The Wyoming Notice of Filing of Final Report of Trustee is a document that must be filed with the Wyoming Secretary of State when a trust has been terminated and its assets have been distributed. The Notice includes the name of the trust, the Trustee's name, the date of filing, the date of termination, the name and address of the Trustee, and a statement that a Final Report of Trustee has been filed with the court. There are two types of Wyoming Notice of Filing of Final Report of Trustee: (1) a Final Report of Trustee-Individual Trustee; and (2) a Final Report of Trustee-Corporate Trustee. Both types of notices must be signed by the Trustee and notarized before being filed with the Wyoming Secretary of State.

Wyoming Notice of Filing of Final Report of Trustee

Description

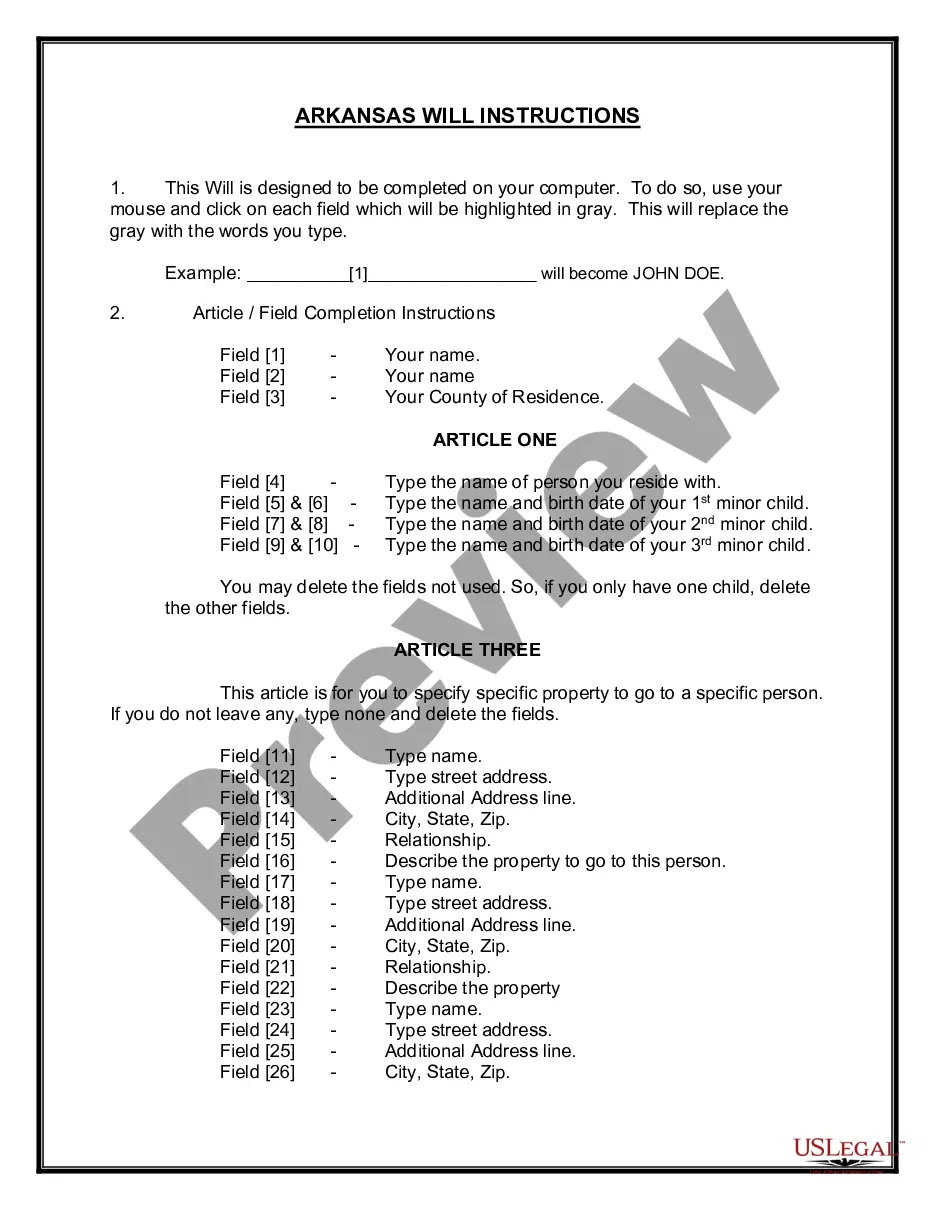

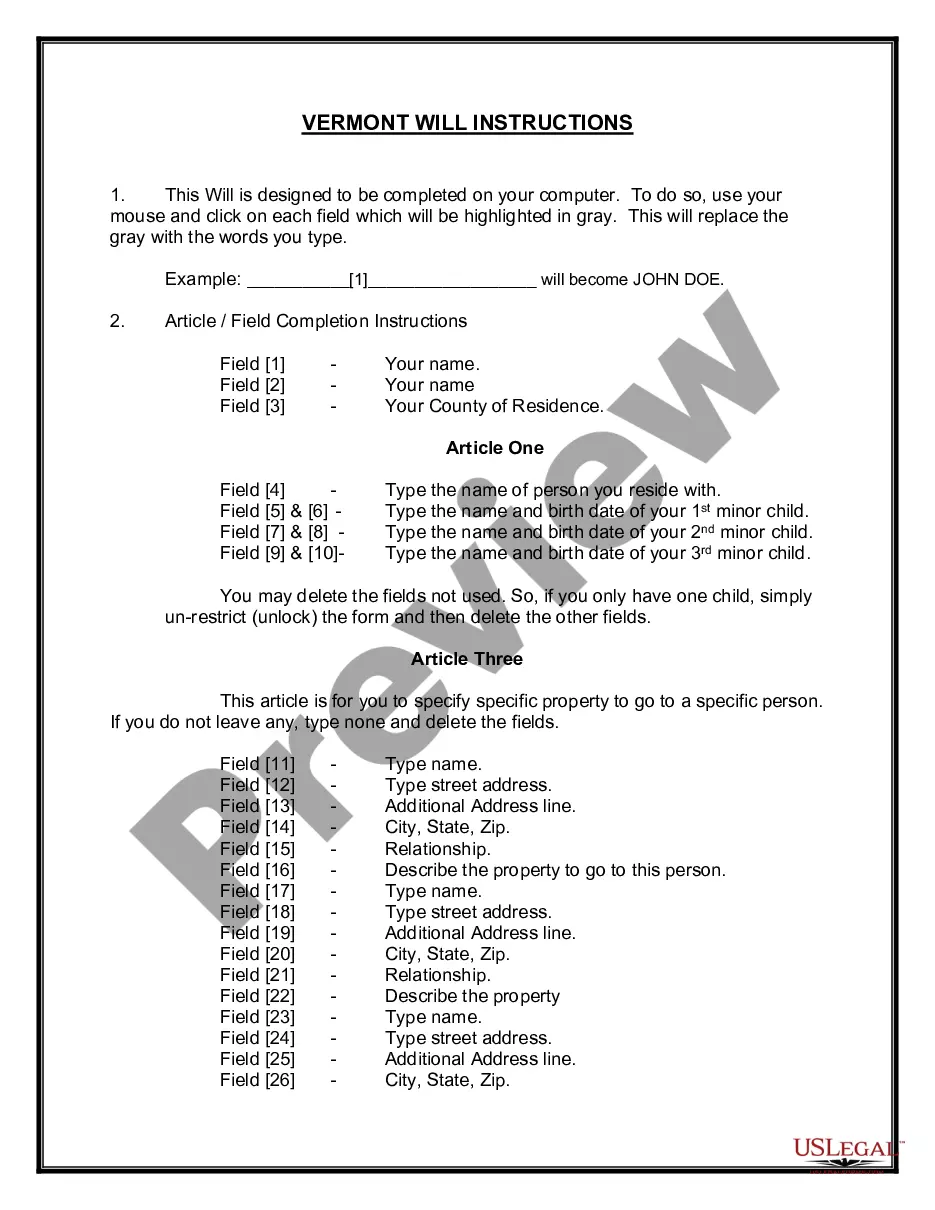

How to fill out Wyoming Notice Of Filing Of Final Report Of Trustee?

Handling official paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Wyoming Notice of Filing of Final Report of Trustee template from our library, you can be certain it complies with federal and state laws.

Dealing with our service is simple and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Wyoming Notice of Filing of Final Report of Trustee within minutes:

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Wyoming Notice of Filing of Final Report of Trustee in the format you need. If it’s your first time with our service, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Wyoming Notice of Filing of Final Report of Trustee you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

