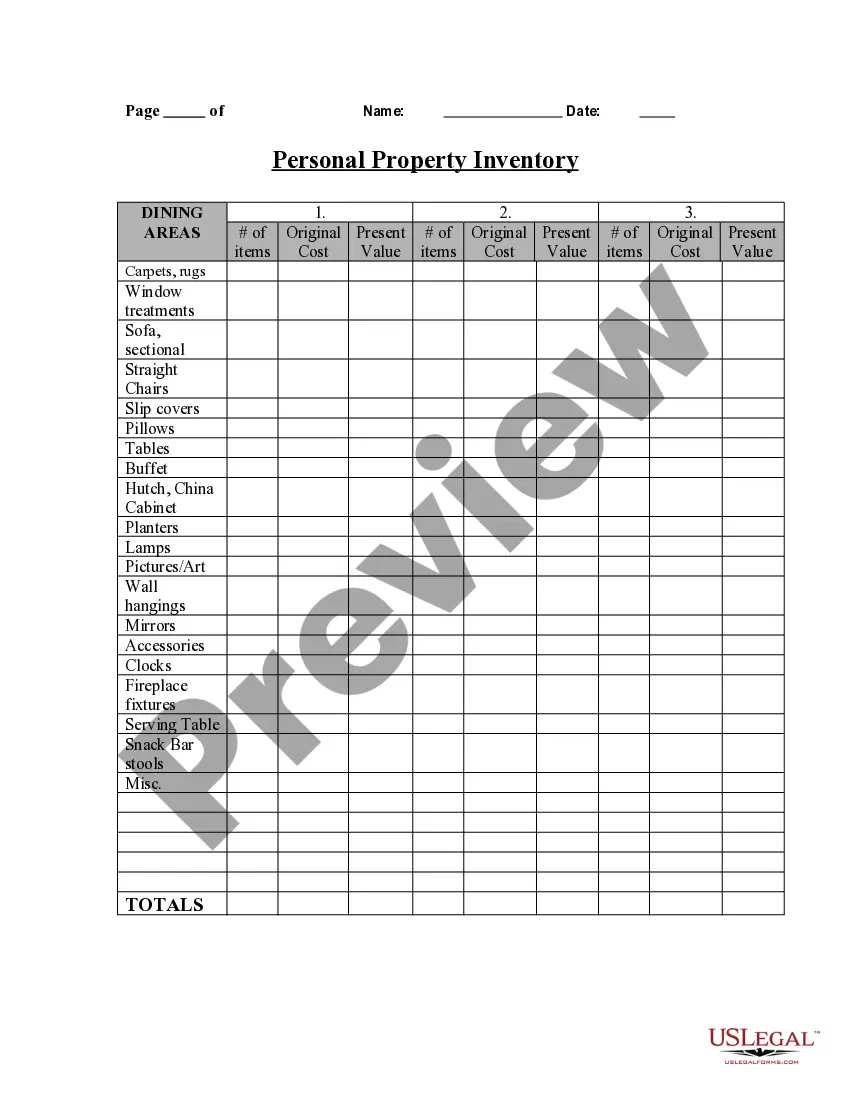

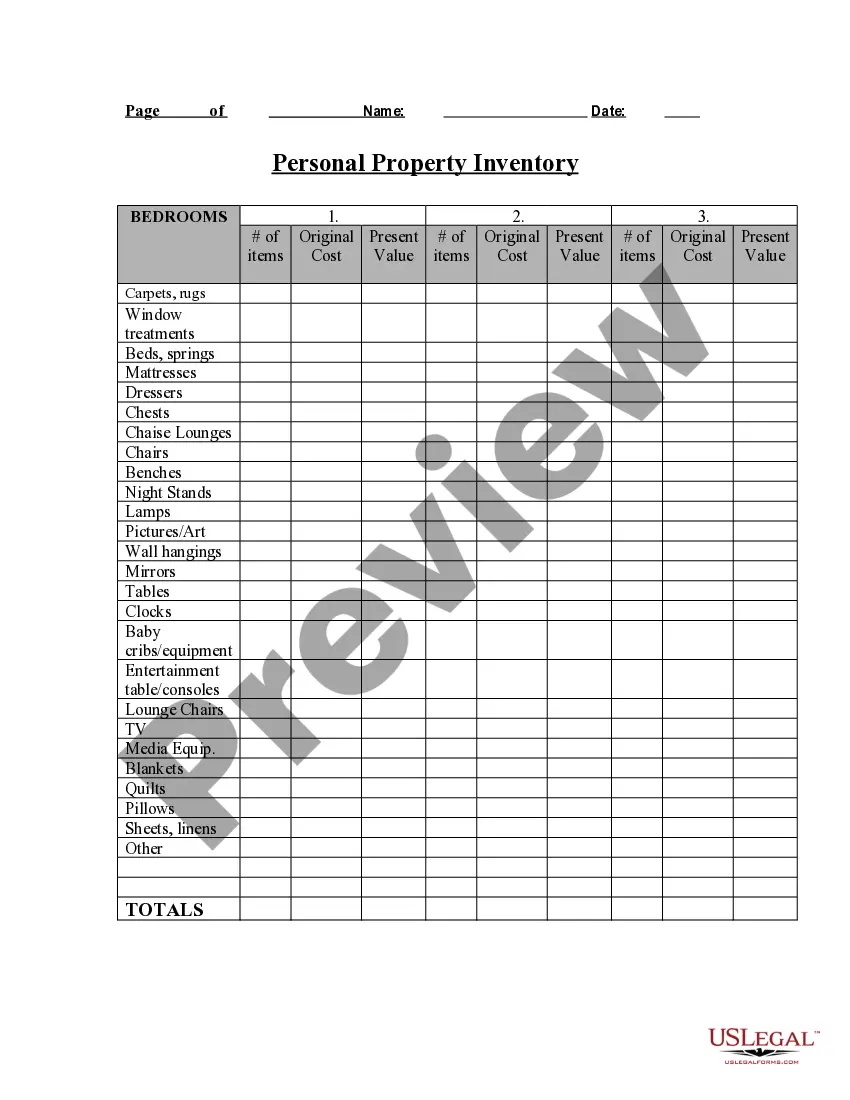

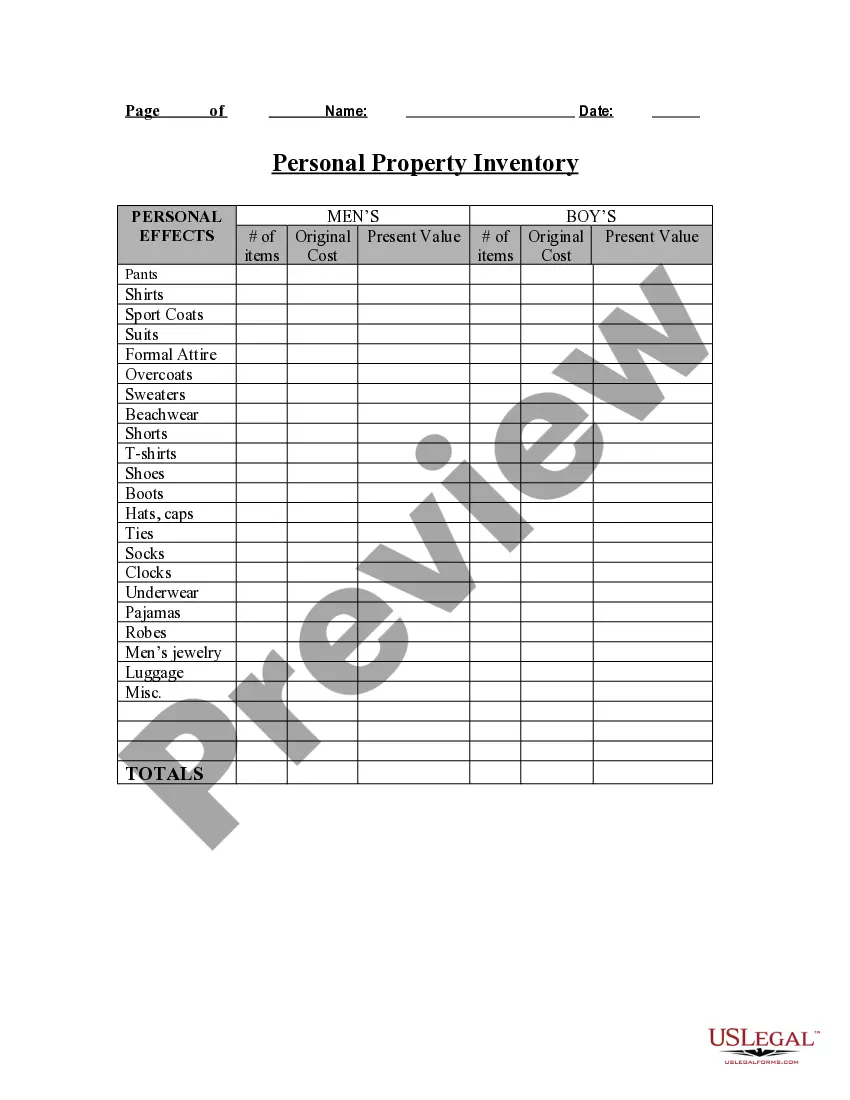

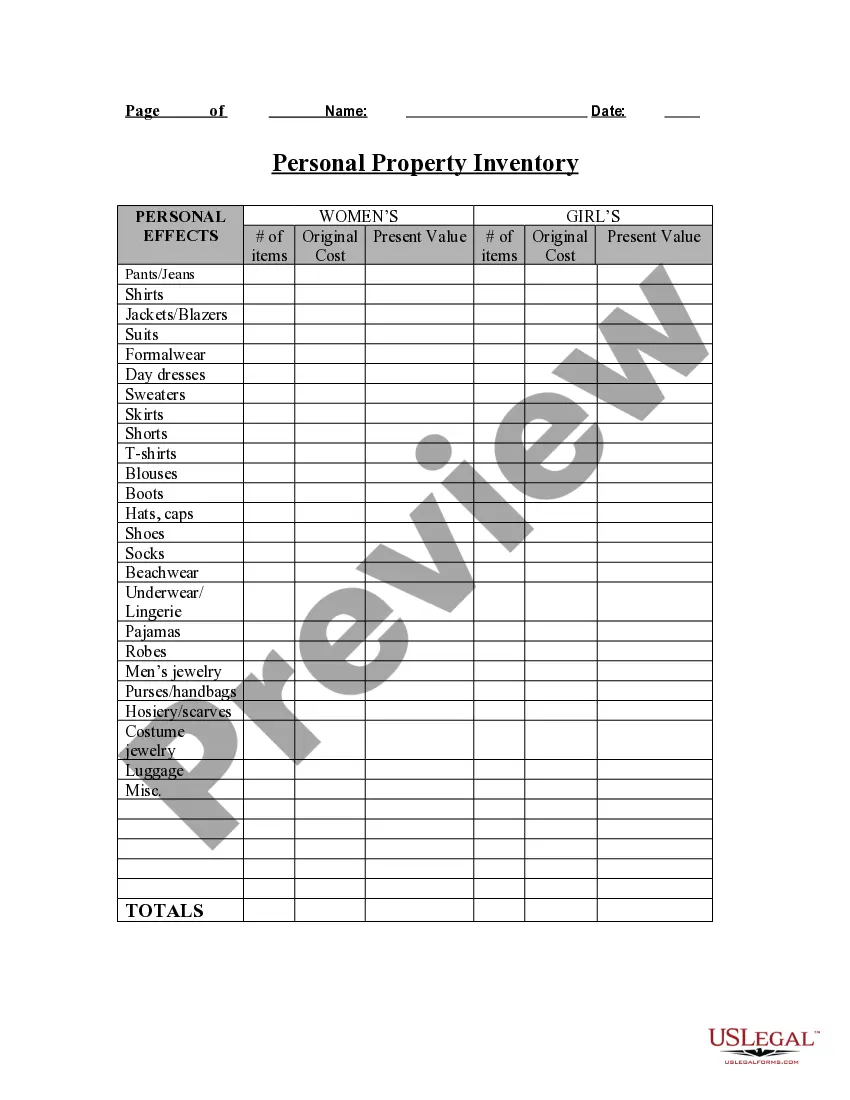

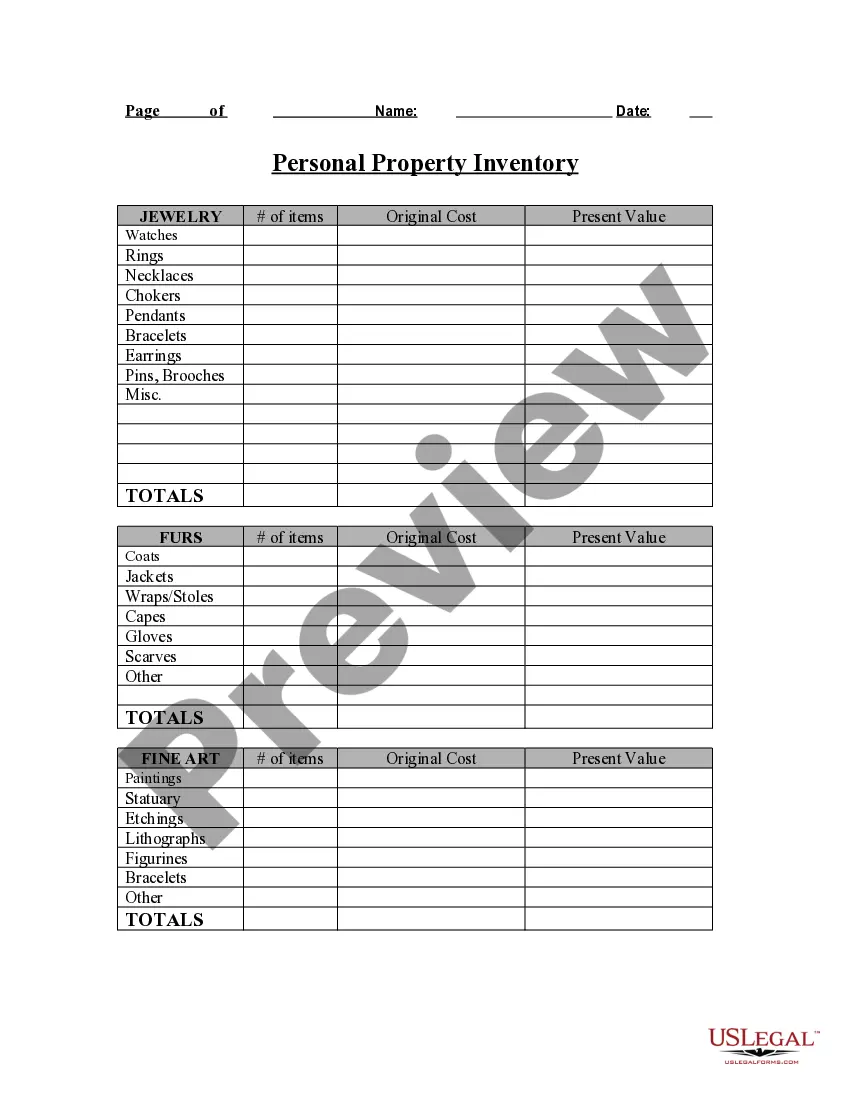

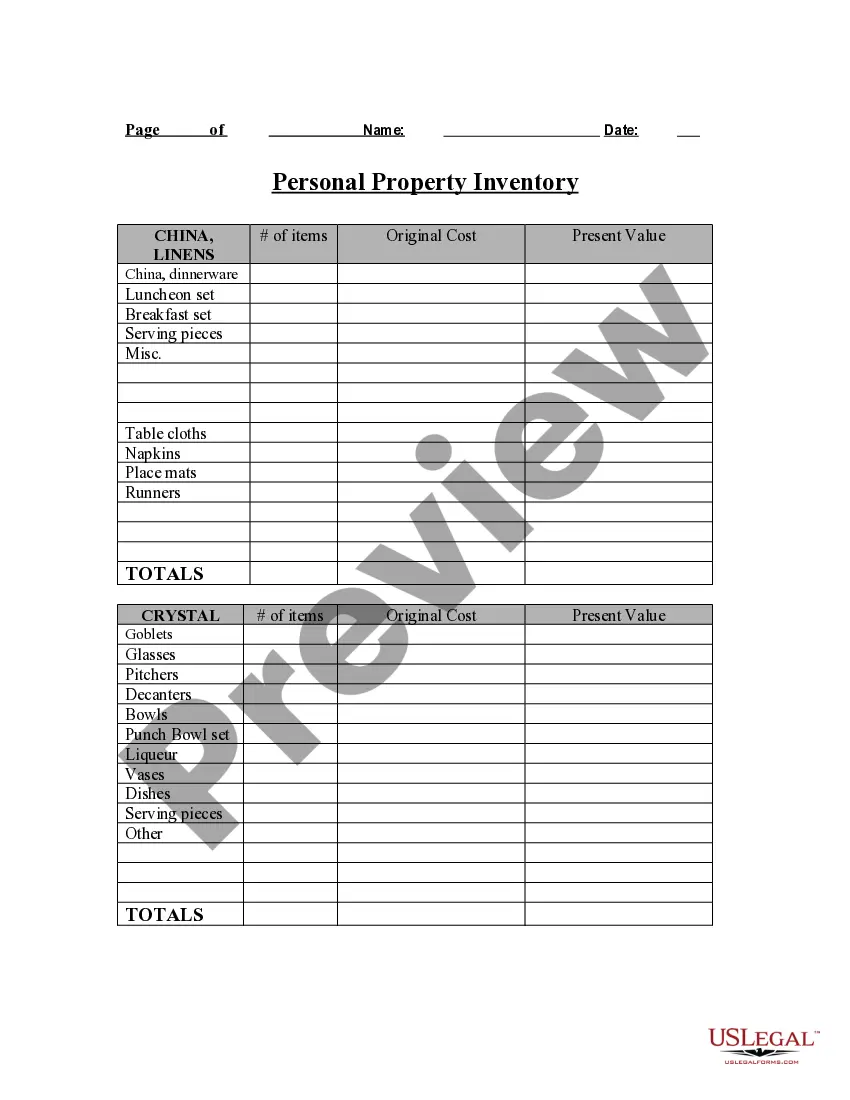

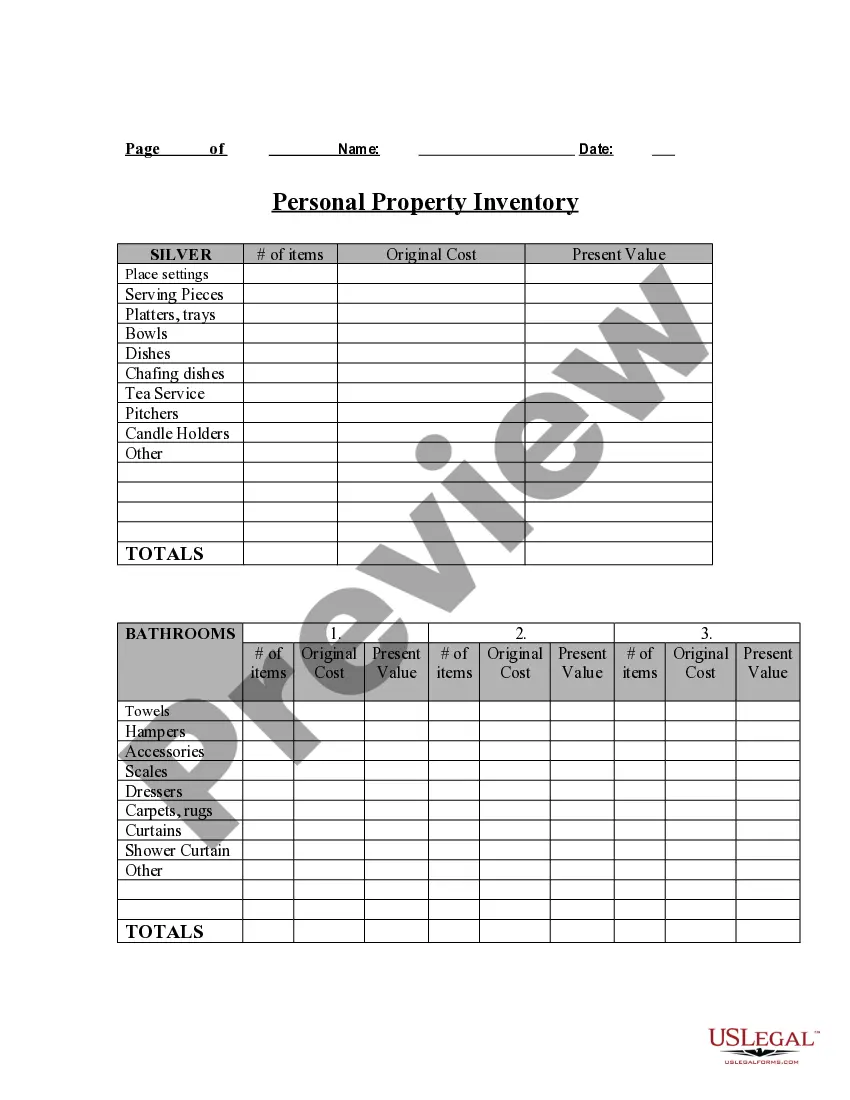

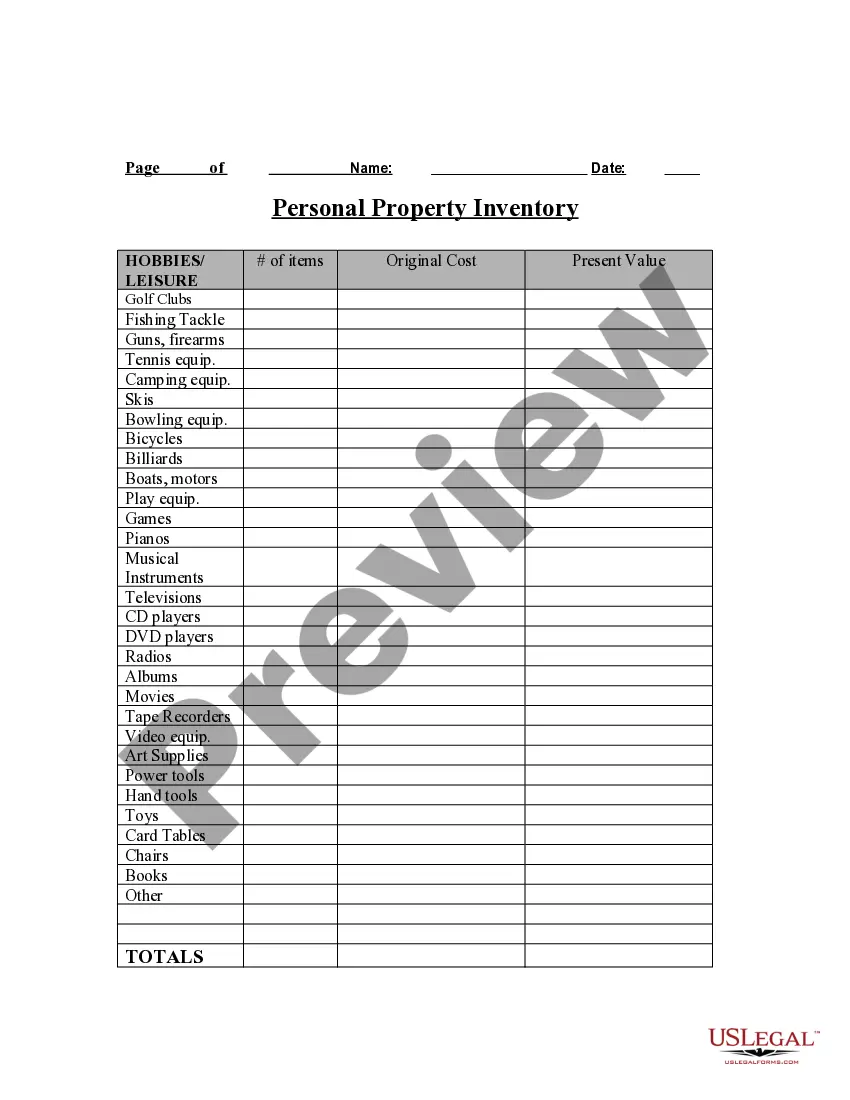

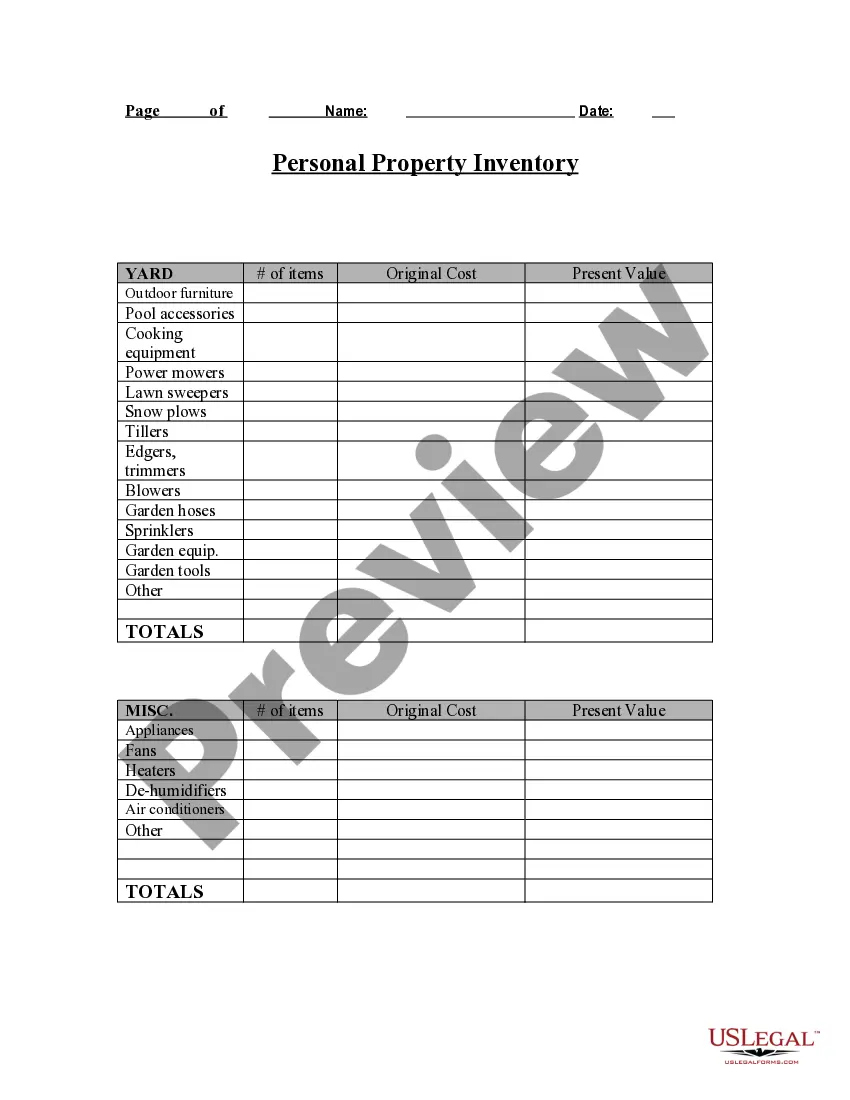

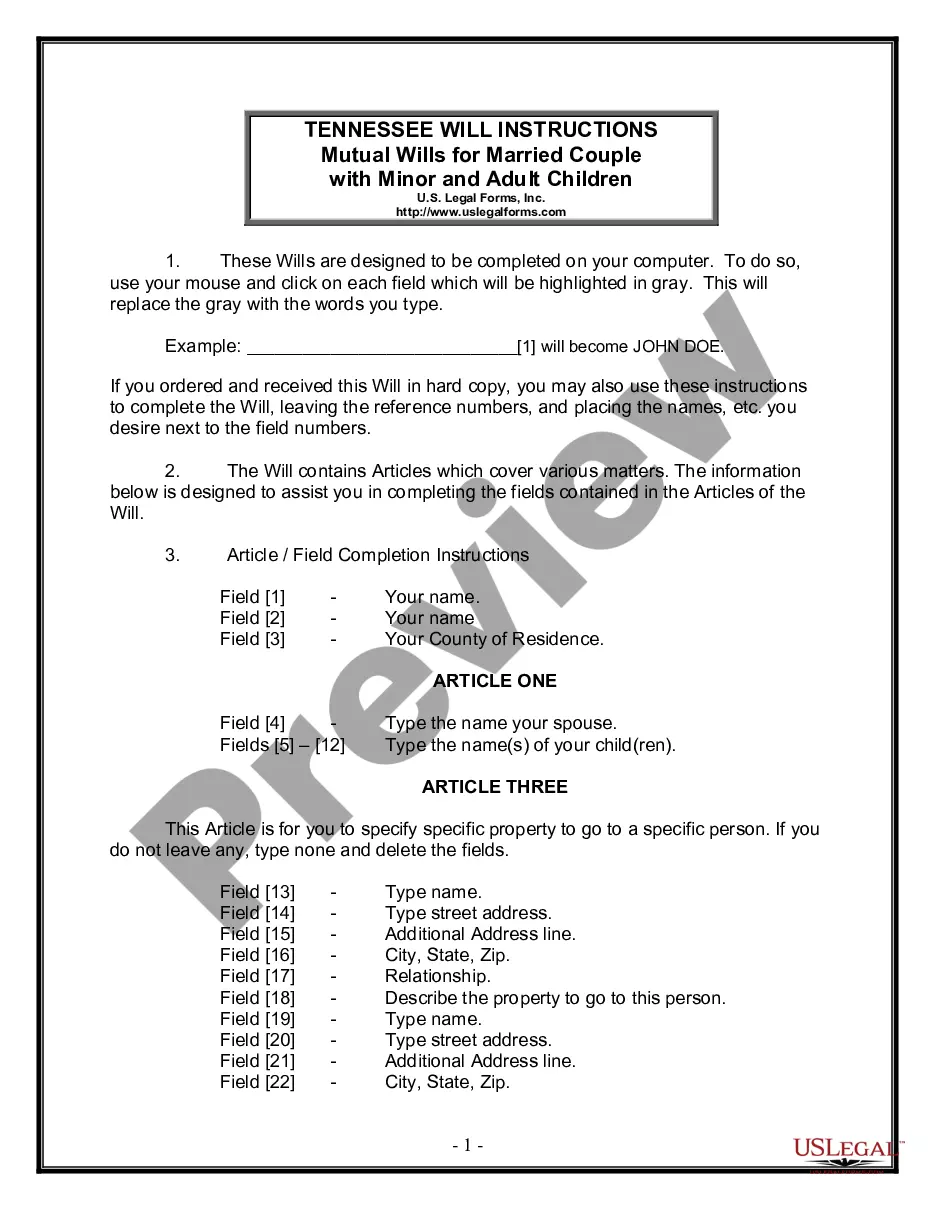

