- US Legal Forms

-

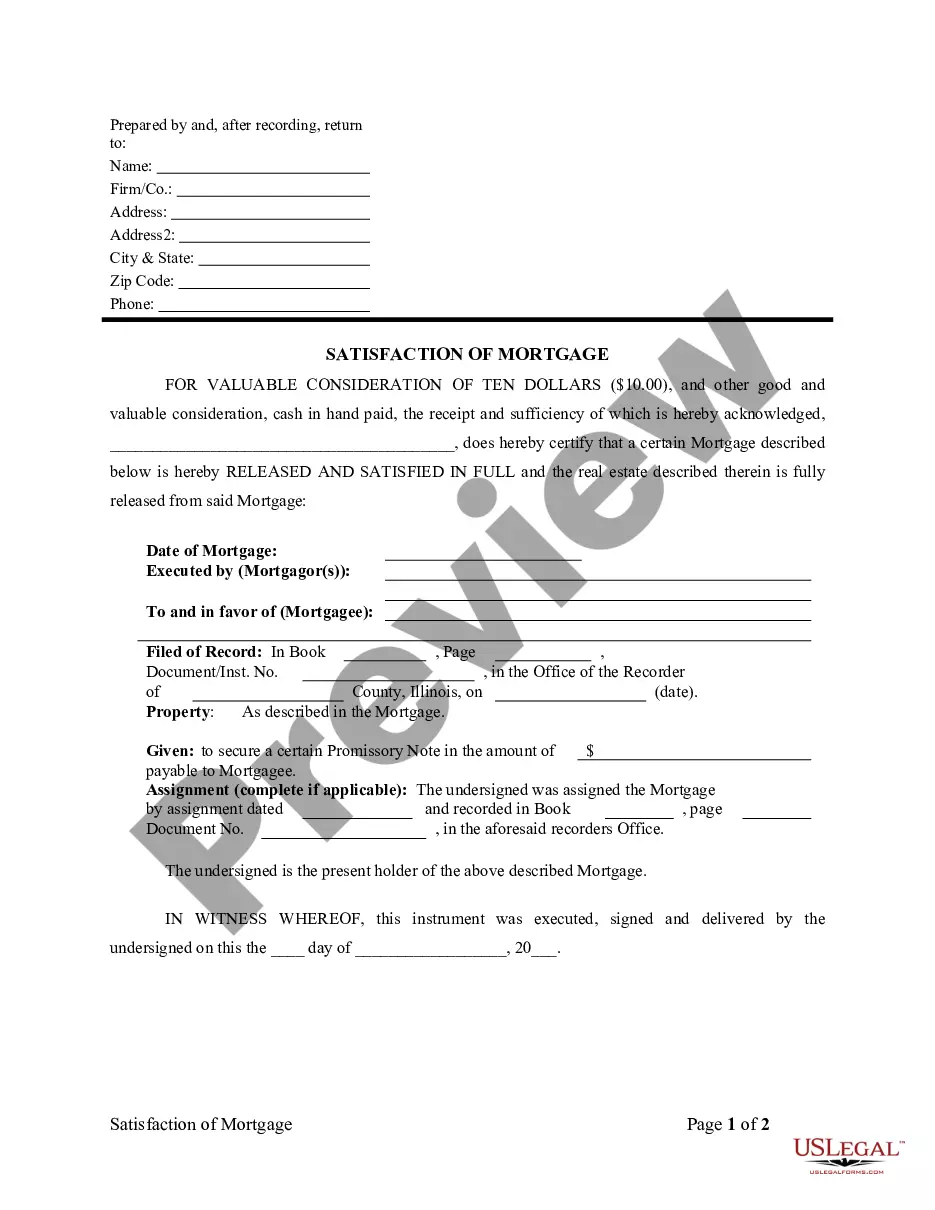

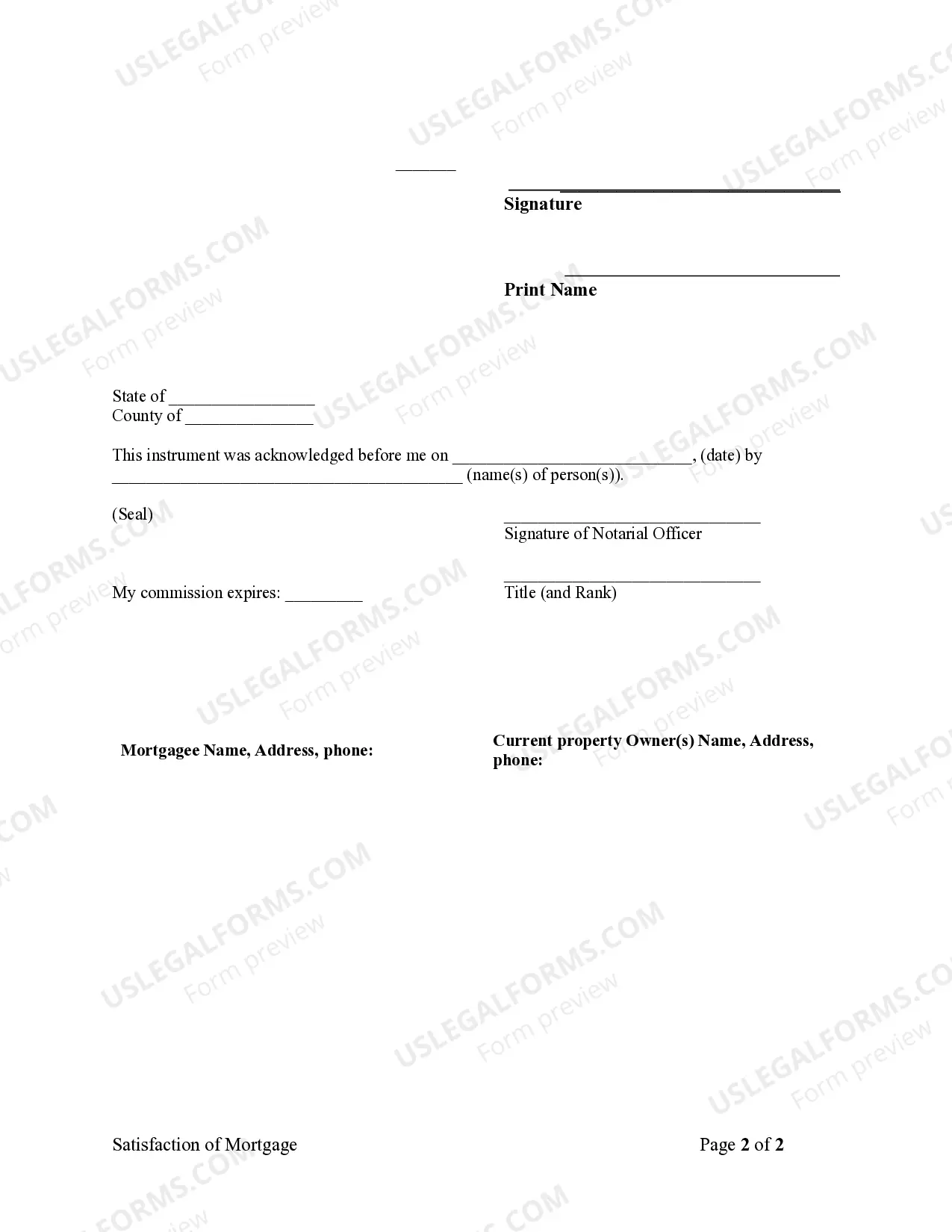

Wyoming Release - Satisfaction - Cancellation Mortgage - Individual

Wy Release Individual Online

Description Wy Release Individual

Mortgagee Released Mortgage Related forms

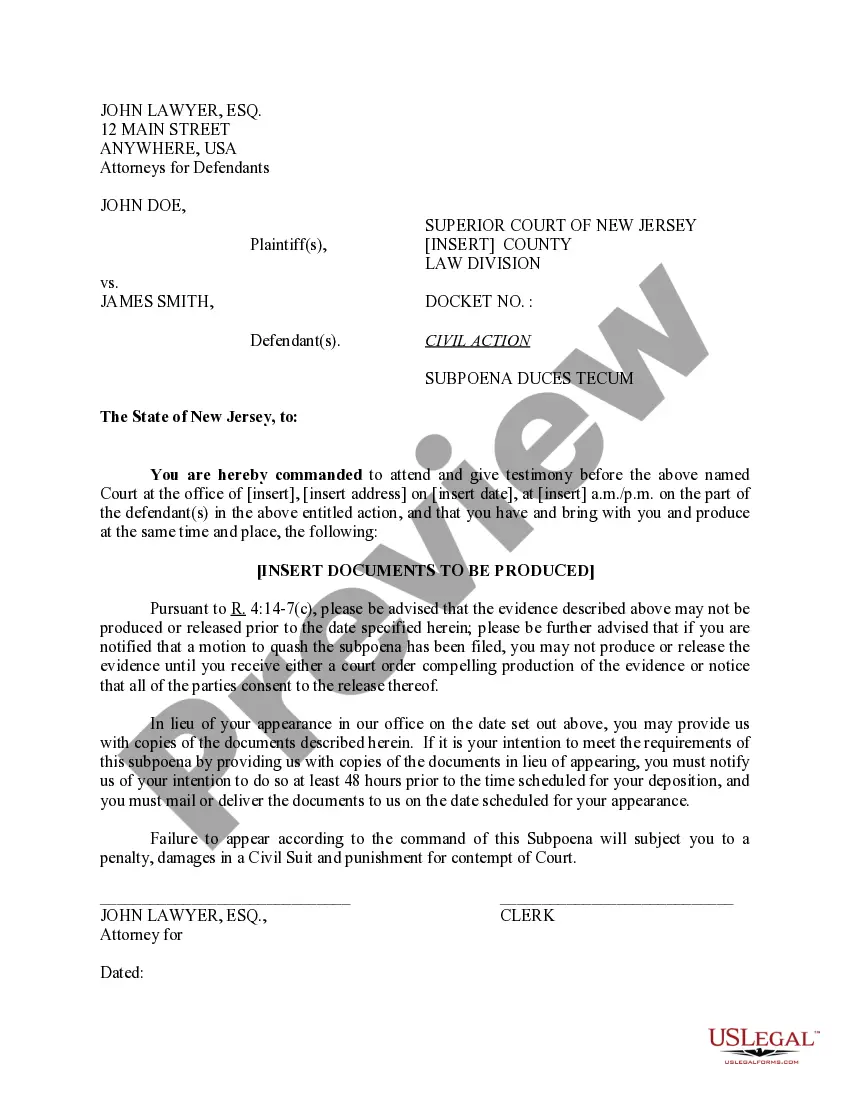

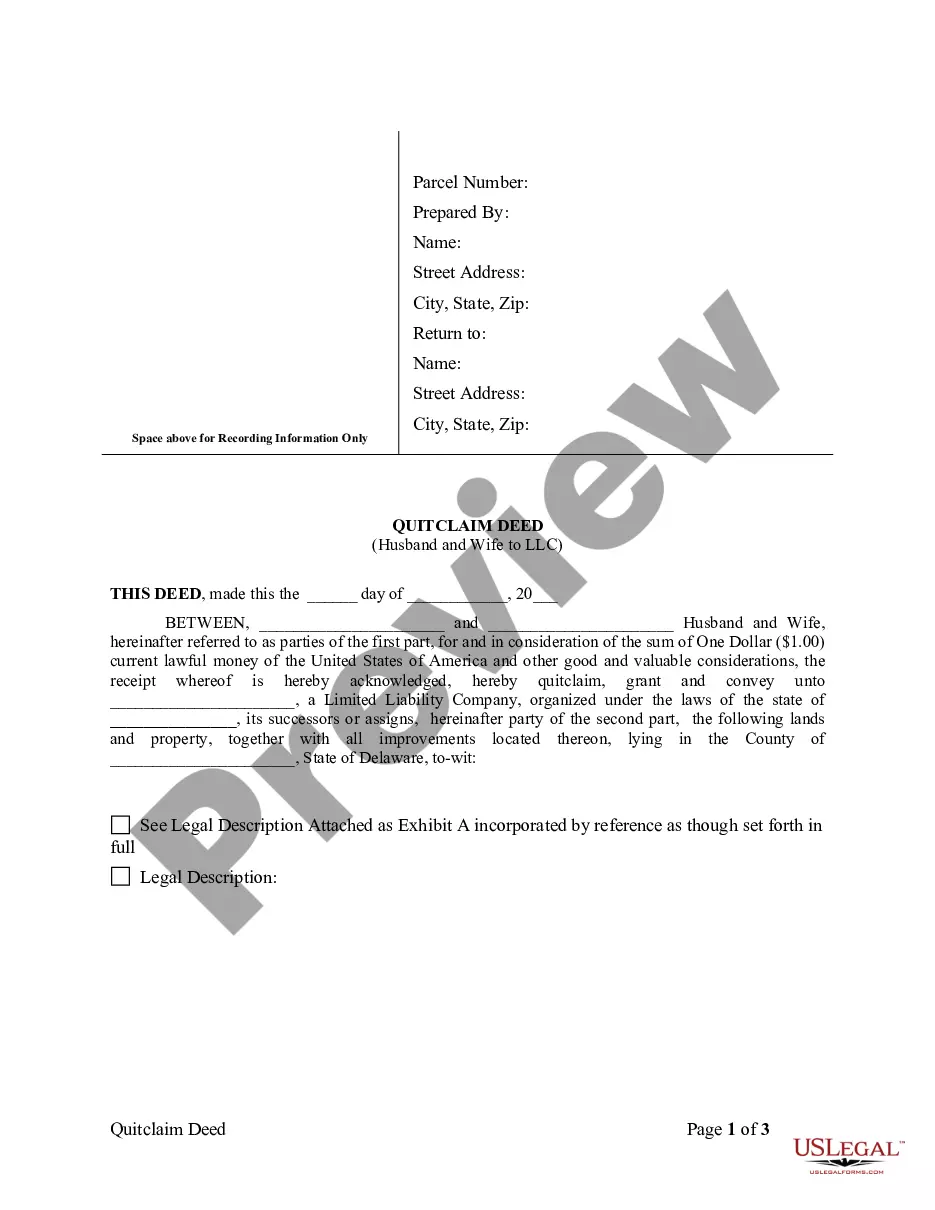

View Quitclaim Deed from Husband and Wife to LLC

View Conditional Waiver and Release Upon Final Payment

View Warranty Deed from Husband and Wife to LLC

View Form to respond to homeowner insurance arbitration request

View Delaware Satisfaction of Judgment

How to fill out Wy Satisfaction Paper?

Use US Legal Forms to get a printable Wyoming Release - Satisfaction - Cancellation Mortgage - Individual. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms library on the web and provides affordable and accurate samples for consumers and attorneys, and SMBs. The templates are grouped into state-based categories and some of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Wyoming Release - Satisfaction - Cancellation Mortgage - Individual:

- Check to make sure you get the proper form in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Press Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search engine if you need to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Wyoming Release - Satisfaction - Cancellation Mortgage - Individual. More than three million users have utilized our service successfully. Choose your subscription plan and get high-quality documents in just a few clicks.