How much does an LLC in Wyoming cost per year? All Wyoming LLCs need to pay $60 per year for the Annual Report (aka Wyoming Annual License Tax). These Wyoming LLC fees are paid to the Secretary of State. And this is the only state-required annual fee.

Business Center Annual Report License TaxConvenience Fee$25 to $100$2.00$101 to $250$5.00$251 to $500$8.95If your Annual Report fee is greater than $500, E-Filing is not permitted.

All Wyoming corporations, nonprofits, LLCs, and LPs need to file a Wyoming Annual Report each year. These reports must be submitted to the Wyoming Secretary of State, Business Division.

To create your living trust in Wyoming, prepare a written trust document and then sign it in front of a notary. For the trust to be effective, you must next transfer ownership of assets into it. A living trust may be a good solution for your estate plan. Weigh its benefits and limitations when making a decision.

CHAPTER 3 - FUGITIVES AND PREVENTION OF CRIME. 7-3-702. Prohibition against interception or disclosure of wire, oral or electronic communications; exceptions; penalties. (B) Such device transmits communications by radio or interferes with the transmission of such communication.

Registered Limited Liability Partnerships: Annual Report License tax is $60 or two-tenths of one mill on the dollar ($. 0002) whichever is greater based on the company's assets located and employed in the state of Wyoming.

Trust advisor. (v) To direct, consent or disapprove a trustee's or cotrustee's action or inaction in making distributions to beneficiaries. Disclaimer: These codes may not be the most recent version.

Wyoming does not add a delinquent penalty, but the Secretary of State will send you a delinquency notice. You have 60 days from the date on the notice to submit the annual report and pay all taxes and fees. There's also a $50 reinstatement fee.