- Ensure you have chosen the proper type to your city/county. Click on the Review option to analyze the form`s content. Read the type information to actually have selected the appropriate type.

- When the type does not fit your demands, make use of the Look for field near the top of the display to discover the the one that does.

- When you are happy with the shape, confirm your choice by simply clicking the Get now option. Then, choose the pricing program you prefer and supply your credentials to register to have an profile.

- Procedure the deal. Make use of your credit card or PayPal profile to finish the deal.

- Select the formatting and obtain the shape on your gadget.

- Make adjustments. Complete, modify and produce and sign the downloaded West Virginia Personal Property Inventory Questionnaire.

Each format you included in your account lacks an expiry day which is your own property forever. So, if you want to obtain or produce another backup, just check out the My Forms portion and click on about the type you need.

Get access to the West Virginia Personal Property Inventory Questionnaire with US Legal Forms, the most considerable collection of lawful record web templates. Use 1000s of expert and express-specific web templates that fulfill your business or individual needs and demands.

In West Virginia July 1st of each year is fixed as the assessment date.personal property including, but not limited to, cars, trucks, inventory, ... Frequently Asked Questions about Tax Maps: What are tax maps? Tax maps are maintained by the Assessor's Office to provide a visual inventory for each parcel of ...Along with production and minerals, real estate and personal property are appraised in the state of West Virginia per regulations guided by WV State Code. REAL ESTATE. Please complete this section for all property your business has in Cabell County, West Virginia only. Include all buildings owned.2 pages

REAL ESTATE. Please complete this section for all property your business has in Cabell County, West Virginia only. Include all buildings owned. As your Assessor, I am directed by West Virginia State Law to have businesse.s file returns listing personal property and real property by the deadline ... Real and Personal Property Tax Ambulance Fees Fire Fees Motor Vehicle Registration Renewals To see a sample tax bill- click sample tax bill. pdf. QUESTIONS? In West Virginia, there are four classes of property:land and buildings, rental property, vehicles, commercial real estate, equipment, inventory). The state receives sales information monthly from assessors and enters information onto a data file. Each assessor determines which sales ... (1) ?Industrial property? means real and personal property integrated as ain this code relating to failure to list any property or to file any return ... Income tax repeal is on the agenda in West Virginia,Businesses must fill out forms identifying all their personal property subject to ...