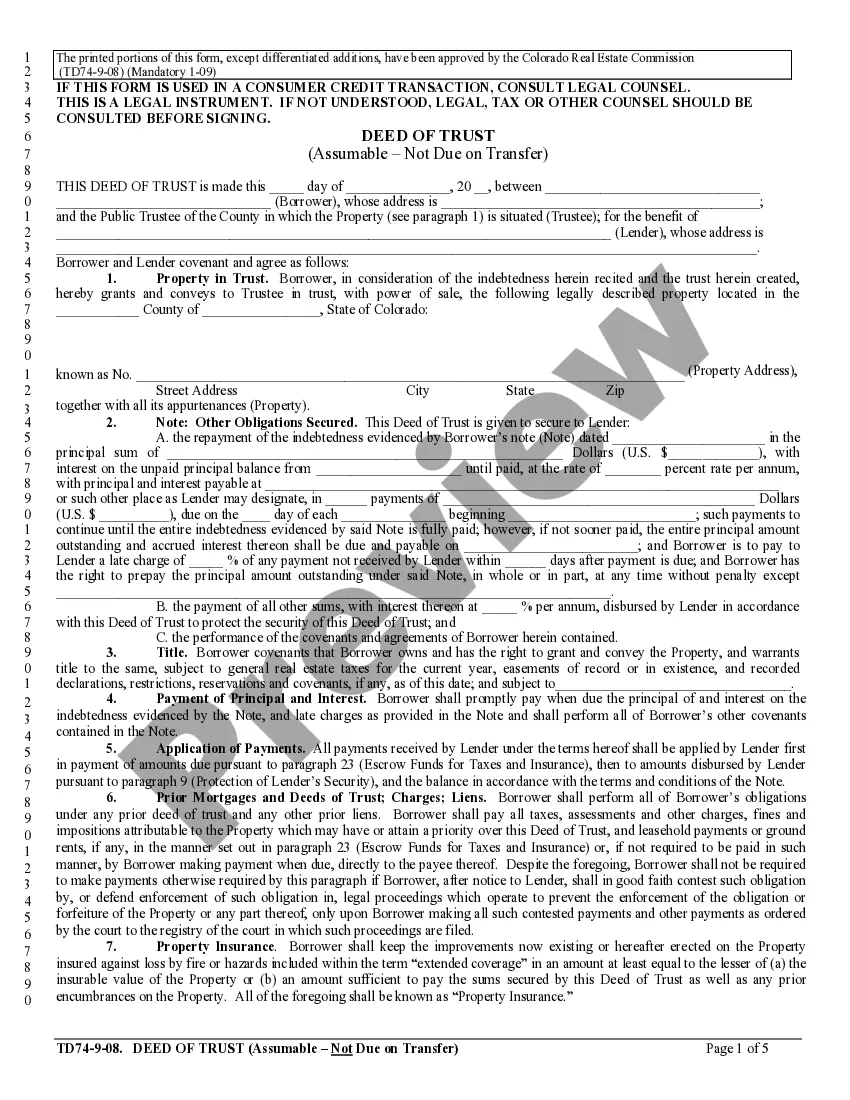

Wyoming CAMP 8. Initial Disclosures is a set of disclosure documents for mortgage lenders in Wyoming. These disclosures provide borrowers with important information about their loan, including the loan terms, estimated closing costs, and any potential risks associated with the loan. There are two types of Wyoming CAMP 8. Initial Disclosures: the Consumer Right to Know and the Mortgage Servicing Disclosure. The Consumer Right to Know includes information about the loan terms, fees, and rights, while the Mortgage Servicing Disclosure provides information about the service’s practices and responsibilities. Both documents are required to be provided to borrowers before closing on a loan.

Wyoming CAMP 8. Initial Disclosures is a set of disclosure documents for mortgage lenders in Wyoming. These disclosures provide borrowers with important information about their loan, including the loan terms, estimated closing costs, and any potential risks associated with the loan. There are two types of Wyoming CAMP 8. Initial Disclosures: the Consumer Right to Know and the Mortgage Servicing Disclosure. The Consumer Right to Know includes information about the loan terms, fees, and rights, while the Mortgage Servicing Disclosure provides information about the service’s practices and responsibilities. Both documents are required to be provided to borrowers before closing on a loan.