Wyoming Satisfaction Complete Form Rating

Release Cancellation Individual Fillable Form popularity

Wyoming Satisfaction Cancellation Download Other Form Names

Wyoming Cancellation Individual Buy FAQ

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

Wyoming Individual Form File Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Wyoming

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Wyoming Law

Execution of Assignment or Satisfaction: To be executed and acknowledged by Mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Upon full payoff, written request by mortgagor may be sent to mortgagee by registered or ceritified mail, requesting satisfaction, whereupon the mortgagee must record satisfaction within 30 days.

Recording Satisfaction: Mortgagee shall, within 30 days after receiving written request for satisfaction, execute and acknowledge a deed of discharge if there has been full performance of the mortgage.

Marginal Satisfaction: Any mortgage or deed of trust shall be discharged upon the record thereof ... and the county clerk shall make a reference to such release upon the margin of the record of the mortgage or trust deed.

Penalty: A mortgagee who fails to discharge a mortgage within the 30 day period following notice is liable to the mortgagor or his assignees for actual damages resulting from the failure and special damages in the amount of one-tenth of one percent (.10%) of the original principal amount of the mortgage for each additional day (maximum of $100 per day) after the 30 day period until the mortgage is discharged.

Acknowledgment: An assignment or satisfaction must contain a proper Wyoming acknowledgment, or other acknowledgment approved by Statute.

Wyoming Statutes

34-1-130. County clerk to discharge mortgage or deed of trust on record when certificate of release recorded.

Any mortgage or deed of trust shall be discharged upon the record thereof, by the county clerk in whose custody it shall be, or in whose office it is recorded, when there shall be recorded in his office a certificate or deed of release executed by the mortgagee, trustee or beneficiary, his assignee or legally authorized representative, or by a title agent or title insurer acting in accordance with the provisions of W.S. 34-1-145 through 34-1-150, acknowledged or proven and certified as by law prescribed to entitle conveyances to be recorded, specifying that such mortgage or deed of trust has been paid or otherwise satisfied or discharged, and the county clerk shall make a reference to such release upon the margin of the record of the mortgage or trust deed.

34-1-131. Force and effect of section 34-1-130 on mortgages and deeds of trust executed and deeds of trust discharged prior to act.

The preceding section, as hereby amended, shall apply to all mortgages and deeds of trust, heretofore as well as those which may be hereafter, executed and the release or discharge of any deed of trust heretofore made in accordance with said section, by the trustee named in said deed of trust or his successor, is hereby legalized and declared to be as binding upon all parties in interest as though such release or discharge had been made after the passage of this act.

