The dissolution of a corporation package contains all forms to dissolve a corporation in Wyoming, step by step instructions, addresses, transmittal letters, and other information.

Wyoming Dissolution Package to Dissolve Corporation

Description Dissolve A Wyoming Corporation

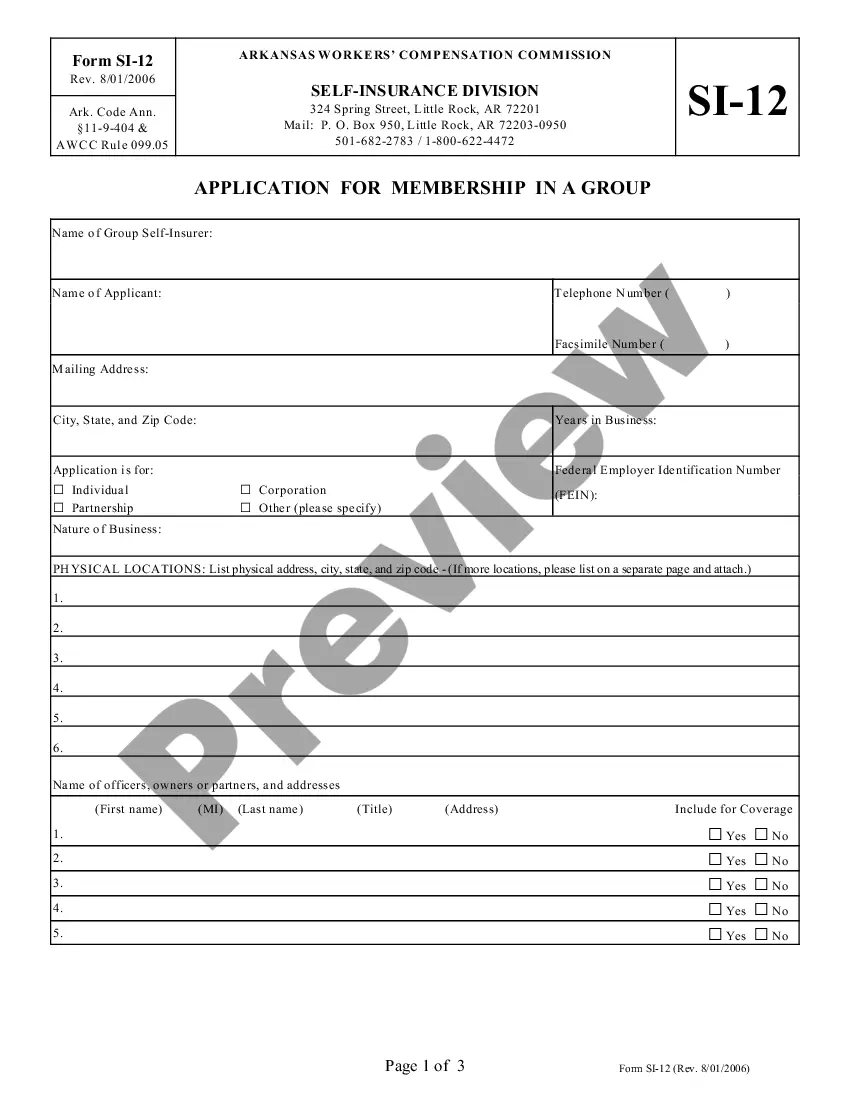

How to fill out Wyoming Dissolution Download?

Use US Legal Forms to obtain a printable Wyoming Dissolution Package to Dissolve Corporation. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue on the internet and provides reasonably priced and accurate samples for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and some of them might be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For people who do not have a subscription, follow the tips below to easily find and download Wyoming Dissolution Package to Dissolve Corporation:

- Check out to ensure that you have the correct form in relation to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Click Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Make use of the Search field if you need to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Wyoming Dissolution Package to Dissolve Corporation. Over three million users have already used our service successfully. Select your subscription plan and obtain high-quality documents within a few clicks.

