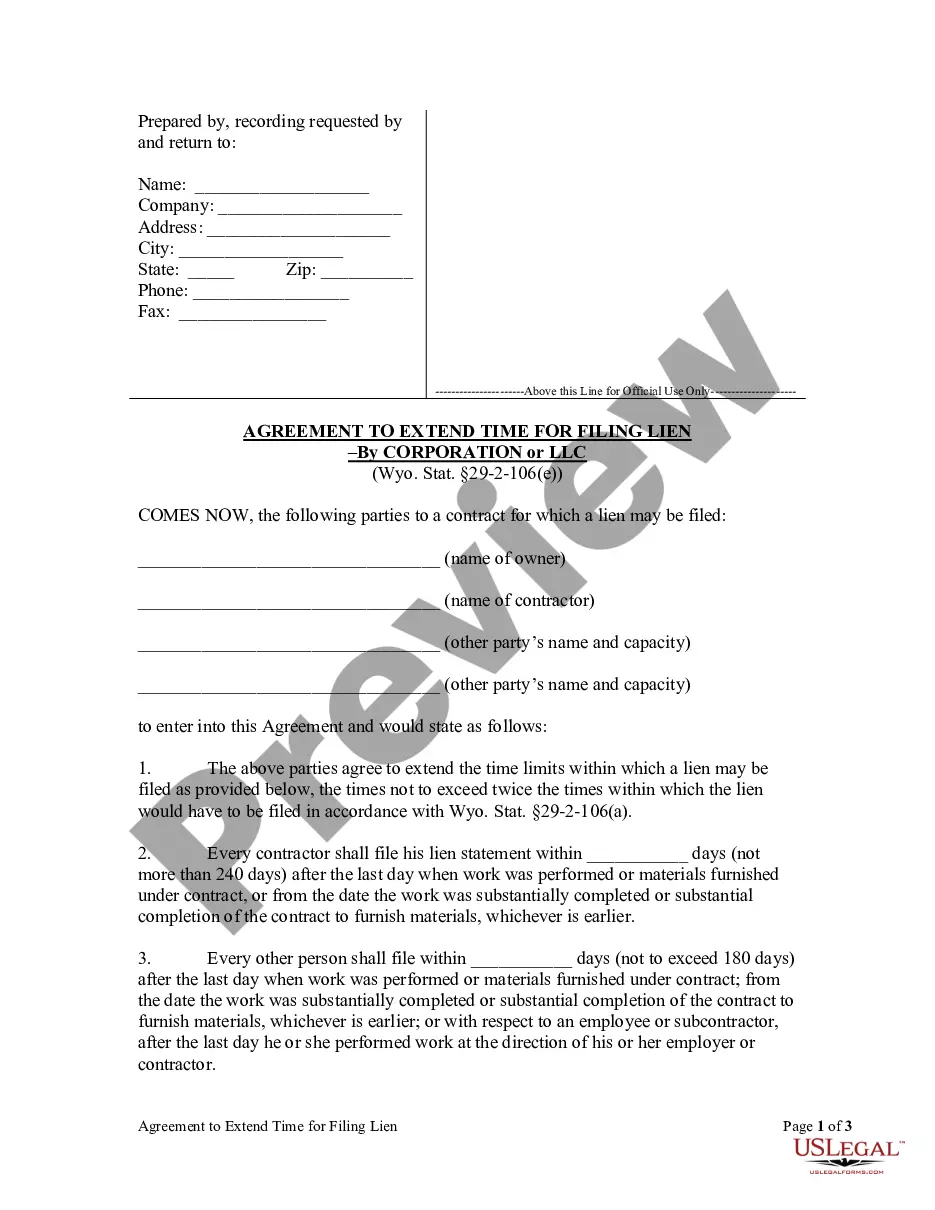

This Agreement to Extend Time For Filing Lien is for use by corporate parties to a contract for which a lien may be filed to agree to extend the time limits within which a lien may be filed, the times not to exceed twice the times within which the lien would have to be filed in accordance with Wyo. Stat. §29-2-106(a).

Wyoming Agreement to Extend Time For Filing Lien - Corporation

Description

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Corporation?

Out of the large number of services that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before purchasing them. Its complete catalogue of 85,000 templates is categorized by state and use for simplicity. All the forms available on the platform have already been drafted to meet individual state requirements by accredited lawyers.

If you have a US Legal Forms subscription, just log in, look for the form, click Download and gain access to your Form name in the My Forms; the My Forms tab holds all of your downloaded documents.

Follow the guidelines listed below to obtain the form:

- Once you find a Form name, make sure it’s the one for the state you really need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Search for a new sample through the Search field if the one you’ve already found is not appropriate.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

After you’ve downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor of your choice. Any document you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service offers easy and fast access to samples that suit both lawyers as well as their clients.

Form popularity

FAQ

First, the tax climate in the state is incredibly business-friendly. Wyoming does not have a corporate income tax, nor does it have an individual income tax or gross receipts tax.Of all fifty States, Wyoming has one of the best records of business survival.

Many companies incorporate in Wyoming because the administrative costs are generally lower than in Delaware or Nevada.Wyoming also has personal asset protection laws in place to protect business owners and company officers from losing assets like cars and houses in the event of litigation.

File A Lien Preliminary Notice to owner and prime contractor of right to file lien required within 30 days after first providing labor or materials. Notice of Intent to lien required 20 days prior to filing lien. Lien must be filed w/in 120 days from last delivering labor or materials.

Has 2 LLC filings to maintain (a Domestic Wyoming LLC and a Foreign California LLC) has 2 state filing fees. has to meet annual requirements and fees in both states. may have increased Registered Agent fees.

Incorporating your business is one of the best ways you can protect your personal assets. A corporation can own property, carry on business, incur liabilities, and sue or be sued.In effect, that means business owners can conduct business without risking their homes, cars, savings, or other personal property.

Expired mechanic's liens will not disappear from the clerk. It must be cancelled by the contractor or subcontractor when it's paid. Even if the contractor simply decides not to pursue the lien claim, it must be cancelled in order to release the lien on the property.

In Alberta, for example, your lien is valid for 180 days from the date the lien was placed. In Ontario, liens are only valid for 90 days from the date of last on site working.

No state taxes. Asset protection and limited liability. Members nor Managers are not listed with the state. Best asset protection laws. No citizenship requirements. Perpetual life. Transferability of ownership. Ability to build credit & raise capital.

The Close LLC is designed with small businesses in mind. The Wyoming LLC Act allows close companies to sidestep onerous formalities while otherwise keeping the benefits of a Wyoming LLC. Generally, the designation is for single-member LLCs and for when members are close to one another, i.e. family and close friends.