34-1-132. Liability of mortgagee for failing to discharge; damage limitations; definition.

(a) A mortgagee shall, within thirty (30) days after having received by certified or registered mail a request in writing for the discharge or release of a mortgage, execute and acknowledge a certificate or deed of discharge or release of the mortgage if there has been full performance of the condition of the mortgage and if there is no other written agreement between the mortgagee and mortgagor encumbering the property subject to the mortgage.(b) A mortgagee who fails or refuses to discharge or release a mortgage within the thirty (30) day period required by subsection (a) of this section is liable to the mortgagor or his assignees for:

(i) All actual damages resulting from the mortgagee's failure or refusal to discharge or release the mortgage; and

(ii) Special damages in the amount of one-tenth of one percent (.10%) of the original principal amount of the mortgage for each additional day after the thirty (30) day period until the mortgage is released or discharged. Special damages authorized by this paragraph shall not exceed one hundred dollars ($100.00) per day.

(c) Notwithstanding any assignment of the mortgage, the mortgagee of record is liable for the damages specified in subsection (b) of this section unless, within sixty (60) days after receipt of the request for discharge or release as provided by subsection (a) of this section, he furnishes to the person making the request the name and address of the current assignee or holder of the mortgage who has legal authority to execute the discharge or release.

(d) As used in this section "mortgagee" means the mortgagee named in the original mortgage or, if assigned, the current holder of the mortgage or the servicing agent for the current holder of the mortgage.

34-1-142. Instrument transferring title to real property; procedure; exceptions; confidentiality.

(a) When a deed, contract or other document transferring legal or equitable title to real property is presented to a county clerk for recording, the instrument shall be accompanied by a statement under oath by the grantee or his agent disclosing the name of the grantor and grantee, the date of transfer, date of sale, a legal description of the property transferred, the actual full amount paid or to be paid for the property, terms of sale and an estimate of the value of any nonreal property included in the sale.(b) No instrument evidencing a transfer of real property may be accepted for recording until the sworn statement is received by the county clerk. The validity or effectiveness of an instrument as between the parties is not affected by the failure to comply with subsection (a) of this section.

(c) This section does not apply to:

(i) An instrument which confirms, corrects, modifies or supplements a previously recorded instrument without added consideration;

(ii) A transfer pursuant to mergers, consolidations or reorganizations of business entities;

(iii) A transfer by a subsidiary corporation to its parent corporation without actual consideration or in sole consideration of the cancellation or surrender of a subsidiary stock;

(iv) A transfer which constitutes a gift of more than one-half (1/2) of the actual value;

(v) A transfer between husband and wife or parent and child with only nominal consideration therefor;

(vi) An instrument the effect of which is to transfer the property to the same party;

(vii) A sale for delinquent taxes or assessments or a sale or a transfer pursuant to a foreclosure;

(viii) Any other transfers which the state board of equalization and department of revenue exempts upon a finding that the information is not useful or relevant in determining sales-price ratios.

(d) The sworn statements shall be used by the county assessors and the state board of equalization and the department of revenue along with other statements filed only as data in a collection of statistics which shall be used collectively in determining sales-price ratios by county. An individual statement shall not, by itself, be used by the county assessor to adjust the assessed value of any individual property.

(e) The statement is not a public record and shall be held confidential by the county clerk, county assessor, the state board of equalization the department of revenue and when disclosed under subsection (g) of this section, any person wishing to review or contest his property tax assessment or valuation and the county board of equalization. These statements shall not be subject to discovery in any other county or state proceeding.

(f) Repealed by Laws 1991, ch. 174, 3.

(g) Any person or his agent who wishes to review his property tax assessment or who contests his property tax assessment or valuation in a timely manner pursuant to W.S. 39-13-109(b)(i) is entitled to review statements of consideration for properties of like use and geographic area available to the county assessor in determining the value of the property at issue as provided under W.S. 39-13-109(b)(i). During a review, the county assessor shall disclose information sufficient to permit identification of the real estate parcels used by the county assessor in determining the value of the property at issue and provide the person or his agent papers of all information, including statements of consideration, the assessor relied upon in determining the property value and including statements of consideration for properties of like use and geographic area which were available to the assessor and are requested by the person or his agent. The county assessor shall, upon request, provide the person or his agent a statement indicating why a certain property was not used in determining the value of the property at issue. The county assessor and the contestant shall disclose those statements of consideration to the county board of equalization in conjunction with any hearing before the board with respect to the value or assessment of that property. As used in W.S. 34-1-142 through 34-1-144:

(i) A review is considered the initial meetings between the taxpayer and the county assessor's office pursuant to W.S. 39-13-109(b)(i);

(ii) Contest means the filing of a formal appeal pursuant to W.S. 39-13-109(b)(i);

(iii) Geographic area may include any area requested by the property owner or his agent within the boundaries of the county in which the subject property is located.

(h) The state board of equalization shall adopt rules and regulations to implement W.S. 34-1-142 and 34-1-143 which shall include forms to be used and which shall be used by county assessors and county clerks.

34-1-145. Definitions.

(a) As used in W.S. 34-1-145 through 34-1-150:(i) Beneficiary means the record owner of the beneficiary's interest under a trust deed, including successors in interest;

(ii) Mortgage means as described in W.S. 34-2-107;

(iii) Mortgagee means the record owner of the mortgagee's interest under a mortgage, including a successor in interest;

(iv) Satisfactory evidence of the full payment of the obligation secured by a trust deed or mortgage means the original cancelled check or a copy of a cancelled check, showing all endorsements, payable to the beneficiary, servicer or mortgagee and reasonable documentary evidence that the check was to effect full payment under the trust deed or an encumbrance upon the property covered by the trust deed or mortgage;

(v) Servicer means a person or entity that collects loan payments on behalf of a beneficiary or mortgagee;

(vi) Title agent means a title insurance agent licensed as an organization under W.S. 26-23-316 and bonded as a title abstractor under W.S. 26-23-308 or 33-2-101;

(vii) Title insurer means a title insurer authorized to conduct business in the state under the Wyoming Insurance Code;

(viii) Trust deed means as described in W.S. 34-3-101.

