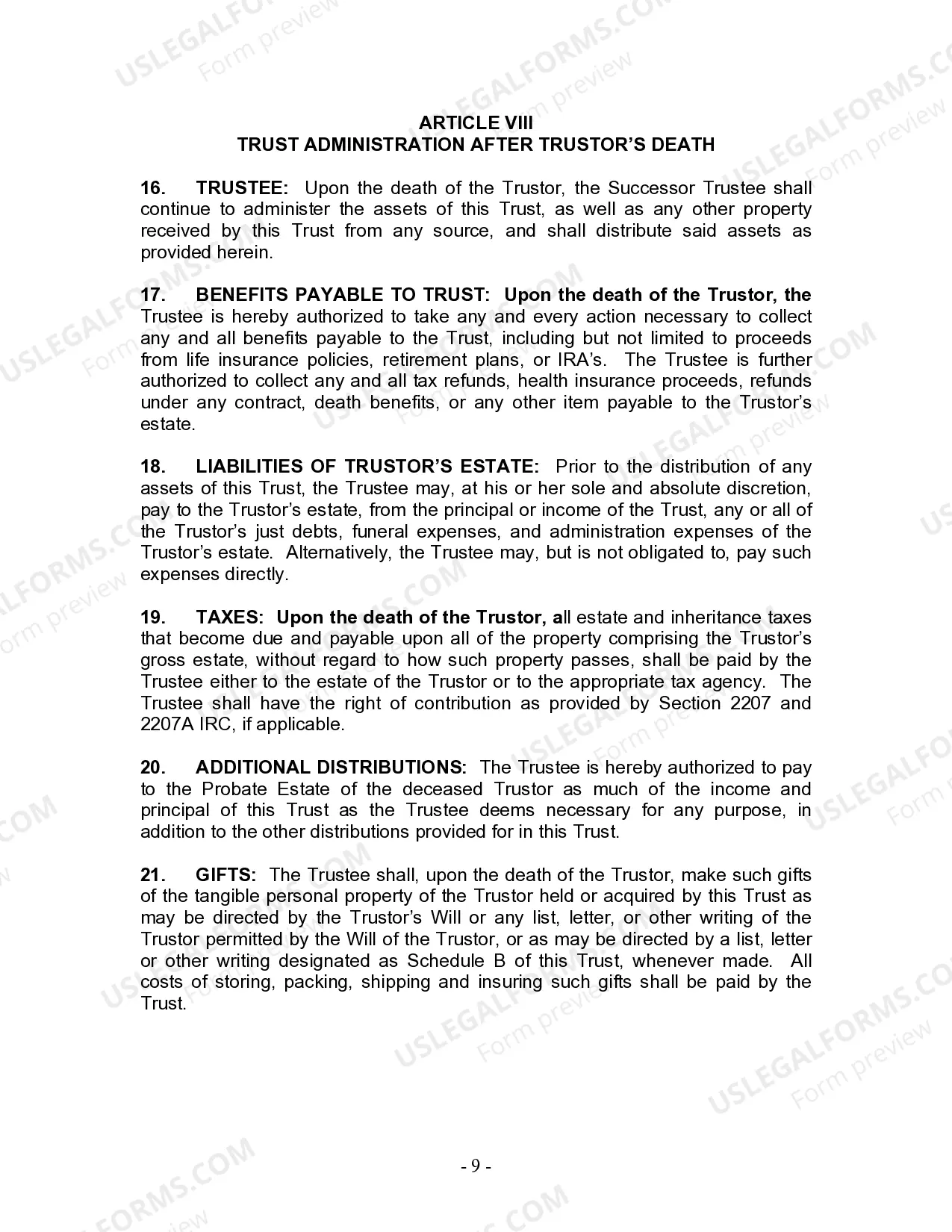

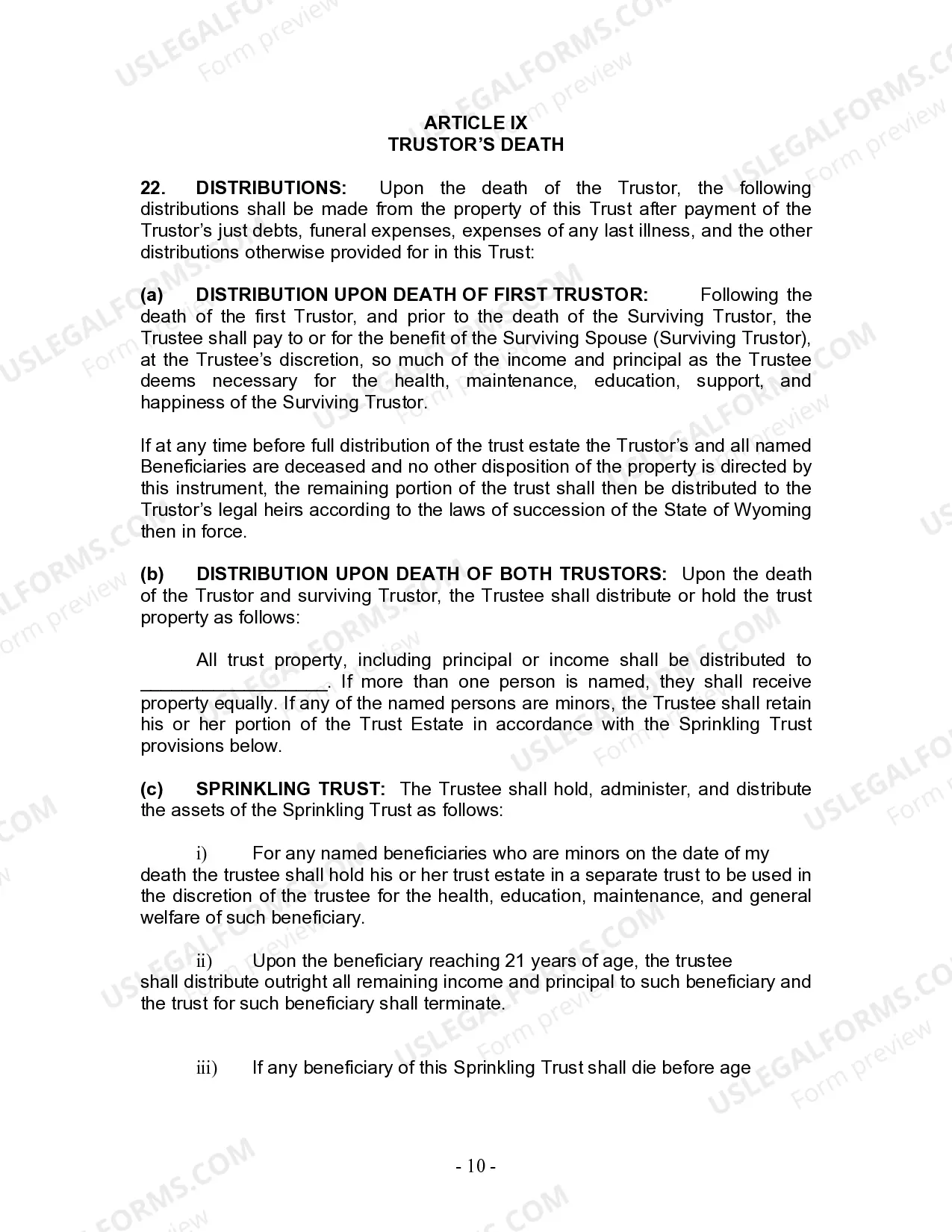

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Wyoming Living Trust for Husband and Wife with No Children

Description

How to fill out Wyoming Living Trust For Husband And Wife With No Children?

Use US Legal Forms to obtain a printable Wyoming Living Trust for Husband and Wife with No Children. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue on the internet and provides cost-effective and accurate templates for customers and attorneys, and SMBs. The documents are grouped into state-based categories and a number of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the tips below to quickly find and download Wyoming Living Trust for Husband and Wife with No Children:

- Check to make sure you get the proper form with regards to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search field if you need to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Wyoming Living Trust for Husband and Wife with No Children. Above three million users have already used our service successfully. Choose your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own. Find the Paperwork for Your Assets. Choose Beneficiaries. Choose a Successor Trustee. Choose a Guardian for Your Minor Children.

The UTC provides that a trust must meet the following requirements (UTC 402): 1) the settlor must have the capacity to create the trust; 2) the settlor must have the intent to create the trust 3) there must be at least one definite beneficiary; 4) there must be duties for the trustee to perform; and 5) the sole trustee

Here's a good rule of thumb: If you have a net worth of at least $100,000 and have a substantial amount of assets in real estate, or have very specific instructions on how and when you want your estate to be distributed among your heirs after you die, then a trust could be for you.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

A living trust is designed to allow for the easy transfer of the trust creator or settlor's assets while bypassing the often complex and expensive legal process of probate. Living trust agreements designate a trustee who holds legal possession of assets and property that flow into the trust.

When you create a DIY living trust, there are no attorneys involved in the process.It is also possible to choose a company, such as a bank or a trust company, to be your trustee. You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Its primary purpose is to avoid probate court, since revocable living trusts do not reduce estate taxes. With a revocable trust, your assets will not be protected from creditors looking to sue. That's because you maintain ownership of the trust while you're alive.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

An estate plan that includes a trust costs $1,000 to $3,000, versus $300 or less for a simple will. What a living-trust promoter may not tell you: You don't need a trust to protect assets from probate. You can arrange for most of your valuable assets to go to your heirs outside of probate.

To set up a Living Trust, you first create a Revocable Living Trust document and appoint a trustee. You may then list the property you will place in the trust, as well as your beneficiaries. After executing your Living Trust document properly, you will need to transfer your property into the trust.