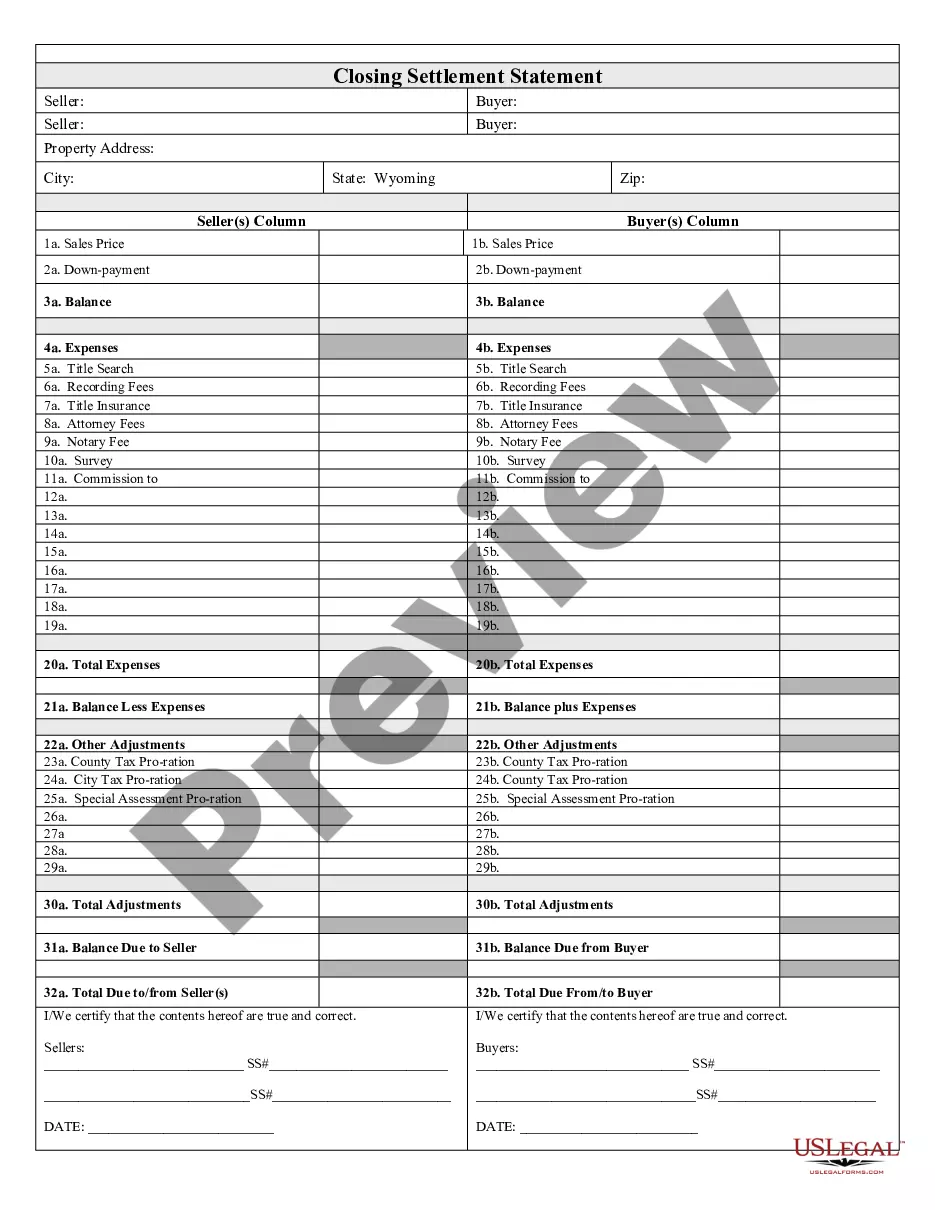

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Wyoming Closing Statement

Description

How to fill out Wyoming Closing Statement?

Use US Legal Forms to get a printable Wyoming Closing Statement. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the web and offers reasonably priced and accurate samples for customers and lawyers, and SMBs. The documents are categorized into state-based categories and many of them can be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to easily find and download Wyoming Closing Statement:

- Check to make sure you have the right form in relation to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Wyoming Closing Statement. Above three million users have already utilized our platform successfully. Choose your subscription plan and obtain high-quality forms in just a few clicks.

Form popularity

FAQ

To receive a certificate of good standing, contact the Wyoming Secretary of State's office. Wyoming offers options to complete the process online or by mail. The process is free if done online at the Secretary of State website. By mail, the processing fee is $10.

A formal dissolution requires submitting Articles of Dissolution and a $50 check to the Wyoming Secretary of State. Once received, there is a 3-5 day processing time before the documents are filed online and the company is formally closed.

Most business entities file their annual reports online at the Wyoming Secretary of State website. All you need is your SOS filing ID. If you don't remember your ID or you don't have it, look it up. If you'd prefer, you can also print out your Wyoming report from the SOS website and send it by mail.

Hold a board of directors meeting and formally move to dissolve your corporation. Fill out and file the Articles of Dissolution with the Wyoming Secretary of State. Fulfill all tax obligations with the state of Wyoming, as well as with the IRS.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.

In order to start the divorce process, you'll need to complete some forms. You can obtain the forms you'll need online through the Wyoming Judicial Branch's Self-Help Section. The forms and instructions are not a substitute for legal advice. If you decide to proceed "pro se," you'll be representing yourself.

You'll need to formally close your LLC or Corporation. Otherwise, you can still be on the hook for filing your inactive business' annual reports, filing state/federal tax returns, and keeping up any business licenses.

Most business entities file their annual reports online at the Wyoming Secretary of State website. All you need is your SOS filing ID. If you don't remember your ID or you don't have it, look it up. If you'd prefer, you can also print out your Wyoming report from the SOS website and send it by mail.