This stock option plan provides employees with a way to gain ownership in the company for which they work. The plan addresses SARs, stock awards, dividends and divided equivalents, deferrals and settlements, and all other subject matter generally included in stock option plans.

West Virginia Employee Stock Option Plan

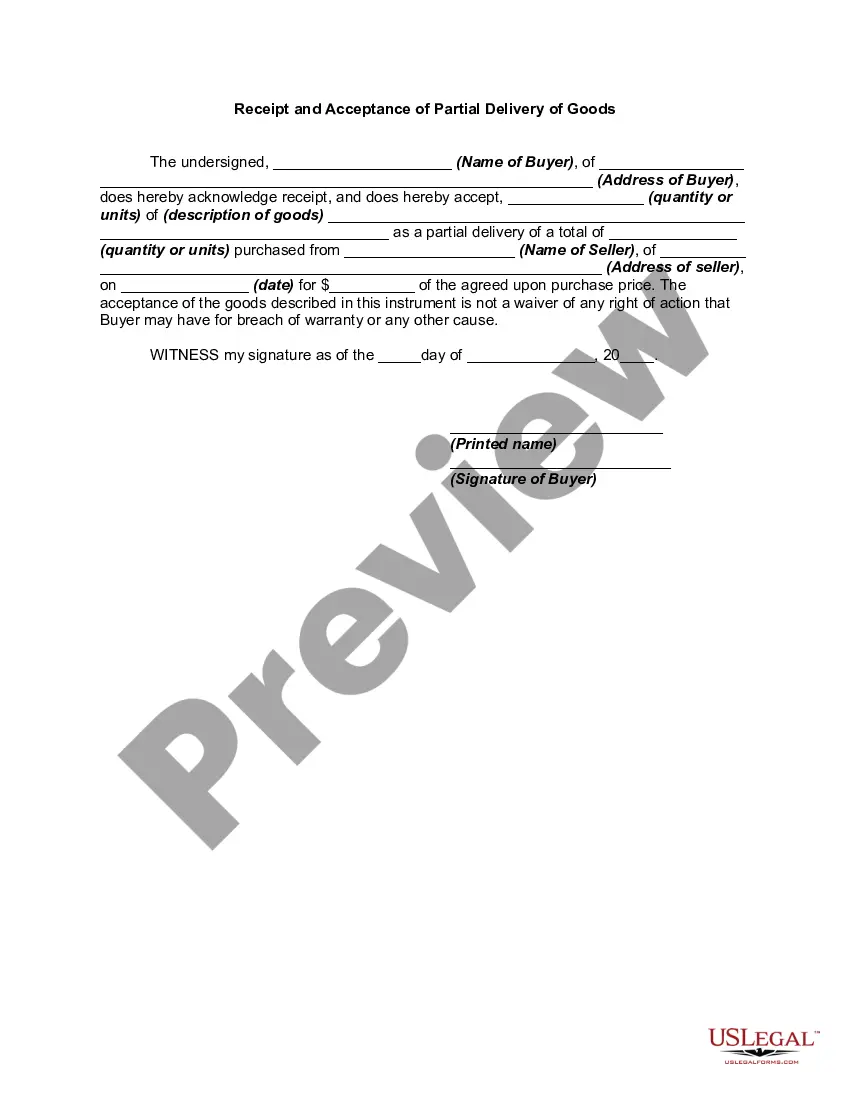

Description

How to fill out Employee Stock Option Plan?

US Legal Forms - one of several largest libraries of legitimate kinds in the USA - provides an array of legitimate document web templates you may obtain or print out. Using the web site, you will get thousands of kinds for company and personal purposes, categorized by groups, suggests, or keywords.You can find the most recent variations of kinds such as the West Virginia Employee Stock Option Plan in seconds.

If you already have a registration, log in and obtain West Virginia Employee Stock Option Plan from your US Legal Forms catalogue. The Obtain button will appear on every single type you see. You get access to all previously acquired kinds in the My Forms tab of your bank account.

If you want to use US Legal Forms initially, listed below are straightforward directions to help you get began:

- Make sure you have picked out the best type to your metropolis/region. Click on the Review button to check the form`s articles. Browse the type outline to actually have selected the right type.

- If the type doesn`t suit your specifications, utilize the Look for area on top of the display screen to find the one who does.

- When you are satisfied with the shape, verify your option by clicking on the Purchase now button. Then, pick the pricing program you like and provide your accreditations to register for an bank account.

- Method the deal. Use your Visa or Mastercard or PayPal bank account to perform the deal.

- Select the format and obtain the shape on the system.

- Make changes. Fill out, edit and print out and signal the acquired West Virginia Employee Stock Option Plan.

Each and every design you included with your account does not have an expiry date and it is your own property eternally. So, if you wish to obtain or print out another duplicate, just go to the My Forms portion and click on about the type you will need.

Get access to the West Virginia Employee Stock Option Plan with US Legal Forms, the most extensive catalogue of legitimate document web templates. Use thousands of expert and state-particular web templates that fulfill your organization or personal requires and specifications.

Form popularity

FAQ

?Vesting? in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. An employee who is 100% vested in his or her account balance owns 100% of it and the employer cannot forfeit, or take it back, for any reason.

A leveraged employee stock ownership plan (LESOP) uses borrowed money to fund an ESOP as a form of equity compensation for employees. The company borrows against its assets and then repays the loan used to fund the ESOP via annual contributions.

An employee stock ownership plan (ESOP) is a retirement plan in which an employer contributes its stock to the plan for the benefit of the company's employees.

An Employee Stock Ownership Plan (ESOP) is a tax- qualified retirement plan authorized and encouraged by federal tax and pension laws.

An Employee Stock Ownership Plan (ESOP) is an individual stock bonus plan designed specifically to invest in the stock of the employer corporation. An ESOP may be either nonleveraged or leveraged. An Employee Stock Ownership Trust (ESOT) is the entity responsible for administering the ESOP.

ESOP vs ESPP ? The Difference ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate. ESOPs are qualified defined contribution retirement plans.

The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase. A nonqualified ESPP may have a discount, a match, or other features. By contrast, the purchase price of stock under a stock option plan is the fair market value on the date of grant.

An Employee Share Ownership Plan (ESOP) allows employees, who qualify, to acquire shares in their employer's company, with or without monetary assistance from the company. Employees can acquire shares and ownership through an ESOP that can range from one percent to 100 percent.