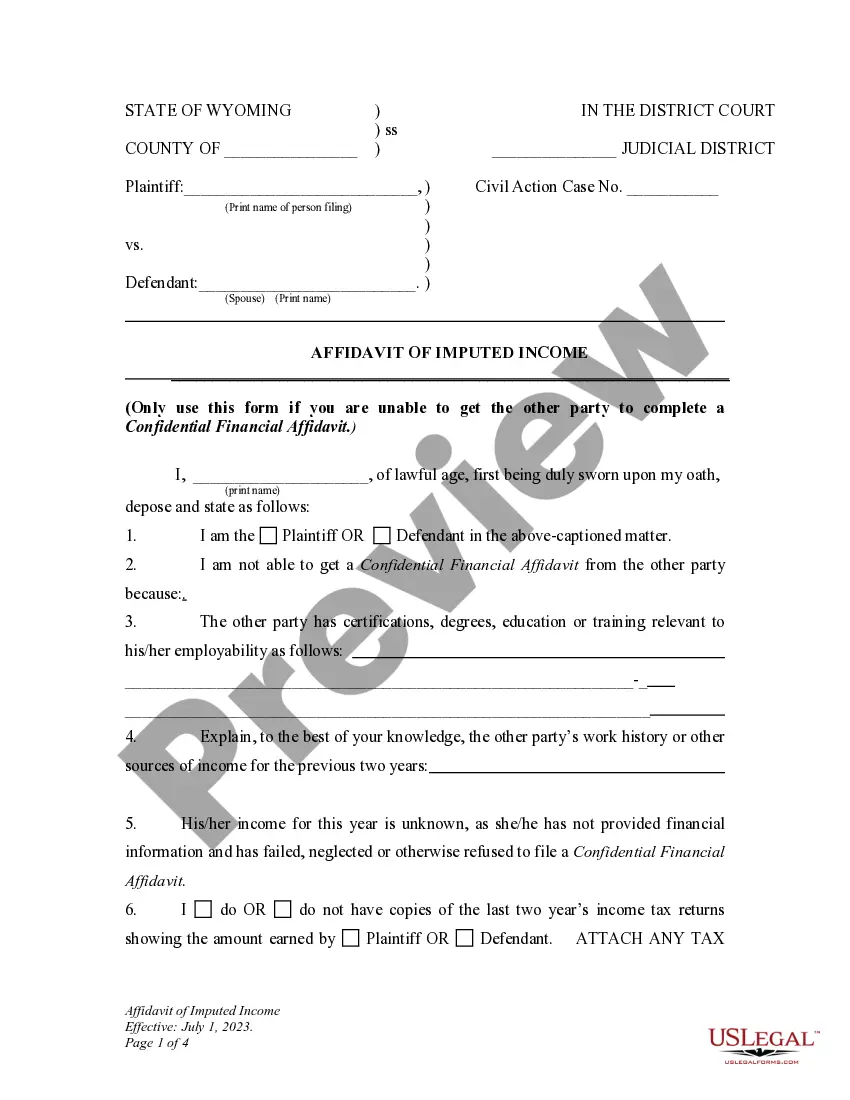

The Wyoming CAMP 10. Affidavit of Imputed Income is a legal document used in the state of Wyoming to prove that a party has sufficient funds to pay for a child support obligation. The affidavit is typically signed by the party responsible for paying for the child support obligation and is used to provide evidence of the party's ability to pay. The affidavit is typically filed with the court, along with other evidence of income, to prove the party's financial resources. There are two types of Wyoming CAMP 10. Affidavit of Imputed Income: the sole affidavit and the joint affidavit. The sole affidavit is used when only one party is responsible for the child support obligation and the joint affidavit is used when both parties are responsible for the child support obligation. The affidavit includes information such as the party's income, assets, expenses, and other financial information. The affidavit must be signed by both parties, if applicable, and notarized.

Wyoming CCMP 10. Affidavit of Imputed Income

Description

How to fill out Wyoming CCMP 10. Affidavit Of Imputed Income?

If you’re searching for a way to properly prepare the Wyoming CCMP 10. Affidavit of Imputed Income without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business situation. Every piece of paperwork you find on our web service is designed in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Wyoming CCMP 10. Affidavit of Imputed Income:

- Ensure the document you see on the page corresponds with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Wyoming CCMP 10. Affidavit of Imputed Income and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Ing to the guidelines, for two kids, you must pay between 20% to 36.8% of your net income, plus an additional percentage of any income above a certain baseline amount. The baseline for our example net income of $2,500) is $2,083. The percentage of child support due on $2,083 is 35%.

The House Judiciary Committee advanced a bill on Monday that adjusts the states child support payment formula for the first time in nearly 10 years and would raise payments by roughly 12%. A legislative committee has advanced a proposal that would raise recommended child support payments in Wyoming by about 12%.

To change a custody or visitation order that is already in place, you need to file a petition to modify the order (which you can find on the Wyoming Courts website). A petition to modify would generally not be filed right away after the judge issues the custody order.

Imputed income means a judge believes a spouse is not meeting their full earning potential. A court will recognize a spouse who purposefully takes a part-time job compared to a full-time job to receive more child support from the other parent.

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

An Answer to Complaint for Divorce is a written document explaining to the court exactly which provisions you agree with and which provisions you deny. If you fail to answer, a default judgment may be entered against you and your spouse may be entitled the relief he or she asked for in the Complaint for Divorce.

In state-by-state rankings, Massachusetts ranks highest with the most expensive child support payments, averaging $1,187 per month. Virginia mandates the least support at $402 per month.

To calculate it by long hand, take the Combined Parental Income (but only up to $141,000) and multiply it by the applicable Child Support Percentages (1 child in the care of the custodial parent: 17%, 2 children: 25%, 3 children: 29%, 4 children: 31%, 5 or more children: 35% or more).