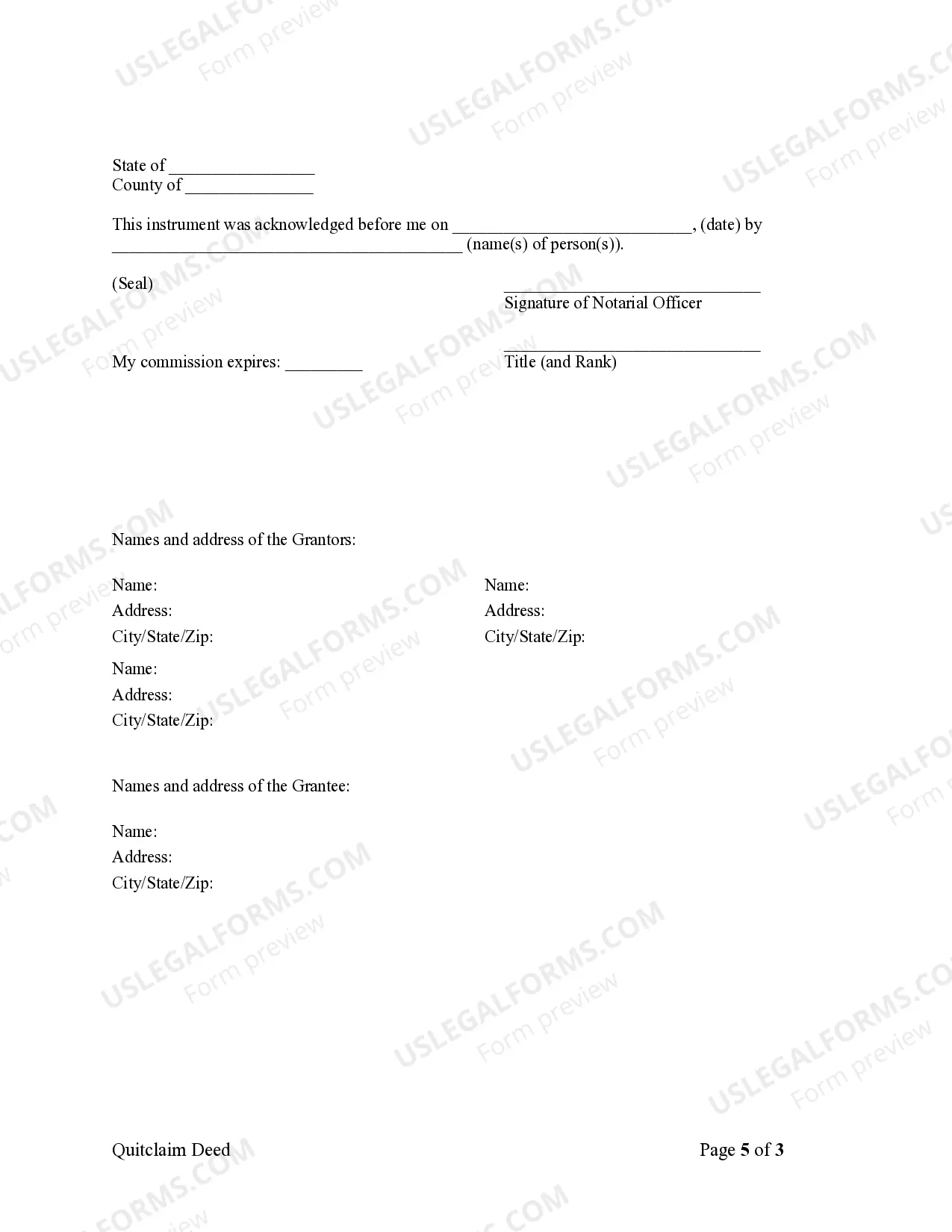

This form is a Quitclaim Deed where the grantors are three individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Wyoming Quitclaim Deed - Three Individuals to One Individual

Description

How to fill out Wyoming Quitclaim Deed - Three Individuals To One Individual?

Out of the multitude of services that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before purchasing them. Its extensive library of 85,000 samples is grouped by state and use for efficiency. All the forms available on the platform have been drafted to meet individual state requirements by certified lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, click Download and obtain access to your Form name from the My Forms; the My Forms tab keeps all of your downloaded documents.

Stick to the guidelines below to obtain the form:

- Once you find a Form name, make sure it is the one for the state you need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Search for a new sample via the Search engine in case the one you have already found is not proper.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

After you have downloaded your Form name, you may edit it, fill it out and sign it with an web-based editor of your choice. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most updated version in your state. Our platform offers easy and fast access to templates that suit both legal professionals and their clients.

Form popularity

FAQ

The law doesn't forbid adding people to a deed on a home with an outstanding mortgage. Mortgage lenders are familiar and frequently work with deed changes and transfers.When you "deed" your home to someone, you've effectively transferred part ownership, which could activate the "due-on-sale" clause.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Six people can be on title. It can cause a lot of problems when it comes time to sell though. If even one of the six won't sign, you have a problem. They can sign at different times and from different locations depending on the closing attorney or escrow company.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.