34-1-146. Reconveyance of trust deed or release of mortgage; procedures; forms.

(a) A title insurer or title agent may reconvey a trust deed or release a mortgage in accordance with the provisions of subsections (b) through (f) of this section if:(i) The obligation secured by the trust deed or mortgage has been fully paid by the title insurer or title agent; or

(ii) The title insurer or title agent possesses satisfactory evidence of the full payment of the obligation secured by a trust deed or mortgage.

(b) A title insurer or title agent may reconvey a trust deed or release a mortgage under subsection (a) of this section regardless of whether the title insurer or title agent is named as a trustee under a trust deed or has the authority to release a mortgage.

(c) No sooner than thirty (30) days after payment in full of the obligation secured by a trust deed or mortgage, and after notice is given pursuant to W.S. 34-1-132, the title insurer or title agent shall deliver to the beneficiary, mortgagee or servicer, or send by certified mail to the beneficiary, mortgagee or servicer, at the address specified in the trust deed or mortgage or at any address for the beneficiary or mortgagee specified in the last recorded assignment of the trust deed or mortgage a notice of intent to release or reconvey and a copy of the release or reconveyance to be recorded as provided in subsections (d) and (e) of this section.

(d) The notice of intent to release or reconvey shall contain the name of the beneficiary or mortgagee and the servicer if loan payments on the trust deed or mortgage are collected by a servicer, the name of the title insurer or title agent, the date and be substantially in the following form:

NOTICE OF INTENT TO RELEASE OR RECONVEY Notice is hereby given to you as follows: 1. This notice concerns the (trust deed or mortgage) described as follows: (Trustor or Mortgagor):________________________________ (Beneficiary or Mortgagee):____________________________ Recording Information: ________________________________ Book Number:___________________________________________ Page Number: __________________________________________ 2. The undersigned claims to have paid in full or possesses satisfactory evidence of the full payment of the obligation secured by the trust deed or mortgage described above. 3. The undersigned will fully release the mortgage or reconvey the trust deed described in this notice unless, within thirty (30) days from the date stated on this notice, the undersigned has received by certified mail a notice stating that the obligation secured by the trust deed or mortgage has not been paid in full or that you otherwise object to the release of the mortgage or the reconveyance of the trust deed. Notice shall be mailed to the address stated on this form. 4. A copy of the (release of mortgage or reconveyance of trust deed) is enclosed with this notice. (Signature of title insurer or title agent) (Address of title insurer or title agent)

(e) If, within thirty (30) days from the day on which the title insurer or title agent delivered or mailed the notice of intent to release or reconvey in accordance with subsections (c) and (d) of this section, the beneficiary, mortgagee or servicer does not send by certified mail to the title insurer or title agent a notice that the obligation secured by the trust deed or mortgage has not been paid in full or that the beneficiary, mortgagee or servicer objects to the release of the mortgage or reconveyance of the trust deed, the title insurer or title agent may execute, acknowledge and record a reconveyance of a trust deed or release of a mortgage:(i) A reconveyance of a trust deed under this subsection shall be in substantially the following form:

RECONVEYANCE OF TRUST DEED (Name of title insurer or title agent), a (title insurer or title agent) authorized to conduct business in the state does hereby reconvey, without warranty, the following trust property located in ___________ County, state of Wyoming, that is covered by a trust deed naming (name of trustor) as trustor, and (name of beneficiary) as beneficiary and was recorded on ___________ (year), as document number ___________, or, if applicable, in Book ___________ at Page ___________, (insert a description of the trust property): The undersigned title insurer or title agent certifies as follows: 1. The undersigned title insurer or title agent has fully paid the obligation secured by the trust deed or possesses satisfactory evidence of the full payment of the obligation secured by the trust deed. 2. No sooner than thirty (30) days after payment in full of the obligation secured by the trust deed, the title insurer or title agent delivered or sent by certified mail to the beneficiary or servicer at the address specified in the trust deed and at any address for the beneficiary specified in the last recorded assignment of the trust deed, a notice of intent to release or reconvey and a copy of the reconveyance. 3. The title insurer or title agent did not receive, within thirty (30) days from the day on which the title insurer or title agent delivered or mailed the notice of intent to release or reconvey, a notice from the beneficiary or servicer sent by certified mail that the obligation secured by the trust deed has not been paid in full or that the beneficiary or servicer objects to the reconveyance of the trust deed. ____________________________ ____________________________ (Notarization) (Signature of title insurer or title agent)

(ii) A release of a mortgage under this subsection shall be in substantially the following form:RELEASE OF MORTGAGE (Name of title insurer or title agent), a (title insurer or title agent) authorized to conduct business in the state does hereby release the mortgage on the following property located in ___________ County, state of Wyoming, that is covered by a mortgage naming (name of mortgagor) as mortgagor, and (name of mortgagee) as mortgagee and was recorded on ___________(year), as document number ___________, or, if applicable, in Book ___________ at Page ___________ (insert a description of the trust property): The undersigned title insurer or title agent certifies as follows: 1. The undersigned title insurer or title agent has fully paid the obligation secured by the mortgage or possesses satisfactory evidence of the full payment of the obligation secured by the mortgage. 2. No sooner than thirty (30) days after payment in full of the obligation secured by the mortgage, the title insurer or title agent delivered to the mortgagee or sent by certified mail to the mortgagee or servicer at the address specified in the mortgage and at any address for the mortgagee specified in the last recorded assignment of the mortgage, a notice of intent to release or reconvey and a copy of the release. 3. The title insurer or title agent did not receive, within thirty (30) days from the day on which the title insurer or title agent delivered or mailed the notice of intent to release or reconvey, a notice from the mortgagee or servicer sent by certified mail that the obligation secured by the mortgage has not been paid in full or that the mortgagee or servicer objects to the release of the mortgage. ___________________________ ___________________________ (Notarization) (Signature of title insurer or title agent)

