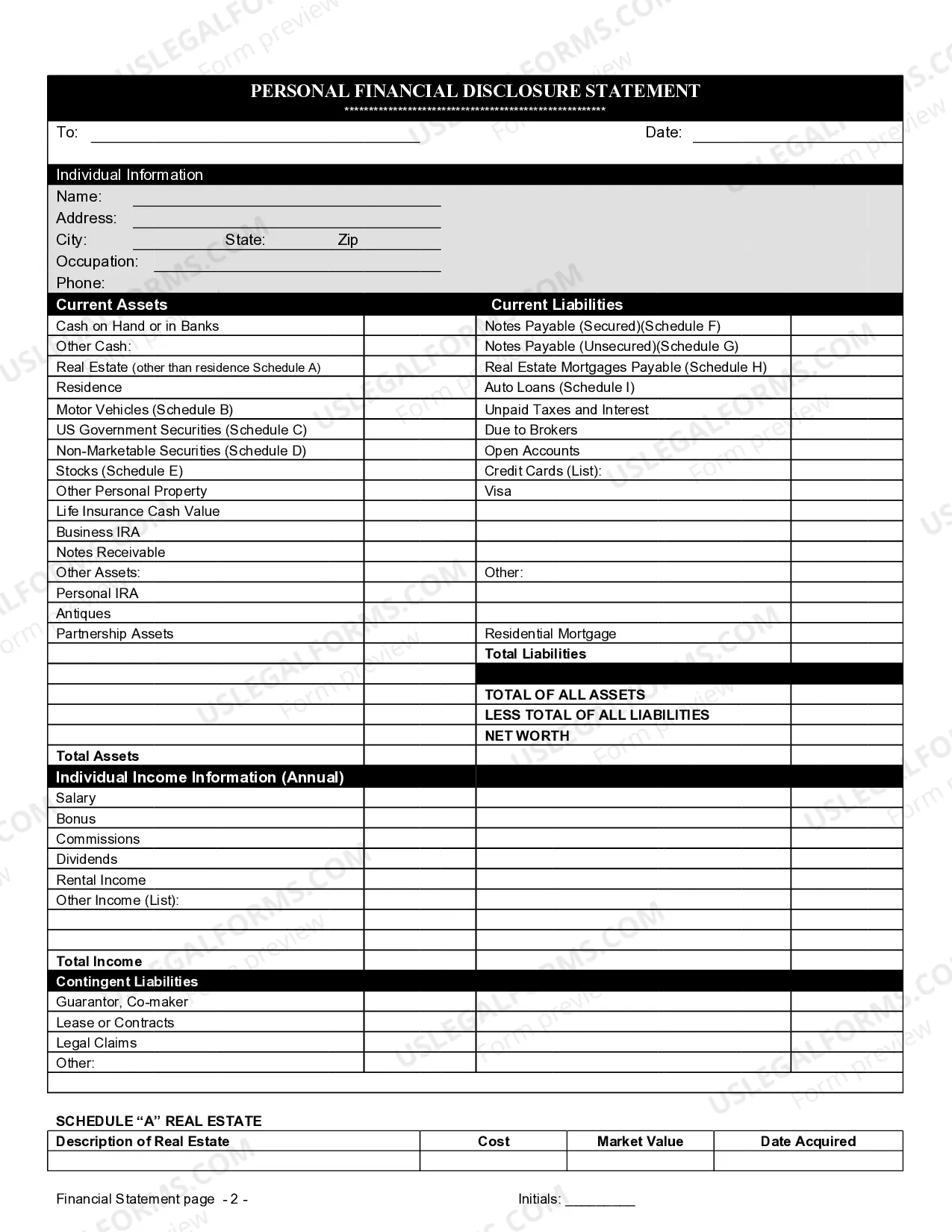

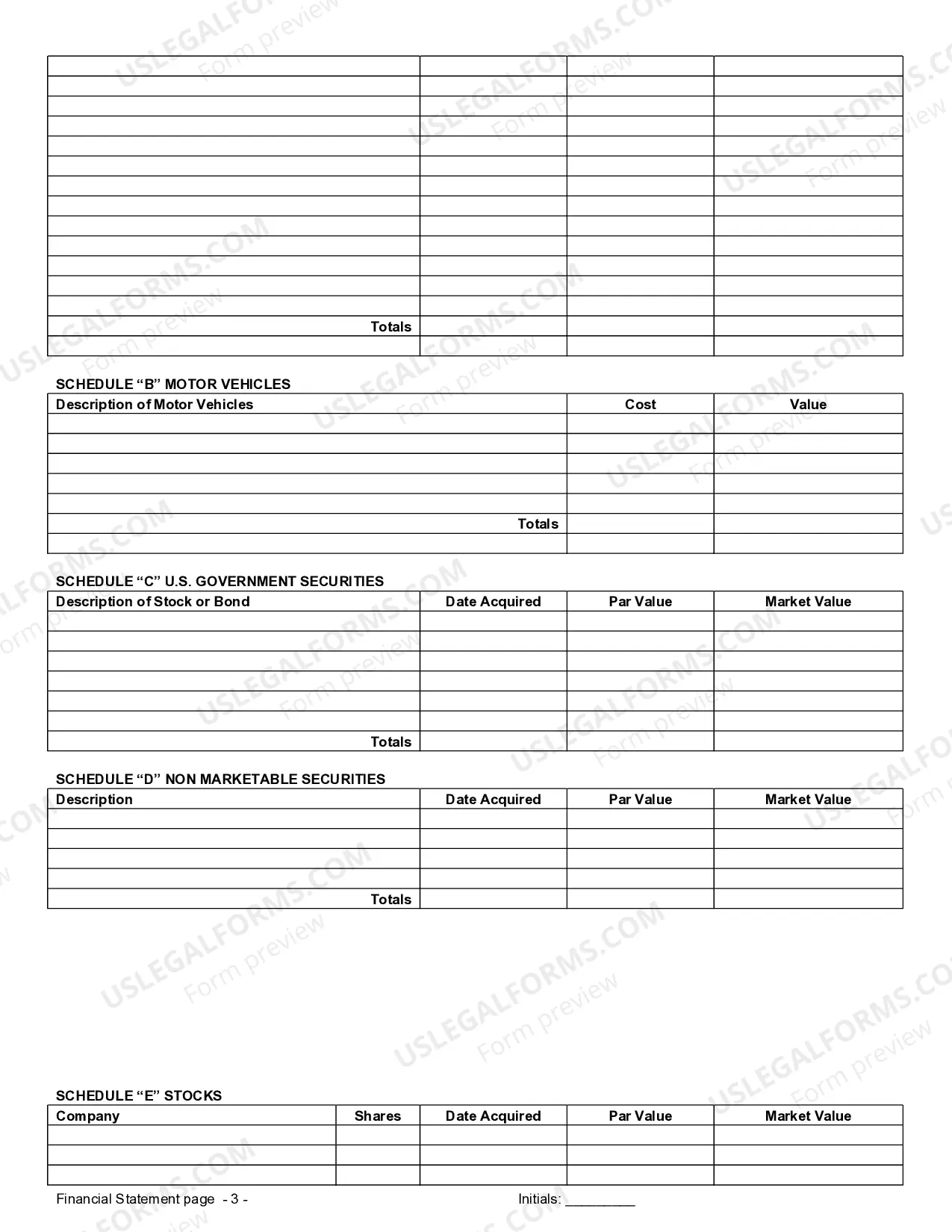

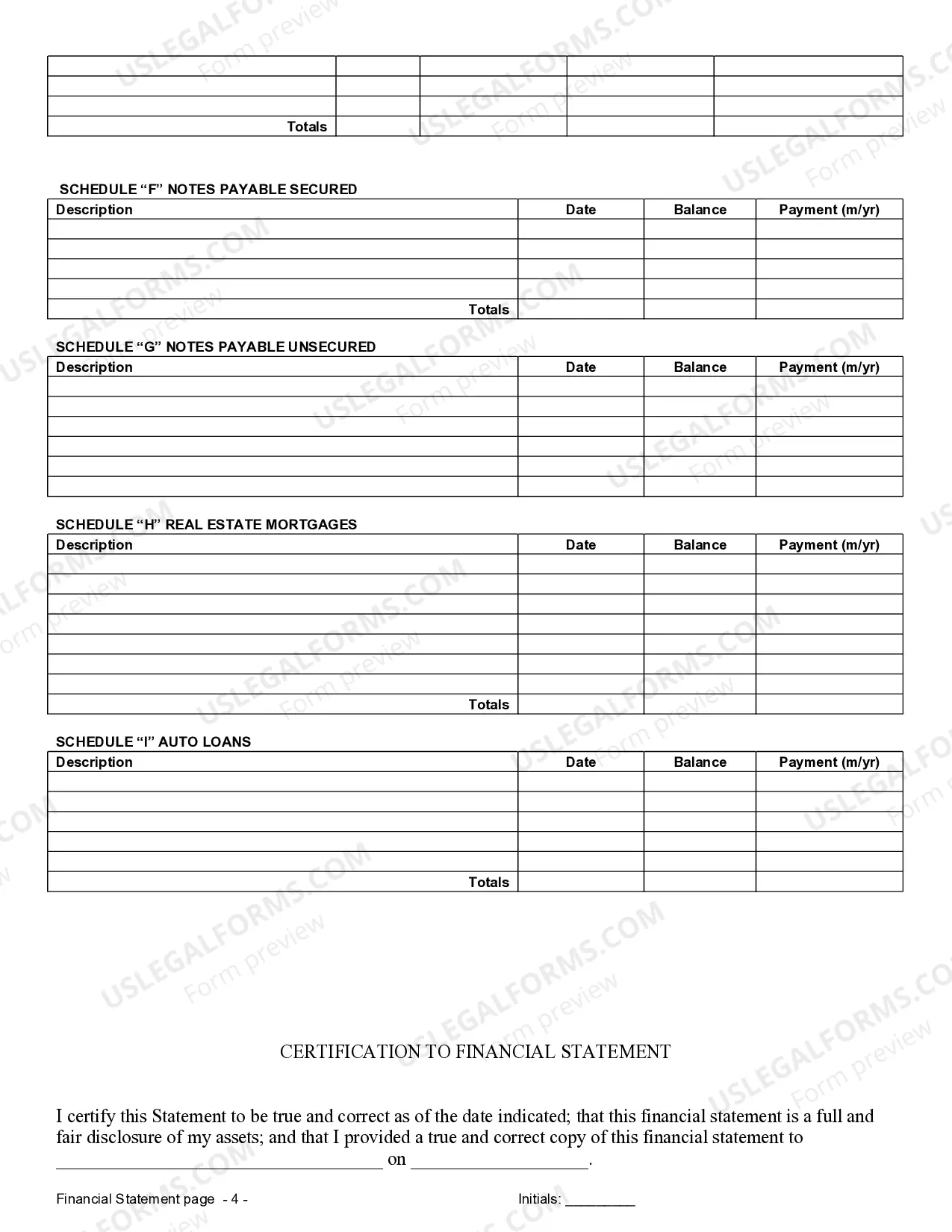

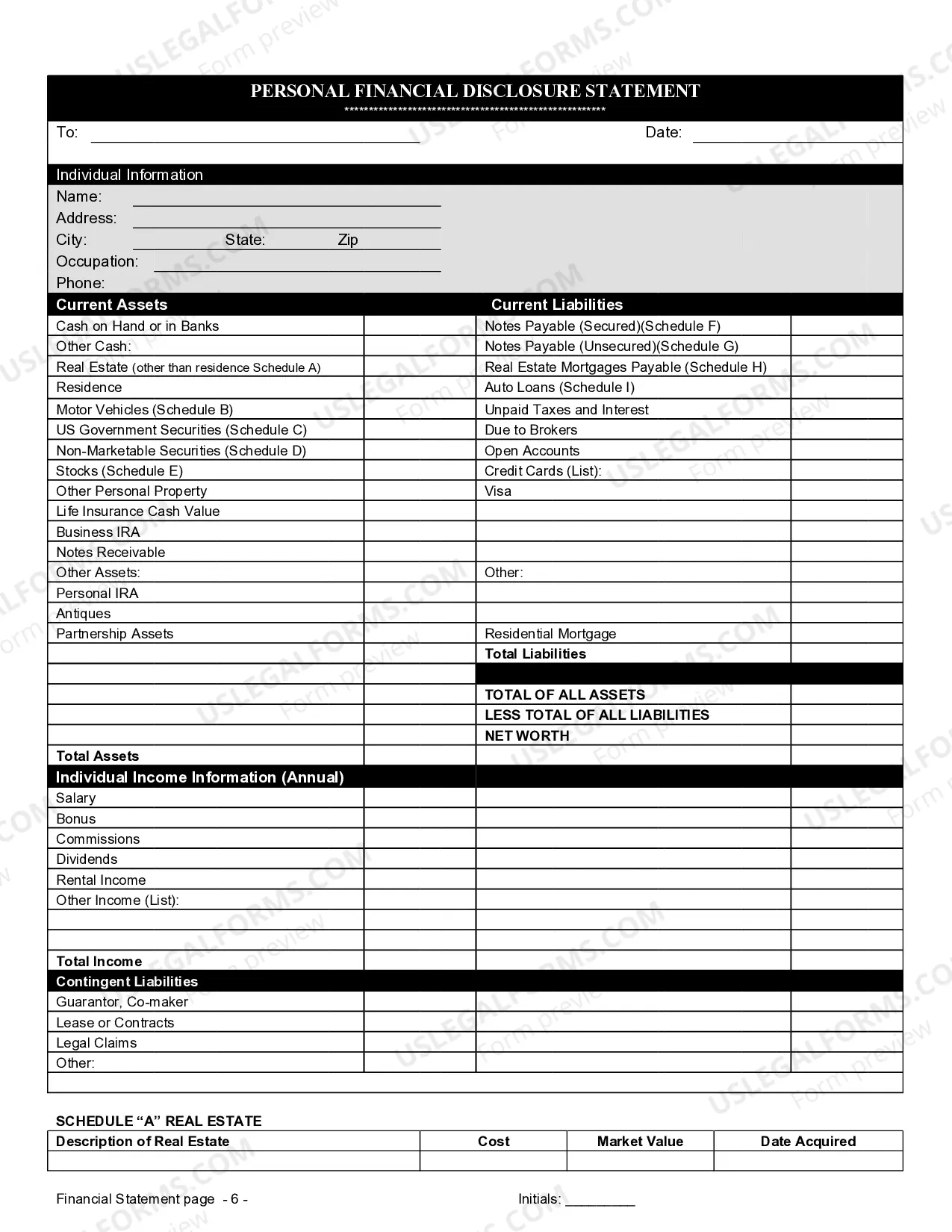

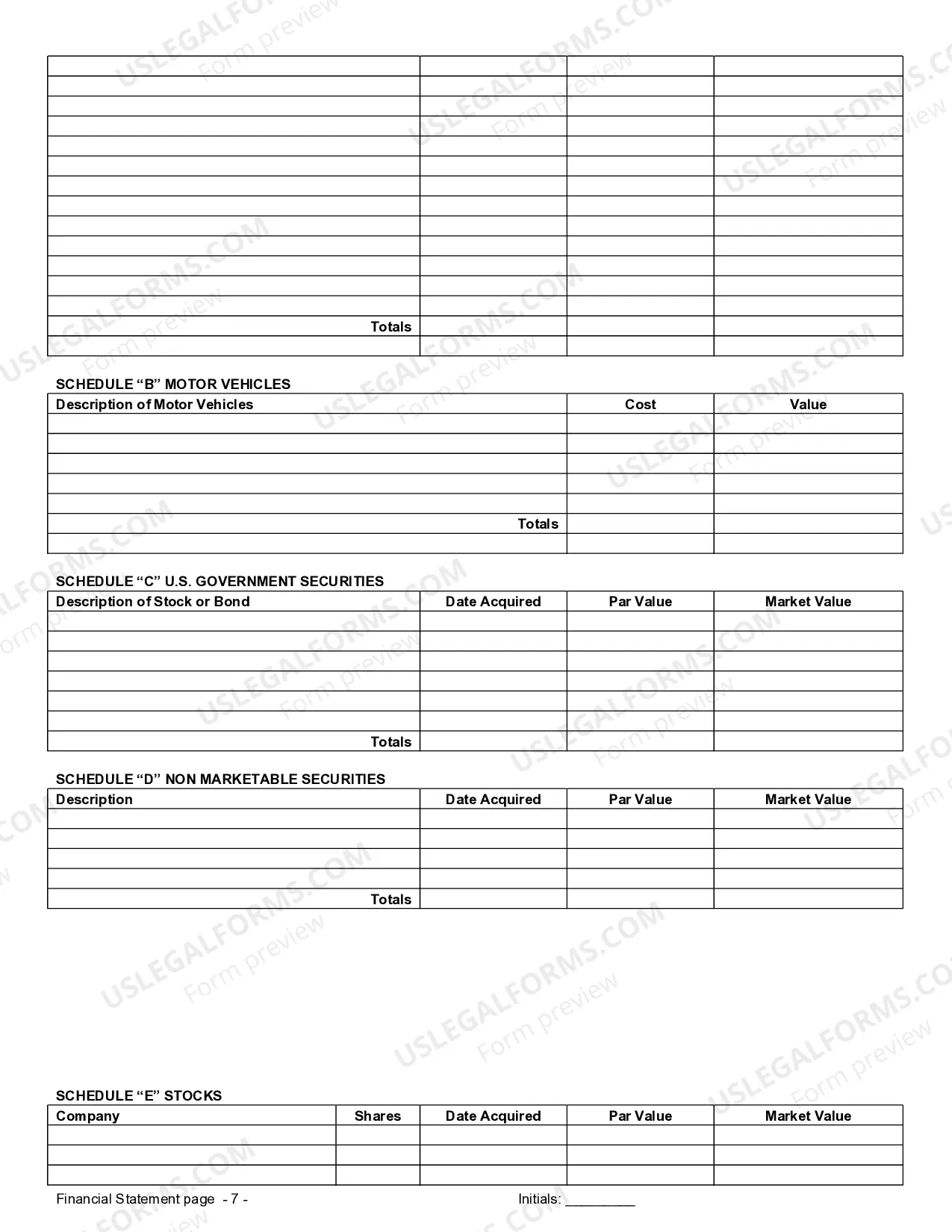

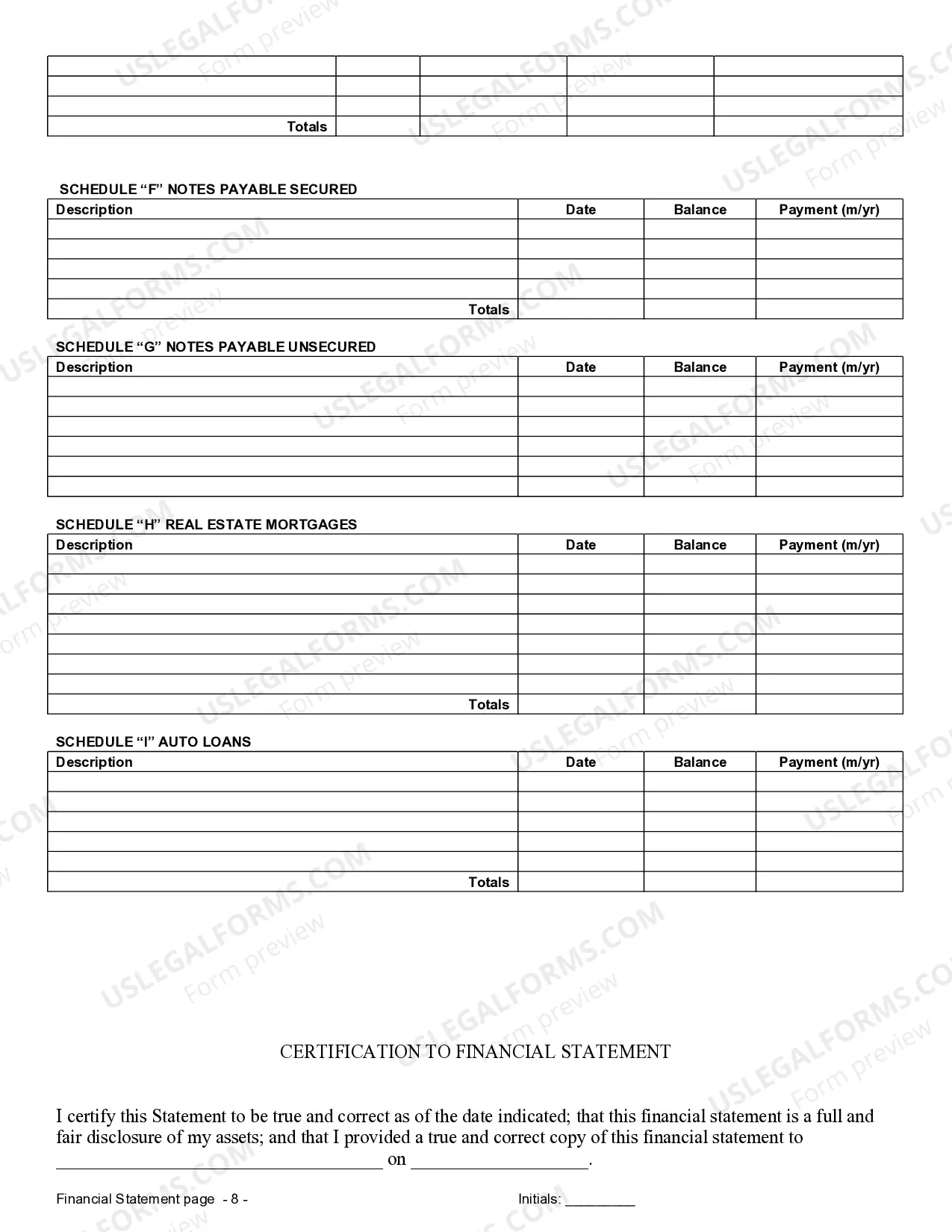

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Wyoming Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Wyoming Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Out of the multitude of platforms that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates prior to buying them. Its extensive library of 85,000 samples is