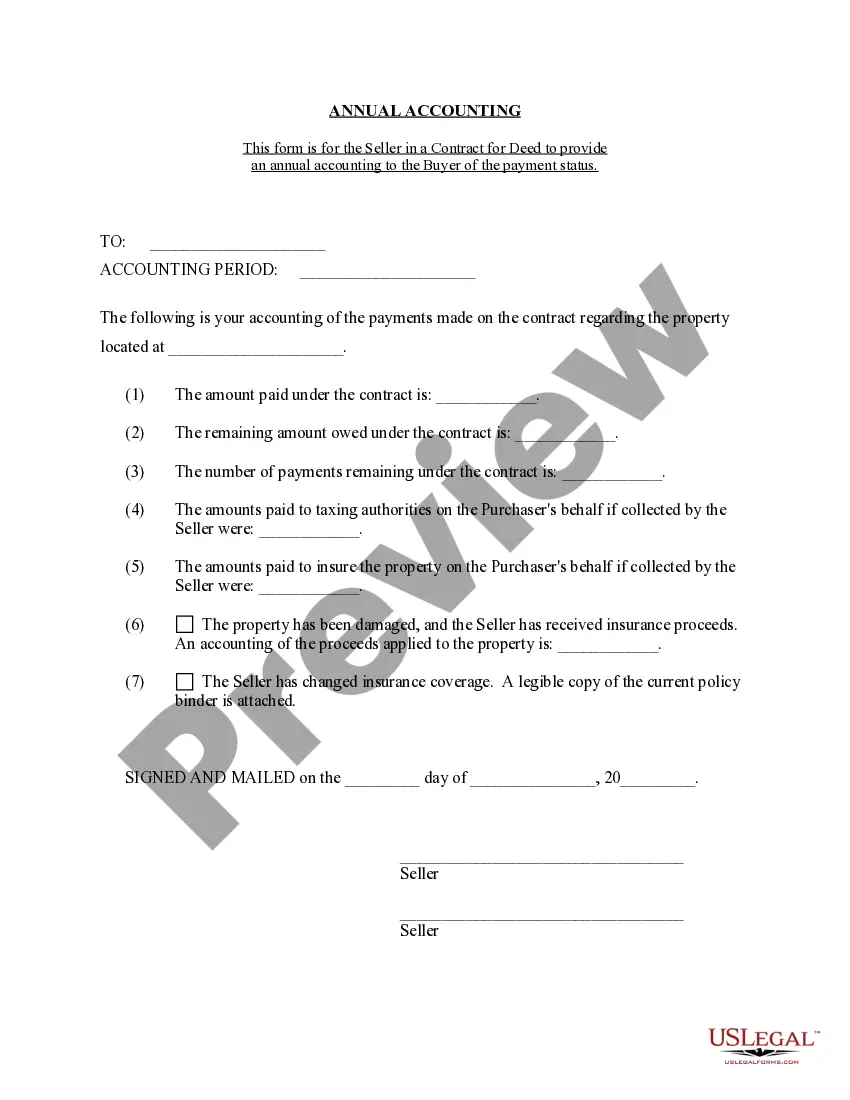

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Wyoming Contract for Deed Seller's Annual Accounting Statement