(iii) A release of mortgage or reconveyance of trust deed that is executed and notarized in accordance with paragraph (i) or (ii) of this subsection is entitled to recordation in accordance with W.S. 34-1-119 and 34-1-130. Except as otherwise provided in this paragraph, a reconveyance of a trust deed or release of a mortgage that is recorded under this paragraph is valid regardless of any deficiency in the release or reconveyance procedure. If the title insurer's or title agent's signature on a release of mortgage or reconveyance of trust deed recorded under this paragraph is forged, the release of mortgage or reconveyance of trust deed is void.(f) A release of mortgage or reconveyance of trust deed under this section does not discharge an obligation that was secured by the trust deed or mortgage at the time the trust deed was reconveyed or the mortgage was released.

34-2-113. Cancellation form for mortgage or deed of trust; recordation; effect.

(a) A cancellation or discharge of mortgage or deed of trust may be in the following form substantially:Certificate of Discharge This certifies that a (mortgage or deed of trust, as the case may be) from ___________ to ___________ dated ___________ A.D ___________ and recorded in book ___________ of ___________ on page ___________ has been fully satisfied by the payment of the debt secured thereby, and is hereby cancelled and discharged. Signed in the presence of ___________ county clerk of ___________ County. Filed and recorded ___________ A.D. ___________ at ___________ M. County clerk

(b) Such cancellation or discharge shall be entered in a book kept for that purpose, and signed by the mortgagee or trustee, his attorney-in-fact, executor, administrator or assigns, in the presence of the county clerk or his deputy who shall subscribe the same as a witness, and such cancellation or discharge shall have the same effect as a deed or release duly acknowledged and recorded.Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Wyoming Law

Execution of Assignment or Satisfaction: To be executed and acknowledged by Mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Upon full payoff, written request by mortgagor may be sent to mortgagee by registered or ceritified mail, requesting satisfaction, whereupon the mortgagee must record satisfaction within 30 days.

Recording Satisfaction: Mortgagee shall, within 30 days after receiving written request for satisfaction, execute and acknowledge a deed of discharge if there has been full performance of the mortgage.

Marginal Satisfaction: Any mortgage or deed of trust shall be discharged upon the record thereof ... and the county clerk shall make a reference to such release upon the margin of the record of the mortgage or trust deed.

Penalty: A mortgagee who fails to discharge a mortgage within the 30 day period following notice is liable to the mortgagor or his assignees for actual damages resulting from the failure and special damages in the amount of one-tenth of one percent (.10%) of the original principal amount of the mortgage for each additional day (maximum of $100 per day) after the 30 day period until the mortgage is discharged.

Acknowledgment: An assignment or satisfaction must contain a proper Wyoming acknowledgment, or other acknowledgment approved by Statute.

Wyoming Statutes

34-1-130. County clerk to discharge mortgage or deed of trust on record when certificate of release recorded.

Any mortgage or deed of trust shall be discharged upon the record thereof, by the county clerk in whose custody it shall be, or in whose office it is recorded, when there shall be recorded in his office a certificate or deed of release executed by the mortgagee, trustee or beneficiary, his assignee or legally authorized representative, or by a title agent or title insurer acting in accordance with the provisions of W.S. 34-1-145 through 34-1-150, acknowledged or proven and certified as by law prescribed to entitle conveyances to be recorded, specifying that such mortgage or deed of trust has been paid or otherwise satisfied or discharged, and the county clerk shall make a reference to such release upon the margin of the record of the mortgage or trust deed.

34-1-131. Force and effect of section 34-1-130 on mortgages and deeds of trust executed and deeds of trust discharged prior to act.

The preceding section, as hereby amended, shall apply to all mortgages and deeds of trust, heretofore as well as those which may be hereafter, executed and the release or discharge of any deed of trust heretofore made in accordance with said section, by the trustee named in said deed of trust or his successor, is hereby legalized and declared to be as binding upon all parties in interest as though such release or discharge had been made after the passage of this act.

34-1-132. Liability of mortgagee for failing to discharge; damage limitations; definition.

(a) A mortgagee shall, within thirty (30) days after having received by certified or registered mail a request in writing for the discharge or release of a mortgage, execute and acknowledge a certificate or deed of discharge or release of the mortgage if there has been full performance of the condition of the mortgage and if there is no other written agreement between the mortgagee and mortgagor encumbering the property subject to the mortgage.(b) A mortgagee who fails or refuses to discharge or release a mortgage within the thirty (30) day period required by subsection (a) of this section is liable to the mortgagor or his assignees for:

(i) All actual damages resulting from the mortgagee's failure or refusal to discharge or release the mortgage; and

(ii) Special damages in the amount of one-tenth of one percent (.10%) of the original principal amount of the mortgage for each additional day after the thirty (30) day period until the mortgage is released or discharged. Special damages authorized by this paragraph shall not exceed one hundred dollars ($100.00) per day.

(c) Notwithstanding any assignment of the mortgage, the mortgagee of record is liable for the damages specified in subsection (b) of this section unless, within sixty (60) days after receipt of the request for discharge or release as provided by subsection (a) of this section, he furnishes to the person making the request the name and address of the current assignee or holder of the mortgage who has legal authority to execute the discharge or release.

(d) As used in this section "mortgagee" means the mortgagee named in the original mortgage or, if assigned, the current holder of the mortgage or the servicing agent for the current holder of the mortgage.

34-1-142. Instrument transferring title to real property; procedure; exceptions; confidentiality.