How To Dissolve An Llc In Wyoming Form popularity

Wy Dissolution Blank Other Form Names

Wyoming Dissolve File FAQ

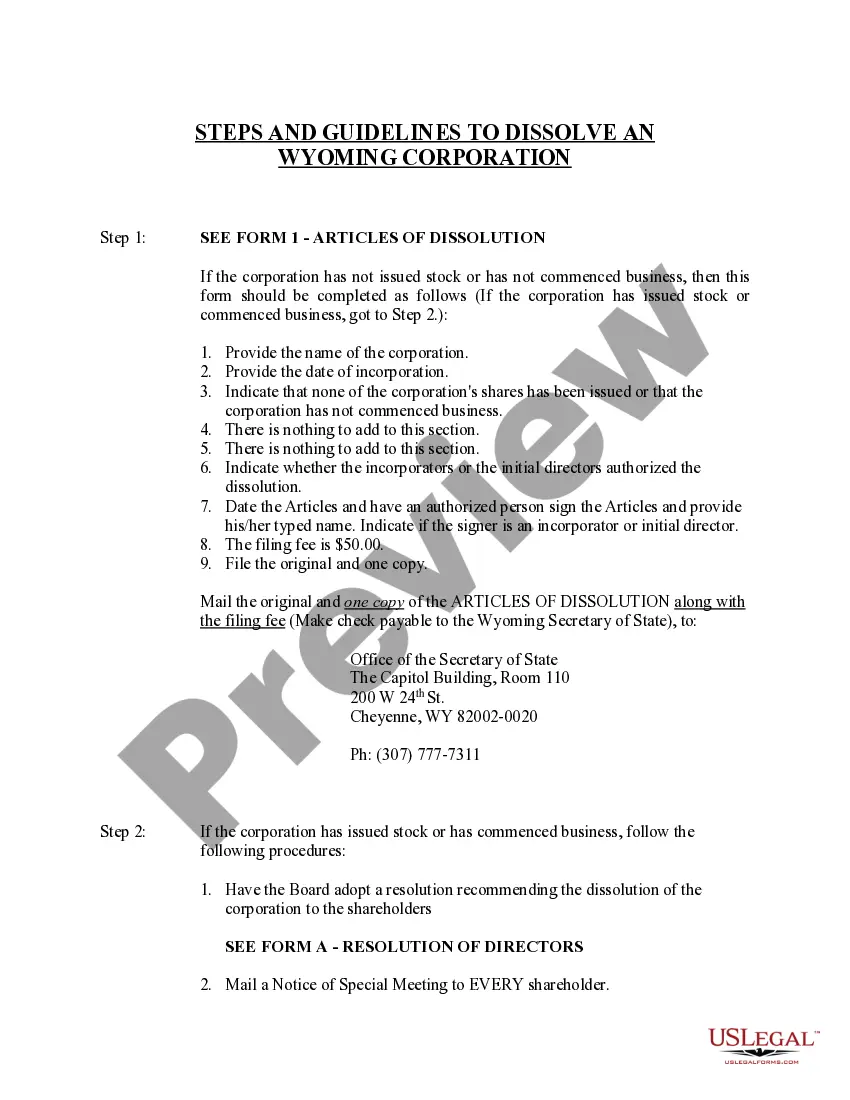

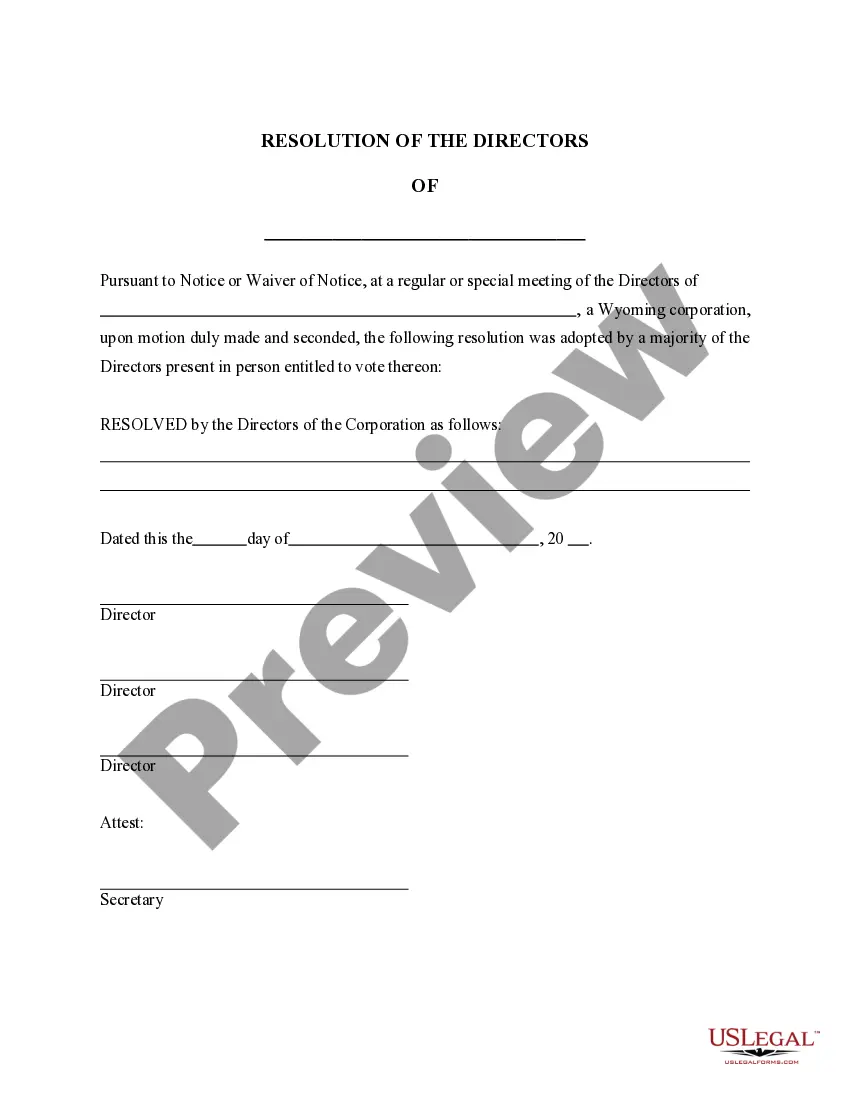

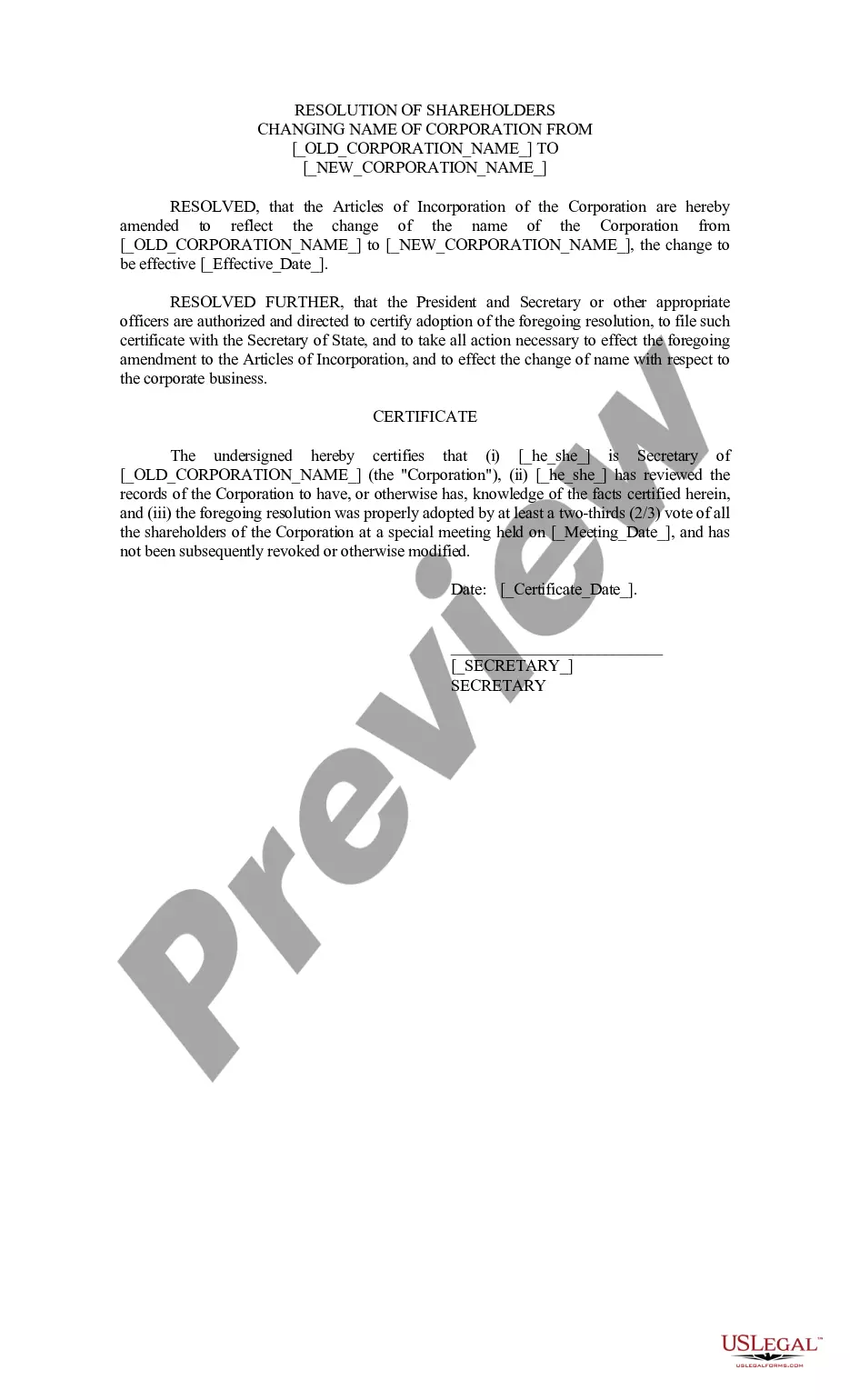

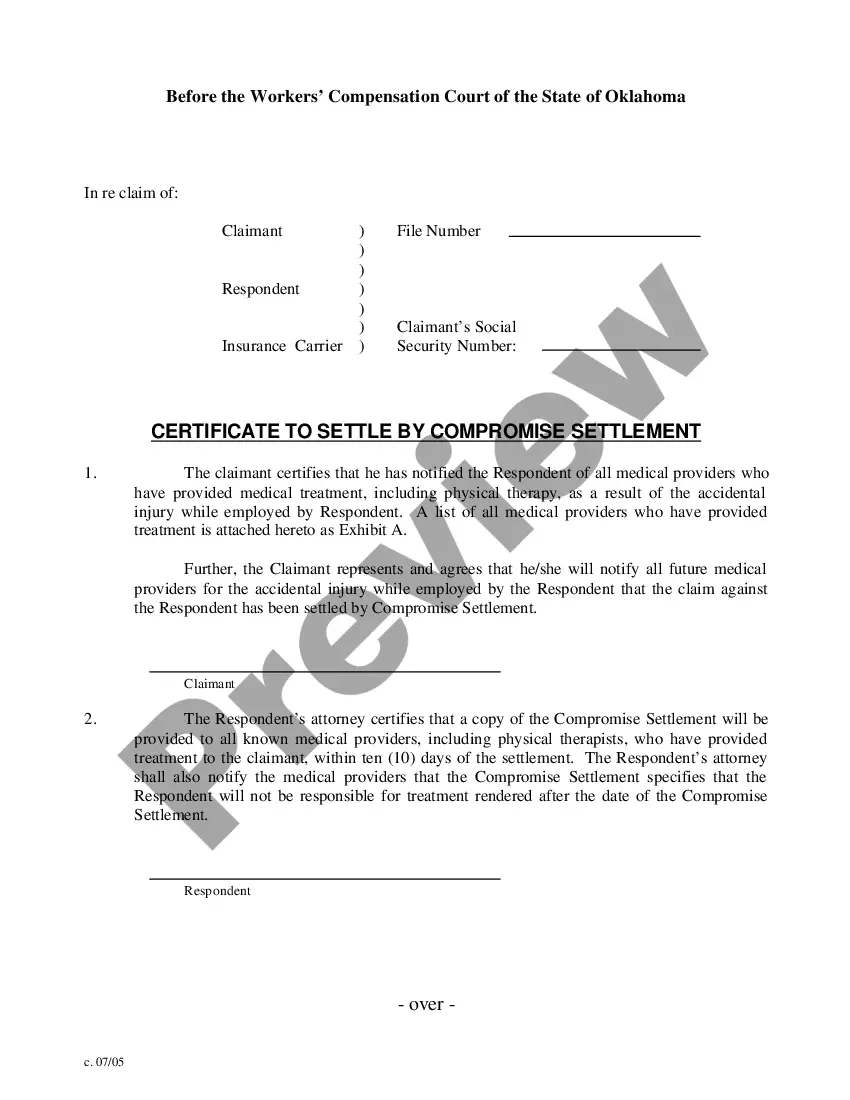

Hold a board of directors meeting and formally move to dissolve your corporation. Fill out and file the Articles of Dissolution with the Wyoming Secretary of State. Fulfill all tax obligations with the state of Wyoming, as well as with the IRS.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

In most states, to keep a corporation active, the owners must file annual reports and income tax returns. They may have to pay annual fees as well. Failure to do these things can render the corporation inactive. A corporation may also voluntarily become inactive by ceasing to do business.

After dissolution, you cannot use the funds remaining in your business bank account for new business. LLC members no longer have the authority to conduct business or do anything that would indicate that the LLC is still active. Your bank account can cover only essential winding up affairs.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

An inactive business is a business that still exists but has no activity, which means no business transactions during a specific year.Even if the business has no income, it may still be considered active for tax purposes. There are many reasons a business may become inactive.