Description

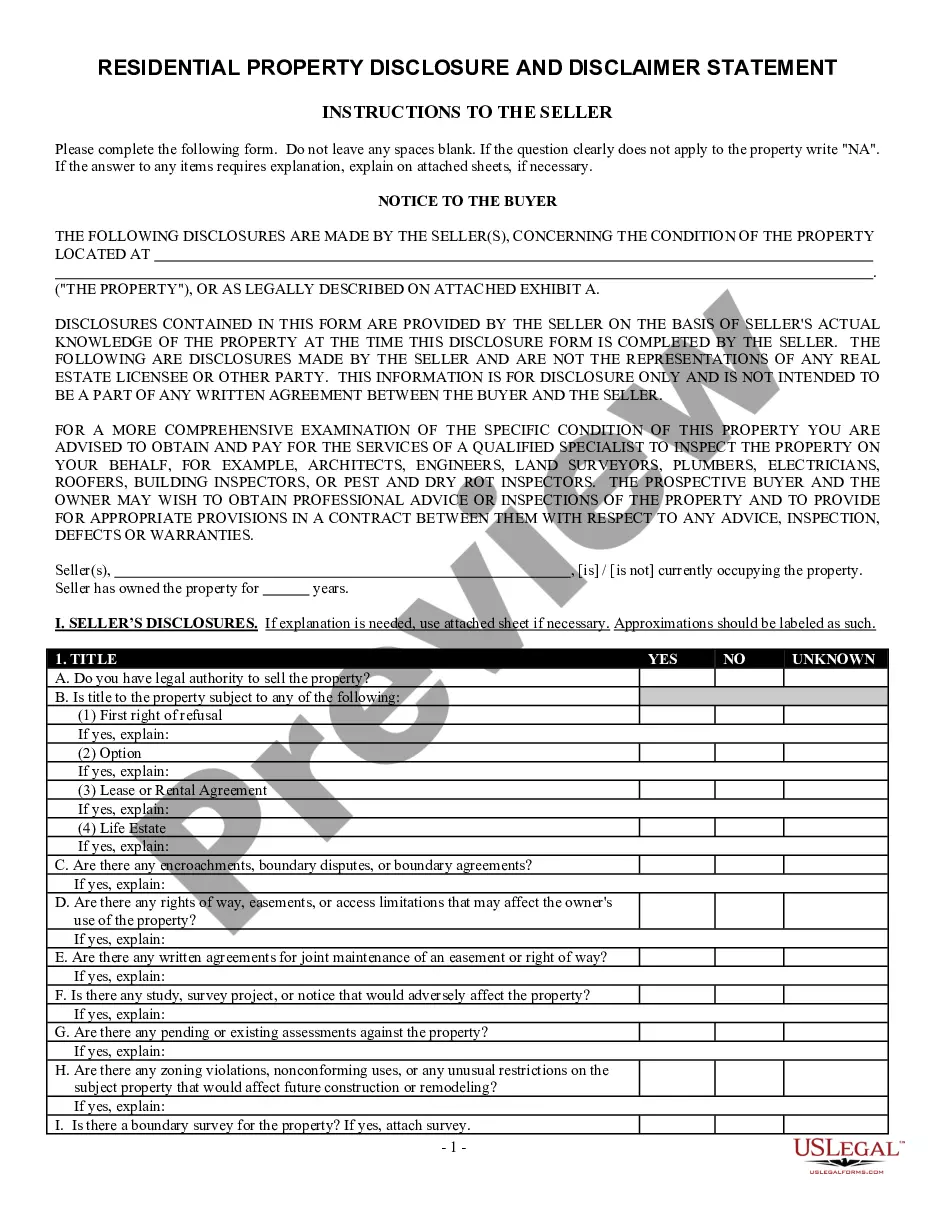

How to fill out Wyoming Contract For Deed Seller's Annual Accounting Statement?

Use US Legal Forms to get a printable Wyoming Contract for Deed Seller's Annual Accounting Statement. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms library online and provides cost-effective and accurate templates for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and some of them might be previewed before being downloaded.

To download samples, users must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to quickly find and download Wyoming Contract for Deed Seller's Annual Accounting Statement:

- Check to ensure that you get the proper form with regards to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search engine if you need to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Wyoming Contract for Deed Seller's Annual Accounting Statement. Above three million users already have utilized our service successfully. Choose your subscription plan and have high-quality forms within a few clicks.