(a) When a deed, contract or other document transferring legal or equitable title to real property is presented to a county clerk for recording, the instrument shall be accompanied by a statement under oath by the grantee or his agent disclosing the name of the grantor and grantee, the date of transfer, date of sale, a legal description of the property transferred, the actual full amount paid or to be paid for the property, terms of sale and an estimate of the value of any nonreal property included in the sale.(b) No instrument evidencing a transfer of real property may be accepted for recording until the sworn statement is received by the county clerk. The validity or effectiveness of an instrument as between the parties is not affected by the failure to comply with subsection (a) of this section.

(c) This section does not apply to:

(i) An instrument which confirms, corrects, modifies or supplements a previously recorded instrument without added consideration;

(ii) A transfer pursuant to mergers, consolidations or reorganizations of business entities;

(iii) A transfer by a subsidiary corporation to its parent corporation without actual consideration or in sole consideration of the cancellation or surrender of a subsidiary stock;

(iv) A transfer which constitutes a gift of more than one-half (1/2) of the actual value;

(v) A transfer between husband and wife or parent and child with only nominal consideration therefor;

(vi) An instrument the effect of which is to transfer the property to the same party;

(vii) A sale for delinquent taxes or assessments or a sale or a transfer pursuant to a foreclosure;

(viii) Any other transfers which the state board of equalization and department of revenue exempts upon a finding that the information is not useful or relevant in determining sales-price ratios.

(d) The sworn statements shall be used by the county assessors and the state board of equalization and the department of revenue along with other statements filed only as data in a collection of statistics which shall be used collectively in determining sales-price ratios by county. An individual statement shall not, by itself, be used by the county assessor to adjust the assessed value of any individual property.

(e) The statement is not a public record and shall be held confidential by the county clerk, county assessor, the state board of equalization the department of revenue and when disclosed under subsection (g) of this section, any person wishing to review or contest his property tax assessment or valuation and the county board of equalization. These statements shall not be subject to discovery in any other county or state proceeding.

(f) Repealed by Laws 1991, ch. 174, 3.

(g) Any person or his agent who wishes to review his property tax assessment or who contests his property tax assessment or valuation in a timely manner pursuant to W.S. 39-13-109(b)(i) is entitled to review statements of consideration for properties of like use and geographic area available to the county assessor in determining the value of the property at issue as provided under W.S. 39-13-109(b)(i). During a review, the county assessor shall disclose information sufficient to permit identification of the real estate parcels used by the county assessor in determining the value of the property at issue and provide the person or his agent papers of all information, including statements of consideration, the assessor relied upon in determining the property value and including statements of consideration for properties of like use and geographic area which were available to the assessor and are requested by the person or his agent. The county assessor shall, upon request, provide the person or his agent a statement indicating why a certain property was not used in determining the value of the property at issue. The county assessor and the contestant shall disclose those statements of consideration to the county board of equalization in conjunction with any hearing before the board with respect to the value or assessment of that property. As used in W.S. 34-1-142 through 34-1-144:

(i) A review is considered the initial meetings between the taxpayer and the county assessor's office pursuant to W.S. 39-13-109(b)(i);

(ii) Contest means the filing of a formal appeal pursuant to W.S. 39-13-109(b)(i);

(iii) Geographic area may include any area requested by the property owner or his agent within the boundaries of the county in which the subject property is located.

(h) The state board of equalization shall adopt rules and regulations to implement W.S. 34-1-142 and 34-1-143 which shall include forms to be used and which shall be used by county assessors and county clerks.

34-1-145. Definitions.

(a) As used in W.S. 34-1-145 through 34-1-150:(i) Beneficiary means the record owner of the beneficiary's interest under a trust deed, including successors in interest;

(ii) Mortgage means as described in W.S. 34-2-107;

(iii) Mortgagee means the record owner of the mortgagee's interest under a mortgage, including a successor in interest;

(iv) Satisfactory evidence of the full payment of the obligation secured by a trust deed or mortgage means the original cancelled check or a copy of a cancelled check, showing all endorsements, payable to the beneficiary, servicer or mortgagee and reasonable documentary evidence that the check was to effect full payment under the trust deed or an encumbrance upon the property covered by the trust deed or mortgage;

(v) Servicer means a person or entity that collects loan payments on behalf of a beneficiary or mortgagee;

(vi) Title agent means a title insurance agent licensed as an organization under W.S. 26-23-316 and bonded as a title abstractor under W.S. 26-23-308 or 33-2-101;

(vii) Title insurer means a title insurer authorized to conduct business in the state under the Wyoming Insurance Code;

(viii) Trust deed means as described in W.S. 34-3-101.

34-1-146. Reconveyance of trust deed or release of mortgage; procedures; forms.

(a) A title insurer or title agent may reconvey a trust deed or release a mortgage in accordance with the provisions of subsections (b) through (f) of this section if:(i) The obligation secured by the trust deed or mortgage has been fully paid by the title insurer or title agent; or

(ii) The title insurer or title agent possesses satisfactory evidence of the full payment of the obligation secured by a trust deed or mortgage.

(b) A title insurer or title agent may reconvey a trust deed or release a mortgage under subsection (a) of this section regardless of whether the title insurer or title agent is named as a trustee under a trust deed or has the authority to release a mortgage.

(c) No sooner than thirty (30) days after payment in full of the obligation secured by a trust deed or mortgage, and after notice is given pursuant to W.S. 34-1-132, the title insurer or title agent shall deliver to the beneficiary, mortgagee or servicer, or send by certified mail to the beneficiary, mortgagee or servicer, at the address specified in the trust deed or mortgage or at any address for the beneficiary or mortgagee specified in the last recorded assignment of the trust deed or mortgage a notice of intent to release or reconvey and a copy of the release or reconveyance to be recorded as provided in subsections (d) and (e) of this section.

