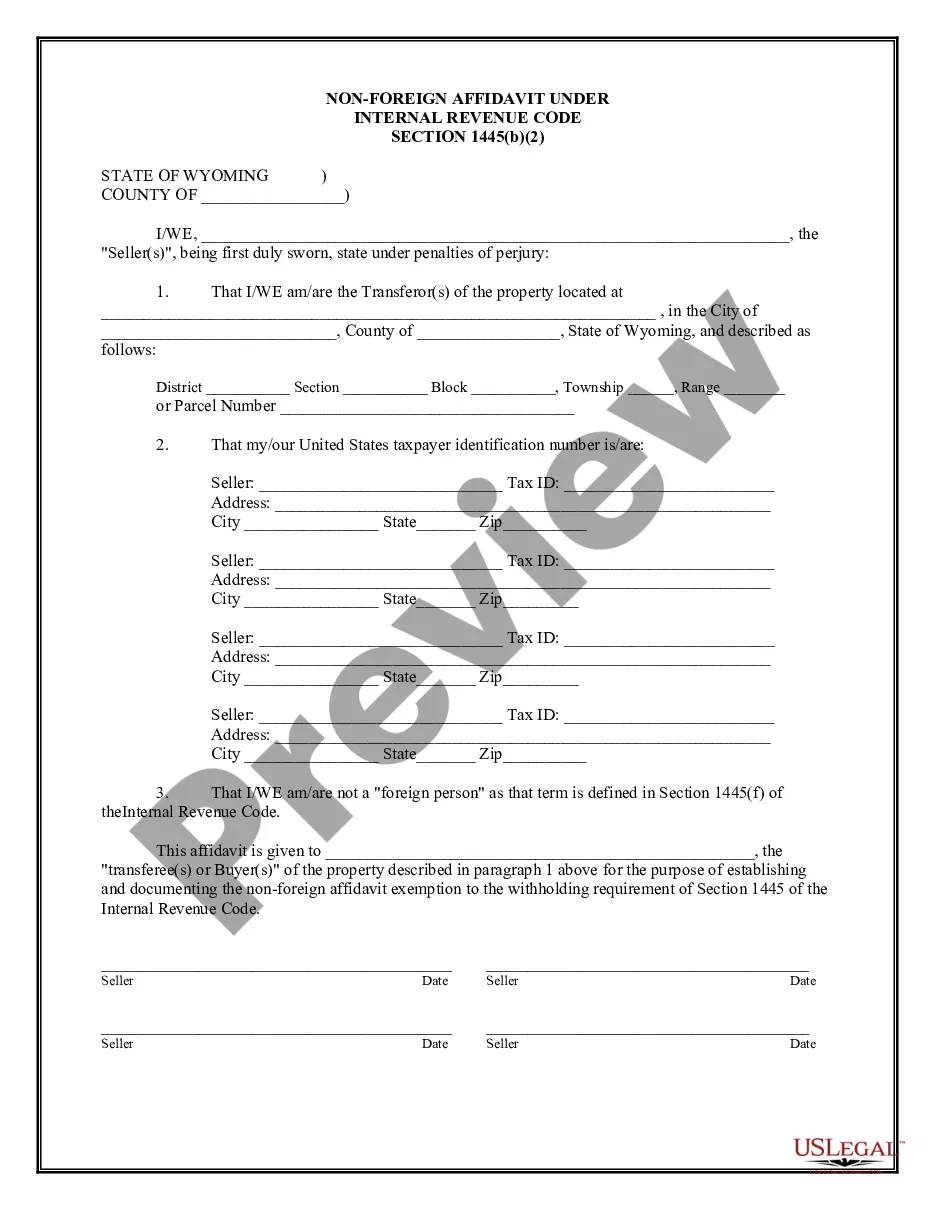

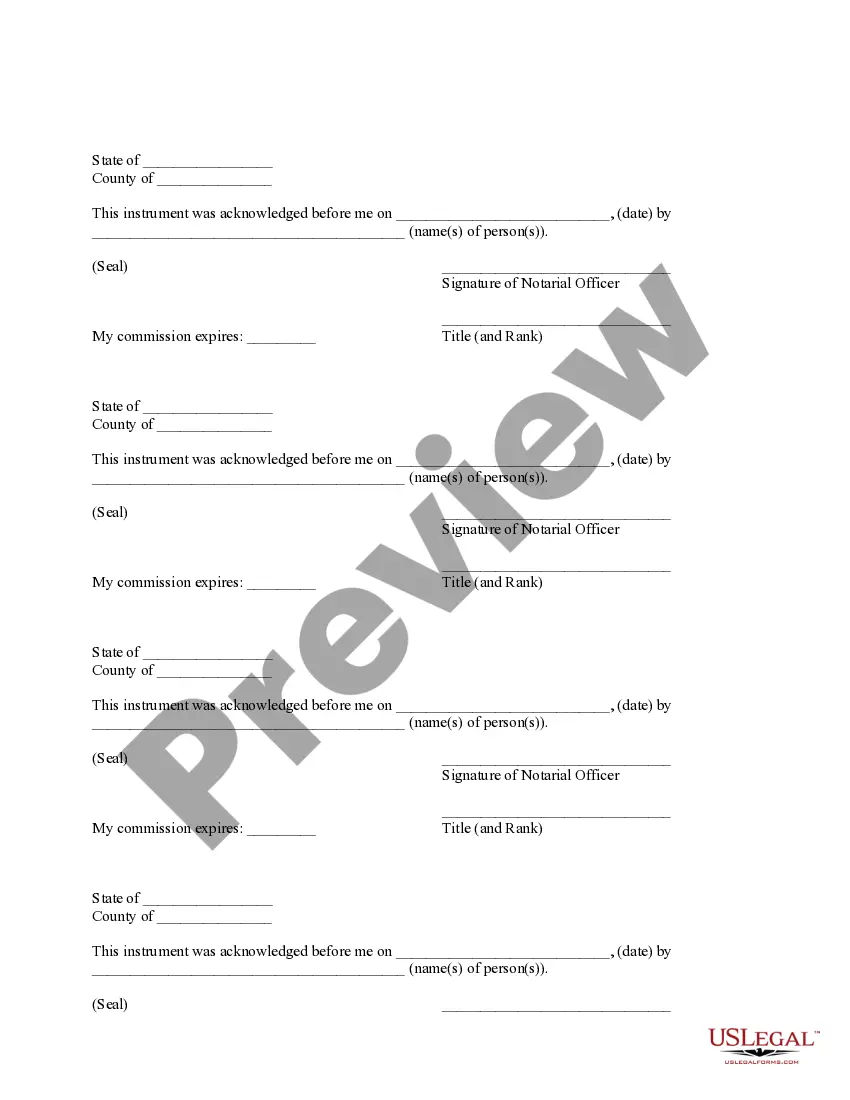

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Wyoming Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Wyoming Non-Foreign Affidavit Under IRC 1445?

Use US Legal Forms to get a printable Wyoming Non-Foreign Affidavit Under IRC 1445. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms library on the internet and offers cost-effective and accurate templates for consumers and attorneys, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For those who do not have a subscription, follow the tips below to easily find and download Wyoming Non-Foreign Affidavit Under IRC 1445:

- Check to make sure you have the right template with regards to the state it’s needed in.

- Review the document by reading the description and using the Preview feature.

- Click Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search engine if you need to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Wyoming Non-Foreign Affidavit Under IRC 1445. Over three million users have already used our platform successfully. Select your subscription plan and have high-quality forms in just a few clicks.

Form popularity

FAQ

Foreign affidavit is an affidavit involving a matter of concern in one state but taken in another state or country before an officer of that state or country.

FIRPTA Certificate: Certification of Non-Foreign Status - FIRPTA is the Foreign Investment in Real Property Act and Form 8288. It was developed to ensure that foreign sellers of U.S. property be subject to U.S. tax on the sale.

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).