grouped by state and use for efficiency. All the forms available on the platform have been drafted to meet individual state requirements by qualified legal professionals.

If you have a US Legal Forms subscription, just log in, search for the form, hit Download and obtain access to your Form name from the My Forms; the My Forms tab holds all of your saved documents.

Follow the guidelines listed below to obtain the form:

- Once you see a Form name, make sure it’s the one for the state you really need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Search for a new sample through the Search engine if the one you’ve already found isn’t appropriate.

- Click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

After you’ve downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor that you pick. Any document you add to your My Forms tab can be reused many times, or for as long as it remains to be the most updated version in your state. Our service provides fast and easy access to samples that suit both attorneys and their clients.

Form popularity

FAQ

Pitfall 1: Negotiating a prenuptial agreement may irrevocably damage your relationship and make divorce more likely.Generally speaking, both fiance's should hire attorneys to negotiate and draft a prenup on their own behalf, because the agreement may not be enforceable without involvement of separate legal counsel.

Omitting an asset, even if just by accident, can void the entire agreement. The prenup loophole is that, should the agreement come into a court setting, the only thing one side has to do is find a legitimate asset that was excluded when the agreement was executed. As the law goes, ignorance is no excuse.

One formality that many do not realize the importance of is a full and fair disclosure of assets and debts prior to the prenuptial agreement being signed. In other words, both parties are supposed to disclosure all the assets and debts that they are bringing into the marriage.

A prenup can also be overturned if one or both parties change their mind after initially signing the agreement. They may decide at that time to sign a new agreement suspending the prenup.

The three most common grounds for nullifying a prenup are unconscionability, failure to disclose, or duress and coercion.Duress and coercion can also invalidate a prenup. If the prenup was signed the day before your wedding, it may appear that the parties didn't have much time to fully review the agreement.

Spousal abuse or cheating does not void or invalidate a prenuptial or partition agreement unless the agreement specifically states that.A custom marital agreement can include an infidelity clause, but the ramifications should be carefully considered.

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.

Just as a future asset can be protected by a prenup if adequately described, future income can also be treated as belonging to one partner but not both.