(d) The notice of intent to release or reconvey shall contain the name of the beneficiary or mortgagee and the servicer if loan payments on the trust deed or mortgage are collected by a servicer, the name of the title insurer or title agent, the date and be substantially in the following form:

NOTICE OF INTENT TO RELEASE OR RECONVEY Notice is hereby given to you as follows: 1. This notice concerns the (trust deed or mortgage) described as follows: (Trustor or Mortgagor):________________________________ (Beneficiary or Mortgagee):____________________________ Recording Information: ________________________________ Book Number:___________________________________________ Page Number: __________________________________________ 2. The undersigned claims to have paid in full or possesses satisfactory evidence of the full payment of the obligation secured by the trust deed or mortgage described above. 3. The undersigned will fully release the mortgage or reconvey the trust deed described in this notice unless, within thirty (30) days from the date stated on this notice, the undersigned has received by certified mail a notice stating that the obligation secured by the trust deed or mortgage has not been paid in full or that you otherwise object to the release of the mortgage or the reconveyance of the trust deed. Notice shall be mailed to the address stated on this form. 4. A copy of the (release of mortgage or reconveyance of trust deed) is enclosed with this notice. (Signature of title insurer or title agent) (Address of title insurer or title agent)

(e) If, within thirty (30) days from the day on which the title insurer or title agent delivered or mailed the notice of intent to release or reconvey in accordance with subsections (c) and (d) of this section, the beneficiary, mortgagee or servicer does not send by certified mail to the title insurer or title agent a notice that the obligation secured by the trust deed or mortgage has not been paid in full or that the beneficiary, mortgagee or servicer objects to the release of the mortgage or reconveyance of the trust deed, the title insurer or title agent may execute, acknowledge and record a reconveyance of a trust deed or release of a mortgage:(i) A reconveyance of a trust deed under this subsection shall be in substantially the following form:

RECONVEYANCE OF TRUST DEED (Name of title insurer or title agent), a (title insurer or title agent) authorized to conduct business in the state does hereby reconvey, without warranty, the following trust property located in ___________ County, state of Wyoming, that is covered by a trust deed naming (name of trustor) as trustor, and (name of beneficiary) as beneficiary and was recorded on ___________ (year), as document number ___________, or, if applicable, in Book ___________ at Page ___________, (insert a description of the trust property): The undersigned title insurer or title agent certifies as follows: 1. The undersigned title insurer or title agent has fully paid the obligation secured by the trust deed or possesses satisfactory evidence of the full payment of the obligation secured by the trust deed. 2. No sooner than thirty (30) days after payment in full of the obligation secured by the trust deed, the title insurer or title agent delivered or sent by certified mail to the beneficiary or servicer at the address specified in the trust deed and at any address for the beneficiary specified in the last recorded assignment of the trust deed, a notice of intent to release or reconvey and a copy of the reconveyance. 3. The title insurer or title agent did not receive, within thirty (30) days from the day on which the title insurer or title agent delivered or mailed the notice of intent to release or reconvey, a notice from the beneficiary or servicer sent by certified mail that the obligation secured by the trust deed has not been paid in full or that the beneficiary or servicer objects to the reconveyance of the trust deed. ____________________________ ____________________________ (Notarization) (Signature of title insurer or title agent)

(ii) A release of a mortgage under this subsection shall be in substantially the following form:RELEASE OF MORTGAGE (Name of title insurer or title agent), a (title insurer or title agent) authorized to conduct business in the state does hereby release the mortgage on the following property located in ___________ County, state of Wyoming, that is covered by a mortgage naming (name of mortgagor) as mortgagor, and (name of mortgagee) as mortgagee and was recorded on ___________(year), as document number ___________, or, if applicable, in Book ___________ at Page ___________ (insert a description of the trust property): The undersigned title insurer or title agent certifies as follows: 1. The undersigned title insurer or title agent has fully paid the obligation secured by the mortgage or possesses satisfactory evidence of the full payment of the obligation secured by the mortgage. 2. No sooner than thirty (30) days after payment in full of the obligation secured by the mortgage, the title insurer or title agent delivered to the mortgagee or sent by certified mail to the mortgagee or servicer at the address specified in the mortgage and at any address for the mortgagee specified in the last recorded assignment of the mortgage, a notice of intent to release or reconvey and a copy of the release. 3. The title insurer or title agent did not receive, within thirty (30) days from the day on which the title insurer or title agent delivered or mailed the notice of intent to release or reconvey, a notice from the mortgagee or servicer sent by certified mail that the obligation secured by the mortgage has not been paid in full or that the mortgagee or servicer objects to the release of the mortgage. ___________________________ ___________________________ (Notarization) (Signature of title insurer or title agent)

(iii) A release of mortgage or reconveyance of trust deed that is executed and notarized in accordance with paragraph (i) or (ii) of this subsection is entitled to recordation in accordance with W.S. 34-1-119 and 34-1-130. Except as otherwise provided in this paragraph, a reconveyance of a trust deed or release of a mortgage that is recorded under this paragraph is valid regardless of any deficiency in the release or reconveyance procedure. If the title insurer's or title agent's signature on a release of mortgage or reconveyance of trust deed recorded under this paragraph is forged, the release of mortgage or reconveyance of trust deed is void.(f) A release of mortgage or reconveyance of trust deed under this section does not discharge an obligation that was secured by the trust deed or mortgage at the time the trust deed was reconveyed or the mortgage was released.

34-2-113. Cancellation form for mortgage or deed of trust; recordation; effect.

(a) A cancellation or discharge of mortgage or deed of trust may be in the following form substantially:Certificate of Discharge This certifies that a (mortgage or deed of trust, as the case may be) from ___________ to ___________ dated ___________ A.D ___________ and recorded in book ___________ of ___________ on page ___________ has been fully satisfied by the payment of the debt secured thereby, and is hereby cancelled and discharged. Signed in the presence of ___________ county clerk of ___________ County. Filed and recorded ___________ A.D. ___________ at ___________ M. County clerk

(b) Such cancellation or discharge shall be entered in a book kept for that purpose, and signed by the mortgagee or trustee, his attorney-in-fact, executor, administrator or assigns, in the presence of the county clerk or his deputy who shall subscribe the same as a witness, and such cancellation or discharge shall have the same effect as a deed or release duly acknowledged and recorded.