Form popularity

FAQ

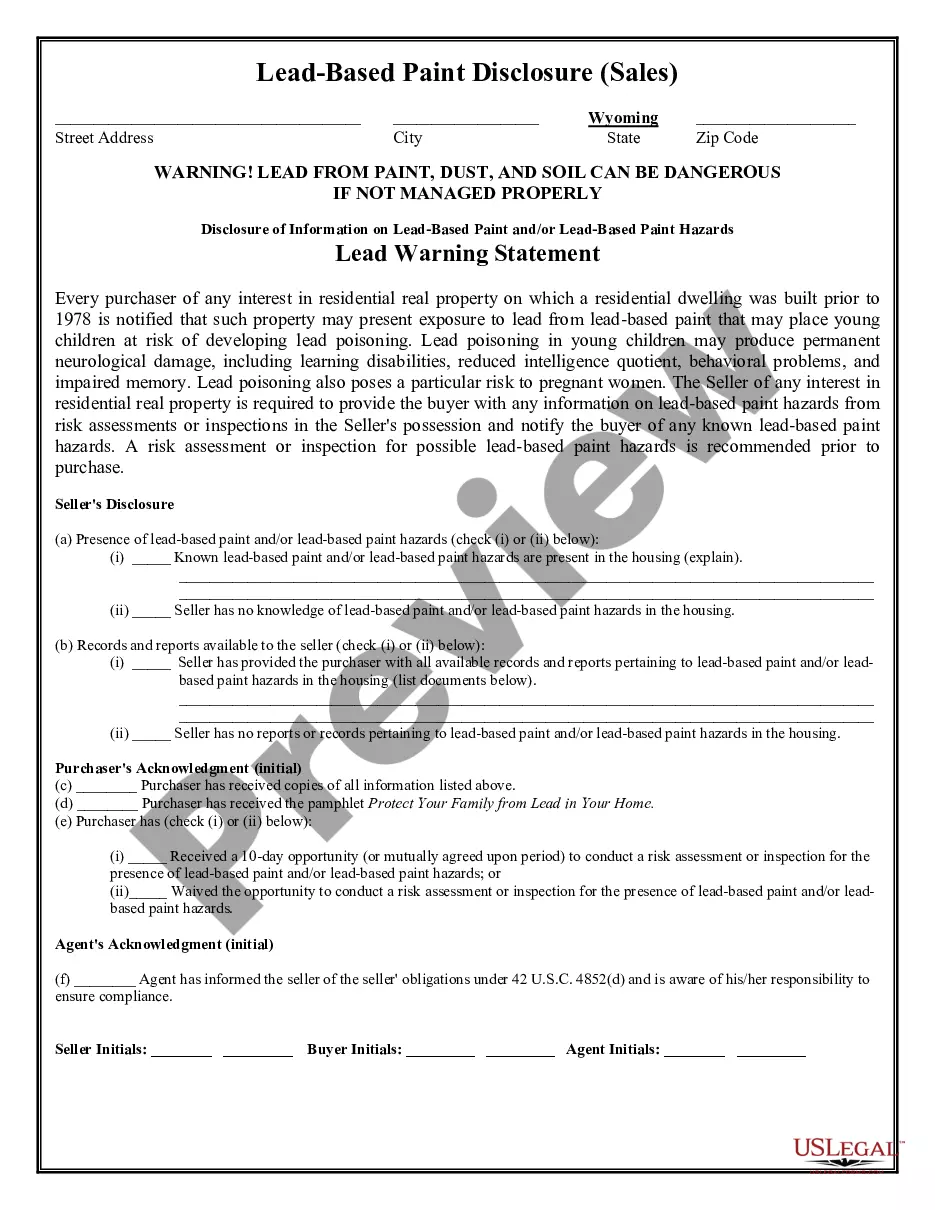

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

A: No, they are not. The Contract to Sell comes before a Deed of Sale, as the former serves as the basis for the latter. There is an act of finality when it comes to the Deed of Sale. On the other hand, the Contract to Sell requires that the parties first complete the conditions they agreed to.

The interest rate on a contract for deed loan is typically 3% - 6% higher than the rate on regular mortgage. A higher interest rate means a higher monthly mortgage payment plus you are also responsible for property taxes and insurance even though you do not own the property.

The Contract for Deed buyer also has an ownership interest and to get the legal and equitable interest all sorted out you need to consult an attorney.Yes, because legally the Seller (the person selling the home to a tenant buyer through CFD) still owns the house and can sell it.

Other benefits include: no loan qualifying, low or flexible down payment, favorable interest rates and flexible terms, and a quicker settlement. The biggest risk when buying a home contract for deed is that you really don?t have a legal claim to the property until you have paid off the entire purchase price.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

Usually the contract requires the buyer to make payments over time with interest payable on the unpaid balance. Once a buyer pays all of the payments called for under the contract, the owner transfers to the buyer a deed to the property.

Generally, contract for deed sellers use IRS Form 6252 to report installment sales in the year in which they take place. You also use Form 6252 during each year you receive income from your contract for deed.