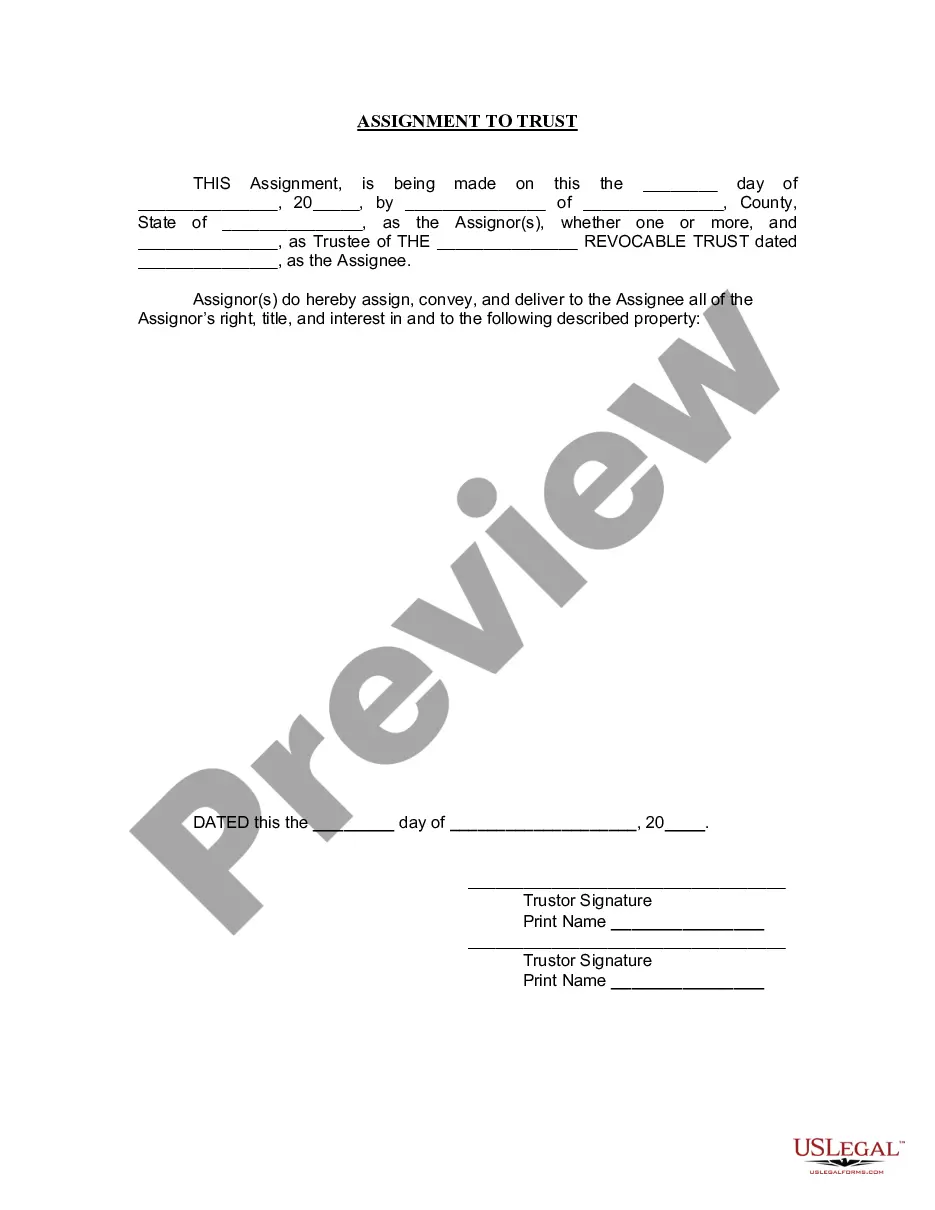

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.

Wyoming Assignment to Living Trust

Description

How to fill out Wyoming Assignment To Living Trust?

Use US Legal Forms to obtain a printable Wyoming Assignment to Living Trust. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms library on the web and provides reasonably priced and accurate samples for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and many of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to quickly find and download Wyoming Assignment to Living Trust:

- Check out to ensure that you get the right template with regards to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Press Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Wyoming Assignment to Living Trust. Above three million users have used our platform successfully. Select your subscription plan and have high-quality documents within a few clicks.

Form popularity

FAQ

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust. However, if real estate is involved, the trust may be recorded in the local office of the county clerk.

Trusts created during your lifetime, known as living trusts, do not go into the public record after you die. With rare exceptions, trusts remain private regardless of whether you have an irrevocable or revocable trust at the time of your death.

A revocable living trust isn't subject to the same kind of rules as a will; it should be valid in any state, no matter where you signed it.If you acquire real estate in your new state, you'll probably want to hold it in the trust, so that it doesn't have to go through probate at your death.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

No. Trust does not need to be filed in California. Trusts are private documents and usually there are compelling reasons not to file the trust.